office of the municipal assessor

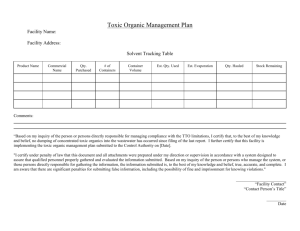

advertisement

Republic of the Philippines Province of Pampanga MUNICIPALITY OF SAN SIMON ACCOMPLISHMENT REPORT Real property appraisal and assessment operation is acknowledged to be one of the major sources of revenue in the local government unit. While real property taxes remain a meaningful source of local taxes, this revenue source offers potential platform that would provide one of the solution to the quest of Local Government Units in building capacity for their development needs. Utilizing real property taxes and administration as the instrument not only for gaining financial strength but for real property development in their respective jurisdictions. Thus, real property appraisal and assessment operation becomes an important place in the local government finance as a source of income that will augment funds for basic services, funds for local school board and barangays. The Local Government Unit and real property owners can expect a uniform, effective and consistent discharge of functions by the assessor’s office with fairness and equity in the distribution of tax burdens that will eventually produce better results. Real Property Tax would become one of the main sources of local revenue for the Municipality of San Simon, Pampanga due to significant increase in the collection of Real Property Tax through properly appraised and assessed real properties coupled with an efficient Real Property Tax Collection system. To update and upgrade an equitable market value of Real Properties and to account all real property units within the municipality; to provide an efficient frontline service in the field of real property taxation through the use of information technology and properly trained, responsible and highly motivated work force. The Office of the Municipal Assessor shall take charge of the discovery, classification, appraisal, assessment and valuation of all real properties within its territorial jurisdiction which shall be used as the basis for taxation. Its duties include the preparation, installation and maintenance of a system of tax mapping, record management and the preparation of a schedule of fair market values of the different classes of real property within the municipality. The appointment of assessor shall be mandatory municipal government. an for The assessor shall take charge of the assessor’s office, perform the duties provided for under Book II of the Local Government Code, and shall: 1. Ensure that all laws and policies governing the appraisal and assessment o real roperties for taxation purpose are properly executed; 2. Initiate, review and recommend changes in policies and objectives, plans and programs, techniques, procedures and practices in the valuation and assessment of real properties for taxation purposes 3. Establish a systematic method of real property assessment; 4. Install and maintain a real property identification and accounting system; 5. Prepare, install and maintain a system of tax mapping, showing graphically all properties subject to assessment and gather all data concerning the same; 6. Conduct frequent physical surveys to verify and determine whether all real properties within the province are properly listed in the assessment roll; 7. Exercise the functions of appraisal and assessment primarily for taxation purposes of all real properties in the local government unit concerned; 8. Prepare a schedule of the fair market value for the different classes of real properties, in accordance with the Title Two, Book II of the Local Government Code 9. Issue, upon request of any interested party, certified copies of assessment records of real property and all other records relative to its assessment, upon payment of a service charge or fee to the treasurer; 10. Exercise such other powers and perform such other duties and functions as may be prescribed by law or ordinance. 