Same-Day: The Next Killer App

advertisement

INDUSTRY NOTE

USA | Technology

Internet

April 10, 2013

EQUITY RESEARCH AMERICAS

Internet

Fulfillment / Same-Day: The Next Killer App

Key Takeaway

We believe fulfillment and omni-channel capabilities represent the next high

ground in the eCommerce war. The winners are not clear yet but major players

are investing heavily. For now, Amazon and eBay have the most comprehensive

offerings longer-term but leaders could change any time; more than a few

other players are close behind. We reiterate our Buy ratings on AMZN and EBAY.

Fulfillment is becoming critical for commerce as an impending online sales tax

should soon neutralize any price advantage online retailers had. When this happens, we

believe, fulfillment options will become a differentiating feature for many online (and

offline) retailers. At the same time, Local becomes the new battleground in commerce.

While 90% of all retail still happens in brick-and-mortar stores, 75% of total spending is

within 15 miles of shoppers' homes. Mobile is changing the picture, too. It is driving the

transition to a world where it is expanding commerce beyond conventional stores and

eCommerce websites. In such an omni-channel world consumers have multiple touch

points with a brand / retailer and these have to be well integrated and optimized for a

seamless user experience. We believe the growing importance of fulfillment and omnichannel already drives retailers to explore options beyond free shipping.

With free shipping now available on approximately 50% of orders, retailers

already feel renewed pressure to explore new fulfillment options. Over the past 2-3 years,

competitive pressure and customer expectations have pushed online retailers to offer free /

reduced shipping on an increasing number of orders with constantly shrinking minimum

order requirements. Today, free / reduced shipping is a "must have" in eCommerce and

online retailers are focusing their attention on the next wave of options that could give them

a leg up on competition. Currently, same-day delivery and delivery to local secure

lockers where customers pick up their goods on their own time schedule seem to be

the biggest focus. With most of these services still in beta test, the landscape is constantly

changing but we believe the major contenders have already emerged.

Major players: There are generally three types of players in fulfillment – those that only

fulfill, those that sell and fulfill, and those that source, sell and fulfill. For now, the first

type are largely niche (location based) start-ups that have expanded from running errands

for customers into same-day delivery. The other two types have the highest stakes in the

game and are the ones, we believe, most likely to drive fulfillment into new territories. Key

players here include not only the usual suspects - Amazon and eBay - but also Google,

big national retailers, and the USPS.

Potential winners: While it is not clear yet if consumers are actually ready to pay (and how

much) for same-day delivery and similar services, the competition in fulfillment is on and

major players are already investing. Which aspects of fulfillment (e.g. speed, flexibility, cost)

will prove more important to consumers could determine which of the existing offerings

will survive and thrive. Currently, we believe, Amazon and eBay have the most

compelling offerings. Amazon is a clear leader, based on number of services, global

fulfillment center footprint, and ability to manage demand elasticity through its digital

assets. And while many retailers are wary of using Amazon as a channel, we believe longerterm it could become their best partner, especially for branded products/retailers (selling

exclusive inventory through Amazon). eBay has partnered with top national retailers (while

maintaining neutrality) and, in our view, has the most compelling offering that helps

retailers leverage their own brands and assets to evolve their multi-channel strategies. Its

products enable retailers to address the full opportunity of the converging online and offline

markets. And while most of the other contenders' offerings are still in beta mode (i.e. could

change materially), a few stand out as potentially strong enough to compete with Amazon

and eBay. We believe two to keep an eye on are Walmart and Google.

Jefferies US Internet Team *

Jefferies Equity Research

pitz-fitz@jefferies.com

Brian Pitz *

Equity Analyst

(212) 336-7413 bpitz@jefferies.com

Brian Fitzgerald *

Equity Analyst

(212) 284-2491 bfitzgerald@jefferies.com

Timothy O'Shea *

Equity Associate

(212) 284-3415 toshea@jefferies.com

Sachin Khattar, CFA *

Equity Associate

(212) 323-3381 skhattar@jefferies.com

Stan Velikov, CFA *

Equity Associate

(212) 284-2140 svelikov@jefferies.com

* Jefferies LLC

Jefferies does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that Jefferies may have a conflict

of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Please see analyst certifications, important disclosure information, and information regarding the status of non-US analysts on pages 45 to 49 of this report.

Technology

Internet

April 10, 2013

Key Takeaways

Fulfillment is becoming critical for commerce as an impending online sales tax should

soon neutralize any price advantage online retailers had. When this happens, we believe,

fulfillment options will become a differentiating feature for many online (and offline)

retailers. At the same time, Local becomes the new battleground in commerce. While

90% of all retail still happens in brick-and-mortar stores, 75% of total spending is within

15 miles of shoppers' homes. Mobile is changing the picture, too. It is driving the

transition to a world where it is expanding commerce beyond conventional stores and

eCommerce websites.

Reiterating Buy ratings on AMZN and EBAY

In the ongoing eCommerce war, we believe, Amazon and eBay have the most

comprehensive next-gen offerings and seem best positioned to benefit from these

fundamental trends. Amazon is a clear leader, based on number of services, global

fulfillment center footprint, and ability to manage demand elasticity through its digital

assets. And while many retailers are wary of using Amazon as a channel, we believe

longer-term it could become their best partner, especially for branded products / retailers

(selling exclusive inventory through Amazon). eBay, at the same time, has partnered with

top national retailers (while maintaining neutrality) and, in our view, has the most

compelling offering that helps retailers leverage their own brands and assets to evolve

their multi-channel strategies. Its products enable retailers to address the full opportunity

of the converging online and offline markets.

Amazon

Near term, we will likely see a more significant impact to Amazon's CapEx growth as the

company continues to aggressively build out fulfillment centers domestically and

internationally. We expect FC build out for this year to peak in late Q2 into Q3, with a

slowdown just ahead of the 2013 holiday season. So far, Amazon has commitments (part

of state tax agreements) to build 9 new FCs in the US over the next 2 years and we

estimate it could eventually build 5-10 more to rationalize its US footprint. According to

Marc Wulfraat, President of MWPVL International, a supply chain and logistics consulting

firm, having 40-45 facilities in the US is probably sufficient to cover the Top 20 markets for

same-day delivery. However, internationally Amazon could grow its presence materially,

especially in Australia, South America, Eastern Europe, and India. We estimate it could

open another 10-15 within the next 2-3 years.

We continue to expect Amazon to support additional same-day and next-day shipping

tests, as we consistently see with Quidsi and Zappos products in several markets. We

anticipate same-day tests will begin and grow on the core Amazon.com site by year end

in some markets.

Longer term, as Amazon drives same-day and next-day shipping into the top 20 or top

50 US markets (and eventually into the larger international markets), we believe same-day

shipping will drive reaccelerating unit growth; the earliest impact could even begin in Q4

2013, but most likely will have a longer term impact in 2014 and beyond.

page 2 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

eBay

Near term, eBay may have the performance edge as the Marketplaces / PayPal / GSI

combo, with their combination of front-end and back-end eCommerce and digital

marketing solutions, gives retailers competing against Amazon a real fighting chance.

Further, the very nature of eBay being on the "retailers’ team" and enabling overall omnichannel commerce will likely be a huge selling point for eBay's services, especially among

the offline sellers of commoditized goods.

Longer term, we believe the biggest challenges for eBay will be achieving significant

scale in fulfillment and same-day shipping, though we are in no way counting them out

of the competition.

Over time, as consumers begin to digest and appreciate the value of same-day shipping,

and eventually even start to EXPECT or REQUIRE near instantaneous shipping, we believe

the next leg down for traditional brick-and-mortar could begin... As competing with this

service level will likely be very difficult from a cost perspective.

