The Automotive Industry in the UK

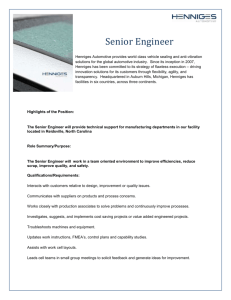

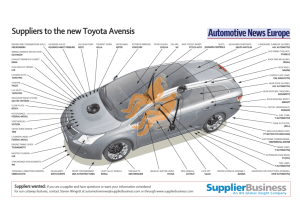

advertisement