Chapter 13

Part 2 Contingencies

C ti

i

Intermediate Accounting II

Dr. Chula King

© Dr. Chula King

All Rights Reserved

Student Learning Outcomes

• Identify situations that constitute contingencies

and the circumstances under which they should

be accrued

• Demonstrate the appropriate accounting

treatment for contingencies, including

unasserted claims and assessments

© Dr. Chula King

All Rights Reserved

Definition of Liability

• Probable future sacrifice of economic benefit

arising from a present obligation to transfer

assets or provide services to other entities in

the future as a result of past transactions or

events.

© Dr. Chula King

All Rights Reserved

1

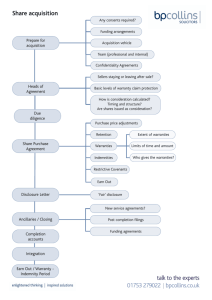

Loss Contingency

• Existing uncertain situation involving potential

loss depending on whether some future event

occurs

• Factors affecting whether loss contingency is

accrued and reported as a liability

The likelihood that the confirming event will occur

Whether the loss amounts can be reasonably

estimated

© Dr. Chula King

All Rights Reserved

Likelihood of Occurrence

• Probable – a confirming event is likely to

occur

• Reasonably Possible – the chance the

confirming event will occur is more than

remote, but less than likely

• Remote – the chance the confirming event will

occur is slight

© Dr. Chula King

All Rights Reserved

Loss Contingencies

Dollar Amount of Potential Loss

Likelihood

Probable

ob b e

Reasonably possible

Remote

Known

Subject to

Reasonable

Estimation

Not subject to

Reasonable

Estimation

Liability accrued

and

d ddisclosure

sc osu e note

oe

Liability accrued

and

d ddisclosure

sc osu e note

oe

Disclosure note

oonly

y

Disclosure note

only

Disclosure note

only

Disclosure note

only

No disclosure

required

No disclosure

required

No disclosure

required

A loss contingency is accrued only if a loss is probable

and the amount can be reasonably estimated

© Dr. Chula King

All Rights Reserved

2

Product Warranties and Guarantees

• Product warranties inevitably entail costs, i.e.,

they are probable

• The amount of those costs can be reasonable

g commonly

y available

estimated using

estimation techniques

• Therefore, a liability for the estimated cost

should be accrued

Warranty expense

Estimated liability for warranty

© Dr. Chula King

All Rights Reserved

For Example

• Apex, Inc., sold a product that carried a oneyear warranty against defects. Estimates based

upon past experience and industry standards

indicate that warranty costs approximate 3% of

sales. During 2013, sales of the warranty

based product were $2,000,000, and were all

on account. In 2013, Apex paid $10,000 to

service the warranties.

© Dr. Chula King

All Rights Reserved

For Example (continued)

Accounts receivable

2,000,000

Sales revenue

2,000,000

Warranty expense (3% x 2,000,000)

60,000

Estimated liability for warranty

60,000

60 000

(entry to estimate total warranty costs)

Estimated liability for warranty

10,000

Cash, parts, etc.

10,000

(entry to record actual expenditures for warranty)

© Dr. Chula King

All Rights Reserved

3

Extended Warranty Contracts

• Sold separately from the product

• The related revenue is not earned until

Claims are made against the extended warranty;

OR

The extended warranty period expires

• Entry to record the sale of extended warranty

Cash

Unearned warranty revenue

© Dr. Chula King

All Rights Reserved

Premiums

• Included with the product

• Expensed in the period of the sale of the

product

• Contingent

C i

on action

i by

b the

h customer, andd

require accounting similar to warranties

© Dr. Chula King

All Rights Reserved

Subsequent Events

• Events occurring between the fiscal year-end

date and the date financial statements are

issued can affect the appearance of disclosures

on financial statements

• Events occurring after the year-end date but

before the financial statements are issued can

also affect the appearance of disclosures on the

financial statements

© Dr. Chula King

All Rights Reserved

4

Unasserted Claims and Assessments

Unasserted claim

No

disclosure

needed

No

Is a claim

or assessment

probable?

Yes

© Dr. Chula King

All Rights Reserved

Evaluate (a) the likelihood of an unfavorable outcome and

(b) whether the dollar amount can be estimated.

An estimated loss and contingent liability would be

accrued if an unfavorable outcome is probable and the

amount can be reasonably estimated.

The Next Step

• Exercises 2, 3, 5, 6, 7, 15, 19, 24

• Problems 2, 4, 5, 6

© Dr. Chula King

All Rights Reserved

5