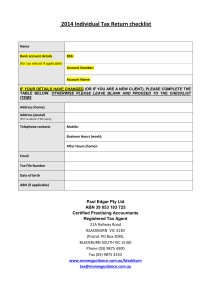

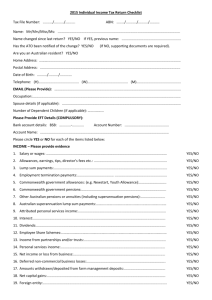

Individual tax return instructions 2013

advertisement