National University of Singapore

advertisement

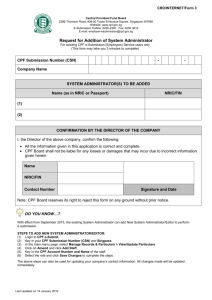

Managing National Provident Funds in Malaysia and Singapore By Mukul G. Asher Professor, Public Policy Programme National University Of Singapore E-mail: mppasher@nus.edu.sg Fax: (65) 778 1020 To be presented at the World Bank Conference on Public Pension Fund Management, 24 ~ 26 September 2001, Washington D.C. 1 Organization I. Governance Structure II. Importance of Investment Policies And Performance III.Main Characteristics of the EPF And The CPF IV.Investment Policies And Performance: The Accumulation Phase V. Will The EPF And The CPF Be Adequate For Retirement? VI.Distribution Of Accumulated Funds VII.Suggestions For Reform The Public Policy Programme, National University of Singapore 2 Governance Structure • The EPF (Established in 1951) The CPF (Established In 1955), Have Statutory Authority Status. • Malaysia’s EPF Is Under The Ministry of Finance. • Singapore's CPF Is Under The Ministry of Manpower The Public Policy Programme, National University of Singapore 3 Governance Structure Contd. • Malaysia’s EPF: – Operational (Mainly Administrative) Autonomy – The EPF Board Has Representation From The Government, Employers, Employees And Professionals. – The Investment Panel Is Separate From The Board. It Has Six Members, Executive Chairman Of The EPF, And Representatives Form The Finance Ministry And Private Sector Experts. – There are Indications That The Trade Unions and Other Groups in Malaysia are Uneasy About the functioning of the Investment Panel. They Desire Greater Transparency and Representation on the Investment Panel. The Public Policy Programme, National University of Singapore 4 Governance Structure Contd. • Malaysia’s EPF Contd.: – Investment By The EPF Have Been Wholly Domestic. – Lack of Policy Autonomy And Research Capability – Insulation From Political Risk In Investments Primarily Through Government Guarantees of Individual Investments. However No Guarantee of Return on Overall Balances – Moderately Open Information Regime The Public Policy Programme, National University of Singapore 5 Governance Structure Contd. • Singapore’s CPF – Operational (Mainly Administrative) Autonomy – The CPF Board Has Representation From The Government, Employers, Employees And Professionals. It Has 12 Members. – Key Challenge: How To Get Competent and Independent Representation on the Board in a Mono-centric Power Structure ? The Public Policy Programme, National University of Singapore 6 Governance Structure Contd. • Singapore’s CPF Contd.: – Investment Function In Reality Performed Outside The CPF Board’s Jurisdiction By The Government Of Singapore Investment Corporation (GSIC), And Other Government Investment Holding Companies. – No Statutory Obligation On These Holding Companies To Reveal Investment Portfolio And Performance of CPF Balances. – International Investment Is However Believed To Predominate. The Public Policy Programme, National University of Singapore 7 Governance Structure Contd. • Singapore’s CPF Contd.: – Lack of Policy Autonomy and Research Expertise. – Very Selective Openness Relating to Information; So Extensive Data Collected and Stored in Its Supper Computer Is Used in A Strategic Manner And Not As A Public Good. Therefore, Unsurprisingly Data Made Publicly Available Are Insufficient for Independent Analysis. – A Guarantee of 2.5% Nominal Return on the CPF’s Accumulated Balances. The CPF Act Requires That the Permission of the Finance Minister Be Obtained for Paying Interest Rate Higher Than 2.5 Percent. – No Other Provision For Insulation Against Political Risk. The Public Policy Programme, National University of Singapore 8 Importance of Investment Policies and Performance • The National Provident Funds of Malaysia (the EPF) And Singapore (The CPF) Are Nominally DC-FF Schemes • Such Schemes Rely On The Power of Compound Interest • To Realize This Power, Need Effective Asset Diversification; Low Administration and Investment Management Costs; And Internationally Benchmarked Pension Fund Governance The Public Policy Programme, National University of Singapore 9 Main Characteristics Of The EPF And The CPF • Contribution Rate – More Complex And Varied The