02 Contingent Claims Markets

advertisement

2. Contingent Claims Markets

Objectives

A deeper understanding of the pricing function:

-

Introduction of contingent claims

-

Complete market structure

-

Change of probability measure: Risk neutral probabilities

-

Optimal Risk Sharing

-

Graphical presentation of the Pricing Function in the State Diagram

Contents

2.

Contingent Claims Markets

2.1

Contingent Claims

2.2

Risk Neutral Probabilities

2.2

Investors’ Optimal Decision

2.4

Optimal Risk Sharing

2.5

State Diagram and Price Function

Financial Theory, js

Contingent Claims Markets

12

2.1 Contingent Claims

Suppose there are s = 1,2…,S states of the world. The set of states define the state space ℜ S

that defines the maximum set of payoffs investors could purchase or sell. In a simple

example we have three states of the world, e.g. good, middle, and bad economic situations.

Moreover, there n = 1,2…,N are contingent claims who pay 1 € in one state of the world, and

nothing in other states of the world. We denote the price of the contingent claim that pays one

€ in state s as pct s . The prices of the contingent claims present the present values of the s-

()

contingent claims of 1 €.

Obviously, there is a natural limit to the number of contingent claims, N ≤ S . If N = S , the

set of the contingent claims constitute the complete canonical vector basis of the state space,

given by the S-dimensional identity matrix. The contingent claims span the total state space.

If N < S , they establish the canonical vector basis of a N-dimensional subspace of the state

space, given by a N-dimensional identity matrix. In this case contingent claims span only a

subset of the state space.

Assumption A.2.1: Complete Market Structure

Contingent claims span the total state space, i.e. N = S .

A.2.1

Theorem 2.1 Existence of discount factors

Given assumption A.2.1, there exist state contingent (positive) discount factors. They equal

the quotient of contingent claims prices and their probabilities.

Proof: In order to proof this theorem we start from the present value of the state contingent

payoffs of any arbitrary asset given as

()

S

() ()

pt x = ∑ pct s xt +1 s .

s=1

(2.1)

It is convenient to substitute the summation of present values of the state contingent payoffs

by the expectation of the present values of the state contingent payoffs. If we denote the

probability of the occurrence of state s as π t +1 s we can express the expectation of the

()

present values of the state contingent payoffs as

()

S

s=1

( )x s .

()

( s)

pct s

( )π

pt x = ∑ π t +1 s

(2.2)

t +1

t +1

Therefore we can identify the stochastic discount as

( ).

(2.3)

π ( s)

pc ( s ) π ( s ) is sometimes referred as state-price-density. Using (2.3) we express (2.2) as

pct s

()

mt +1 s =

t +1

t

t +1

()

S

()

pt x = ∑ π s

s=1

t +1

Financial Theory, js

() ()

() ()

mt +1 s xt +1 s = E ⎡⎣ mt +1 s xt +1 s ⎤⎦ .

Contingent Claims Markets

(2.4)

13

2.2 Risk-Neutral Probabilities

()

Another common transformation leads to the so-called “risk neutral probabilities”, π *t +1 s .

We define the latter as

()

()

()

()

π *t +1 s = Rtf+1π t +1 s mt +1 s = Rtf+1 pct s .

(2.5)

Of course we have

S

1

=

∑ pc s = E ⎡⎣ mt +1 s ⎤⎦ .

Rtf+1 s=1 t

()

()

(2.6)

With (2.6) we can express equation (2.5) as

()

()

()

π *t +1 s = Rtf+1 mt +1 s π t +1 s =

() π s.

()

( s)⎤⎦

mt +1 s

E ⎡⎣ mt +1

(2.7)

t +1

Moreover, using (2.5) we can rewrite the pricing formula (2.4) as

()

S

()

() ()

pt x = ∑ π t +1 s mt +1 s xt +1 s =

s=1

1 S *

1

π s xt +1 s = f E * ⎡⎣ xt +1 s ⎤⎦ .

f ∑ t +1

Rt +1 s=1

Rt +1

() ()

()

(2.8)

We use the notation E * to indicate that the expectation is based on the risk neutral

probabilities π *t +1 s rather than the real probabilities π t +1 s . Asset prices can be thought of

()

()

()

as the result of a risk neutral evaluation with risk neutral probabilities π *t +1 s , rather than real

()

probabilities π t +1 s .

The transformation from real to risk neutral probabilities is

()

π *t +1 s =

() π s

()

( s)⎤⎦

mt +1 s

(2.9)

t +1

E ⎡⎣ mt +1

The risk neutral probabilities give more weights to the states with above average discounts

(IMRS). From this perspective risk aversion can be thought as giving higher weights to

unpleasant states. Sometimes risk averse people report unrealistic probabilities to catastrophic

events such as plane crashes etc. We should not understand this as an expression of

irrationality, but as referring to risk neutral probabilities, i.e. the product of

Rtf+1 mt +1 s π t +1 s . This product gives important information for decision under uncertainty.

