A Marketing Plan for Lipton Ice Tea Institutional

advertisement

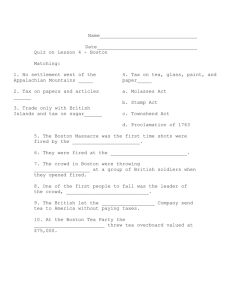

A Marketing Plan for Lipton Ice Tea Institutional Affiliation Date Marketing Plan: Lipton Ice Tea Industry Analysis In 2005, the tea industry reached the $1.7 billion category and it is expected to continue growing indefinitely (Mintel 2005). Market analysts believe the tea industry will continue to boom and is not expected to reach saturation level in the near future. The favorable movement in the tea industry can be attributed to two major factors: a) consumers need for convenience and time-saving services; and b) the positive press given to tea. American lifestyle and work habits have made convenience a necessity. As employers demand for productivity from their employees, consumers are more pressed for time. In addition, the shaky economy has made Americans fear for their jobs; thus, any product that can fill the consumers' need for convenience and speed are almost automatically embraced into the American lifestyle (Mintel 2005). For the last decade, the health benefits of tea have gained wide coverage in the media. Studies continue to show the beneficial properties of teas, with health benefits ranging from lower cholesterol levels to improve arterial health and decreasing chance of cancer. This positive press has definitely catapulted the demand for tea (Mintel 2005). Both the need for convenience and positive press on tea have spurred an increase in sales of tea products, specifically ready-to-drink (RTD) teas sold in single-serve containers (Mintel 2005). Recognizing this trend, various companies in the tea industry have come up with innovative products to take advantage of the booming market for ready-to-drink teas. Lipton tea, one of the global leaders in refreshment brands, launched new products to meet the growing the need for ready-to drink teas and introduced innovative product line to capture the healthconscious market. 2 For over a century, Lipton has been dominating the world tea market with the company’s tea-based drinks including leaf tea, infusions and ready-to-drink tea. Its success has been attributed to the firm’s “strong focus on innovation and the expertise of its tea specialistsprofessionals in tea-growing, tasting, buying, blending and R&D teams” (Wikipedia 2007). One of the main driving forces for Lipton’s success is the company’s source of tea. Lipton teas are sourced from various plantations in well-know tea-producing countries such as India, Indonesia, Kenya and Sri Lanka. It maintains specialized tasting rooms in seven regional located across the globe. Presently, Lipton has about 30 different tea blends (Wikipedia 2007). As Lipton is a part of the Unilever global consortium, the company ensures that its tea producing farms do not only yield high-quality product but also protect and improve the natural environment and livelihood of workers and local communities. Lipton’s plantations in East Africa have been working with third party estates to ensure compliance with Unilever’s sustainable agriculture guidelines and the Ethical Tea Partnership criteria (Wikipedia 2007). As part of Lipton tea’s drive to capture the booming market for ready-to-drink teas, the Anglo-Dutch Unilever Company entered into a joint agreement with American PepsiCo in 2003. Through the joint venture agreement, PepsiCo distributes or markets Lipton tea products, specifically Lipton Ice Tea in more than 60 countries where PepsiCo has established its corporate presence (Wikipedia 2007). “The 50-50 JV - Pepsi Lipton International - is the latest move in Unilever's Path to Growth strategy which has mostly involved the disposal of non-core businesses rather than support for existing brands” (“Unilever-PepsiCo” 2003). In a press statement, Unilever announced that the joint agreement with PepsiCo has two main goals: to move the Lipton brand into new distribution channels and into new markets. While Unilever claims that Lipton is the leader in the 16-billion liter world market for ready-to- 3 drink tea, its presence remains slim in a number of key markets; thus, the agreement with PepsiCo is expected to address such concern (“Unilever-PepsiCo” 2003). Unilever stated that “the [50-50 JV - Pepsi Lipton International] will target the ‘white space' markets where Lipton has no current presence and it is anticipated that significant business opportunities will come from the key high-potential markets where Pepsi is already strong” (“Unilever-PepsiCo” 2003). PepsiCo is expected to build the sales of the Lipton ice tea in 60 countries including Brazil, Spain, Greece, Poland, Czech Republic, Slovakia, Hungary, Albania, Romania, Thailand, Singapore, Vietnam, Australia, Turkey, Egypt, Saudi and the six Gulf States. The Pepsi Lipton International venture is a logical expansion of an earlier collaboration between the two companies. The