Cash Handling - Bay of Plenty Polytechnic

advertisement

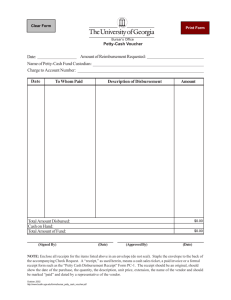

QUALITY MANAGEMENT SYSTEM – Policies and Procedures Standard 3: Financial, Administrative and Physical Resources Policy title: (F15) Cash Handling First approved: September 2011 Current version approved: November 2011 Applies from: November 2011 Review due: November 2013 Policy overview 1. Purpose/Principles 1. 2. Scope Approving body: Responsibility: First point of contact: 3. Definitions Management Forum Finance Director Finance Director 4. Policy 5. Procedures Purpose/principles The purpose of this policy is to provide cash handling controls in the recording, administering and securing of cash taken at departmental/programme level, the transfer of cash to cashiers and its recording and receipting by cashiers in order to minimize risk of cash losses. 2. Scope This policy applies to internal campus receipt of cash and EFTPOS transactions including field trips and petty cash reimbursements. 3. Definitions Cash Includes, notes, coins, cheques and EFTPOS transactions . Person in Finance assigned with the responsibility of: • Reconciling and reimbursing the Petty Cash floats • Banking the till float surpluses Cashier Accounting technician Person in Finance assigned with the responsibility of reconciling, recording and assigning till floats Cash in Transit Refers to the movement of cash and cheques between remote campus sites and between the Bank and the main Windermere Campus (cashiers) Till Floats Designated amounts of cash held within campus and at remote campus locations. Receipt An acknowledgment slip to verify cash has been received. Surplus takings Cash collected over and above the till float allowance. Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 1 4. Trading Sales Sales made by cost centres e.g. massage, vehicle servicing, restaurant meals, etc. Booking system Certain parts of the organisation require the service to be booked in advance such as Hairdressing or Bay Auto. Imprest system A system that ensures that the cash float balance is kept at the same level at all times. Realtime BoPP’s accounting system. Jasper UoW’s accounting system ICT Internal Cash transfer Policy 4.1 The approved points of cash collection for Bay of Plenty Polytechnic are: Location Till Float EFTPOS Petty Cash Float Windermere Cashiers $100 Yes $500 Bongard Cashiers $150 Yes $200 Copy Centre $150 Training Restaurant $100 Yes Training Café $100 Hairdressing $50 Yes Beauty $50 Yes Massage $50 Aquatic Centre $50 Yes Library – Windermere $50 Library – Bongard $50 Kahurangi Student Services $0 Yes Bay Auto $0 Yes Childcare Centre $0 Yes $50 4.2 All cash will be receipted immediately on acceptance – procedures 5.1 – 5.3 4.3 All cash will be reconciled to a day sheet, cash register or to a computer printout where an independent book-keeping system is in place utilising a standard cashing-up procedure – procedure 5.4 4.4 All cash will be transferred daily or weekly (on approval by the Finance Director) to the cashiers at Bongard or Windermere using the Internal Cash Transfer Form -procedure 5.5 4.5 All cash will be secured at all times – see procedure 5.6 4.6 The Windermere cashiers will be the lead cashier and will take responsibility for: • The Bongard cashiers • The transfer of cash from Bongard to Windermere. • Ensuring policy procedures are applied • Overall control, banking, reconciliation and administration as laid down by procedures 5.6, 5.7 & 5.8 Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 2 4.7 5. The following transactions are not permitted under any circumstances • Cashing of cheques; • “Cash out” transactions (e.g. from EFTPOS transactions); • IOUs, temporary loans or any other form of personal advance. Procedures 5.1 5.1.1 5.1.2 5.1.3 5.1.4 5.1.5 5.2 5.2.1 5.2.2 5.2.3 5.2.4 5.2.5 5.3 5.3.1 5.3.2 5.3.3 5.3.4 5.4 5.4.1 Departmental receipting and recording of cash All cash will be receipted immediately (unless a booking system is in place – see 5.1.4) using one of the following: EFTPOS, manual receipt book, cash register receipt (if available). (See also section 5.2) Where the manual receipt book is used, the white copy is given to the customer/client; the yellow is for the cashiers and the pink stays in the book. Unless a computerised book-keeping system is used, each receipt and EFTPOS docket will be listed onto a day sheet. Where a commercial computerized book-keeping system is used, a daily transaction report must be printed out and reconciled. Cash received will be placed in till or a cashbox that must be kept in a locked drawer or filing cabinet. Specific procedure relating to Field Trips The Programme Administrator must advise cashiers by email that a field trip is underway giving the approximate number of students and cost and the code to which receipts must be coded. Individual student invoices to be completed using bulk invoice requests. Students are required to individually pay at cashiers, taking receipt back to the Programme Administrator as proof of payment. The policy requires that no cash is to be collected through any other source on site or off site. The Programme Administrator to attach cashiers receipts or yellow copy of internally issued receipts to the schedule of participants and file away in accordance of recordkeeping standards and for auditing purposes. Specific procedure relating to retail & book purchases, course readings and resit fees Each relevant Programme Administrator to advise (re-advise) to Cashiers by email of their retail products, book requirements, course readings and resit allowances together with costs and related income codes as they become aware of them. Students to individually pay at reception, taking receipt back to administrator. Receipt is entered onto a goods outwards schedule on which the student must sign on collection of any product, book, course readings etc. Every month, the schedule is costed up and used for stock reconciliation purposes and then filed away in accordance of recordkeeping standards and for auditing purposes. Reconciliation prior to taking to cashiers The daily EFTPOS transactions must be printed out and the day sheets totalled up, where required. Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 3 5.4.2 5.4.3 5.4.4 5.4.5 5.4.6 5.4.7 5.5 5.5.1 5.5.2 5.6 5.6.1 5.6.2 5.6.3 5.6.4 5.7 5.7.1 5.7.2 5.7.3 5.7.4 Each day the EFTPOS cutover amount must be conveyed to Cashiers irrespective of when the cash is transferred or as instructed otherwise by cashiers. Cash must be reconciled every day when transactions occur, balancing to day sheet or to printouts generated by the cash register / computer using the standard reconciliation form. Where cash is involved, reconciliations must be carried out in a back office away from customers/clients. The data from the day sheet must be transferred to the internal cash transfer form and reconciled. The purpose of the internal cash transfer is to prove the reconciliation and help the main cashiers by showing the account codes, GST and cash denominations. Reconcile cash float on no less than a weekly basis using the ‘imprest’ system. Where discrepancies arise, assistance should be sought from the Management Accountant or the Finance Director. Cash transfer to cashiers On the appointed day and time, the person responsible for cash control must: • Sign the internal cash transfer form. • Enter the totals onto a monthly summary sheet. • Attach the official receipts, EFTPOS dockets or day sheet where a booking system is used. • Take the internal cash transfer form together with the cash to cashiers using policy step 5.6.3 or 5.6.4. Cashiers will provide an official computerised cashiers receipt which must be attached to the appropriate day sheet. Security All cash must be secured at all times At night, cash must be transferred to a back-office safe or a back office lockable cabinet. Cash must be taken to cashiers no less than weekly. Campus Security may be used on request. Cash must be transferred using campus security where the amount is in excess of $250. Administration For audit trail purposes, cashiers will file away the daily bank reconciliation reports, internal transfer forms, EFTPOS dockets and all receipts/documentation and in accordance of record-keeping standards. At the end of the month, the manager/ group leader should ensure that the variance report tallies with the summarised internal cash transfer forms, advising the Management Accountant where discrepancies occur. All cashiers will be allowed a float appropriate to the circumstances; these floats to be approved yearly by the Finance Director at budgeting time. Should the coinage in the float be inappropriate for operating, change may be available at the Windermere cashiers office. Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 4 5.8 5.8.1 5.8.2 5.8.3 5.8.4 5.9 5.9.1 5.9.2 5.9.3 5.9.4 5.9.5 The function of Cashiers - Bongard All cash (e.g. library fines and fees; BoPP student fees; internet & printing top-up, miscellaneous purchases etc.) is recorded through ‘real time’ with a receipt given to the customer. Cash received from UoW students for tuition fees to be recorded through UoW’s Jasper system. A cash till will be operated using the ‘imprest system’. Each day, the takings (including EFTPOS) less the float must be reconciled to the computer printout. Any discrepancies notified to the Windermere cashier who should ask the Management Accountant for assistance should a breach of security be suspected. The money is to be placed in the safe overnight and transferred the next day to Windermere using ‘sprint courier’. The function of Cashiers – Windermere All cash is recorded through real time with a receipt given to the customer. Cash received via the ICT system will be checked to the ICT form and entered into ‘real time’. Cash received from UoW students for tuition fees to be recorded through UoW’s Jasper system. Cash received from other sources (e.g. library fines and fees; BoPP student fees; internet & printing top-up, miscellaneous purchases etc.) to be recorded through ‘real time’. Cash received from Bongard will be rechecked and placed in safe until reconciliation time. 5.10 Reconciling and Banking of cash 5.10.1 A daily ‘cash received’ report and a banking report from real time will be printed from both UoW’s Jasper system and BoPP’s real time system. Reports will be by operator showing cash, cheques and EFTPOS. 5.10.2 The imprest system will be employed. 5.10.3 Every day, reports must be reconciled to the various sources prior to banking and given to the financial accounting technician who will reconcile to the bank statement. 5.10.4 Banking reports for BoPP and UoW to be filled daily. 5.10.5 Both BoPP and UoW cash will be banked daily using Post Haste NZ couriers. 5.11 5.11.1 5.11.2 5.11.3 Staff Petty Cash reimbursements (Windermere and Bongard) This function can only be used for expense claims under $30. Staff to download the petty cash docket form from the Hub. All claims must have a GST receipt, coded to the department and authorised in accordance with authority held. 5.11.4 The claimant must take all claims to cashiers who will • manually record details of the cash issued, and • require signature from the staff member on receipt of cash. 5.11.5 A spreadsheet summary of the petty cash dockets will form the basis of a cheque requisition to reimburse the petty cash float on a timely basis. Related policies • F02 Purchasing Goods and Services • F07 Personal Purchases Related forms • Petty cash docket • Internal cash transfer (ICT) Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 5 • • • F13 Procurement of Goods and Services F17 Travel and Reimbursement of Expenses G16 Fraud Hardcopies of this document are considered copies of the original. Please refer to the electronic source (Hinaki) for the controlled latest version. 6