()

()

People pay a lot of attention to contingencies that are highly probable or to contingencies that

are improbable but have disastrous results.

Moreover, we can think of the transformation (2.9) as a change of measure from real

probabilities π t +1 s to subjective probabilities π *t +1 s . This change of the measure is quite

()

()

common, especially in derivative pricing.

2.3 Investors’ Optimal Decision

It is interesting to analyze once more investors’ decision of an optimal inter-temporal

utilization in a world with uncertain income streams:

Financial Theory, js

Contingent Claims Markets

14

S

Max u ( c ) + ∑ βπ ( s )u ⎡⎣ ct +1 ( s ) ⎤⎦

{c ,c (s)} t s=1 t +1

t

(2.10)

t+1

S

S

() ()

()

()

s.t. ct + ∑ pct s ct +1 s = yt + ∑ pct s yt +1 s

s=1

s=1

(2.11)

If we denote the Lagrange multiplier representing the marginal utility of the present value of

wealth in t+1 as λt we receive the first order conditions

( )

u′ ct − λt = 0 ,

()

(2.12a)

()

()

βπ t +1 s u′ ⎡⎣ ct +1 s ⎤⎦ − λt pct s = 0 .

(2.12b)

Of course, we have a condition of the type (2.12b) for all states of the world. Eliminating the

Lagrange multiplier yields the first order conditions of an optimal allocation of consumption

streams between the presence and any arbitrary future state s of the world as

()

pct s =

()

()

π t +1 s β u′ ⎡⎣ ct +1 s ⎤⎦

,

u′ ct

( )

(2.13)

or between two arbitrary different future states of the world, s and w as

( ) = π ( s) u′ ⎡⎣c ( s)⎤⎦ .

pc ( w) π ( w) u′ ⎡ c ( w) ⎤

⎣

⎦

pct s

t +1

t

t +1

t +1

(2.14)

t +1

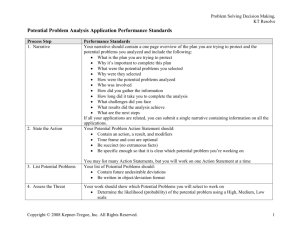

For states 1 and 2 optimal state contingent consumption streams are presented in Figure 2.1.

state 2

ct+1(2)

α

state 1

ct+1(1)

tg α = −

()

pc ( 2 )

pct 1

t

Figure 2.1 Optimal Decision under Uncertainty

()

If mt +1 s refers the MRS between date- and state-contingent goods we can express (2.13) as

()

mt +1 s =

()

( )

()

()

β u′ ⎡⎣ ct +1 s ⎤⎦ pct s

.

=

u′ ct

π t +1 s

(2.15)

Obviously we obtain again the CBAPM:

Financial Theory, js

Contingent Claims Markets

15

S

()

()

S

() ()

()

pt x = ∑ π t +1 s mt +1 s xt +1 s = ∑ π t +1 s

s=1

s=1

()

( )

β u′ ⎡⎣ ct +1 s ⎤⎦

xt +1 s

u′ ct

()

(2.16)

The first order condition (2.13’) implies for any arbitrary pair s, w of states of the world

( ) = u′ ⎡⎣c ( s)⎤⎦ = pc ( s)

( w) u′ ⎡⎣c ( w)⎤⎦ pc ( w)

mt +1 s

mt +1

t +1

π t +1

t

t +1

().

( w)

π t +1 s

t

(2.17)

The marginal rate of substitution of the consumption in two states of the world has to be equal

to the state-price-density of the two states. The quota mt +1 s mt +1 w defines the relation at

()

( )

which an investor is willing to exchange consumption of state w against consumption of state

s through purchases and sales of contingent claims. Thus, this relation defines the MRS

between two state-contingent goods.

Given the choice of consumption streams and the utility function we can calculate the implicit

contingent claim prices which have let the investors to this decision.

2.4 Optimal Risk Sharing

For two arbitrary individuals i and j, from (2.13) or (2.15) and (2.14) or (2.17) follows

π

()

i

t +1

()

()

()

π ti +1 s β iui′ ⎡⎣ cti+1 s ⎤⎦

π tj+1 s β j u′j ⎡⎣ ctj+1 s ⎤⎦

s =

= pct s =

= mtj+1 s π tj+1 s ,

i

j

′

′

ui ct

u j ct

( s) m ( )

i

t +1

( )

()

( )

()

()

(2.18)

and

( ) ( ) = π ( s) u′ ⎡⎣c ( s)⎤⎦ = pc ( s) = π ( s) u′ ⎡⎣c ( s)⎤⎦ = π ( s) m ( s) .

