Student Number: QUIZ 5 Section D Question 1. [6 marks] A multi

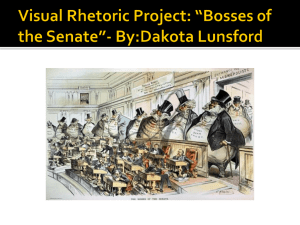

advertisement

![Student Number: QUIZ 5 Section D Question 1. [6 marks] A multi](http://s3.studylib.net/store/data/008742299_1-7796f4af9de13710ac74bceb66080117-768x994.png)

Student Number: QUIZ 5 Section D Question 1. [6 marks] A multi-plant monopolist faces demand P = 460 − 6Q . The first plant (call it Plant 1) has total cost, TC1 = 2.5Q 2 and the second plant (call it Plant 2) has total cost, TC 2 = 5Q 2 . a) [2.5 marks] If the monopolist owned only plant 2, what is the optimal price this monopolist should charge, the total number of units the monopolist should supply, and the profit the monopolist would earn.(Assume that the demand curve faced by the monopolist is the same as given above). Answer: To find the profit-maximizing price, set MR = MC . In this case we have 460 − 12Q = 10Q ⇒ Q = 20.91 At this quantity, the monopolist will charge a price ⇒ P = 460 − 6(20.91) = 334.54 The profit of monopolist is Profit = 334.54(20.91) − [5( 20.91)^ 2] = 6995.23 − 2186.14 = 4809.09 b) [2.5 marks] Suppose that monopolist owns both, plants 1 and 2. Determine the optimal price this monopolist should charge, the total number of units the monopolist will supply, and the number of units the monopolist should produce at each plant. Also calculate the profit of the multi-plant monopolist Answer: The monopolist will produce so that the marginal costs are equal at both plants. To begin, find the multi-plant marginal cost curve, MCT . This is found by horizontally summing the marginal cost curves for the individual plants. This implies QT = Q1 + Q2 MCT MCT + 5 10 3MCT QT = 10 10QT MCT = 3 QT = The second equation above is obtained from the marginal cost curves for the individual plants. Because the marginal costs will be equal at each plant, we call this MCT . To find the optimal price and quantity, set marginal revenue equal to marginal cost. In this case we have 10Q 3 1, 380 − 36Q = 10Q Q = 30 At this (total) quantity, the firm will charge a price equal to P = 460 − 6(30) = $280 . Finally, to determine the amounts to produce at each plant plug the marginal cost, MCT = 100 , into each plant’s marginal cost curve and solve for Q . For Plant 1 we have 460 − 12Q = 100 = 5Q1 Q1 = 20 and at Plant 2 we have, 10Q2=100, implies Q2=10. The profit =280(30)-[2.5(20)^2+5(10)^2]=6900. c) [1 mark] Is the profit calculated in part b) more or less than the profit calculated in part a), and why? Answer: Part b) profit – Part a) profit = 6900-4809.09 = 2090.91. Thus, the profit calculated in part b) is more and the reason is that the additional firm owned by the monopolist is a lower marginal cost firm than firm 2. And, in the absence of any fixed costs, the profit had to rise. Note that the quantity supplied is more in part b). Question 2. [4 marks] A homogeneous products duopoly faces a market demand function given by P = 500 − 10Q . Both firms have a constant marginal cost of MC = 200 . a) [1 mark] What would the equilibrium price in this market be if it were perfectly competitive? Answer: If this market were perfectly competitive, then equilibrium would occur at the point where P = MC . Assuming two firms, this will occur where 500 − 10Q1 − 10Q 2 = 200 . Since in equilibrium Q1 = Q2 , 500 − 20Q1 = 200 300 = 20Q1 Q1 = 15 Since both firms will produce the same level of output in equilibrium, both firms will produce 15 units. At this level of output, price will be P = 500 − 10(15) − 10(15) = 200 b) [1 mark] What would the equilibrium price in this market be if the two firms colluded to set the monopoly price? Answer: If the firms colluded to set the monopoly price, then 500 − 20Q = 200 300 = 20Q Q = 15 P = 500 − 10Q P = 350 c) [2 marks] What is the Bertrand equilibrium price in this market? Answer: If the firms acted as Bertrand oligopolists, the equilibrium would coincide with the perfectly competitive equilibrium of P = 200 and Q = 30 , with each firm producing onehalf of the market output of 15 units each. If either firm tried to raise its price, it would lose its entire market share.