Proving the Service Continuum

Proving the Service Continuum

Proving the Service

Continuum

Insights from the Oxford Economics study quantifying the strategic and economic impact to global manufacturers as they adopt advanced services business models

PTC.com

Proving the Service Continuum

SERVICE TRANSFORMATION

There is a fundamental transformation service organizations are undergoing across the global manufacturing industry. To drive competitive advantage, best-in-class manufacturers are shifting their business models from producing and selling products to selling outcomes—combining products and services to deliver greater customer value.

Through research with Oxford Economics, surveying 370 service executives around the globe, PTC validated the existence of a Service Continuum; a predictable model of service transformation that companies follow as they evolve toward advanced services offerings to improve revenue, profit margin, and customer value.

The profit and revenues earned as you move into different forms of services are understood to some extent. This Oxford study provides us collectively with an opportunity to get a big step forward in our understanding of that profitability. Nobody else has performed such an international study before, across such a large range of organizations.”

— Professor Tim Baines of Aston Business School.

1

Read Oxford Economics’ interview with Professor Tim Baines here .

Oxford Economics

Oxford Economics was founded in 1981 as a joint venture with Oxford

University. Since then, they have become one of the world’s foremost independent global research firms.

Headquartered in Oxford, England, with offices throughout the world,

Oxford Economics employs more than 90 professional macroeconomic and industry economists—one of the largest teams of economists in the private sector.

Get more information at oxfordeconomics.com

PTC

PTC enables manufacturers to achieve sustained product and service advantage. The company’s technology solutions help customers transform the way they create, operate, and service products across the entire product lifecycle—from conception and design to sourcing and service.

Founded in 1985, PTC employs over 6,000 professionals and serves more than 27,000 businesses in rapidly-evolving, globally distributed manufacturing industries worldwide.

Get more information at PTC.com

PTC.com

Proving the Service Continuum

THE SERVICE CONTINUUM EXPLAINED

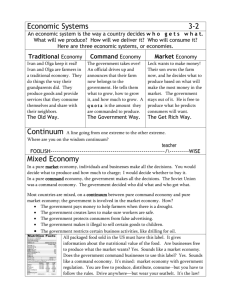

PTC describes the business model paradigm shift as a Service Continuum, where companies progress through stages of transformation to enable the delivery of advanced services. As companies transition from left to right on the Service Continuum, they are forced to reevaluate their processes, technology, and organizational structures and make changes in order to transform and evolve along the continuum.

As companies move through the continuum they don’t abandon existing business models, but enhance them to offer additional services and contracts that coincide with how their products are evolving. For example, as they add sensors, processors, software, and Internet connectivity in products and are able to harvest product performance data, new and advanced service model opportunities are a natural progression. Additionally, engineering can use the data in product development to understand the necessary improvements to make for better product performance, as well as serviceability.

PRODUCT MODEL

SERVICE CONTINUUM

SERVICE PARTS FIELD SERVICES

Break/Fix Model

Cost-plus

SERVICE CONTRACTS

SLAs

OUTCOME-BASED

SERVICE MODEL

+

LAGGING FORMATIVE

Sale of Products

MODERATE

Sale of Outcomes

PROGRESSIVE BEST-IN-CLASS

CASE IN POINT: Trane

®

Delivers More Customer Value.

Trane, a world leader in heating and air conditioning systems, services, and solutions, prioritizes their customer-first culture each time the company evolves. Dane Taival, Vice President of Building Services and

Customer Care, views this approach as a crucial driver in the company’s ongoing service transformation: “Now we describe our mission, not in internally focused terms of product quality, profit goals, or market share, but as helping our customers make their buildings better for life.”

With their ongoing service organization transformation, Trane relies on the power of technology and their smart, connected strategy. Taking advantage of the information captured through the Internet of Things, they have shifted from a reactive approach to one where they can proactively identify and fix potential failures before they even happen. “This is the power of smart, connected products. We don’t just get the predictive data we need to improve product uptime and performance; we also get data to demonstrate the increase in bottom-line value our intelligent services provide.” 2

PTC.com

Proving the Service Continuum

SURVEY PROFILE

Oxford Economics surveyed 370 senior service executives responsible for some, or all, of their company’s service profit and loss. Respondents represented manufacturing and airline companies across the globe, including

North America, Europe, and Asia, with more than $1 billion in total revenues.

Number of survey respondents in North America, Europe, and Asia

What is your firm’s annual revenue in USD for the most recently completed fiscal year?

$20 bn or more

9 %

$15bn – $19.9 bn 13 % 30 % $1bn – $4.9 bn

102 161 97

What is your company’s industry segment?

