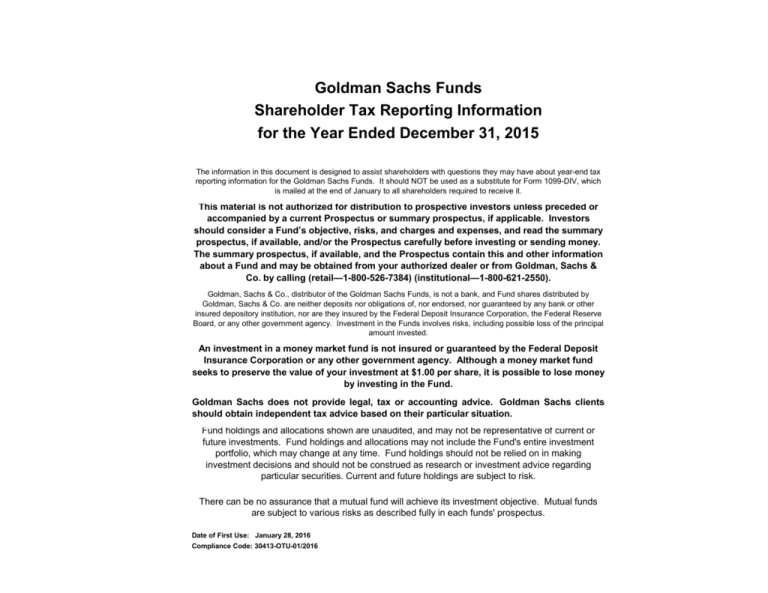

2015 Shareholder Tax Reporting Information (Blue book)

advertisement

Goldman Sachs Funds Shareholder Tax Reporting Information for the Year Ended December 31, 2015 The information in this document is designed to assist shareholders with questions they may have about year-end tax reporting information for the Goldman Sachs Funds. It should NOT be used as a substitute for Form 1099-DIV, which is mailed at the end of January to all shareholders required to receive it. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a current Prospectus or summary prospectus, if applicable. Investors should consider a Fund’s objective, risks, and charges and expenses, and read the summary prospectus, if available, and/or the Prospectus carefully before investing or sending money. The summary prospectus, if available, and the Prospectus contain this and other information about a Fund and may be obtained from your authorized dealer or from Goldman, Sachs & Co. by calling (retail—1-800-526-7384) (institutional—1-800-621-2550). Goldman, Sachs & Co., distributor of the Goldman Sachs Funds, is not a bank, and Fund shares distributed by Goldman, Sachs & Co. are neither deposits nor obligations of, nor endorsed, nor guaranteed by any bank or other insured depository institution, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency. Investment in the Funds involves risks, including possible loss of the principal amount invested. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Goldman Sachs does not provide legal, tax or accounting advice. Goldman Sachs clients should obtain independent tax advice based on their particular situation. Fund holdings and allocations shown are unaudited, and may not be representative of current or future investments. Fund holdings and allocations may not include the Fund's entire investment portfolio, which may change at any time. Fund holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. Current and future holdings are subject to risk. There can be no assurance that a mutual fund will achieve its investment objective. Mutual funds are subject to various risks as described fully in each funds' prospectus. Date of First Use: January 28, 2016 Compliance Code: 30413-OTU-01/2016 Goldman Sachs Money Market Funds Shareholder Reporting Information For the Year Ended 12/31/15 Goldman Sachs Money Market Funds - Financial Square Tax-Exempt California Fund: During calendar year 2015, 89.06% of the distributions paid by the Fund were "exempt-interest dividends" and as such, are not subject to either U.S. federal income tax or California state income tax. The following is a breakdown of the source of the exempt-interest dividends paid by the Fund during calendar year 2015: State Percentage California 100.00% Total 100.00% Note: During calendar year 2015, none of the exempt-interest dividends paid by the Fund were derived from Private Activity Bonds ("AMT Bonds"). Goldman Sachs Money Market Funds - Financial Square Tax-Exempt New York Fund: During calendar year 2015, 73.38% of the distributions paid by the Fund were "exempt-interest dividends" and as such, are not subject to either U.S. federal income tax or New York state income tax. The following is a breakdown of the source of the exempt-interest dividends paid by the Fund during calendar year 2015: State Percentage New York 100.00% Total 100.00% Note: During calendar year 2015, none of the exempt-interest dividends paid by the Fund were derived from Private Activity Bonds ("AMT Bonds"). 