Corporate Profile

advertisement

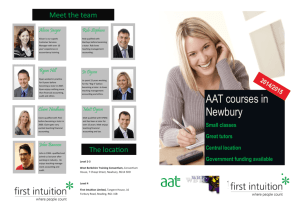

AAT Australia AAT membership Student The Association of Accounting Technicians (AAT) is a professional accountancy body for Accounting Technicians. AAT provides professional recognition for support staff working in accounting and finance with qualified accountants (PNA’s, CPA’s and CA’s). Employed in all sectors of the economy, this large strata of individuals make a significant contribution to the efficiency of Australian business but until now have not been recognised or supported by a professional body. There are four levels of AAT Membership including a Student level. Student Membership is available to anyone studying a certificate course (or higher) in an accounting program at TAFE or at a Private Educational College. In addition to representing members’ interests through advocacy, AAT helps individuals develop their skills and provides tools and resources to facilitate career advancement. AAT also seeks to assist employers improve the productivity and cost effectiveness of Accounting Technician employees, and contribute to enhancing the efficiency of the broader economic environment. Association of Accounting Technicians (Australia) MEMBERSHIP STRUCTURE Student Affiliate Certificate IV Graduate without 1 year work experience or employee with no formal qualification awaiting workplace assessment TAFE student AAT History- a Global Network AAT was formed in 1980 in the United Kingdom. Sponsored by four of the chartered accountancy bodies in the UK, there are more than 100,000 AAT members and students worldwide. AAT is the world’s largest dedicated body for qualified Accounting Technicians. Until now AAT has not had a presence in Australia. The National Institute of Accountants (NIA) under licence from AAT in the UK has launched AAT in Australia, providing Accounting Technicians with full reciprocal recognition as part of a global network of Accounting Technicians. Who are accounting technicians? Accounting Technicians work in all levels of finance from Financial Managers to Accounts Clerks. They work in all industries and sectors, for organisations large and small. In a small organisation, Accounting Technicians may be the only trained member of the finance team or solely responsible for the finance function. In a large orgasnisation, they are a crucial part of a balanced team working alongside fully qualified accountants and administrative staff. Skills for a changing environmnet Like many professions, accountancy is changing. Rapid technology development, tax reform and flatter organisational structures require broader and more flexible skills. Today’s accounting technicians play an integral role in the overall business management function and need to be equipped not only with core technical accountancy skills, but also vital complementary skills in areas such as IT, communication, leadership and time management. AAT will offer a range of training and development opportunities for Accounting Technicians at all stages of their careers. Affiliate Affiliate membership is available to applicants who have completed a Certificate IV in accounting (or equivalent) but who have not met the work experience requirement for admission to the Member level. Applicants over 21 years of age and have at least four years experience in accounting can also apply for affiliate status. Affiliates are entitled to use the term 'AAT Affiliate' when describing their relationship with AAT. Member To advance to Member status an applicant must: • have completed at least a Certificate IV in Accounting or equivalent, and have at least one year’s work experience or • Member Holds a Certificate IV in Accounting and has completed one year’s work experience have membership of a recognised professional body; and be able to provide evidence of suitability for membership and commitment to the rules of AAT. Applicants can meet the requirements for membership through the award of a Certificate IV in Accounting and one year’s work experience. The Certificate IV in accounting can be attained through a Workplace Assessment (WPA) conducted by AAT, or through completion of a course at a local tertiary institute, or a combination of both whereby the WPA gives a number of exemptions from a Certificate IV course. Members can use the postnominals MAAT after their name. Fellow Fellow (FMAAT) Holds a Certificate IV in Accounting and has at least 5 years at Member status and 5 years in a senior/supervisory position Fellow Members must meet the requirements for Member status and in addition have: • Five years at member status • Five years experience at a senior supervisory or managerial level The Benefits of Membership to the Member Status AAT Members enjoy the status of being part of a global network of Accounting Technicians. They are able to use the AAT postnominals, MAAT- Members and FMAAT- Fellows. The postnominals are evidence of achievement and professionalism. Recognition All members receive a Membership Certificate as confirmation of their professional status. Members benefit