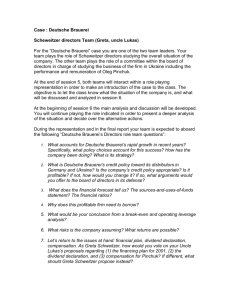

2001 Annual Report (*, 2.0 MB)

advertisement