ELECTRONICS & HIGH TECH

WHITE GOODS

HEAVY & INDUSTRIAL EQUIPMENT

AUTOMOTIVE & TRANSPORTATION

COMMERCIAL/CARGO AIRLINES

MEDICAL EQUIPMENT

AEROSPACE & DEFENSE 13 %

14 %

14 %

14 %

14 %

15 %

16 %

$10bn – $14.9 bn

21 %

27 % $5 bn – $9.9 bn

To which business function in your company do you report?

Function reporting explains the fragmented nature of the service structure inside an organization. Service accountability is spread among several functions, rather than one dedicated service organization.

16 %

SERVICES

14 %

ENGINEERING

27 %

SALES

20 %

OPERATIONS

23 %

MARKETING

PTC.com

Proving the Service Continuum

SURVEY METHODOLOGY AND KEY FINDINGS

A primary goal of the study was to better understand the extent to which companies are able to create value by evolving their service strategies to an outcome-based model. To help determine this, Oxford Economics’ survey included questions on the topics of service parts management, field service, contact center, service knowledge and engineering, warranty, service collaboration, and other operational functions. Based on their responses, companies earned a service score indicating their level of service business focus with organization and process maturity today and in three years’ time.

Oxford researchers analyzed the data in the context of PTC’s Service Continuum and found that service transformation evolves through five stages: lagging, formative, moderate, progressive, and best-in-class. This supports

PTC’s position that a predictable model of service evolution, a Service Continuum, exists.

SERVICE ORGANIZATION – STAGES AT A GLANCE

LAGGING

Have limited or non-existent service leadership

Measure service-related activities, not issue resolution

Tend to be subordinate to engineering

Use basic IT tools and do-it-yourself programming

Isolated information silos

MODERATE

Have fragmented service organization, but beginning to organize under one umbrella

BEST-IN-CLASS

Demonstrate strong, globalized service leadership

Use mixed measurement standards/KPIs

Measure results based on resolving customer problems

Influence engineering, but are not equal collaborators Are equal collaborators and innovators with engineering

Use disconnected tools

Unstructured and inconsistent intelligence sharing

STAGES WHEN VIEWED IN THE CONTEXT OF SMART, CONNECTED PRODUCTS

Use sophisticated tools and systems

Share structured intelligence with enterprise

LAGGING

Limited or no connectivity with products; some new products are connected and remote monitoring may occur to watch for failure trends

MODERATE

More products are connected and some processes include remote diagnostics and service (firmware updates) to automate service delivery processes

BEST-IN-CLASS

Smart, connected products enable install-base product intelligence to develop and sustain outcomes-based contracts as companies transition to new service business models

PTC.com

Proving the Service Continuum

SERVICE CONTINUUM DISTRIBUTION TODAY

Based on their survey scores to determine service business focus and organizational and process maturity, companies were mapped against the stages of the Service Continuum. Those with lower scores tend to lag behind global servitization trends, while those with higher scores lead the industry with the adoption of advanced services offerings. Key findings show 70 percent of survey respondents are in the first three stages of the Service Continuum and evolving through shifts that will take them beyond the “Break/Fix Model” in the middle of the Service Continuum. Moving beyond the middle of the

Service Continuum is a critical tipping point.

SERVICE CONTINUUM TODAY

PRODUCT MODEL SERVICE PARTS FIELD SERVICES

Break/Fix Model

Cost-plus

SERVICE CONTRACTS

SLAs

OUTCOME-BASED

SERVICE MODEL

+

31 %

23 %

15 %

70 %

OF SURVEY RESPONDENTS ARE IN THE FIRST

3 STAGES OF THE SERVICE CONTINUUM

18 %

13 %

LAGGING FORMATIVE MODERATE PROGRESSIVE BEST-IN-CLASS

PTC.com

Proving the Service Continuum

SERVICE INNOVATION

As companies evolve along the Service Continuum, service will have a greater economic impact on their overall business performance and offer a differentiated, competitive service advantage. The gains they achieve in each stage encourage further evolution along the Service Continuum. In fact, when survey respondents were asked where they see their company on the

Service Continuum in three years, 95 percent projected that they will be in the best-in-class service stage. The rapid rate of service innovation and strategic change these companies are undertaking is undeniable, yet the goal is not only to surpass competitors, but to keep up with the changing world.

“Innovation,” Professor Baines believes, “takes root through two processes: customer pull and technology push.” Manufacturers today are experiencing the pull and push of new services innovation in response to changing customer demands.

3

The marketplace is changing and adding more and more pressure for manufacturers to not only address today’s service business challenges, but to put strategies in motion for sustainable growth and competitive advantage.

Service Organizations across the Continuum – Today and in Three Years

95 %

95 % of service executives project that their companies will have best-in-class status within three years.