Objectives, Higher The Contribution Rate Required. THE CPF – CPF has many other objectives beside Retirement. It Administers many schemes covering Housing, Medical Savings Accounts, Tertiary Education, and permits extensive pre-retirement investments in real estate and financial assets. – CPF Contribution Rate effective from January 1, 2001: 36% (20% By The Employee And 16% By The Employer); With The Wage Ceiling Of S$ 6000 Per Month. – Lower contribution Rates for Those > 55 (18.5% for those between 55–60; 11.0% for those 60-65; 8.5%for those >65). The Public Policy Programme, National University of Singapore 10 Main Characteristics Of The EPF And The CPF Contd. • Contribution Rate Contd.: – Self-employed May Join Voluntarily (But Must Contribute to the Medisave Account). They Get Tax Relief for CPF Contributions up to the Combined Employer and Employee Contributions, Subject to Same Ceiling. – The CPF Contributions are channeled into three Accounts. § Ordinary Account: − For those below 55 years, between 72.2 percent and 61.1 percent of the contributions are channeled into this Account depending on age, with the proportion decreasing with age. − Balance in this Account can be used for housing, preretirement investment schemes, and others. For most members, housing is the pre-dominant expense. The Public Policy Programme, National University of Singapore 11 Main Characteristics Of The EPF And The CPF Contd. • Contribution Rate Contd.: § Special Account: − This Account is for Retirement. For those < 55 years, between 11.1 percent and 16.7 percent of the contributions are channeled into this Account, with the proportion increasing with age. − The proportion for Retirement purposes is rather low by international standards. The Public Policy Programme, National University of Singapore 12 Main Characteristics Of The EPF And The CPF Contd. • Contribution Rate Contd.: § Medisave Account: − For those < 55 years, between 16.7% and 22.2% of the contributions are channeled into this Account, with the proportion increasing with age. − Funds from this Account are used to pay for hospital and selected out-patient services; and for Catastrophic Health Insurance Premium which covers between 20 and 40 percent of the total hospital bill. − The Medisave amount can not be withdrawn until death, when it reverts to the nominee. − The Average Medisave balance of 55 year old in mid 2001 was S$16,000, while the required sum for those with enough balances is S$21,000. So many do not have even the minimum balances. The Public Policy Programme, National University of Singapore 13 Main Characteristics Of The EPF And The CPF Contd. • Contribution Rate Contd.: The EPF – 23% (11% By The Employee And 12% By The Employer, With No Wage Ceiling). – From April 1 2001, There were plans to reduce Employees’ Contribution Rate to the EPF to 9% for a Period of One Year. Higher Priority to Short-Term Stabilization Over Retirement Security implicit in this has proved to be very unpopular The trade union and other public pressure has forced a change from mandatory to voluntary reduction in the contribution rate. – Self-employed are Permitted to Join the EPF voluntarily, but Few Do. The Public Policy Programme, National University of Singapore 14 Main Characteristics Of The EPF And The CPF Contd. • Contribution Rate Contd.: The Contributions to the EPF are channeled into three Accounts. I. Account I: 60 percent Main purpose is Retirement. 20 percent of the Balance in this Account over RM 55,000 may be withdrawn for investments in Unit Trusts approved by the EPF. Members not permitted to purchase stocks directly. Potential amount that can be thus invested, and potential number of individuals which can participate is limited. II. Account II: 30 percent Main purpose is Housing. III. Account III: 10 percent Main Purpose is Healthcare. There are however no health insurance schemes. The Public Policy Programme, National University of Singapore 15 Main Characteristics Of The EPF And The CPF Contd. III.Coverage III.Contributors/Labor Force In 2000: 54.7% For The EPF, And Rising As Formal Sector Expands. For CPF (in 1999): 62.0% And Falling, But Not of Concern Due To 25% of Labor Force Consisting of Foreign Workers. IV.Total Labor Force