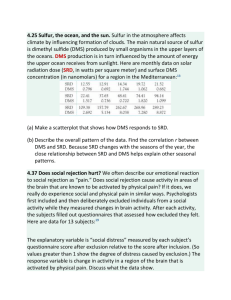

Payroll and Personnel Administrative Processes

advertisement