1. Typing, recording and filing of real property records, documents, certifications, etc. 2. Prepare/issue certified true copies of tax declarations and other certifications of real properties. 3. Prepare Request of Issuance of Property Index Number (PIN) for newly discovered real properties and approved subdivision /consolidation plans and submit request to tax mapping division at the Provincial Assessor’s Office for approval. 4. Assigned issued PIN and type tax declarations. 5. Update tax maps. 6. Drafting Building Appraisal Slips. 7. Act as Liaison Officer coordinating the Provincial Assessor’s Office and other agencies (Bureau of Lands, Bureau of Local Government Finance Region III, Register of Deeds, DAR, Bureau of Internal Revenue, etc. 8. Perform other works as may be required by the Municipal Assessor. 1. Update all Assessment Records of Real Properties: Lands, Buildings, Machineries and other structures. a. Tax Declarations b. Masterlist per barangay c. Record of Assessment d. Assessment Roll e. Index Card f. Logbook of tax declaration numbers 2. Typing and Filing of real property records, documents, certifications, etc. 3. Released documents to property owner 4. Bookbinding works. 1. Conducted ocular inspection of lands, buildings and other structures for assessment and appraisal purposes. 2. Validated appraisal/assessment of Real Property Units subject of complaints, protests and requests. 1. Appraised real property units in accordance with the approved Schedule of Market Values. 2. Assessed the real property units in accordance with the approved assessment level. 3. Transferred ownership records for four hundred nine (409) Real Property Units. 4. Reassessed four ( 4 ) lots from agricultural to residential; and one (1) lot from agricultural to commercial. 5. Consolidated/subdivided thirty three (33 ) lots into two hundred seventy (270) parcels of land. 6. Declared new real property units: a. Six (6) land b. One hundred thirty five (135) residential buildings c. Six (6) industrial buildings d. Nine ( 9) school buildings e. One (1) day care center f. Four (4) commercial machineries g. Thirty one (31) Industrial Machineries h. One (1) Barangay Health Center i. Two (2) Barangay Halls 7. Issued various certifications: a. Forty Four (44) certifications of no property holdings for medical/ social and scholarship services. b. Sixty Seven (67) certifications of property holdings for general purposes. c. One Hundred Sixty One (161) certifications of non-improvement for BIR Capital Gains Tax purposes. d. One Thousand Six Hundred Forty Five (1,645) Certified True/Machine Copies/ Owner’s Copies of Tax Declarations for general purposes. Updated and maintained assessment records Master list per barangay Property Ownership Index Assessment Rolls Assessment Record Tax Maps Tax Declarations FAAS for land, improvements and machineries 1. Office Report Prepared and submitted assessment reports required by the Provincial Assessor’s Office such as Weekly/ Monthly Assessment transactions/Accomplishments and Quarterly Report on Real Property Assessments. 2. Human Resource Management Attended workshop/trainings and meetings relative to the preparation and recording of appraisal and assessment of real properties conducted by the Bureau of Local Government Finance, Region III and office of the Provincial Assessor. 1. Attended meetings and conferences organized by the office of the Municipal Mayor and other agencies. 