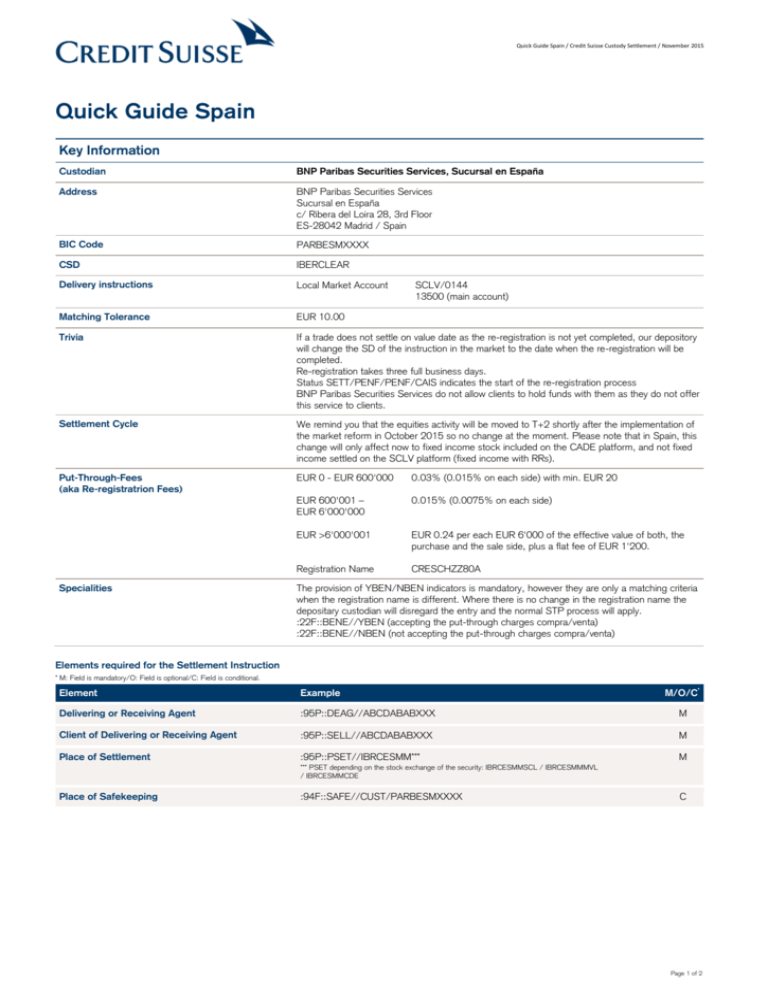

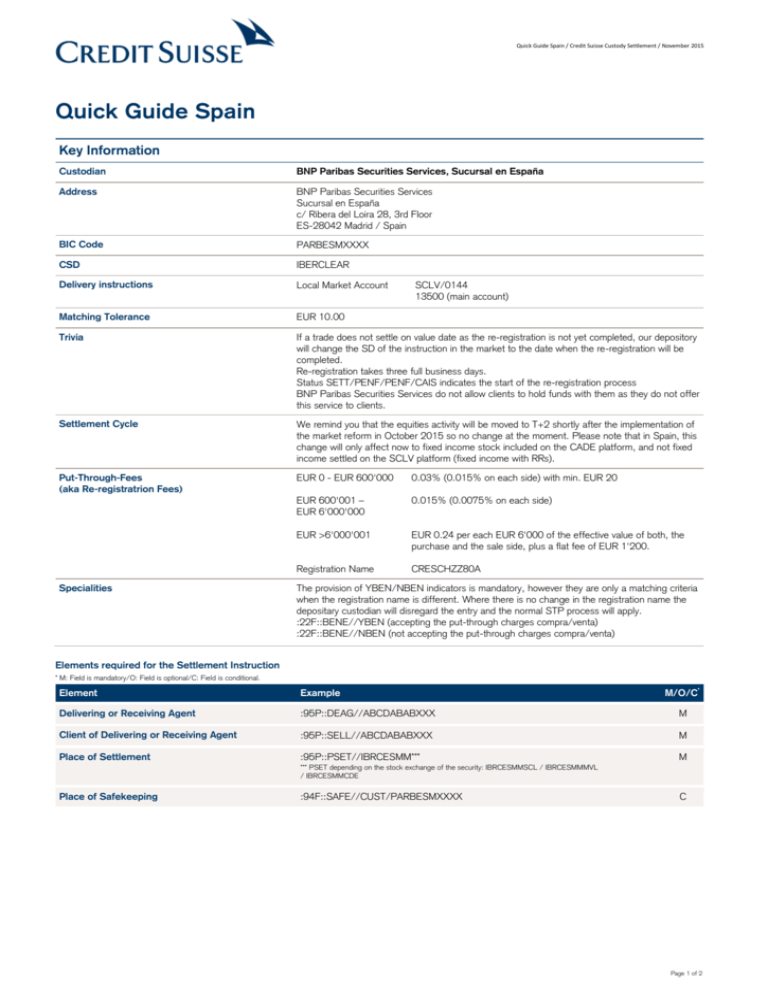

Quick Guide Spain / Credit Suisse Custody Settlement / November 2015

Quick Guide Spain

Key Information

Custodian

BNP Paribas Securities Services, Sucursal en España

Address

BNP Paribas Securities Services

Sucursal en España

c/ Ribera del Loira 28, 3rd Floor

ES-28042 Madrid / Spain

BIC Code

PARBESMXXXX

CSD

IBERCLEAR

Delivery instructions

Local Market Account

Matching Tolerance

EUR 10.00

Trivia

If a trade does not settle on value date as the re-registration is not yet completed, our depository

will change the SD of the instruction in the market to the date when the re-registration will be

completed.