Offline – who wins, who loses?

Amazon IS indeed a competitor in many product categories – again, namely in consumer

products – with the likes of Best Buy; that is unlikely to change. And we believe that sameday shipping capabilities could provide the next level of pain for the offline retailers in

these categories. If Amazon is successful in its same-day shipping efforts, some of these

retailers could give Amazon exclusive inventory to ship same day, replacing their tradition

fulfillment businesses.

We believe that unique product brands that sell almost exclusively through their own

stores or exclusive channels could win while commodity product sellers of consumer

electronics, media (books, movies, video), etc. would likely lose.

The net of it all...

Amazon may actually become LESS of a competitor to some players in the offline world

over time as larger brands (specialty, luxury, exclusive) decide that "if you can't beat 'em,

join 'em" strategy could actually work and allocate a certain percentage of their inventory

to Amazon's FBA (many already provide eBay with access to exclusive SKUs and

inventory)... Think about it... Why should specialty retailers maintain 1,000's of specialty

stores / fulfillment centers when one could maintain a fraction of those stores as

strategically well-placed "showrooms" to allow consumers to satisfy their need to

occasionally view actual merchandise?

Let's use an example such as the offline retailer Lululemon; once the customer can try on

a pair of yoga pants and determine that she is size small in a flagship store; she can order

new styles and colors directly online - and potentially even have them delivered to her

hotel in a few hours if she forgets them on a business trip. (Note: there isn’t a single

Lululemon product to be found on Amazon’s site). Our sense is that Lululemon would

not pay to actually provide that level of service to their customer direct from their stores,

but why not someday leverage the most efficient supply chain platform in the world in an

exclusive merchandise deal with Amazon? Some 39% of units Amazon sells on its site are

already from third parties. Why, with the success of FBA, shouldn't that number represent

70% of total units? We think it could.

page 3 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

The Race in eCommerce Fulfillment

Convenience is one of three major components, along with selection and price, which

drive consumers to choose one retailer over another (offline and online alike). And

flexibility or choice of fulfillment options is a critical element of convenience, we believe.

In the early days of eCommerce, free / reduced shipping was the exception and usually

was tied to requirements of minimum order size. Later, the order size requirements began

to shrink and in the past 2-3 years completely disappeared, particularly during the holiday

shopping season. The reasons for this trend, however, were not that retailers were getting

more generous but rather that they were responding to customer and competitive

pressure. According to a January 2013 comScore survey, without free shipping,

54% of consumers would abandon a purchase. Per comScore, the number of

transactions with free shipping continues to increase – from roughly 35% in

2008 to 47% in 2012.

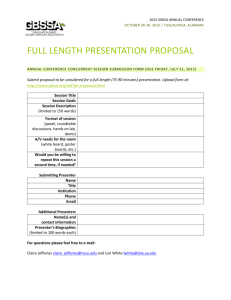

Exhibit 1: Free Shipping Penetration Continues to Grow

65%

35%

58%

57%

54%

53%

42%

43%

46%

47%

2008

2009

2010

Transactions w/ Free Shipping

2011

2012

Transactions w/ Paid Shipping

Source: comScore, Jefferies

Now that free / reduced shipping has pretty much established itself as a

“must have” for online retailers, the battle for customers is moving to new

frontiers in fulfillment, such as same-day delivery and delivery to local secure

lockers where customers pick up their goods on their own time schedule. This

trend is further accelerated by increasing local competition and an impending Internet

sales tax. Amazon has been in this game probably the longest but this fact has not

discouraged a growing list of competitors to enter the field. It is still the first inning of a

game that could take years to play out but we have already seen what happens with

losers – Kozmo and Urbanfetch, two companies that offered free one-hour delivery in the

late 1990’s, crashed and burned spectacularly in the last Internet bubble. Now most

players have more sound and profitable business models or simply are so big that they

could afford to keep a loss leader that builds customer loyalty and doesn’t give

competitors a lot of breathing space.

page 4 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Key Players

There are generally three types of players in the fulfillment game – those that only fulfill

(F), those that sell and fulfill (SF), and those that source, sell and fulfill (SSF). Currently,

in addition to Amazon (SSF), major players include eBay (SF), Walmart (SSF) and Google

(SF) – all three of them testing a variation on same-day delivery service (and all three still

in beta). The list of other players includes Barnes & Noble (SSF), Nordstrom (SSF), the US

Postal Service (F) and start-ups such as Exec (F), Instacart (F), Postmates (F), Shutl (F),

TaskRabbit (F), and WunWun (F).

Amazon

Amazon is one of the largest online retailers in the world and currently has one of the

most comprehensive fulfillment offerings; it includes free shipping, same-day delivery,

and delivery to a neighborhood locker.

Amazon Prime offers free twoday shipping on millions of

eligible items with no minimum

order size; for all other items,

standard or no-rush shipping is

also free

Free Shipping

Amazon Prime, the company’s membership program, offers free two-day shipping on

millions of eligible items with no minimum order size; for all other items, standard or norush shipping is also free. Shipping upgrades for expedited delivery in the US are available

too. Prime Members also enjoy unlimited instant streaming of more than 33,000 movies

and TV episodes as well as access to the Kindle Owners’ Lending Library where they can

borrow one Kindle book for free each month. All this for a $79 annual fee. By far, in our

opinion, Amazon Prime has been the gold standard in free / reduced shipping that other

online retailers are trying to match.

Exhibit 2: Amazon Prime

Source: Amazon, Jefferies

Same-Day Delivery

Amazon also offers Local Express Delivery, a same-day delivery service available in 10

metro areas – Baltimore, Boston, Chicago, Indianapolis, Las Vegas, New York City (and

parts of New Jersey), Philadelphia, Phoenix, Seattle, and Washington, DC. It costs $3.99

per item for Prime members and $8.99 per shipment + $0.99 per item for non-members

(gift cards $3.99 per shipment). The cut-off times vary from 7am in Chicago and

page 5 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Indianapolis to 12pm in Seattle. Orders placed after the deadline are delivered the next

business day with Saturday and Sunday delivery available for certain locations.

Local Express Delivery was launched in October 2009 in seven metro areas – Baltimore,

Boston, Las Vegas, New York City, Philadelphia, Seattle, and Washington, DC. It covered

thousands of items and cost $5.99 per item for Prime members and $15-$20 per item

(based on category) for non-members. By holiday season 2009 it had expanded to

include Chicago, Indianapolis and Phoenix. Customers ordering as late as 10:00am10:30am (1:00pm for Seattle) could get their orders delivered the same day.

Delivery to Neighborhood Locker

Amazon Locker, another shipping service by the company, solves a different problem.

Shoppers who are unable to wait at home for delivery can pick up their Amazon package

from a secure locker at their own convenience. At check-out, for eligible items, users can

select a convenient locker location and, once the package arrives there, they receive an email or text message with instructions and a unique pick-up code. Packages are available

for pick-up for three business days after receipt of notice. Complementary to other

shipping options, Amazon Locker is free and is currently available in Seattle, New York

City, and some shopping centers in the UK. Reportedly, Amazon has signed agreements

with 7-Eleven, RadioShack, Rite Aid, and Staples for hosting its lockers in their national

chain locations.

Exhibit 3: Amazon Locker

Source: Internet, Jefferies

“White Truck” Network for Localized Delivery

Reportedly, for the “last mile” of its services Amazon has engaged several “white truck”

companies that offer local delivery in numerous cities. The list of its partners includes A-1

Express and Dynamex, for Local Express Delivery, and Ensenda, LaserShip, OnTrac,

and Prestige for Prime deliveries. While it’s hard to control the quality of user experience

completely, by leveraging third-party carriers with established infrastructure in major

page 6 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

markets, Amazon can enter new markets quickly and can spare itself the investment in a

fleet of its own. Later, the company can always decide to bring this aspect of fulfillment

in-house, once demand levels and the economics become clearer.