Today

In 3 Years

15 %

0 %

23 %

1 %

31 %

1 %

18 %

3 %

13 %

LAGGING FORMATIVE MODERATE PROGRESSIVE BEST-IN-CLASS

PTC.com

Proving the Service Continuum

I think it is a very important finding to see that in the next three years manufacturers fully expect to be engaged in the provision of outcomes-based relationships with their customers, often times associated with performance-based contracting. And that is consistent with a lot of things that have been happening at least in the last five to 10 years [inside the manufacturing industry].”

— Professor Morris Cohen of the Wharton School of Business at the

University of Pennsylvania.

4

Read Oxford Economics’ interview with Professor Morris Cohen here .

CASE IN POINT: Diebold

®

Adopts Remote Service Model

With their service channel accounting for more than half of the company’s revenue, Diebold—a global leader in providing integrated self-service delivery and security systems and services—is consistently challenged with a standard of higher-quality, cost effective service. To uphold the company’s efficient service delivery, Diebold adopted an advanced, innovative technology strategy. Shelly Ewing, Senior Product Manager of Service

Product Management, understood the value of this strategy: “Remote service software would allow us to service machines while continuing to respond to issues within minutes as opposed to always sending a technician on-site.”

With Diebold’s implementation of a remote service model, they can diagnose an issue before their engineer even arrives. Their technology now reduces the on-site resolution time, increases the number of firsttime-fixes, and in many cases prevents unnecessary dispatch. With their remote service model, an impressive 17 percent of Diebold’s problems have been resolved remotely with a much improved 15 percent decrease in downtime.

5

PTC.com

Proving the Service Continuum

SERVICE TRANSFORMATION OBSTACLES

Global manufacturers are adept at product focused business models, but as they transform toward outcomes-based service models—whether with a partner or through their own service ecosystem—they are confronted with obstacles that impede growth.

Oxford Economics asked survey respondents to identify the biggest obstacles that keep their organization from progressing along the Service Continuum.

Seven common challenges were identified that differ in intensity depending on a company’s stage. Here are the top three:

Lagging Stage Biggest Obstacle: Lack of Specialized Technology for Service

When companies embark on the service transformation journey, they attempt to use their ERP or CRM systems or build something from scratch to address their evolving service needs. Limitations with this approach will ultimately delay progress along the Service Continuum. Eventually, companies will realize that in order to advance they need to use specialized technology for service. This explains why we see a 20 percent drop in this challenge at the best-in-class stage, as these companies tend to adopt specialized technology for service to help enable their progress along the continuum.

Moderate Stage Biggest Obstacle: Company Culture is Still Product Centric

Progression from the lagging to moderate stage is filled with volatility. While their service strategies are evolving, companies will inevitably encounter cultural challenges when changing from product to outcomes-based service models. The moderate stage is where companies experience this challenge the most—they are trying to support service operations while still being very product oriented.

CASE IN POINT: Joy Global Innovates with Connected Service,

Overcoming Obstacles to Success

For Joy Global, a worldwide leader in high-productivity mining solutions, their service information technology (lack of specialized technology for service) was an obstacle preventing the company from seeing immediate success. It was an unstable legacy system used to collect mass volumes of data. The analytics from this system were not enough to rely on when making important business decisions, leading to Joy Global’s decision to move toward a model that would allow advanced manufacturing capabilities.

With this new model, the company has standardized their data collection process by capturing, storing, and analyzing field-level data through connected devices. Joy Global’s ability to optimize their remote monitoring and analytics processes has allowed the company to anticipate failures, reduce downtime, decrease cost of resources, and improve safety. Facing one of their biggest challenges head on proved to encourage transformation as they continue to progress through the Service Continuum.

6

PTC.com

Proving the Service Continuum

Best-in-Class Stage Biggest Obstacle: Service has Limited Synergy with Sales and Marketing

According to the survey profile, 50 percent of service leaders now report to sales or marketing groups, however the structure of service is changing.

Survey results reveal that service functions, such as warranty claims and process management and product support and planning, are rapidly consolidating under the service umbrella, expanding the role and accountability of service organizations within the business. Limited synergy between service with sales and marketing is likely attributable to the shift in service culture and functional responsibility.

Biggest Obstacles to Service Transformation

58 % Lack of specialized technology

60

50

40

30

20

10

LAGGING

56 %

Company culture still product-centric

MODERATE

58 %

Limited synergy with sales and marketing

Challenge with lack of specialized technology

DROPS BY

20 %

Lack of specialized technology for service

Limited synergy between sales and marketing

Company culture is still product-centric

Too many logistical issues to create larger strategy

Not enough of the right resources to take service in-house

Lack of centralized processes

Talent acquisition, retention

BEST-IN-CLASS

PTC.com

Proving the Service Continuum

THE ECONOMIC BENEFITS OF SERVITIZATION

Another goal of the study was to determine predictable financial performance associated with evolving from product-focused to customer-focused with improved service offerings and advanced service models (i.e., servitization). Survey findings show a direct correlation between revenue performance and a company’s position on the Service Continuum.

