Brazil - consolut

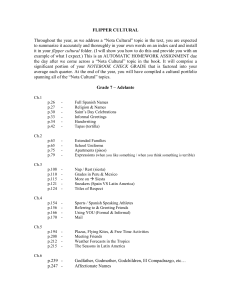

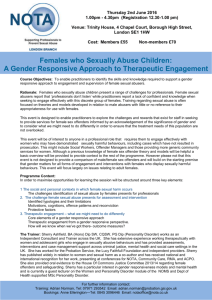

advertisement