Online orders can be processed

in as little as 15 min in FCs with

Kiva robots (pictured below) vs.

an average of ~2 hrs for current

Amazon FCs

Excellence in Order Processing

Another piece of Amazon’s fulfillment platform is Kiva Systems, maker of robotic order

fulfillment systems which streamline the process of picking, packing and shipping

eCommerce orders for delivery. Amazon closed the acquisition of Kiva in May 2012 but its

Quidsi (Soap.com and Diapers.com) business had been using Kiva robots since before

2010. While we believe management may not initially plan to retrofit Kiva robots into all

existing FCs (based on existing fulfillment centers’ layout / type), we believe all newlybuilt ones will feature the systems. Kiva’s integrated inventory storage, quality control

and order fulfillment systems not only expedite order processing (2-3x vs. pick-toconveyor and 5-6x vs. manual pick-to-cart / pick-to-pallet environments, according to

MWPVL International) but also improve order accuracy and optimize warehousing. Its

adaptive and dynamic software algorithms are constantly seeking new efficiencies to

improve throughput. Such optimization helps cut costs in more than one way. According

to the two Quidsi co-founders, thanks to Kiva robots, the company was able to offer free

overnight shipping on orders over $25 to customers in about 70% of the US.

Kiva began working with companies like Staples and Walgreens in 2004 and today it

counts among its customers more than a dozen of the biggest retailers in the US

including Crate & Barrel, Drugstore.com, Gap, Gilt Groupe, Office Depot, Saks Fifth

Avenue, and Toys “R” Us. Kiva Systems might as well prove the driver behind Amazon’s

Local Express Delivery service as its efficiency is hard to match. Since Kiva does not require

batching and waving of orders, any online order can be processed in as little as 15

minutes (from the time a shopper places the order to when his/her picked, packed and

labeled package is sitting on a delivery truck). This compares to a roughly 2-hour average

processing time in current Amazon fulfillment centers.

Exhibit 4: Kiva Robots in Action at a Warehouse

Source: Internet, Jefferies

While Kiva has many advantages, it may not be well-suited for all fulfillment settings. Kiva

systems sacrifice cubic volume and there is no way to take advantage of warehouse

height. In addition, according to some retailers (Kiva customers), its replenishment

software is not as robust as other applications and it doesn't integrate well with outbound

sortation software of any kind. We believe this is an opportunity for Amazon to improve

page 7 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Kiva’s software stack (Amazon is well known for its expertise) and re-launch its products

in the market. Perhaps this was one reason Amazon bought Kiva in the first place – being

able to re-engineer the product and make it even better.

Digital Content

While it may seem strange, digital content is another weapon in Amazon’s arsenal that

helps the company control shipping costs if not make its fulfillment offerings better than

competitors’. Starting in 2H11, Amazon began offering Prime Members who would agree

to downgrade their shipping (from the standard for Prime 2-day shipping) the option to

earn credit ($1 per order, increased to $3 in 2H12) that can be used for digital downloads

from the Amazon MP3 Store or for a movie from Amazon Instant Video. The new shipping

option, called No-Rush Shipping, allows Amazon to ship orders for delivery in 5-7 days

and thus more effectively balance shipping loads during critical shopping periods.

Exhibit 5: Digital Content as Load Balancer

Source: Amazon, Jefferies

The combination of Prime, Amazon Locker, and Local Express Delivery helps create the

most comprehensive fulfillment service existing today, in our view. How these services fit

into Amazon’s overall strategy can be gleaned, we believe, from the company’s evolving

position on the question of online sales tax and its push for new domestic fulfillment

centers. Until 2011-12, Amazon waged a high-profile war on the issue of eCommerce tax

with populous states such as New York, California, and Texas (note: its New York tax case

is currently in state appeals court); and new fulfillment center locations, we think, may

have been equally based on proximity to customers as well as on state tax laws.

Expanding Domestic Footprint While Striking Advantageous Tax Windows

Then, in late 2011, the company made an abrupt turn and began striking deals with state

and local governments that granted Amazon tax holidays of different length in exchange

for commitments to build new fulfillment centers and employ thousands of people. It also

initiated a campaign to encourage comprehensive resolution of the tax question on the

federal level instead of the piecemeal approach by individual states. This, we believe, was

triggered by Amazon’s insight that 1) the days of no online sales tax were numbered, 2)

fast local delivery can be a great competitive weapon that reinforces an online retailer’s

offline presence, and 3) many state and local governments were willing to sign

accelerated deals given their financial situations. In a matter of 16 months (beginning

with California in September 2011) Amazon reached agreements with 8 states.

While some might argue that an online tax is a potential near-term negative catalyst for

eCommerce stocks, we believe the real impact should be fairly insignificant. Amazon has

been collecting for years punitive VAT in many international locations and this has not

had any discernible impact on international sales growth rates. In fact, as we have seen in

states such as NY, the imposition of sales tax did not really impact sales;

page 8 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

ultimately – price, selection and service (along with convenience and speed, which are

service-related derivatives) are the main levers that resonate with online shoppers.

In Exhibit 6 below, we take a look at Amazon’s US operational footprint with a tax overlay.

We believe, the company will continue to expand its presence in select states, primarily

those that provide optimal infrastructure and proximity to markets with high

concentration of Amazon.com customers who are most likely to choose same-day

delivery if offered.

Exhibit 6: Current View of Amazon’s US Sales Tax Footprint

●States currently collecting

online sales taxes

(AZ, CA, KS, KY, NY, ND, PA,

TX, WA)

●States collecting online sales

taxes starting in 2H13

(CT, MA, NJ, VA)

●States collecting online sales

taxes starting in 2014

(IN, NV, TN)

●States collecting online sales

taxes starting in 2016

(SC)

●States with an Amazon.com

point-of-presence or affiliated

business -- zappos, woot!,

audible.com, quidsi, etc.

(AZ, CA, DE, GA, IN, KS, KY,

MI, NJ, NV, NH, NY, ND, PA,

SC, TN, TX, VA, WA, WI, WV)

Source: Amazon, Jefferies

Amazon currently collects taxes in 9 states – Arizona, California, Kansas,

Kentucky, New York, North Dakota, Pennsylvania, Texas, and Washington. In

the second half of 2013, the company has agreed to begin collecting taxes in 4 other

states – Connecticut, Massachusetts, New Jersey, and Virginia. Following that, in 2014

Amazon will begin collecting taxes in Indiana, Nevada and Tennessee; and in 2016 it adds

South Carolina to its tax rosters. So that’s 16 states by 2016.

Currently, the company has operations in the following (21) states: Arizona, California,

Delaware, Georgia, Indiana, Kansas, Kentucky, Michigan, New Jersey, Nevada, New

Hampshire, New York, North Dakota, Pennsylvania, South Carolina, Tennessee, Texas,

Virginia, Washington, Wisconsin, and West Virginia. Included here is a mix of both

operational / business headquarters as well as fulfillment (FC) and customer service (CSC)

centers. The following exhibit shows Amazon’s current customer service center footprint.

