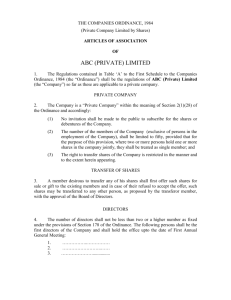

Commercial Companies Law

advertisement