Pepsi Lipton Tea Partnership was set up by the two companies some 10 years ago to expand sales in the North American market, and is now firmly established as the leading RTD tea player in both the United States and Canada. With the aim of achieving a similar level of market dominance in the rest of the world, the latest joint venture will aim to leverage the strengths of both parents. It will principally sell ready-to-drink tea concentrate to franchise bottlers for distribution by Pepsi. As the world's largest tea producer, Unilever will bring the brand, knowledge of the tea industry and a substantial research and development capability to the JV; Pepsi will contribute access to its extensive bottling and distribution network with strong customer relations (“Unilever PepsiCo” 2003). 4 Customer Analysis There are two major target markets for ready-to-drink ice tea. One group is the consumers on the go. These are the employees, students, and other consumers who lead a busy lifestyle. The hectic American lifestyle demands for optimize productivity with lesser timeconsumption. Thus, there is a need for products that are accessible and readily available. Convenience has dominated the market, particularly the food and beverage industry. The other group is made up of health conscious consumers, specifically the baby boomers who patronize anything healthy. The positive reviews as well as the studies on the benefits of tea drinking have stirred an interest in tea drinking. Representing about 10 percent of the world market for tea (Wikipedia 2007), Lipton ice tea is poised to improve its customer base through a joint agreement with PepsiCo and aggressive marketing strategy. Recent report (Winslow 2006) that the main factor for the improving market performance of Lipton ice tea is its health benefits. Consumers believe that tea is very good for the body; thus, it is more logical to drink more tea and less soda pop and other drinks. Consumers drink Lipton tea because of its beneficial effects to one’s health. Consumers consider drinking Lipton as a healthy habit. The 100 percent Natural Tea and 150 mg of protective natural antioxidants has made Lipton tea a major participant in the global tea market. “Many tea drinkers choose Lipton because it is really inexpensive and you can get it just about anywhere. It is surprising that more people do not drink tea, as they would longer, happier and healthier lives if they did” (Winslow 2006). Furthermore, some customers think that taking anti-oxidants are healthy, thus, customers drink a couple of gallons per week: “Tea makes you look younger too and gives you energy as 5 well. You know it also costs a lot less to drink tea too, for 100 bags at $2.50 lasts you about 3weeks. 2-quarts per day are possible when it is really hot out, of course it varies with the drinker” (Winslow 2006). Recognizing that majority of Lipton ice tea’s consumers are the health-conscious and onthe-go drinkers, Lipton continues to develop its product lines to make it more convenient, accessible and health-appealing to consumers. Brand Analysis and Positioning Lipton ice tea is produced to make it “great tasting and good for [consumers] because it is rich in protective antioxidants” (Unilever 2007). Lipton ice tea is marketed globally as “the perfect drink for active, healthy lifestyle” (Unilever 2007). It is available in 16 oz plastic bottles with select flavors sold in six-pack cases. Flavors available are: Iced tea Sweetened - Lightly sweetened iced tea Iced tea Unsweetened - Tea with no sugar and no added flavors Iced tea with Lemon - Sweetened iced tea with a twist of citrus flavor Iced tea with Raspberry - Sweetened iced tea with raspberry flavor Iced tea with peach - Sweetened iced tea with peach flavor Iced tea Diet Sweet Tea - Lightly sweetened with Splendid and no calories Iced tea Diet Lemon - Lightly sweetened with a hint of lemon Iced tea Extra Sweet - Very sweet iced tea, marketed as "Southern Style" in some areas Half & Half - Half sweetened ice tea and half lemonade Diet green tea with Mixed Berry - Mellow tea diet and lightly flavored with mixed berry (Wikipedia 2007; Unilever 2007). 6 The packaging and marketing strategy for Lipton ice tea is a reflection of Unilever’s thrust for consumer welfare and sustainable development. To meet the growing demand for ice tea, Lipton continues to develop new products through its research and development department. New flavors are being added to cater to changing and adventurous tastes of consumers. More importantly, the Unilever-PepsiCo ensures that Lipton ice tea continues to expand its niche in the global market. According to Patrick Cescau, director of Unilever Foods: We [Unilever] have a strong presence in the developing and emerging markets yet there is plenty of ‘white space' to move into. These markets are the next in our planned rollout and we see Pepsi as the best partner to help us achieve this. This new joint venture marks a truly significant step in the expansion of the brand, bringing it within the reach of many millions of new consumers."