The company has announced plans to open 1 new CSC in Kentucky in 2013.

page 9 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Exhibit 7: Amazon Customer Service Centers

Americas

United States

North Dakota

Washington

West Virginia

Costa Rica

Heredia

San Jose

Europe

United Kingdom

Edinburgh, Scotland

Ireland

Cork

Germany

Berlin

Regensburg

Asia

China

Beijing

India

Hyderabad

Japan

Sapporo

Source: Amazon (http://www.amazon.com/b/?node=239366011), Jefferies

By our estimates, Amazon

operates close to 90 Fulfillment

Centers globally with a total

space in excess of 55MM sq ft

The following exhibit shows what we believe is Amazon’s worldwide fulfillment center

footprint as of 1Q13. By our estimates, excluding Quidsi and Zappos, the company

operates close to 90 fulfillment centers globally with a total space in excess of

55MM square feet. Reportedly, Amazon had plans to open a fulfillment center in

Mumbai, India in 2012 but we couldn’t find a confirmation of this. In addition, we

understand that a new fulfillment center is planned to open in France sometime in 2013.

Exhibit 8: Amazon International Fulfillment Centers

North America

See pages 12-15 for a more

detailed listing of Amazon’s

Global Fulfillment Center

footprint including size,

location, etc.

Europe

Asia

United States

Arizona (4)

California

Delaware (2)

Indiana (5)

Kansas

Kentucky (7)

United Kingdom

Hemel Hempsted, Hertfordshire

Marston Gate, Milton Keynes

Swansea, Wales

Dunfermline, Fife, Scotland

Gourock, Inverclyde, Scotland

Doncaster, South Yorkshire

China

Beijing (2)

Chengdu

Guangzhou

Shenyang

Suzhou

Wuhan

Nevada (2)

New Hampshire

Pennsylvania (6)

South Carolina (2)

Tennessee (5)

Virginia (3)

Washington (2)

Canada

Peterborough, Cambridgeshire

Rugeley, Staffordshire

Germany

Augsburg

Bad Hersfeld (2)

Koblenz

Leipzig

Pforzheim

Xiamen

Xi'ian

HaErbin

Kunshan

Nanning

Tianjin

Japan

Ichikawa

Toronto

Vancouver

Rheinberg

Werne

France

Montelimar

Saran (Orléans)

Sevrey

Italy

Castel San Giovanni

Sakai

Yachiyo

Daito

Kawagoe City

Kawajima

Sayama

Tajimi

Tokoname City

Spain

San Fernando de Henares

Tosu

Yoshinodai

Source: Amazon, MWPVL International, Foursquare, Google, FCC.gov, Jefferies

page 10 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

The following exhibit shows Amazon’s current US fulfillment center footprint. The

company operates 41 fulfillment centers with an estimated 33MM square feet of space

and has announced plans for 9 new FCs to open over the next 2 years.

Exhibit 9: Amazon US Fulfillment Centers (Total Number if >1)

State

Arizona

Operational

Planned

Goodyear

Phoenix (3)

California

Ontario / San Bernardino

Patterson

Tracy

Connecticut

TBD

Delaware

Middletown

New Castle

Indiana

Indianapolis

Jeffersonville

Plainfield (2)

Whitestown

Kansas

Coffeyville

Kentucky

Campbellsville

Hebron (3)

Lexington (2)

Louisville

Nevada

Fernley

Las Vegas

New Hampshire

Nashua

New Jersey

Robbinsville

TBD

Pennsylvania

Breinigsville / Allentown (2)

Carlisle (2)

Hazleton

Lewisberry

South Carolina

Cayce / Lexington

Spartanburg

Tennessee

Charleston / Cleveland

Chattanooga

Lebanon (2)

Murfreesboro

Texas

Schertz

Coppell

Haslet

Virginia

Chester

Petersburg

Sterling

Washington

Bellevue

DuPont

Sumner

Source: Amazon, MWPVL International, Foursquare, Google, FCC.gov, Jefferies

page 11 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

The continuing build out of fulfillment centers is helping the company manage shipping

costs more effectively. While these costs keep growing (outpacing revenue growth from

4Q10 to 1Q12), the pace is currently decelerating and in 4Q12 reached its lowest point in

over three years.

The following exhibit gives a comprehensive view of Amazon’s global presence from a

geo-spatial perspective. It includes offices, fulfillment centers, customer service centers,

data centers, and software development centers.

Exhibit 10: Amazon Global Locations

Source: Amazon

Table 1: Amazon Worldwide Fulfillment Centers

State / Country

Arizona

Amazon.com Address / Location

Identifier

PHX4

PHX3

PHX6

PHX7

California

ONT2

Delaware

PHL7

PHL1

Indiana

page 12 of 49

Please see important disclosure information on pages 45 - 49 of this report.

IND4

16920 W Commerce Dr

Goodyear, AZ 85338-3620

6835 W Buckeye Rd

Phoenix, AZ 85043-4428

4750 W Mohave St

Phoenix, AZ 85043

800 N 75th Ave

Phoenix, AZ 85043

1910 E Central Ave

San Bernardino, CA 92408

560 Merrimac Ave

Middletown, DE 19709-4652

1 Centerpoint Blvd

New Castle, DE 19720-4172

710 S Girls School Rd

Indianapolis, IN 46231-1132

Opened

Size

Type

Jun '08

1.4MM sq ft

Non-sortable

Sep '07

1.0MM sq ft

Big sortable

Oct '10

1.2MM sq ft

Big sortable

Sep '11

1.2MM sq ft

Oct '12

950K sq ft

Oct '12

1.2MM sq ft

Nov '97

202K sq ft

Jun '11

903K sq ft

Big sortable

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Table 1: Amazon Worldwide Fulfillment Centers

State / Country

Amazon.com Address / Location

Identifier

SDF8

IND2

IND5

IND1

Kansas

TUL1

Kentucky

SDF1

CVG1

CVG2

CVG3

LEX1

LEX2

SDF2

Nevada

RNO1

LAS2

New Hampshire

BOS1

Pennsylvania

ABE2

ABE3

PHL6

PHL4

AVP1

PHL5

South Carolina

CAE1

GSP1

Tennessee

CHA2

CHA1

BNA1

BNA2

BNA3

Virginia

RIC2

RIC1

BWI1

Washington

SEA8

BFI1

Canada

page 13 of 49

Please see important disclosure information on pages 45 - 49 of this report.

