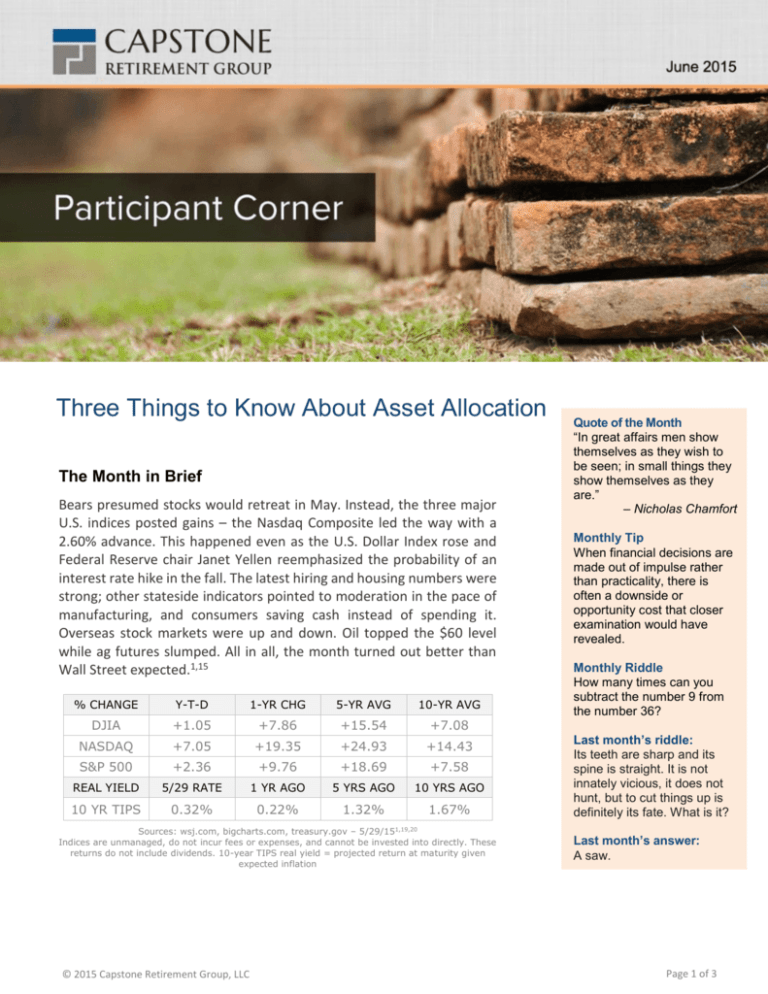

June 2015 – Participant Corner

advertisement

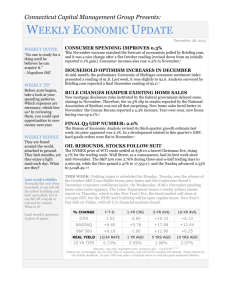

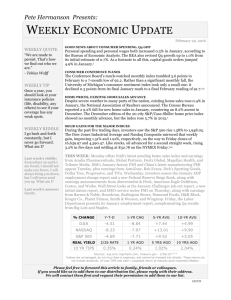

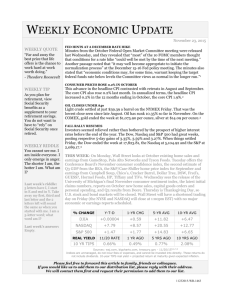

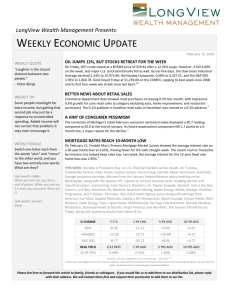

Three Things to Know About Asset Allocation The Month in Brief Bears presumed stocks would retreat in May. Instead, the three major U.S. indices posted gains – the Nasdaq Composite led the way with a 2.60% advance. This happened even as the U.S. Dollar Index rose and Federal Reserve chair Janet Yellen reemphasized the probability of an interest rate hike in the fall. The latest hiring and housing numbers were strong; other stateside indicators pointed to moderation in the pace of manufacturing, and consumers saving cash instead of spending it. Overseas stock markets were up and down. Oil topped the $60 level while ag futures slumped. All in all, the month turned out better than Wall Street expected.1,15 % CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG DJIA +1.05 +7.86 +15.54 +7.08 NASDAQ +7.05 +19.35 +24.93 +14.43 S&P 500 +2.36 +9.76 +18.69 +7.58 REAL YIELD 5/29 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO 10 YR TIPS 0.32% 0.22% 1.32% 1.67% Quote of the Month “In great affairs men show themselves as they wish to be seen; in small things they show themselves as they are.” – Nicholas Chamfort Monthly Tip When financial decisions are made out of impulse rather than practicality, there is often a downside or opportunity cost that closer examination would have revealed. Monthly Riddle How many times can you subtract the number 9 from the number 36? Last month’s riddle: Its teeth are sharp and its spine is straight. It is not innately vicious, it does not hunt, but to cut things up is definitely its fate. What is it? 1,19,20 Sources: wsj.com, bigcharts.com, treasury.gov – 5/29/15 Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation © 2015 Capstone Retirement Group, LLC Last month’s answer: A saw. Page 1 of 3 1. Different Assets Play Different Roles While stocks have significant appreciation and wealth-building potential, bonds can generate steady income. Cash can buffer the effect of market losses, while alternative investments can help improve a portfolio’s diversification potential. 2. Markets Are Unpredictable Capital markets are dynamic, and today’s asset class leader may be tomorrow’s laggard. A diversified investment approach that includes a range of asset classes can help investors pursue their long-term financial goals while managing the risks along the way. 3. The Mix Matters Selecting the mix of assets in your portfolio may be the dominant contributor to total return— more so than the choice of individual holdings. In fact, an influential, decade-long study of 82 large pension plans revealed that this asset mix explained, on average, nearly 92% of the variation in total return.