in June 2000 For Singapore: 2.19 Million V. For Malaysia as at end 2000: 9.2 Million The Public Policy Programme, National University of Singapore 16 Main Characteristics Of The EPF And The CPF Contd. • Contributors/Members In 2000: 50.5% For EPF, And 43.2% For CPF. • EPF(2000): Total Members 9.97 Million (of which 0.6 Million Foreign Workers). [AACGR:1990-2000: 5.3%) Pressure to exclude foreign workers on grounds of disproportionate administrative and compliance costs • Active Members: 5.03 Million. [AACGR:1990-2000: 5.5%) • Total Employers 318, 220 (Default Rate 5.65%) [AACGR:19902000: 6.2%) • CPF(1999):Members 2.83 Million; [AACGR:1987-99: 3%) • CPF Contributors (1999) 1.22 Million. [AACGR:1987-99: 2.3%) The Public Policy Programme, National University of Singapore 17 Main Characteristics Of The EPF And The CPF Contd. III.Contributions And Withdrawals III.Too Many Pre-Retirement Withdrawals Distract From The Retirement Objective IV.AACGR: EPF (1990-2000): Contributions: 15.2%; Withdrawals 18.0%. Withdrawals/Contributions EPF (1990-2000): 37.6%. V. AACGR CPF (1987-99): Contributions 9.2% Withdrawals 9.5%. Withdrawals/Contributions CPF (1987-99): 71.9%. The Public Policy Programme, National University of Singapore 18 Main Characteristics Of The EPF And The CPF Contd. III.Members Balances : III.EPF: RM 180.1 Billion (55.4% of GDP) End 2000 IV.CPF: S$ 90.3 Billion (56.8% of GDP) End 2000 IV.Average Balance per member for EPF: Year 2000 III.RM 18,067 V. Average Balance per member for CPF: Year 2000 III.S$ 31,137 VI.Per Capita GDP: 2000 III.RM 12,883 VII.Per Capita GNP: 2000 III.S$ 42,212 The Public Policy Programme, National University of Singapore 19 Main Characteristics Of The EPF And The CPF Contd. VIII.These Balances Are A Significant Proportion of Total Savings And Stock Market Capitalization. Given low levels of free-float and liquidity, market prices (and even management control) may be significantly impacted by the provident fund authorities. The Public Policy Programme, National University of Singapore 20 Investment allocation of the EPF, 1991-2000 80 Composition of investment (%) 70 60 MGS 50 D&L 40 30 Equi 20 MM 10 0 1990 1992 1994 1996 1998 2000 Time The Public Policy Programme, National University of Singapore 21 Investment Policies And Performance: The Accumulation Phase Contd. • Investment Performance of The EPF – Average Returns Over 40 Years Satisfactory in Absolute Terms. – Challenge Is How to Sustain At Least The Current Level of Returns In The New Economic Environment, particularly as there is considerable unease concerning the perception that the EPF and other provident and pension funds are being used to help support the government-favored firms and business groups. The Public Policy Programme, National University of Singapore 22 Table 1 Malaysia: Nominal and Real Rates of Dividend On EPF Balances 1961-2000 Period Nominal Dividend Rate % Inflation Rate (CPI) % Real Rate of Dividend % AACGR (%) (1961-2000) 7.04 3.49 3.55 AACGR (%) (1983-2000) 8.24 3.14 5.11 AACGR (%) (1987-2000) 8.16 3.47 4.70 AACGR (%) (1990-2000) For Nominal GDP: 10.56% - This is higher than the nominal dividend rate. So low replacement rate. AACGR (%) (1990-2000) For Members Balances: 14.18% Note: This return is after taxes and investment management fees. The Public Policy Programme, National University of Singapore 23 Table 2 Nominal Return – Risk Performance of Malaysian and other Markets, Jan 1988 – Jan 2001 period • There are other ways to compare the EPF Returns. Malaysia (KLSE) Cumulative Returns 78.1 Global Bond Global Equity AsiaPac US Japan 139.1 172.8 -12.3 401.8 -25.6 Returns (% P.A.) 4.5 6.8 7.9 -1.0 13.0 -2.2 Std. Dev. (% P.A.) 35.7 6.3 14.0 22.3 13.7 25.0 KLSE: Kuala Lumpur Stock Exchange Source: Eliza Lim “Importance of Portfolio Diversification”, Asian Pension Funds Seminar, organized by the Citigroup Asset Management, Kuala Lumpur, May 911, 2001. Lim is Asset Consultant with Towers Perrin, Hong Kong. Note: Exchange rate risk is not taken into account in Table 2. The Public Policy Programme, National University of Singapore 24 Table 2 Comments on Table 2 - The annual return on KLSE is lower and volatility (as represented by the standard deviation) is much greater than