YYZ1

900 Patrol Rd

Jeffersonville, IN 47130-7761

715 Airtech Pkwy

Plainfield, IN 46168

800 Perry Rd

Plainfield, IN 46168-7637

4255 Anson Blvd

Whitestown, IN 46075-4412

2654 N US Highway 169

Coffeyville, KS 67337-9254

1048 S Columbia Ave

Campbellsville, KY 42718-2454

1155 Worldwide Blvd

Hebron, KY 41048-8648

1600 Worldwide Blvd

Hebron, KY 41048-8640

3680 Langley Dr

Hebron, KY 41048-9135

1850 Mercer Rd

Lexington, KY 40511-1013

172 Trade St

Lexington, KY 40511-2607

4360 Robards Ln

Louisville, KY 40218-4512

1600 Newlands Dr E

Fernley, NV 89408-8903

3837 Bay Lake Trl

North Las Vegas, NV 89030

10 State St

Nashua, NH 03063-1012

705 Boulder Dr

Breinigsville, PA 18031-1533

650 Boulder Dr

Breinigsville, PA 18031-1536

675 Allen Rd

Carlisle, PA 17015-7788

21 Roadway Dr

Carlisle, PA 17015-8806

550 Oakridge Rd

Hazleton, PA 18202-9361

500 McCarthy Dr

Lewisberry, PA 17339-8725

4400 12th Street Ext

Cayce, SC 29172-3300

402 John Dodd Rd

Spartanburg, SC 29303-6312

225 Infinity Dr NW

Charleston, TN 37310-1400

7200 Volkswagen Dr

Chattanooga, TN 37416-1757

14840 Central Pike

Lebanon, TN 37090-8118

500 Duke Dr

Lebanon, TN 37090-8123

2020 Joe B Jackson Pkwy

Murfreesboro, TN 37127-7792

1901 Meadowville Technology Pkwy

Chester, VA 23836-2841

5000 Commerce Way

Petersburg, VA 23803-6917

22630 Dulles Summit Ct

Sterling, VA 20166-9565

1227 124th Ave NE

Bellevue, WA 98005-2111

1800 140th Ave E

Sumner, WA 98390-9624

6363 Millcreek Dr

Mississauga, ON L5N 1L8

450 Derwent Pl

Delta, BC V3M 6H4

Opened

Size

Type

Oct '12

1.0MM sq ft

Oct '08

943K sq ft

Aug '11

926K sq ft

Aug '08

1.0MM sq ft

Big sortable

Apr '99

750K sq ft

Big sortable

May '99

770K sq ft

Big sortable

Jun '05

427K sq ft

Specialty

Dec '05

543K sq ft

Specialty

Jul '07

711K sq ft

Replenishment

Nov '00

604K sq ft

Big sortable

Jun '06

380K sq ft

Returns Center

Sep '05

110K sq ft

Specialty

Jan '99

786K sq ft

Big sortable

Oct '08

284K sq ft

Small sortable

Jul '07

64K sq ft

Small sortable

Jul '10

600K sq ft

Big sortable

Jun '11

997K sq ft

Aug '10

1.2MM sq ft

Non-sortable

Sep '10

559K sq ft

Non-sortable

Jul '08

630K sq ft

Replenishment

Aug '10

750K sq ft

Non-sortable

Oct '11

1.0MM sq ft

Oct '12

1.0MM sq ft

Sep '11

1.2MM sq ft

Sep '11

1.0MM sq ft

Sep '11

449K sq ft

Oct '12

1.0MM sq ft

Oct '12

1.0MM sq ft

Oct '12

1.1MM sq ft

Oct '12

1.0MM sq ft

Oct '10

1.0MM sq ft

Small sortable

Aug '07

313K sq ft

Small sortable

Jun '11

492K sq ft

Feb '11

502K sq ft

Fall '12

194K sq ft

Non-sortable

Big sortable

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Table 1: Amazon Worldwide Fulfillment Centers

State / Country

UK

Amazon.com Address / Location

Identifier

LTN1

GLA1

CWL1

EUK5

LBA1

BHX1

EDI4

LTN2

Germany

FRA1

FRA3

LEJ1

EDE4

DUS2

MUC3

STR1

France

Jul '04

300K sq ft

Apr '08

800K sq ft

Oct '09

500K sq ft

Dec '10

415K sq ft

Aug '11

700K sq ft

Nov '11

1.0MM sq ft

Nov '12

450K sq ft

Aug '99

452K sq ft

Aug '99

1.2MM sq ft

Sep '06

807K sq ft

Sep '11

1.4MM sq ft

Dec '11

1.2MM sq ft

Dec '11

1.2MM sq ft

Sep '12

1.2MM sq ft

1.2MM sq ft

ORY1

Dec '07

753K sq ft

Aug '10

388K sq ft

Sep '12

431K sq ft

Oct '11

269K sq ft

Jul '12

301K sq ft

PEK3

1401 Rue du Champ Rouge, Pole 45

45770 Saran, Loiret

Building 2 Rue Joseph Garde

ZAC Les Portes de Provence

26200 Montelimar

ZAC du Parc d'Activite du Val de Bourgogne

1 Rue Amazon

71100 Sevrey, Burgundy

Parco Logistico Bertola

Via Dogana Po 2

29015 Castel San Giovanni

Avenida de la Astronomia 24

28830 San Fernando de Henares (Madrid)

Yizhuang, Beijing

Apr '04

400K sq ft

SHA1

Suzhou, Jiangsu

Nov '06

500K sq ft

CAN1

Guangzhou, Guangdong

May '07

120K sq ft

CTU1

Chengdu, Sichuan

Nov '09

194K sq ft

PEK5

Tongzhou, Beijing

2010

180K sq ft

XIY1

Xi'an, Shaanxi

Aug '10

WUH1

Wuhan, Hubei

Sep '10

300K sq ft

XMN1

Xiamen, Fujian

Sep '10

17K sq ft

SHE1

Shenyang, Liaoning

Oct '10

SHA2

Kunshan, Jiangsu

Oct '11

TSN2

Tianjin, Tianjin

Jan '12

NNG1

Nanning, Guangxi

Nov '12

538K sq ft

HRB1

Harbin, Heilongjiang

NRT1

Ichikawa, Chiba

Nov '05

670K sq ft

KIX1

Sakai, Osaka

Aug '09

731K sq ft

MXP1

Spain

MAD4

Please see important disclosure information on pages 45 - 49 of this report.

550K sq ft

Nov '12

Italy

page 14 of 49

1998

Amazonstrasse 1 / Am Autobahnkreuz

56072 Koblenz, Rheinland-Pfalz

LYS1

Japan

Size

CGN1

MRS1

China

Marston Gate Distribution Centre

Ridgmont

Milton Keynes, Bedfordshire MK43 0ZA

2 Cloch Road, Faulds Park

Gourock, Inverclyde, Scotland PA19 1BQ

Ffordd Amazon

Crymlyn Burrows

Swansea, South Wales SA1 8QX

Phase Two, Kingston Park

Flaxley Road

Peterborough, Cambridgeshire PE2 9EN

Unit 1, Balby Carr Bank

Doncaster, South Yorkshire DN4 5JS

Towers Business Park

Power Station Road

Rugeley, Staffordshire WS15 1NZ

Amazon Way

Dunfermline, Fife, Scotland KY11 8ST

Boundary Way

Hemel Hempsted, Hertfordshire HP2 7LF

Am Schloss Eichhof 1

36251 Bad Hersfeld, Hessen

Obere Kuehnbach/ Amazonstrasse 1

36251 Bad Hersfeld, Hessen

Amazonstrasse 1

04347 Leipzig, Saxony

Wahrbrink 25

59368 Werne, North Rhine-Westphalia

Amazonstrasse 1

47495 Rheinberg, North Rhine-Westphalia

Amazonstrasse 1

86863 Graben, Bavaria

Amazonstrasse 1 / Bauschlotter Strasse

75177 Pforzheim, Baden-Wurttemberg

Opened

Type

1.3MM sq ft

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Table 1: Amazon Worldwide Fulfillment Centers

State / Country

India

Amazon.com Address / Location

Identifier

Opened

Size

NRT2

Yachiyo, Chiba

Oct '07

367K sq ft

NRT5

Kawagoe City, Saitama

Jul '10

419K sq ft

KIX2

Daito, Osaka

Nov '10

271K sq ft

HND1

Yoshinodai, Saitama

2011

HND2

Sayama, Saitama

2011

HND3

Kawajima, Saitama

NGO1

Tokoname City, Aichi

Apr '11

HSG1

Tosu, Saga

Jul '12

244K sq ft

Tajimi, Gifu

Dec '12

861K sq ft

BOM1

Mumbai, Maharashtra

Type

2011

2012

Source: MWPVL International; Amazon, FCC.gov, Google, Foursquare, Jefferies

page 15 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

eBay

eBay is one of the biggest eCommerce platforms in the world and currently offers a

compelling suite of products and services that facilitate omni-channel commerce.

