Understanding Homeowner Policy Exclusions & Endorsements

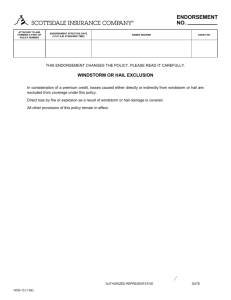

advertisement