the EPF dividends to members. (7.68 percent per year for 1987-99 period) - The EPF dividend is also higher than Global Bond, Asia-Pac, and Japan market returns. - But it is slightly lower than Global Equity; and substantially lower than US market returns. The Public Policy Programme, National University of Singapore 25 Table 2 Comments on Table 2 contd. - If returns net of taxes and investment management fees are considered, than only the US (and Europe but not UK) returns are likely to have exceeded the EPF returns during this period. But volatility in other markets is much lower. - The pension funds in Chile had annual real rate of return of 10.9 percent between 1981-2000. The return to the members was somewhat less due to administrative and investment management costs, and taxes. This is clearly higher than the EPF, and comparable to the U.S. and Europe. The Public Policy Programme, National University of Singapore 26 Table 2 Comments on Table 2 contd. Implications - Improve KLSE’s quality and depth. - Some international diversification will be needed as funds continue to accumulate. At present rates EPF’s balances may be RM 1,000 billion in next 15 years or so. Current Market Capitalization of the KLSE is only about RM 400 billion. - Needs to increase understanding of and develop expertise concerning the international markets. - Develop expertise and tools to manage the exchange rate risk when diversifying internationally. The Public Policy Programme, National University of Singapore 27 Investment Policies And Performance: The Accumulation Phase Contd. • Investment Allocation And Returns: – The CPF – Three Pools of investment funds I. Members’ Balances Invested By the CPF Board. Largest Pool (S$ 90.3 Billion As At End 2000) • On the CPF’s balance sheet, 100 percent of the S$90.3 billion is shown as invested in non-marketable government securities (or as advanced deposits to the Monetary Authority of Singapore for buying such securities. • Singapore Government’s total Internal Debt as at end March 2001 S$138.9 billion (87.4 percent of year 2000 GDP) The Public Policy Programme, National University of Singapore 28 Investment Policies And Performance: The Accumulation Phase Contd. • The interest on government securities is same as that paid by the CPF Board to its members. It is a weighted average of one year fixed deposits (80% weight), and savings account rate (20% weight) of the four domestically owned commercial banks. • Interest is paid quarterly and is variable (subject to a minimum of 2.5 percent). • By administrative decision, balances in the Special Account (which is for Retirement only) receive 1.5 percentage points higher interest than on other balances. From October 1, 2001, the higher interest will also be paid on Medisave Balances. This further demonstrates the administrative nature of the interest rates. The Public Policy Programme, National University of Singapore 29 Investment Policies And Performance: The Accumulation Phase Contd. • The receipts from the sale of government securities are not needed to finance government expenditure as the budget has been in surplus for more than two decades. • The money is channeled through the Consolidated Fund to investment holding companies of the Singapore Government, such as Temasek Holdings and Singapore Government Investment Corporation. • The operations of these holding companies are by law and practice secret and no public disclosure is required or made. The Public Policy Programme, National University of Singapore 30 Investment Policies And Performance: The Accumulation Phase Contd. • The non-transparency and non-accountability of the CPF balances, along with administered rate of interest has turned the CPF from nominally DC-FF scheme to a Notional Defined Benefit (NDB) Scheme, financed on PAYG basis. • To the extent the government holding companies earn higher than what is paid to the CPF members, implicit tax on CPF wealth occurs. The Public Policy Programme, National University of Singapore 31 Investment Policies And Performance: The Accumulation Phase Contd. • The implicit tax is recurrent, and it is regressive as lowincome individuals hold proportionally greater wealth in the form of CPF balances. Moreover, as