Same-Day Delivery

At this time, the company offers eBay Now, its same-day delivery service, only in San

Francisco, San Jose and parts of New York City. It works directly with hundreds of local

stores (those available on its Milo platform) including retailers such as Babies “R” Us, Best

Buy, Free People, GNC, Guitar Center, Home Depot, Macy's, Office Depot, Radio Shack,

Target, Toys “R” Us, Urban Outfitters, and Walgreens, thus circumventing the

warehousing issue. The service costs $5 per order while in beta and the minimum order is

$25 which can go up in periods of peak demand. Currently, eBay Now is available

through its mobile website (now.ebay.com) and an iOS app and users log in with their

eBay user ID. Shoppers fill their carts with items from participating retailers and place the

order by clicking a “Bring It!” button. Delivery takes about an hour depending on order

size, traffic, proximity of store(s), how busy stores are, and seasonal factors. The app

allows users to track the progress of their order by following the shopping valet who is

assigned to that order. Once they deliver the item, valets can help the shopper through

the checkout process (using PayPal Here on their cell phone). Accepted payment methods

include PayPal and major credit cards, no cash.

Exhibit 11: Screenshots of eBay Now App

Source: App Annie, Jefferies

The service launched in exclusive beta in Aug 2012 in San Francisco and expanded to

New York City and San Jose by early 2013. Beta testers were offered $15 off their first

order and the $5 delivery fee was waived on their first three orders. eBay continues to

work on the offering and this summer it will expand it to two new cities – Chicago and

Dallas. The company also plans to introduce a new feature – Scheduled Delivery – which

has been requested the most by current users.

While eBay doesn’t have Amazon’s fulfillment capabilities, its same-day delivery service

has a fighting chance of success, in our view, because the company can leverage several

of its strengths. First, its local shopping platform Milo, acquired in December 2010 for

$75MM, pulls real-time product inventory data from national retailers and local small

businesses. It thus gives users up-to-the-minute info which is crucial for same-day delivery

orders (reducing the number of instances when a shopper finds something in search

results only to discover on the merchant’s website that the item is out of stock). Second,

combining eBay Now with PayPal Here for the checkout makes the service that much

page 16 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

more desirable for small local businesses that would likely choose PayPal over other

payment services if that comes with being able to list their inventory in the eBay Now

database. Third, eBay’s no conflict of interest could be another strong magnet for national

and local retailers. Theoretically, as it gathers enough data over time, eBay may decide to

start sourcing and selling the most popular products itself but we believe this is very

unlikely to happen as it runs against the company’s credo. Fourth, eBay offers local and

national retailers access to 60MM+ monthly shoppers (avg. monthly unique visitors in

2012) which only a few other players could match (i.e. Google and Amazon). And lastly,

eBay already has 150,000 stores on eBay Local.

Omni-Channel Capabilities

As the lines between online and offline commerce are blurring, we believe it is important

for retailers of all sizes to embrace omni-channel in order to grow their business and stay

ahead. Today's consumers expect an omni-channel experience, but retailers still think and

operate in terms of multiple channels – the digital store, the physical store, the

wholesalers, their outlets, and the resellers, among others. eBay, through GSI Commerce

and PayPal / Marketplaces, helps retailers respond by enabling them to have a meaningful

online presence. eBay’s product line helps these retailers leverage their own brands and

assets to evolve their multi-channel strategies to seamlessly meet the increasing demands

of the omni-channel consumer.

GSI’s products enable retailers to address the full opportunity of the online and offline

markets. It has built solutions to help clients attract, engage, convert, and retain their

customers through a combination of demand generation, commerce technology, and

multichannel operations. By leveraging GSI’s full omni-channel portfolio, retailers are able

to 1) attract, engage, and retain customers through demand generation and digital

marketing; 2) deliver a seamless brand experience through eCommerce technology and

multichannel operations; and 3) offer a highly-functional Web store, order management,

fulfillment, and customer service. The combination of GSI and eBay extends eBay’s open

commerce platform capabilities and helps retailers win in a connected environment,

allowing them to grow faster and more profitably than on their own.

page 17 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Two Omni-Channel Case Studies: Dick’s Sporting Goods and Fifth & Pacific /

Kate Spade

#1 Dick’s Sporting Goods is a good example of a leading retailer trying to optimize

omni-channel. Some of its key pain points include:

1) be where customers want to be 24/7 (in store, online, on a smartphone or

tablet);

2) offer fast and free shipping to customers;

3) leverage better physical stores and employees;

4) enable ship-from-store;

5) enable in-store pick-up for online orders;

6) engage and convert more shoppers across all channels and 500+ physical

stores.

The results (powered by GSI products): Leveraging multi-channel solutions,

including Web-enabled store associate ordering system, ship-from-store, and in-store

pick-up technologies, Dick's has created a virtual distribution network closer to their

customers, enabling fast and free shipping. The company also improved optimization of

inventory across its network, making inventory more productive, reducing out-of-stock

items, and capturing incremental sales.

#2 Fifth & Pacific / Kate Spade provide another example of how GSI, in combination

with PayPal / eBay, is producing results. The relationship with Kate Spade evolved from

being a single-solution provider to being a strategy and innovation partner – developing

solutions for a connected consumer that win. The pain points for Kate Spade include:

1) transition from brick and mortar-only to truly omni-channel;

2) enable overnight ship capability with 9pm cutoff time;

3) use stores to drive more demand to the web and use the web to drive more

demand to the stores;

4) drive more users, deeper loyalty, more transactions, higher transaction value,

and grow the brand.

The results (powered by GSI / PayPal / Marketplaces): eBay Marketplaces has

evolved into a way to source new users into the Kate Spade NY franchise (rather than

being a clearance vehicle to get rid of excess inventory). Kate Spade is in the process of

rolling out an entirely new POS system (incorporating PayPal) to every store in the world,

driven by the need to have a system in the store to support true multi-channel marketing

and sales. Across all three brands, multi-channel customers are more loyal, more

committed, and LTV is meaningfully higher than for single-channel customers.

page 18 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Google

While Google is known as the world’s leading search engine and one of the largest

players in online advertising, the company’s presence in eCommerce fulfillment should

not be surprising – shopping is one of its key advertising verticals.

Same-Day Delivery

Another one of the big players – Google – has been reportedly testing in private a sameday delivery service in San Francisco since October 2012. The company just announced

last week the new service officially and opened it to a limited number of external testers

for a trial period of six months. Google Shopping Express, as the service is called, allows a

user to search for and purchase in-stock items from local retailers without leaving the

Google page. Then the user can select a delivery window and a Google courier delivers

the goods in one of the company-inscribed vans.

Exhibit 12: Google Shopping Express

Source: Google, Jefferies

The service, as it currently exists, will require Google to partner with local or national

retailers but it frees the company from investing in physical fulfillment centers. Current

Beta Testers of the service are given a free six-month membership for unlimited same-day

delivery with the following reputable brands and local retailers: American Eagle Outfitters,

Blue Bottle Coffee, Office Depot, Palo Alto Sport Shop & Toy World, Raley’s Nob Hill,

Staples, Target, Toys “R” Us / Babies “R” Us, and Walgreens. The company plans to add

more merchants over the next six months. Reportedly, participating retailers do pay

Google for the leads and, we believe, at rates that likely exceed traditional CPC given the

transaction is immediately consummated. While it is expected that users would be paying

for the service too, after the trial period, Google is still evaluating the economics and

pricing is not available; the company is supposedly considering either an annual fee ($64

or $69) or a per-delivery per-store shipping charge ($4.99). Note, it is still early and both

the implementation and pricing are likely to change.

page 19 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Exhibit 13: Google Shopping Express Screenshot / Flash

Source: Google, Jefferies

Given the fact that Google remains a prime starting point for many product searches, it

seems natural that the company would like to monetize these users as they progress all

the way down the conversion funnel, rather than sending traffic to competing

eCommerce sites to complete the transaction. Google has already taken steps in this

direction by recently enhancing Product Listing Ads (PLA) with rich product information

(image of product, size & color options, etc.), making Google Shopping appear more like

Amazon. With Google Shopping Express, Google is furthering its commerce ambitions.