2. Assist the Municipal Treasurer’s Office in their Tax Information and collection campaign. A. Office Plans and Programs i. Prepare/submit 2013 Office Plans and Programs to Provincial Assessor for review and approval. ii. Prepare/submit Performance Target Worksheet to Provincial Assessor for acceptance and approval. iii. Prepare/submit other reports as required by the Provincial Assessor/ and DOF/BLGF. iv. Prepare/submit 2013 annual budget proposal and procurement programs. i. Conduct Job Training a) Preparation /accomplishment, recording, maintenance and filing pertaining to appraisal and assessment. b) Preparation of Statistics on real property as to kind/classification/actual use and other date. ii. Conduct office periodic training/meetings . iii. Attend formal trainings/workshops relative to assessment matters, operations and personnel administration. iv. Evaluate performance of personnel. v. Provide counseling to personnel. i. Prepare/Issue certified true/machine copies of tax declarations and other certifications of real properties. ii. Update/maintain assessment records. a. b. c. d. e. logbook for tax declaration numbers assessment rolls master list assessment records index cards i. Prepare general correspondence ii. Received/record incoming communication iii. Record/dispatch outgoing communications iv. Maintenance of office file i. Prepare/submit reports required by the Bureau of Local ii. Government Finance Regional Director iii. Prepare/submit reports required by the Provincial Assessor’s Office 1. Office Maintenance i. Maintain cleanliness and orderliness of the office 2. Supply and Property Management i. Requisition of office supplies and materials ii. Physical inventory of supplies, materials and equipment. 1. Appraisal i. Conduct ocular field inspection ii. Apply correct schedule of market value 2. Assessment i. Determine market value, correct assessment level, assessed value and effectivity of assessment. ii. Prepare/submit tax declarations, building appraisal slips for approval of the Provincial Assessor. iii. Effect transfer and cancellation of superceded tax declarations based on documents presented. iv. Prepare/submit to the Municipal Treasurer the assessment rolls of real properties 1. Undertake reassessment, appraisal and revalidation of some real properties 2. Property Tax Collection -Assist the Municipal Treasurer in the implementation of the Real Property Tax Collection Enforcement 3. Supervise and monitor tax mapping operations. 1. Civic Activities i. Participation in civic activities i. Interact/coordinate with the Local/National Officials regarding assessment operations. ii. Attend meetings and conference 1. Conducted continuous ocular inspection of lands, buildings and other structures for assessment and appraisal purposes. 2. Validated appraisal/assessment of Real Property Units subject of complaints, protests and requests. 1. Appraised real property units in accordance with the approved Schedule of Market Values. 2. Assessed the real property units in accordance with the approved assessment level. 3. Transferred of Ownership Records of Real Property Units (RPUs) 4. Reassessed Parcels of Land a) Agricultural to Residential b) Agricultural to Commercial c) Agricultural to Industrial d) Industrial to Agricultural e) Industrial to Residential Transferred of Ownership Records of RPUs July to Dec. 2010 391 RPUs Jan. to Dec. 2011 409 RPUs Jan. to Feb. 2012 75 RPUs TOTAL 875 RPUs 4 lots 1 lot - - 4 lots 1 lot - 2 lots 2 lots 25 lots - 2 lots 2 lots 25 lots REASSESSED PARCELS OF LAND Agricultural to Residential Agricultural to Commercial Agricultural to Industrial Industrial to Agricultural Industrial to Residential 5. Consolidated/Subdivided Lots 6. Declared New Real Property Units a. b. c. d. e. f. g. h. i. Land Residential Buildings Industrial Buildings School Buildings Religious Buildings Commercial Machineries Industrial Machineries Brgy. Health Center BarangayHall Consolidated/ Subdivided Lots DECLARED NEW PROPERTY UNITS Land Residential Buildings Industrial Buildings School Buildings Religious Buildings Commercial Machineries Industrial Machineries Brgy. Health Center BarangayHall July to Dec. 2010 44 lots into 223 parcels of land 10 RPUs 331 RPUs 13 RPUs 40 RPUs 6 RPUs 13 RPUs 12 