only about a third of the labor force pays personal income tax, the low-income members do not receive tax subsidy for contribution, income on preretirement investments, and at the time of withdrawal. II. Investment of the Insurance Funds S$ 2.9 Billion as at End 1999. III. The CPFIS Scheme The Public Policy Programme, National University of Singapore 32 Fig. 2 10 Singapore's CPF : Average Annual Compound Growth Rate (AACGR) 9.35 8.09 8 7.53 7.04 % 6 4 2 3.41 2.83 2.0 0.88 0 AACGR (%)(83-99) Real Rate of return on Balances GDP (Real) The Public Policy Programme, National University of Singapore AACGR (%)[1987-99] Real rate of return on Insurance Funds Average Monthly Nominal Earnings 33 CPFIS Scheme • This is a pre-retirement withdrawal scheme. A Member May Open A CPF Investment Account With Approved Agent Banks, All of Whom are Locally Controlled Banks. Their Charges and Fees Are Not regulated. • Individual CPF Members May invest their Ordinary Account balance as well as Special Account Balance In approved assets. All investments must be in Singapore dollars. • Only safer Investments are permitted from the Special Account. Form the Ordinary Account up to 35% can be invested in shares and corporate bonds by the members directly. • As at end April 2001, S$2.1 billion (17% of the Potential) was invested from the Special Account; with about 90% in insurance products, both investment-linked and endowment. The Public Policy Programme, National University of Singapore 34 CPFIS Scheme Contd. • There is no limit on investments in shares through the approved Unit Trusts. • Till September 30, 2001, 100.0% of the profits realized (less accrued interest which would have been payable by the CPF Board on ALL of the amounts withdrawn under this scheme) may be withdrawn by the individuals. • This proportion will be reduce to 50% for the period October 1, 2001 to September 30, 2002; and to zero thereafter. The Public Policy Programme, National University of Singapore 35 CPFIS Scheme Contd. • As At December,31 2000, Total amount Withdrawn Under the CPFIS was S$ 18,741 (US$10,771 Million) (43.7% of the Potential) by 516,386 members,Or 17.8% of total members. The Average Investment Per Member Thus was S$36,293(US$20,858). • As At March 31, 2001, Total Investments Under CPFIS was S$ 20.192 Billion (US$ 11,218 Million). The Public Policy Programme, National University of Singapore 36 CPFIS Scheme Contd. • The Allocation was: – Stocks and Loan Stocks S$9,550 Million (47.3%); – Insurance Policies S$9,063 Million (44.9%); – Unit Trusts S$1,285 Million (6.4%); – Others S$294 Million (1.5%). The Public Policy Programme, National University of Singapore 37 CPFIS Scheme Contd. • Thus, Individuals have Invested on Their Own and Not Through Unit Trusts. • Transactions Costs of Unit Trust Investments Are High, With 5 to 7 Percent Spread Between the Offer and Bid (Buy and Sell) Prices Common. • In addition, there is an annual investment management fee of between 1 and 2 percent of total investments of members. • Some Effort to Address This Issue, but Low Average Investment and Small Size of the Unit Trusts Market Major Constraints. • Investment Performance Under This Scheme Appears To Be Unsatisfactory. But Insufficient Data for Rigorous Analysis. The Public Policy Programme, National University of Singapore 38 Will The EPF And The CPF Be Adequate For Retirement? V. EPF – Low Balances Per Member. In 2000, RM 18, 067, Only 1.4 Times The Per Capita GDP. – No estimates of the replacement rate provided by the EPF Board. But it is likely to be quite low for most members. The Public Policy Programme, National University of Singapore 39 Will The EPF And The CPF Be Adequate For Retirement? Contd. • CPF (Figure 3 and 4) – The CPF Board Estimated In 1987 (No updates Since Then) That The Replacement Rate Will Vary Between 20 And 40 Percent For The Members, With No Inflation Protection, And Only A Very Limited Protection Against Longevity. – Fig 3 Shows That Average Balance Per CPF Member Doubled Between 1987-99, While The Average Monthly Earnings In 1999 Were 2.4 Times The Earnings in 1987. Thus, Monthly Earnings Have Risen Faster Than Average Balances Per Member. – For October-December 2000 Period, Average Cash Balance