Re-registration takes three full business days.

Status SETT/PENF/PENF/CAIS indicates the start of the re-registration process

BNP Paribas Securities Services do not allow clients to hold funds with them as they do not offer

this service to clients.

Settlement Cycle

We remind you that the equities activity will be moved to T+2 shortly after the implementation of

the market reform in October 2015 so no change at the moment. Please note that in Spain, this

change will only affect now to fixed income stock included on the CADE platform, and not fixed

income settled on the SCLV platform (fixed income with RRs).

Put-Through-Fees

(aka Re-registratrion Fees)

EUR 0 - EUR 600'000

0.03% (0.015% on each side) with min. EUR 20

EUR 600'001 –

EUR 6'000'000

0.015% (0.0075% on each side)

EUR >6'000'001

EUR 0.24 per each EUR 6'000 of the effective value of both, the

purchase and the sale side, plus a flat fee of EUR 1'200.

Registration Name

CRESCHZZ80A

Specialities

SCLV/0144

13500 (main account)

The provision of YBEN/NBEN indicators is mandatory, however they are only a matching criteria

when the registration name is different. Where there is no change in the registration name the

depositary custodian will disregard the entry and the normal STP process will apply.

:22F::BENE//YBEN (accepting the put-through charges compra/venta)

:22F::BENE//NBEN (not accepting the put-through charges compra/venta)

Elements required for the Settlement Instruction

* M: Field is mandatory/O: Field is optional/C: Field is conditional.

M/O/C*

Element

Example

Delivering or Receiving Agent

:95P::DEAG//ABCDABABXXX

M

Client of Delivering or Receiving Agent

:95P::SELL//ABCDABABXXX

M

Place of Settlement

:95P::PSET//IBRCESMM***

M

*** PSET depending on the stock exchange of the security: IBRCESMMSCL / IBRCESMMMVL

/ IBRCESMMCDE

Place of Safekeeping

:94F::SAFE//CUST/PARBESMXXXX

C

Page 1 of 2

Quick Guide Spain / Credit Suisse Custody Settlement / November 2015

Receive from a participant of IBERCLEAR

Receive from a client BNP Paribas Securities Services

(Internal Transfer)

MT541

MT541

:22F::BENE//YBEN or :22F::BENE//NBEN

:95P::DEAG//ABCDABABXXX

:95P::SELL//ABCDABABXXX

:95P::PSET//IBRCESMM***

:22F::BENE//YBEN or :22F::BENE//NBEN

:95P::DEAG//PARBESMXXXX

:95P::SELL//ABCDABABXXX

:95P::PSET//IBRCESMM***

*** PSET depending on the stock exchange of the security: IBRCESMMSCL / IBRCESMMMVL

/ IBRCESMMCDE

*** PSET depending on the stock exchange of the security: IBRCESMMSCL / IBRCESMMMVL

/ IBRCESMMCDE

Receive from a Euroclear participant (outside Euroclear)

Receive from a Clearstream Banking Lux participant

(outside Clearstream)

MT541

MT541

:22F::BENE//YBEN or :22F::BENE//NBEN

:95P::DEAG//PARBESMXXXX

:95P::SELL//MGTCBEBEXXX

:97A::SAFE//nnnnn

:95P::PSET//IBRCESMM***

:22F::BENE//YBEN or :22F::BENE//NBEN

:95P::DEAG//BBVAESMMXXX

:95P::SELL//CEDELULLXXX

:97A::SAFE//nnnnn

:95P::PSET//IBRCESMM***

*** PSET depending on the stock exchange of the security: IBRCESMMSCL / IBRCESMMMVL

/ IBRCESMMCDE

*** PSET depending on the stock exchange of the security: IBRCESMMSCL / IBRCESMMMVL

/ IBRCESMMCDE

Disclaimer:

The instructions contained in this Guide will assist you in making full use of, as well as benefiting from, our settlements services. Under certain circumstances it may be necessary to use other fields or field options, which correspond to the SWIFT guidelines, yet

do not allow for automated processing of your settlement instructions. Credit Suisse AG endeavors to accept and process such instructions on a best effort basis without the mutual benefits of STP handling but accepts no liability for loss arising from the use of

such instructions. The information presented in this Guide has been obtained or derived from sources believed by Credit Suisse AG to be reliable. Credit Suisse AG makes no representation as to the accuracy and/or completeness of the information and/or that

the information is up to date. All information in this Guide will be subject to change without notice. The information and opinions in this Guide are not intended and shall not be interpreted as legal advice nor do they constitute a solicitation offer, or

recommendation, to acquire or dispose any investment or to engage in any other transaction. Credit Suisse AG offers no warranty and accepts no liability for loss arising from the use of this Guide.

Copyright © 2015 Credit Suisse Group AG and/or its affiliates. All rights reserved

Page 2 of 2