(“Unilever PepsiCo” 2003). Moreover the alliance between Unilever and PepsiCo is expected to “enable Lipton to strengthen its global position. At the same time, we are rounding out our portfolio with a strategic partnership in one of the fastest growing beverage segments and providing consumers with Lipton, the world leader in tea." (“Unilever PepsiCo” 2003). Direct Competitor Analysis One of the major competitors for Lipton in the world ice tea market is Nestle Refreshment Company, maker of Nestea Ice Tea, well-known competitor for Lipton ice tea. Like Lipton-Unilever, Nestle Refreshment Company has forged agreement with another soda manufacturer, Coca Cola, to form the Coca Cola/Nestle Refreshment Company (Sturdivant 1992). Nestle’s alliance with Coca Cola has the same purpose as the Unilever PepsiCo joint agreement: global distribution. 7 The strong presence of Coca Cola/Nestle ice tea in the United States and some parts of the globe remains a threat to the goals of Unilever PepsiCo to make Lipton the most dominant player in the global ice tea market. Coca Cola/Nestle has two major products: Nestea sweetened with natural lemon flavor and diet Nestea with natural lemon flavor. Both are available in 12 ounce cans and in 16 ounce wide mouth glass bottles. In addition to the cans and bottles, Nestea is available in refrigerated cartons (as in milk cartons) in the refrigerated sections of grocery stores and convenience stores. The tea is preservative free and made from a brewed product taken back down to a tea powder. While Nestle Coca Cola continues to develop the packaging and marketing strategies for Nestea Ice Tea, there are no recent announcements of impending new products or new flavors of ice tea to be developed soon. There is a limited flavor of Nestea Ice Tea which is basically the original ice tea flavor. The company has not shown interest to capture the emerging demand for healthy ready-to-drink ice tea products. This can be a good opportunity for Unilever PepsiCo to exploit. Lipton Ice Tea can continue to expand its market niche by capturing the growing market for healthy ready-todrink ice tea. Unilever PepsiCo can exploit the limited flavors of Nestea Ice Tea. Recommendations/Conclusions: With the expected growth of the billion dollar ready-to-drink ice tea market, Lipton Ice Tea is poised to capture a bigger share of the market with an aggressive marketing strategy: from packaging to advertising. Short Term Goals: Improve market presence by 20% Short-Term Objectives 8 1) Aggressive Marketing Strategy - Unilever can take advantage of the positive press on the health benefits of tea to boost the sales of its ice tea product line. The company can use recent studies on the health benefits of tea as the basis of its press releases and advertising campaigns. 2) Improve Packaging – Currently, the Lipton Ice Tea are available globally in two sizes: the 16-oz bottle and 2 liter bottle. Unilever can come up with other packaging sizes to ensure that consumers will have other choices and that Lipton Ice Tea will be easily and readily available to consumers. 3) Improve Shelf Presence – Unilever PepsiCo can make a deal with retailers ensure retail shelf space and prominent positioning for Lipton Ice Tea. “Although an average shopper may not notice what brands are positioned in prominent places on shelves or how much room is allotted to each manufacturer, …shelf space and positioning as make or break factors in introducing new products” (Sturdivant 1992). Long-Term Goals: World Number One ready-to-drink ice tea Long-Term Objectives: 4) Product Innovation - Unilever PepsiCo must continue its innovative research and development strategy to come up with new flavors and products. Unilever has extensive research facilities on product improvement. The company can use its resources and professional expertise to come up with new flavors that will suit the continuous demand for healthy ready-to-drink ice tea. With aggressive marketing strategy and product positioning, Lipton Ice Tea is poised to take the global lead in ready-to-drink ice tea industry. 9 Bibliography Mintel. 2005. “Tea and RTD Tea in the United States.” Available from http://www.liptont.com/our_products/iced_tea/ Sturdivant, S. 1992. “Ready to drink teas and new alliances: the race is on for market share.” Tea & Coffee Trade Journal , October 1992. Available from http://www.allbusiness.com/manufacturing/food-manufacturing-food-coffee-tea/3233132.html “Unilever, PepsiCo join forces to meet ice tea challenge.” Available from http://www.foodanddrinkeurope.com/news/ng.asp?id=18257-unilever-pepsico-join Wikipedia. 2007. “Lipton.” Available at http://en.wikipedia.org/wiki/Lipton 10