If Google rolls out Google Shopping Express more broadly, we would expect deep

integration with other Google services like Wallet, Maps, Zavers, and obviously the

broader Google Shopping / Search product. Google Shopping recently started

requiring retailers to upload additional inventory information. This is a step in the right

direction as Google will now face the challenge of maintaining precise, up-to-the-minute

inventory levels across all its Google Shopping Express partners.

Delivery to Neighborhood Locker

Following in Amazon’s footsteps, Google seems to be considering a local delivery service

as well – one very similar to Amazon Locker. In November 2012, the company acquired

BufferBox, a provider of temporary lockers for the delivery of packages. As a Google

spokesperson put it, with the purchase of BufferBox the company is trying “to remove as

much friction as possible from the shopping experience, while helping consumers save

time and money.” We tend to agree that giving users a choice of delivery options that

offer convenience and speed at reasonable / subsidized price should help minimize

friction in online shopping. Google has not announced any services yet leveraging its

BufferBox acquisition but we believe it’s a question of time.

page 20 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Exhibit 14: BufferBox Locker

Source: Google, Jefferies

Currently, BufferBox operates in Canada only and particularly in the Greater Toronto Area.

Pick-up stations are located at about 20 locations in GO Stations and 7-Eleven and Sobeys

stores. Users can register on the BufferBox website and receive a BufferBox Shipping

Address. At the check-out of any online retailer, they can enter that address for shipping

and get the goods deliver to a nearby BufferBox location. Once delivered, the user

receives a PIN that opens the door of the locker containing their package. Users have 72

hours (excluding Sundays and holidays) to pick up their packages. After that, packages

are removed to a warehouse and, if not requested for re-delivery within seven days,

shipped back to the sender. In cases when the BufferBox is full, the service holds the

package until space opens for delivery. Deliveries requiring signature or tax / duty

payment (COD) are accepted too. BufferBox signs for the parcel or covers any fees and

bills the user (including a 9% processing fee for the latter) before sending the PIN email.

page 21 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Walmart

On the other end of the spectrum, Walmart already has the storage capacity and ships

directly from its stores (just over 4,000 in the US). Its service, Walmart To Go, is available

in San Jose / San Francisco, Northern Virginia (outside Washington D.C.), Philadelphia,

Minneapolis, and Denver. The delivery fee varies by region and by day of the week / time

of day as does the minimum order size. Currently, a Californian can get a delivery for $6-9

(two-hour delivery slot) or $5 (four-hour delivery slot) on a minimum order of $45. The

categories eligible for this service include most grocery items, electronics & home office,

home & furniture, sports & fitness, and toys & video games.

Exhibit 15: Walmart To Go

Source: Walmart, Jefferies

Walmart To Go started in April 2010 in San Jose / San Francisco as a home delivery service

for online grocery purchases. In October 2012, the company began a test of same-day

delivery for the holiday season. Priced at $10 per order (regardless of number of items /

no minimum requirement), it was available in Minneapolis, Northern Virginia (outside

Washington D.C.), Philadelphia, and San Jose / San Francisco. Selection of goods was

specific to a user’s location (likely limited to items available in local stores) and included

approximately 5,000 items from the 1MM+ in Walmart’s online catalog. Customers could

place an order until 12pm local time and then choose a four-hour window (i.e., 4-8pm, 59pm, 6-10pm) for delivery the same day. The company had not specified a particular end

date and currently it is not clear if the test is over or it has been extended into a

permanent offering.

Executives at Walmart have said that as it ramps digital online investments, it is serving

both high-income consumers as well as its in-store shoppers ($30-60K average annual

page 22 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

income). Interestingly, we note that the proportion of people who had shopped online in

the previous three months rose steadily from 62% among households with annual

household income <$25K to 84% among those with $100K+. And the company is quick

to highlight that its shoppers also purchase from its website, often on smartphones rather

than computers. Walmart expects its online sales to exceed $9B this year (<2% of total).

Walmart believes its ability to combine digital assets with local points of presence give it a

clear advantage as it could potentially use its 4,000+ US stores as warehouses to fulfill

online orders quickly. Walmart also announced that later this year it would begin testing

its own self-service lockers that customers can use to receive online orders (initial tests are

scheduled in roughly a dozen stores).

Jefferies Broadline & Hardline Retail Analyst Dan Binder believes that Walmart (and

eventually Target) may use their stores as fulfillment centers at some point. However, he

expects longer-term Walmart will have to charge a fee for same-day delivery, so the

market opportunity will probably be small. After all, Walmart’s customers aren’t exactly

Nordstrom’s customers where money is less of an issue. In addition to testing same-day

delivery in 4 cities, Walmart is already offering in-store pick-up for online orders.

Binder also believes that players like BestBuy are very unlikely to ever use Amazon for

fulfillment. He thinks that scale matters and Amazon’s offerings may work for small

businesses but for big businesses and especially for big competitors (such as BestBuy), it

doesn’t seem very logical. We do not agree entirely here as we believe that using Amazon

as a channel could work for branded products / retailers. While Amazon might compete

with 3P merchants that sell commoditized products, we don’t think it does for branded

ones. Thus brands / specialty retailers can benefit from being able to leverage Amazon’s

platform by offering limited / exclusive SKUs. Perhaps over time this would enable these

retailers to lower overhead and still maintain their brands.

Jefferies Specialty Retail team think that while many of the mature specialty retailers are

rationalizing square footage after being “over-stored” when the recession hit (and also

probably in some part due to a shift to online sales), further acceleration of store closures

is unlikely. Most of these retailers still view the store environment as a key marketing tool

for the brand and an important aspect of the user experience (i.e. as a venue for shoppers

to actually try on apparel and view apparel/accessories in person before buying). In

addition, most specialty retailers have begun making significant investments to improve

their in-house e-commerce platforms and make the brands more omni-channel.

We largely agree but believe that costs may outweigh the value longer term – especially

as the high value proposition of same-day delivery begins to take off among consumers

(who did not realize they “needed” it until they had it). Further, since specialty retailers

would not be able to provide such level of service, why wouldn’t they shift some

percentage of inventory to Amazon or eBay if they don’t compete with them?

page 23 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Nordstrom

Nordstrom is another national retailer that offers same-day delivery in select markets.

Launched in November 2011, the service is available every day of the week (including

Saturday and Sunday) and costs $15 per order. Orders placed by 1pm Pacific time are

delivered by 7pm the same day to addresses in over 100 zip codes in Seattle, WA,

Bellevue, WA, and La Jolla, CA.

Exhibit 16: Same-Day Delivery by Nordstrom

Source: Nordstrom, Jefferies

page 24 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Barnes & Noble

A same-day delivery option in Manhattan, NY has been available to Barnes & Noble.com

shoppers since May 2000. Currently, it is free for orders above $25 and for B&N

Members. Orders with all Items marked "Usually ships within 24 hours – Same Day

Delivery in Manhattan" are eligible for this service. Generally, this is merchandise in stock

in New Jersey warehouses of the company and its affiliates. Orders must be placed by

11am, Monday through Friday, to qualify and are delivered by 7pm. Orders placed on

New Year's Day, Good Friday, Thanksgiving, and Christmas are not eligible.