( w) m ( w) π ( w) u′ ⎡⎣c ( w)⎤⎦ pc ( w) π ( w) u′ ⎡⎣c ( w)⎤⎦ π ( w) m ( w)

i

t +1

π ti +1 s mti +1 s

π ti +1

i

t +1

i

t +1

i

i

t +1

t

i

i

t +1

t

j

t +1

j

t +1

j

j

t +1

j

j

t +1

j

t +1

j

t +1

j

t +1

j

t +1

(2.19)

If two arbitrary investors have the same preferences, including time preferences, the same

expectations about future states, and free access to contingent claims (capital) markets we

receive

cti+1

cti

=

ctj+1

ctj

This would imply that people share the shocks equally in relative changes, not in levels. Of

course, these assumptions (alike preferences and completeness of capital markets) are very

restrictive.

The optimal risk sharing as in (2.18) is Pareto optimal – of course, only in the ex ante sense as we can see from the solution of the program

S

S

⎧

⎫

⎧

⎫

i

i

j

⎡

⎤

⎡ ctj+1 s ⎤ ⎬ , (2.20)

λ

u

c

+

βπ

s

u

c

s

+

λ

u

c

+

βπ

s

u

⎨

⎬

⎨

∑

∑

i

i

t

t

+1

i

t

+1

j

j

t

t

+1

j

⎣

⎦

⎣

⎦

i

cti ,ct+1

( s) ,ct ,ct+1 ( s) ⎩

s=1

s=1

⎭

⎩

⎭

Max

j

j

s. t.

( )

()

()

( )

cti + ctj = yt

Financial Theory, js

()

()

(2.21a)

Contingent Claims Markets

16

()

()

()

i

j

ct+1

s + ct+1

s = yt+1 s ,

(2.21b)

where λi and λ j are the weights of the investors in the utility function of the central planer.

If we denote the Lagrange multipliers corresponding to the restrictions (2.21a) and (2.21b) as

µt and µt+1 s we receive the following first order conditions of an optimal allocation:

()

( )

λiui′ cti − µt = 0 ,

()

(2.22a)

()

()

λi βπ t +1 s ui′ ⎡⎣ cti+1 s ⎤⎦ − µt +1 s = 0 ,

(2.22b)

( )

λ j u j ′ ctj − µt = 0

()

(2.22c)

()

()

λ j βπ t +1 s u′j ⎡⎣ ctj+1 s ⎤⎦ − µt +1 s = 0

(2.22d)

From (2.22a) – (2.22d) we receive

()

()

()

()

( )

()

( )

()

()

β iπ t +1 s ui′ ⎡⎣ cti+1 s ⎤⎦ µt +1 s

β jπ t +1 s u′j ⎡⎣ ctj+1 s ⎤⎦

,

=

=

µt

ui′ cti

u′j ctj

or

( )

()

( )

()

()

( )

(2.23)

()

( )

π t +1 s ui′ ⎡⎣ cti+1 s ⎤⎦

π t +1 s u′j ⎡⎣ ctj+1 s ⎤⎦

µt +1 s

.

=

=

π t +1 w ui′ ⎡⎣ cti+1 w ⎤⎦ µt +1 w π t +1 s u′j ⎡⎣ ctj+1 w ⎤⎦

(2.24)

Of course, (2.23) and (2.24) imply (2.18) and (2.19).

2.5 State Diagram and Price Function

()

()

( )

T

We define a vector of prices of contingent claims as pct = ⎡⎣ pct 1 pct 2 … pct S ⎤⎦ , and a

()

()

( )

T

vector of payoffs as xt +1 = ⎡⎣ xt +1 1 xt +1 2 … xt +1 S ⎤⎦ .

The price of the asset is determined as

()

S

() ()

pt x = ∑ pct s xt +1 s .

s=1

(2.1)

The price of the asset is given by the inner product of the vector of contingent claim prices

pct and the vector of the payoffs xt +1 .

The inner product measures the angle between two vectors. This relation can be expressed as

cosθ =

pctT xt +1

pct xt +1

,

(2.25)

where pct and xt +1 present the length of the vectors pct and xt +1 . Because of (2.25) the

asset price defined as the inner product of contingent claim prices pct and asset payoffs xt +1

Financial Theory, js

Contingent Claims Markets

17

can be represented as the product of the length of pc and x, and the cosine of the angle θ .

Finally we can express the price of the asset as the product of the length of pct and the

projection of xt +1 on pct , since the scalar projection of xt +1 onto pct is defined as

(

)

proj xt +1 pct = xt +1 × cosθ .