Withdrawn At Age 55 was Only $19,111. The Public Policy Programme, National University of Singapore 40 Fig. 3 Singapore : Average Balances per member and Average Monthly Earnings , 1987-99 35000 30000 25000 ($) 20000 15000 10000 5000 0 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 Average Monthly Earnings (including Employer’s CPF Contribution) 1998 1999 Year Average Balance Per Member The Public Policy Programme, National University of Singapore 41 Fig. 4 Singapore CPF : Average Balance Per Member/Average Monthly Earnings (including employer’s contribution) 14 12 11.6 11.1 10.1 10.4 10.3 10.5 10.4 10 9.4 9.2 9.3 1993 1994 1995 9.6 10.1 9.9 1998 1999 8 6 4 2 0 1987 1988 1989 1990 1991 1992 1996 1997 Year Average Balance Per Member/Average Monthly Earnings (including employer’s contribution) The Public Policy Programme, National University of Singapore 42 Why Low Balances? • Singapore: – Highly Unequal Wage Structure. In 1999: 51.4% of Contributors Had Monthly Wage < S$ 2,000: Only 6.3% Had Wages > S$ 6,000. – The share of wages in Singapore’s GDP is unusually low at 42 percent; while the share of profits is 48 percent of GDP. – High Rate of Pre-retirement Withdrawals (71.9% for the 1987-99 period). • Tied to the Centrality of Real Estate Sector in the Economy. – Low Real Rate of Return, in Large Part Due to Implicit Tax on CPF Wealth. • Current Political Economy and Governing Philosophy Major impediments to the Reduction or elimination of This Tax. The Public Policy Programme, National University of Singapore 43 Why Low Balances? Contd. • Singapore Contd.: – High Transactions Costs • Restricted Competition and No Regulation Over Prices Charged for Investment Services. For a sample of 14 funds in Singapore, the EXPENSE RATIO (I.e. total cost of running the fund divided by the fund size) varied between 2.9 percent and 5.7 percent. The ratio excludes several charges such as tax at source, front-end load, brokerage and other transaction costs, and foreign exchange gains and losses. • Individual Decentralized Arrangement With Wide Investment Choices Under the CPFIS Scheme Likely To Lead to Higher Cost Than a Centralized System, With Limited Individual Choice Would. The Public Policy Programme, National University of Singapore 44 Why Low Balances? Contd. • Malaysia – Highly unequal Wage Structure. In 2000 60.18% of the Active Contributors to the EPF Reported Monthly Wages Below RM 1,000; 23.96% Between RM1,000-2,000; and only 3.37% Reported Wages Above RM 5,000. – Moderate Rate of Pre-retirement Withdrawals • Tied to Housing withdrawals • 1/3 of the Accumulated Balances can be Withdrawn at Age 50 – Rate of return is reasonable, but could be Higher – Restricted Competition and No Regulation Over Prices Changed for Investment Services. – Individual Investments through Unit Trusts has High Transaction Costs Due to The Undeveloped Nature of this Market. The Public Policy Programme, National University of Singapore 45 The Supplementary Retirement Scheme (SRS) • Implemented From April 1, 2001 • Employers Are Not Allowed To Contribute. Self Employed May Participate. • Contribution and Income (Except Dividends) Can Be Accumulated Tax Free. The Public Policy Programme, National University of Singapore 46 SRS Contd. • 50 Percent of Accumulated Balances at the Time of Statutory Withdrawal Subject to Applicable Marginal Income Tax Rate. Withdrawals can be Made Over a Period of Ten Years to Permit Flexibility in Conversion of Investments in to Cash (Withdrawals Can only be Made in Cash), and for tax Planning. The Public Policy Programme, National University of Singapore 47 SRS Contd. • Full Taxation Plus 5 Percent Penalty for Early Withdrawal • Some Restrictions (Eg Concerning Property and Certain Types of Insurance) on Investment of SRS Funds. The Public Policy Programme, National University of Singapore 48 SRS Contd. • Limitations: – Only One Third of the Labor Force Which Pays Income Tax Has the Potential to Benefit From the SRS – Restrictive Conditions • Foreigners Must Keep the Balances in the SRS for at Least 10 Years. • Only Half of the Accumulated Balances Exempt From Tax. • Penalty for Early Withdrawals: 100% Tax, Plus 5 Percent Penalty. The Public Policy Programme, National