Exhibit 17: Same-Day Delivery in Manhattan by Barnes & Noble

Source: Barnes & Noble.com, Jefferies

Other Independent Merchants

In addition, some local brick-and-mortar retailers are reportedly testing paid deliveries

within a 3-mile store radius to build competitive advantage, loyalty and market share. We

believe, these retailers will ultimately decide to engage the services of some of the bigger

players (Amazon, eBay, Google, even USPS) as scale does play a major role in the cost of

such an offering.

page 25 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

USPS

The US Postal Service began a 1-year experiment in December 2012 for same-day delivery

of in-store and online purchases from participating retailers in San Francisco, CA. While in

beta, the USPS will work with a maximum of 10 retailers with at least 10 physical locations

nationally (one or more within defined major metro areas). Orders completed by 2pm get

picked up after 3pm and delivered between 4pm and 8pm the same day. While pricing is

up to the participating retailer, the regulatory filing for the service states that USPS will be

charging in excess of $2.90 per delivery / package. Only residential addresses are covered

in the test and there are some restrictions on weight and size but they are the same as for

other USPS services. Users can check delivery status through USPS’ Track and Confirm

tool. For returns, merchandise can be returned to the store or sent back with USPS (pickup can be scheduled online). According to the USPS website, the service would be

available eventually through its mobile app too. While the experiment started with a

single retailer (1-800-FLOWERS.COM), new ones were in late-stage negotiations as of

January 2013, according to a USPS spokesperson. If the test is successful, the service will

be expanded to other big metro areas such as Boston, Chicago, Los Angeles, and New

York.

Exhibit 18: Metro Post by USPS

Source: USPS, Jefferies

page 26 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Postmates

Get It Now is a one-hour delivery service available in San Francisco since May 2012 and in

Seattle since March 2013. Users, who have downloaded the iOS app, can place an order

between 8am and midnight every day of the week. The order gets assigned to the best

courier for the job seconds after being placed. Then the courier, called Postmate,

purchases the ordered goods on behalf of the user and delivers them to a drop-off

address. During this time, users can track their delivery from the app in real-time and can

contact the Postmate if a change is needed (e.g. add or cancel an item, change delivery

address, etc.). However, such changes get forwarded to HQ as they might require a fee

adjustment. The delivery fee, currently starting at $4.99, is determined dynamically by an

algorithm that accounts for the distance, time required and effort involved in the delivery.

Exhibit 19: Screenshots of Postmates’ Get It Now App

Source: App Annie, Jefferies

While Postmates (the company) is still managing the inventory of items that users can

order through the service (currently from ~4,000 different locations in San Francisco and

1,000+ in Seattle), it plans to offer a self-serve platform that will allow local businesses to

take control of their venue’s listings and update inventory themselves. In addition, users

can simply prepare a shopping list of items (if the merchant’s inventory is not listed in the

app) and the Postmate will purchase them. Technically, users can order from any retail

store or merchant in the city that accepts credit cards. Another feature in the app (a

nearby tab) allows users to browse stores close to their current location. It updates

dynamically and is powered by Foursquare.

Postmates has been running on-demand same-day deliveries in San Francisco and vicinity

since December 2011. It launched its one-hour delivery service Get It Now in closed beta

in March 2012 and officially in May 2012. The Seattle beta launch happened in February

2013 with the official launch in March. We believe the next city in the company’s

expansion plan is New York (based on its application form for prospective Postmates). The

delivery fee has declined over time to the current $4.99+ but it was $6.99+ when the

service first started. Postmates currently has nearly 200 couriers in San Francisco and just

over 40 in Seattle.

page 27 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Exec

Exec is an errand-running service, similar to TaskRabbit, which provides companies and

individuals access to on-demand personal assistants for delivery, furniture assembly, and

other errands. Once users post what they need, an in-house trained Exec gets assigned on

the task within 10 minutes. Users can track the progress of their errand and stay in touch

with the Exec through messages. The service gets everything done for $25/hour and is

available from 9am to 9pm. The company and its services are currently based in San

Francisco.

Exhibit 20: Exec Errands

Source: Exec, Jefferies

page 28 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Instacart

Instacart is a unique same-day delivery service, which focuses solely on same-day grocery

delivery from Trader Joe’s, Safeway and Whole Foods. Customers can shop directly from

their iPhones from 10am to 9pm every day. The company has a one-hour or a three-hour

promised delivery window for a flat $9.99 and $3.99, respectively. The service is currently

live in San Francisco, Palo Alto and Mountain View. The company has plans to expand

into other verticals.

Exhibit 21: Screenshots of Instacart App

Source: App Annie, Jefferies

Shutl

Shutl is another start-up that provides same-day delivery in the Bay Area, with ambitions

to launch soon in New York City, Chicago, Miami, and several other metro areas in the

US. The company’s technology integrates with online retailers and connects them with a

network of local, same-day carriers, which purportedly provide faster, more flexible

delivery options than the traditional delivery providers such as UPS and FedEx.

Exhibit 22: Shutl

Source: Shutl, Jefferies

page 29 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

TaskRabbit

TaskRabbit, one of the original errand outsourcing services, recently launched a Deliver

Now feature, where customers can have same-day delivery from any local business.

Deliver Now costs $10 and is currently only available in San Francisco, while TaskRabbit

itself is based in 9 metro areas. The feature allows regular users to solicit same-day

deliveries for orders from local businesses such as restaurants and stores that do not

themselves provide a delivery service.

Exhibit 23: Screenshots of TaskRabbit App

Source: App Annie, Jefferies

WunWun

WunWun is a product / service similar to TaskRabbit and Exec with a twist. WunWun has

an on-demand network of Helpers. Once your request is received, a Helper is designated

to see it through. When a request requires a specialized provider, WunWun acts as a

personal concierge service. For deliveries, it’s a flat $15 fee and $2 for every 5 minutes of

other services. Currently, WunWun is in beta in New York City.

Exhibit 24: Screenshots of WunWun App

Source: App Annie, Jefferies

page 30 of 49

Please see important disclosure information on pages 45 - 49 of this report.

Jefferies US Internet Team, Jefferies Equity Research, pitz-fitz@jefferies.com

Technology

Internet

April 10, 2013

Potential Winners

Whether same-day delivery will become prevalent over time or remain a high-touch addon service is not clear yet. Some recent studies reveal that free delivery and lower prices

are much more important to shoppers. According to a BCG survey, conducted in

November 2012, only 9% of participants cited same-day delivery as a top factor that

would improve their online shopping experience. Overwhelmingly more, 74% and 50%

cited free delivery and lower prices, respectively, as top factors. However, that same

survey showed that affluent millennials (18 to 34-year olds with household income in

excess of $150K) were willing to pay up to $10 for same-day delivery vs. up to $6 by

other consumers. The affluent millennial cohort is also spending online about 2 times

more than the average US consumer. Only time will show if millennials again will drive a

change in eCommerce fulfillment as they did with other aspects of everyday life already.

While it is not clear yet if consumers are actually ready to pay (and how much) for such

services, the competition in fulfillment is already on and major players are investing.

Which aspects of fulfillment (e.g. speed, flexibility, cost) will prove more important to

consumers could determine which of the existing offerings will survive and thrive.

We believe that the most compelling offerings, for now, come from Amazon, eBay and

Walmart as each dwells on a competitive strength. However, Amazon is currently the

undisputed leader as it appears to have perfected the logistics function and is likely to

start building new fulfillment centers closer to customers, now that it has signed tax

agreements with a host of states. We also think that the proceeds of its November 2012

debt offering of $3B will be used for fulfillment center build-out, to a large extent. eBay

seems to have solved the inventory / warehousing problem and built scale by partnering

with top national retailers while maintaining neutrality. It also has the most compelling