(2.26)

From this follows

S

()

(

() ()

)

pt x = ∑ pct s xt +1 s = pctT ·xt +1 = pct × xt +1 × cosθ = pct × proj xt +1 pct .

s=1

(2.27)

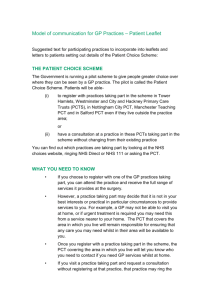

These relations are illustrated in Figure 2.2:

State 2

Payoff

proj(x t+1 |pct )

1

x t+1

pc t

pc(2)

tgα =

θ

α

()

pc (1)

pct 2

t

pc(1) 1

State 1 Payoff

Figure 2.2: Evaluation of Payoffs

Exemplary payoffs are represented by the (green) vector xt +1 , and contingent claim prices by

the (red) vector pct . These vectors form an angle θ satisfying (2.25). The scalar projection,

(

)

xt +1 pct is represented by the (blue) vector proj xt +1 pct .

2.5.1 Planes of Constant Prices

()

The inner product of the vector pct with slope pct 2

()

pct 1 and the vector orthogonal to

pct is zero. Thus, the price of all payoffs along the vector orthogonal to the vector pct is

()

p ( y ) = ∑ pc ( s )y ( s ) = ∑ pc ( s )kx ( s ) = kp ( x ) = 0 .

( )

zero. If xt +1 = 0 , pt x = 0 . Moreover, if yt +1 = kxt +1 , where k > 0 , pt y = 0 , because

t

t

s

t +1

t

s

t +1

t

(2.28)

Because of (2.27), all payoffs xt +1 , which have the same projection onto pct must have the

same price. Thus, lines perpendicular to pct are iso-price-lines. Therefore, all payoffs with

Financial Theory, js

Contingent Claims Markets

18

price equal to one must lie on the “perpendicular” running through the risk free rate Rtf+1 . The

price of contingent claims equals to the projection of the unit vectors onto pct .

The iso-price-lines can are illustrated in figures below:

State 2

Payoff

Price = 2

Risk free rate

1

pc(2)

Price = 1

tgα =

()

pc (1)

pct 2

t

α

pc(1) 1

State 1 Payoff

Price = 0

Figure 2.3: Iso-Price-Lines

pc(x)

Iso-price-level

Iso-price-line

state 2

1

pc(2)

1

pc(1)

1

state 1

Figure 2.4: Perspective Presentation of Contingent Claims Prices and Payoffs

The pricing function can be considered as a map from the state space to the price line,

p : ℜ S → ℜ as illustrated in Figures 2.3 and 2.4.

Financial Theory, js

Contingent Claims Markets

19

Moreover, the pricing function is linear, i.e. that

(

)

()

( )

pt ax + by = apt x + bpt y .

(2.29)

As a consequence of the linearity in (2.29), the iso-price-lines in Figure 2.3 and 2.4 are linear.

()

As can be seen from Figure 2.5 below, the iso-price-lines have the slope − pct 1

()

pct 2 .

State 2

Payoff

pc(2)

α

γ

β

price = pc

β

ϕ

α

State 1 Payoff

pc(1)

Price = 0

Figure 2.5: Slope of the Iso-Price-Lines

As α and γ complement β to 90°, we have α = γ . And from this follows immediately

β =ϕ .

2.5.2 Discount Factors instead of Contingent Claim Prices

We can understand Figure 2.3 in terms of discount factors rather than contingent claims. We

can define an inner product of random variables as

(

)

mtT+1 x ≡ E mtT+1 xt +1 ,

(2.30)

where

()

()

( )

T

mt +1 = ⎡⎣ mt +1 1 mt +1 2 … mt +1 S ⎤⎦ .

Of course mt +1·xt +1 has all mathematical properties of an inner product. For this reason, we

(

)

often call random variables with the property E mtT+1 xt +1 = 0 orthogonal.

When we run a regression of mt +1 on xt +1 ,

mt +1 = bT xt +1 + ε t +1 ,

(2.31)

we find the linear combination of x which is closest to m, by minimizing the quadratic

deviation of mt +1 − bT xt +1 = ε t +1 , i.e. the variance or the size of ε .

Financial Theory, js

Contingent Claims Markets

20

(

)

We do this by forcing the residual to be orthogonal to x, i.e. that E xtT+1ε t +1 = 0 . The

projection of m on x is the defined as

(

)

proj mt +1 xt +1 = b xt +1 =

T

(

E(x

E mtT+1 xt +1

T

t +1 t +1

x

)x

)

t +1

.

(2.32)

This is often illustrated by a vector of residuals that is perpendicular to a plane defined by

variables x. Thus, when the inner product is defined by a second moment, the projection of m

onto x is a regression as in (2.31).

The concept presented in this paragraph can be extended to an infinite state space. (For details

see Appendix Time Continuous Model.)

Financial Theory, js

Contingent Claims Markets

21