from improved employment opportunities and career progression. The AAT will be actively promoting the skills, experience and business values AAT members hold to employers and employment agencies. When a member achieves Membership status the AAT (with the applicant’s agreement) updates the Member’s employer about their success and highlights to them the benefits of employing a professional Accounting Technician. Members’ Services and Benefits As AAT develops in Australia, a range of services and benefits will become available to members, including: Continuing Professional Education AAT’s Continuing Professional Education (CPE) activities help members maintain and improve their skills, knowledge and competence. We are committed to providing high quality, value for money opportunities to help members keep up-to-date and develop new skills. Our program offers an impressive range of activities including training events in the areas of accounting, IT, management and personal effectiveness. Technical Information Members will benefit from free access to an online technical information resource, that will provide ongoing support and assistance. This service will be accessible through our web site at www.aat.org.au The Professional Recommendation Requirement Communication All AAT applicants are required to support their membership application with a reference from a qualified accountant, Company Director, Senior Manager or other approved professional. Members will receive various communications from AAT including newsletters and CPE updates. Our web site contains a mixture of information and services. The web site is continually updated and developed to provide a useful and functional information resource. It includes a technical news service, details on our CPE courses, conferences and a discussion forum. Discussion forums are used by our Members, Affiliates and Students across the world to exchange views on industry issues, study concerns and other interests. Benefits for Employers Employers will benefit from having their staff supported and recognised as part of a professional association. AAT provides a range of training and learning programs that address the diverse range of skills required by organisations. By ensuring your staff are members of the AAT, employers can be confident that staff have attained a high standard of competence and experience in accounting, and be comfortable in the security that staff are governed and supported by the Association’s professional ethics and disciplinary procedures. Employees can be assessed through the AAT Workplace assessment program and can go on to complete a Certificate IV equivalent to meet membership requirements. When your employee achieves AAT Membership status they will benefit from the support of the world’s leading professional body of Accounting Technicians. Other professional development programs will also be available to ensure your staff are abreast of changes affecting the industry and the role that they play within their organisation. This continued learning plays an essential role in developing and maintaining practical and technical skills. Corporate Profile Company Vision To be the professional body of first choice for Accounting Technicians. Further Information AAT offices are located in the following Australian capital cities; MELBOURNE Company Mission SYDNEY A strong, visible and respected professional body for Accounting Technicians offering membership and qualifications that are recognised and valued. BRISBANE We aim to add value to individuals and organisations by: • Providing training and development opportunities • Assessment and ensuring professional conduct of a high quality • Offering flexible solutions to training needs • Promoting lifelong competence ADELAIDE PERTH CANBERRA HOBART??????? If you would like further information about the AAT please contact our membership services area on ?????? We value: Head Office • Our customers first most and foremost Level 8, 12-20 Flinders Lane • Flexibility in meeting customers needs • Effective communication Collins St East, Victoria, Australia 8003 • Our staff and all who contribute to the work of the AAT Tel: 61 3 8665 to be supplied Melbourne, Victoria, Australia 3000 * PO Box 18204 Fax: 61 3 8665 to be supplied The Approach of the Organisation: enquiries@aat.org.au www.aat.org.au • We are open to anyone interested in a career in accounting • We maintain high standards of professional ethics International Office • We are always looking for new ways to help our students and members 154 Clerkenwell Road London ECIR 5AD • We are accountable to our customers Fax: +44 (0) 20 7415 7632 • Our processes are open Tel: +44 (0) 20 7415 7600 www.aat.co.uk Key Objectives of the Association: • To provide formal recognition in Australia for Accounting Technicians • To raise the profile of Accounting Technicians in Australia • To provide an enhancement of members skills through education and training • To provide a pathway for Accounting Technicians to qualify as an NIA Accountant Association of Accounting Technicians