University of Singapore 49 SRS Contd. • High Transaction Costs – Restricted Competition Among the SRS Providers – No Regulation Concerning Fees to Be Charged by the SRS Providers or by Investment Managers. – So, for Those With Small Balances And/or Low Marginal Tax Rates, Transactions Costs May Outweigh Tax Benefits. The Public Policy Programme, National University of Singapore 50 SRS Contd. • Assessment – Impact of the SRS Will Be Marginal As It Does Not Address Lack of Protection Against Inflation and Longevity; and Does Not Help the Lifetime Poor. The Exchange Rate risk may deter expatriates, particularly as the minimum period of membership is ten years. – Will Benefit Local Banks and Investment Managers The Public Policy Programme, National University of Singapore 51 Distribution of Accumulated Funds • Importance Of Inflation And Longevity Protection And Survivors’ Benefits. • Options: – Lump-Sum, Periodic Withdrawals, Annuities or a Combination. Annuities are Like Any Other Financial Product, So Cost of Purchasing Annuity (Therefore Rate of Return from Annuity Purchase) Varies With the Market Structure and the Features (Individual Vs. Joint Annuity, Inflation Indexing etc.) Provided. The Public Policy Programme, National University of Singapore 52 The Decumulation Phase of the CPF • The CPF Permits: – Withdrawal at Age 55 of All Accumulated Balances over and Above the Required Minimum Sum. – If a Member’s Balances are Below the Required Minimum Sum, it Does not Have to make it up From Other Sources. A Significant Proportion of the CPF Members’ Accumulated Balances Fall Below the Minimum Sum. Children May Top-up Parents CPF Account. The Public Policy Programme, National University of Singapore 53 The Decumulation Phase of the CPF Contd. • Required Minimum Sum – As of July 2001: S$ 70,000, of Which S$ 30,000 in Cash: S$ 40,000 Can be Pledged in Property. • This will become S$ 80,000 on July 1, 2003, with the Amount Equally Divided Between Cash and Property. • Three Options with the Cash Component of the Minimum Sum – Buy a Life Annuity from an Approved Insurance Company. Currently, Inflation Index annuities are not Available in the Market. In 1999, >10% of the 26,000 Covered Under the Minimum Sum Scheme chose the Annuity Option – Keep it with an Approved Bank – Leave It with the CPF Board • This Effectively Increases the Politically Sensitive Withdrawal Age For This Component. The Public Policy Programme, National University of Singapore 54 The Decumulation Phase of the EPF • The EPF Has Traditionally Permitted Lump Sum Withdrawal: – 1/3 of the Total Balance at Age 50 – The Remaining at Age 55 – Given the longevity of the Population, the Withdrawal Age is Too Low. The Public Policy Programme, National University of Singapore 55 The Decumulation Phase of the EPF Contd. • In July 2000, the EPF Introduced Two Differed Annuity Schemes. These Can be Purchased in Small Amounts Throughout the Person’s Working Period. In Principle, This is Desirable. The Key is However the Implicit Rate of Return on the Annuity Products, in Comparison with the EPF Dividend Rate. As the Former is Lower, then the Dividend Rate for the Existing Two Annuity Products, the Response may be Adversely Affected. • As at end December 2000, 33,412 Members Had bought Annuities Totaling RM 764.4 Million The Public Policy Programme, National University of Singapore 56 The Decumulation Phase of the EPF Contd. • In May 2001, the government appointed a consultant to review the annuity schemes. This was a result of opposition from the trade unions and the public. • Options being considered: – EPF to provide annuities in-house – Continuation of the current insurance companies based arrangements • Positive aspect is that the usefulness of the deferred annuity concept has been accepted by all parties. The disagreements centre on risk sharing and returns to be provided. The Public Policy Programme, National University of Singapore 57 Suggestions For Reform Key Challenges: – Managing Investments of growing balances for which development of financial and capital markets and greater attention to corporate governance will be necessary – Achieving transparency and accountability – Giving higher priority to fiduciary responsibility – Reducing administrative costs, and investment management fees and charges The Public Policy Programme, National University of Singapore 58 Singapore - CPF • End Implicit Tax on CPF wealth immediately • In the Medium-Term (two to three years) consider making CPF a DCFF system in reality by: i. Establishing a CPF Authority, with independent Board of Directors, whose sole objective would be to act in the interest of the members. Appropriate legislation be introduced to accomplish this. ii. The investment policies and performance of the CPF Authority should be completely transparent, and de-linked from the government holding companies. All investments, wherever feasible, should be mark-to-market. iii. All returns on investment must be made known and go directly to the members’ individual accounts. The Public Policy Programme, National University of Singapore 59 Singapore - CPF contd. • Consider providing limited investment options to individuals on a pooled basis, to be administered by the proposed CPF Authority’s Investment Committee. A member may divide the balances among the options on a periodic basis. Default options on investment allocation can be introduced in cases where no choice has been made. • This will permit individuals to shift to different risk-return profile at different ages, and permit some accommodation of different preferences. • Develop the market for annuity products, and make their purchase compulsory. The Public Policy Programme, National University of Singapore 60 Singapore - CPF Contd. • End discrimination in tax treatment against non-CPF retirement benefits. • There are broader social security reforms needed in Singapore (such as the introduction of tax-financed redistributive tier, and revamping of the current inadequate health insurance arrangements), but these are beyond the scope of this paper. The Public Policy Programme, National University of Singapore 61 Malaysia - EPF • The main challenge is to invest growing balances in good quality assets with commensurate real returns. • It will need to find ways to reduce the rapid accumulation of net additions to its balances as the risks (including political and fiscal risks) are too high in having a government agency manage such large funds in relation to GDP and the stock market capitalization. • This will require institutional reforms of Malaysia’s stock markets, other financial and capital markets, and improved corporate governance. • The EPF must continue its gradual shift towards greater transparency of investment policies and performance, including widening the scope of mark-to-market practices. • It will need to engage in more effective investment diversification, including international diversification. The Public Policy Programme, National University of Singapore 62 Malaysia – EPF contd. • It will also need to develop expertise in contracting – out of balances to various specialized investment management funds, even as it continues to enhance its in-house investment management skills and capacities. • The EPF needs to find a practical solution to continuing offering deferred annuity option, making it mandatory once sufficient expertise and experience has been developed. The annuity product (or at least a periodic payment) should be made compulsory. The withdrawal age must be increased (at least for those below 30 years of age) to 60. The Public Policy Programme, National University of Singapore 63 Malaysia - EPF Contd. • The EPF should encourage greater involvement of outside experts, and its members to enhance its autonomy in pursuing its fiduciary objectives. However, the EPF’s role in economic development should not be totally abandoned, but made more transparent and accountable. • Greater diversification of pension funds industry should be encouraged by permitting companies to set up pension plans and by permitting those with large balances to join private pension plans. • There are broader social security reforms (such as developing tax-financed redistributive tier, risk-pooling through national health insurance with appropriate design to address moral hazard issues) which are beyond the scope of this paper. The Public Policy Programme, National University of Singapore 64 Thank you 65