RPUs 2 RPUs 7 RPUs Jan. to Dec. Jan. to Feb. TOTAL 2011 2012 33 lots into 11 lots into 88 lots into 270 parcels 38 parcels of 531 parcels of land land of land 6 RPUs 135 RPUs 6 RPUs 9 RPUs 2 RPUs 4 RPUs 31 RPUs 1 RPU 2 RPUs 2 RPUs 6 RPUs - 18 RPUs 472 RPUs 19 RPUs 49 RPUs 8 RPUs 17 RPUs 43 RPUs 3 RPUs 9 RPUs 7. Certifications a. Cert. of no property holdings for medical/social and scholarship services. b. Cert. of property holdings for general purposes. c. Cert. of non-improvement for BIR Capital Gains Tax purposes. d. Certified True/Machine Copies/Owner’s Copies of Tax Declarations for general purposes. CERTIFICATIONS Cert. of no property holdings for medical/social and scholarship services. Cert. of property holdings for general purposes. Cert. of non-improvement for BIR Capital Gains Tax purposes. Certified True/Machine Copies/Owner’s Copies of Tax Declarations for general purposes. July to Dec. 2010 44 lots into 223 parcels of land Jan. to Dec. 2011 33 lots into 270 parcels of land Jan. to Feb. TOTAL 2012 11 lots into 38 88 lots into parcels of 531 parcels land of land 22 44 6 72 19 67 4 90 67 161 40 268 570 copies 1645 copies 295 copies 2510 copies Property Classsification As of January 2010 As of December 2011 BASIC SEF BASIC a. Residential P 729,829.00 P 729,829.00 P 1,066,100.00 b. Agricultural 675,519.00 675,519.00 c. Commercial 196,203.00 196,203.00 d. Industrial 3,349,246.00 SEF Increase (Decrease) BASIC SEF P P 336,271.00 P 336,271.00 1,066,100.00 <7,198.00> 668,321.00 668,321.00 675,168.00 675,168.00 478,965.00 3,349,246.00 3,457,072.00 3,457,072.00 107,826.00 453.00 453.00 453.00 - 279.00 <7,198.00> 478,965.00 107,826.00 e. Special - Hospital -Others TOTAL 453.00 - 279.00 279.00 279.00 P 4,951,250.00 P4,951,250.00 P5,867,393.00 P5,867,393.00 P 916,143.00 P 916,143.00 CERTIFICATIONS: A. Cert. of no property holding for medical/ Social and scholarship services. B. Cert. of property holdings for general purposes. C. Cert. of non-improvement for BIR Capital Gains Tax purposes. D. Certified True/Machine Copies/Owner’s Copies of Tax Declarations for general purposes. A. Cert. of no property holding for medical/Social and scholarship services. July to Dec. 2010 QTY FEES AMOUNT (P) (P) 22 50.00 1,100.00 Jan. to Dec. 2011 Jan. to Feb. 2012 QTY FEES AMOUNT QTY FEES AMOUNT (P) (P) (P) (P) 44 50.00 2,200.00 6 50.00 300.00 July 2010 to Feb. 2012 QTY FEES AMOUNT (P) (P) 72 50.00 3,600.00 B. Cert. of property holdings for general purposes. July to Dec. 2010 QTY FEES AMOUNT (P) (P) 19 50.00 950.00 Jan. to Dec. 2011 Jan. to Feb. 2012 QTY FEES AMOUNT QTY FEES AMOUNT (P) (P) (P) (P) 67 50.00 3,350.00 4 50.00 200.00 July 2010 to Feb. 2012 QTY FEES AMOUNT (P) (P) 90 50.00 4,500.00 C. Certificate of non-improvement for BIR Capital Gains Tax purposes. July to Dec. 2010 QTY FEES AMOUNT (P) (P) 67 50.00 3,350.00 Jan. to Dec. 2011 Jan. to Feb. 2012 QTY FEES AMOUNT QTY FEES AMOUNT (P) (P) (P) (P) 161 50.00 8,050.00 40 50.00 2,000.00 July 2010 to Feb. 2012 QTY FEES AMOUNT (P) (P) 268 50.00 13,400.00 D. Certified True/Machine Copies/Owner’s Copies of Tax Declarations for general purposes. July to Dec. 2010 Jan. to Dec. 2011 Jan. to Feb. 2012 July 2010 to Feb. 2012 QTY FEES AMOUNT QTY FEES AMOUNT QTY FEES AMOUNT QTY FEES AMOUNT (P) (P) (P) (P) (P) (P) (P) (P) 570 30.00 17,100.00 1645 30.00 9,350.00 295 30.00 8,850.00 2510 30.00 75,300.00 CERTIFICATIONS: July to Dec. 2010 QTY FEES AMOUNT (P) (P) Jan. to Dec. 2011 Jan. to Feb. 2012 QTY FEES AMOUNT QTY FEES AMOUNT (P) (P) (P) (P) 22 50.00 1,100.00 44 50.00 2,200.00 6 50.00 19 50.00 950.00 67 50.00 3,350.00 4 50.00 67 50.00 3,350.00 161 50.00 8,050.00 40 570 30.00 17,100.00 1645 30.00 9,350.00 295 22,500.00 2,950.00 300.00 July 2010 to Feb. 2012 QTY FEES AMOUNT (P) (P) 72 50.00 3,600.00 200.00 90 50.00 4,500.00 50.00 2,000.00 268 50.00 13,400.00 30.00 8,850.00 2510 30.00 75,300.00 11,350.00 96,800.00