The Automotive Industry in the UK

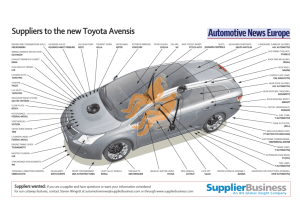

advertisement