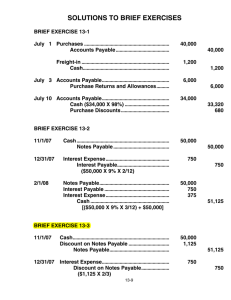

Chapter 13 solutions

advertisement