1 Goldman Sachs Money Market Funds Shareholder Reporting Information For the Year Ended 12/31/15 Goldman Sachs Money Market Funds - Financial Square Tax-Free Money Market Fund: During calendar year 2015, 68.67% of the distributions paid by the Fund were "exempt-interest dividends" and as such, are not subject to U.S. federal income tax. The following is a breakdown of the source of the exempt-interest dividends paid by the Fund during calendar year 2015: State State Alabama Percentage 3.10% Alaska 0.31% Arizona 0.78% Arkansas 0.00% California 18.51% Colorado 2.27% Connecticut 2.71% Delaware 0.41% District of Columbia 1.34% Florida 1.76% Georgia 1.56% Hawaii 0.19% Idaho 0.00% Illinois 2.68% Indiana 0.85% Iowa 0.00% Kansas 2.48% Kentucky 0.06% Louisiana 1.43% Maine 0.09% Maryland 1.53% Massachusetts 5.48% Michigan 0.45% Minnesota 0.88% Mississippi 0.81% Missouri 0.47% Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total: Percentage 0.00% 0.27% 1.10% 0.26% 1.49% 0.78% 17.42% 1.21% 1.23% 2.18% 0.15% 0.64% 2.59% 0.00% 0.00% 1.57% 0.00% 1.17% 8.70% 1.06% 0.00% 1.74% 4.91% 0.00% 1.17% 0.21% 100.00% Note: During calendar year 2015, none of the exempt-interest dividends paid by the Fund were derived from Private Activity Bonds ("AMT Bonds"). 2 Goldman Sachs Money Market Funds Shareholder Reporting Information For the Year Ended 12/31/15 Federal Obligations U.S. Treasury Small Business Admin (SBA) FS Prime Obligations Fund 1.56% 0.00% 0.00% FS Government Fund 2.64% 0.00% FS Treasury Obligations Fund 53.37% FS Treasury Solutions Fund Goldman Sachs Money Market Funds SM Financial Square Funds FS Treasury Instruments Fund FS Money Market Fund FS Federal Instruments Fund Federal Federal Farm Credit Home Loan Bank Bank (FHLB) (FFCB) Tennessee Valley Authority (TVA) Repurchase Agreements (Repos) FNMA, GNMA, FHLMC Other * TOTAL 5.64% 0.00% 29.99% 0.16% 62.65% 100.00% 8.53% 33.10% 0.00% 48.01% 7.33% 0.39% 100.00% 0.00% 0.00% 0.00% 0.00% 45.09% 0.00% 1.54% 100.00% 34.13% 0.00% 14.33% 31.33% 0.00% 12.04% 0.00% 8.17% 100.00% 100.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 100.00% 0.36% 0.00% 0.00% 2.67% 0.00% 22.88% 0.00% 74.09% 100.00% 39.95% 0.00% 13.89% 44.17% 0.00% 0.00% 0.00% 1.99% 100.00% * Includes the distribution of net short-term capital gains (if any), and interest income generated by non-Federal obligations not separately listed above. Notes: The above table provides information with respect to the "pass-through" of the tax-exempt nature of dividend distributions derived from federal obligations for state income tax purposes. However, state and local taxes differ from state to state and it is strongly recommended that shareholders consult their own tax adviser with respect to the entitlement of a "pass-through" of dividends derived from federal obligations. Please note that shareholders of the funds listed to the right that are residents of California, Connecticut, or New York will not be entitled to the pass-through of interest derived from federal obligations for state income tax purposes. FS Prime Obligations Fund FS Government Fund FS Treasury Obligations Fund FS Money Market Fund Goldman Sachs Financial Square FundsSM is a registered service mark of Goldman, Sachs & Co. 3