Companies with lower levels of servitization routinely earn less revenue, while companies with higher levels of servitization who are further along the

Service Continuum routinely earn more revenue. As it relates to profit margin, 46 percent of companies in the lagging stage of the Service Continuum achieve a margin of 10 points or less, whereas 85 percent of best-in-class companies achieve greater than 10 points, and 44 percent are achieving more than 20 points.

Profit Margin Increases for Companies Across the Continuum

Less than 10 % profit 10 % – 20 % profit Greater than 20 % profit

100 15 %

80

46 %

60

40

20

0

LAGGING MODERATE

44 %

BEST-IN-CLASS

The takeaway is that companies do not need to progress all the way through the Service Continuum to the best-in-class status to realize benefits. There are gains incrementally as new business models are added, or as new service optimization and better practices are applied all along the stages of the

Service Continuum.

CASE IN POINT: Sysmex Realizes Higher Levels of Service Revenue

As a global leader in the design and development of high-quality, reliable, and innovative clinical diagnostic equipment and information systems,

Sysmex faces intense competition in the medical device market. The company feels the constant demand for a higher level of customer service at a lower cost. By recognizing that their business was constrained in their ability to deliver the value-add services that they needed to stay ahead of their competition, Sysmex implemented a new connected service solution. With an advanced manufacturing platform, they were able to lower costs while expanding their service offerings significantly.

Sysmex’s innovative approach allowed the company to improve business processes faster. Sysmex restored their competitive advantage by improving their uptime, labor utilization, and overall customer satisfaction. Proof of the company’s transformation gains comes from the 10 percent of Sysmex’s revenue contributed by its service offerings.

7

PTC.com

Proving the Service Continuum

SUMMARY

Evidence gained through the Oxford Economics study points to an undeniable correlation between companies’ service transformation journey and increased economic gains.

The opportunity to achieve competitive advantage through servitization is so compelling that 95 percent of the respondents plan for their company to reach the best-in-class stage in three years. This is a notable expectation they are putting on their service organizations, as 70 percent are still shifting through the lagging, formative, and moderate stages on the Service Continuum.

As companies progress along the Service Continuum and foster a stronger service culture, successfully implement change management practices, and adopt better processes and technology specialized for service, they can bring more advanced service offerings to market for greater competitive advantage and success.

Key Takeaways

• A well-executed outcomes-based services model contributes to higher growth and competitive differentiation

• Best-in-class companies—those furthest on the Service Continuum— realize the highest economic gains in terms of overall revenue and profits

• As companies move along the Service Continuum they will encounter different obstacles and will need to be successful at change management related to culture, process, and technology

To learn more about product and service transformation, go to:

PTC.com/smart-connected-products/workshops .

1, 3 Oxford Economics interview of Tim Baines, Professor of Operations Strategy and a member of the

Operations and Information Management Group at Aston Business School in Birmingham, UK. Professor

Baines leads Aston’s global research and thought leadership on servitization through the Aston Center for Servitization Research and Practice.

2 Trane Customers Get Better Air and More Value with Intelligent Services , PTC, blogs.PTC.com/2014/11/10/ trane-customers-get-better-air-and-more-value-with-intelligent-services.

4 Oxford Economics interview of Morris Cohen, Professor of Manufacturing and Logistics in the Operations and Information Management Department at the Wharton School of Business at the University of

Pennsylvania. Professor Cohen is also co-director of Wharton’s Fishman-Davidson Center for Service and Operations Management.

5 Diebold and Axeda Resolve Issues and Reduce Downtime with OpteView

®

, PTC, PTC.com/File%20Library/

Topics/Smart%20Connected%20Products/Axeda-CS-Diebold.pdf.

6,7 Demonstrating the Value of Smart, Connected Products with Internet of Things Case Studies , PTC, PTC.com/ smart-connected-products/customer-success.

© 2015, PTC Inc. All rights reserved. Information described herein is furnished for informational use only, is subject to change without notice, and should not be taken as a guarantee, commitment, condition or offer by PTC. PTC, the PTC logo, Product & Service Advantage, Creo, Elements/Direct, Windchill, Mathcad,

Arbortext, PTC Integrity, Servigistics, ThingWorx, ProductCloud and all other PTC product names and logos are trademarks or registered trademarks of PTC and/or its subsidiaries in the United States and other countries. All other product or company names are property of their respective owners.

J4442–Proving the Service Continuum–EN–0115

PTC.com