¹ The investment universe is expanding Today, there are over 100 Morningstar categories, which now include niche 58 The number of fund categories tracked by Morningstar in 2003 112 The number of fund categories tracked by Morningstar TODAY styles and alternative investments. This variety of asset classes and specialized managers presents new opportunities for investors.² This was originally published by John Hancock Investments in their Portfolio Insight. Asset Allocation | Redefining diversification in your portfolio. for investors.² © 2015 Capstone Retirement Group, LLC Page 2 of 3 Disclosures: This material is not intended to replace the advice of a qualified attorney, tax advisor, investment professional or insurance agent. Securities and Investment Advisory Services offered through NFP Advisor Services, LLC (NFPAS), member FINRA/SIPC. NFPAS is not affiliated with Capstone Retirement Group, LLC. This material was prepared by MarketingLibrary.Net Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. Citations: Article: 06 June 2015 – Three Things to Know About Asset Allocation – RPAG ACR#143521 05/15 ¹ Brinson, Singer, and Beebower, 1991. ² Morningstar, as of 12/31/2014. Static categories, those currently without description and without funds, are omitted from this figure. Economic Update: 1 - wsj.com/mdc/public/page/2_3023-monthly_gblstkidx.html [5/29/15] 15 - money.cnn.com/data/commodities/ [5/31/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F29%2F14&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F29%2F14&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F29%2F14&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F28%2F10&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F28%2F10&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F28%2F10&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F27%2F05&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F27%2F05&x=0&y=0 [5/29/15] 19 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F27%2F05&x=0&y=0 [5/29/15] 20 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/1/15] About Capstone Retirement Group Capstone Retirement Group is a professional retirement plan consulting firm. We partner with plan fiduciaries to identify and implement the optimal retirement plan for their organization. 1945 Old Gallows Road Suite 350 Vienna, VA 22182 Tel: 703.291.8200 Fax: 202.747.5267 Email: info@capstoneRG.com Securities and Investment Advisory Services offered through NFP Advisor Services, LLC (NFPAS), member FINRA/SIPC. NFPAS is not affiliated with Capstone Retirement Group, LLC. This e-mail message and all attachments transmitted with it may contain legally privileged and/or confidential information intended solely for the use of the addressee(s). If the reader of this message is not the intended recipient, you are hereby notified that any reading, dissemination, distribution, copying, forwarding or other use of this message or its attachments is strictly prohibited. If you have received this message in error, please notify the sender immediately and delete this message and all copies and backups thereof. © 2015 Capstone Retirement Group, LLC Page 3 of 3