Return of Organization Exempt From Income Tax

advertisement

Fort

OMB No 1545-0047

'990

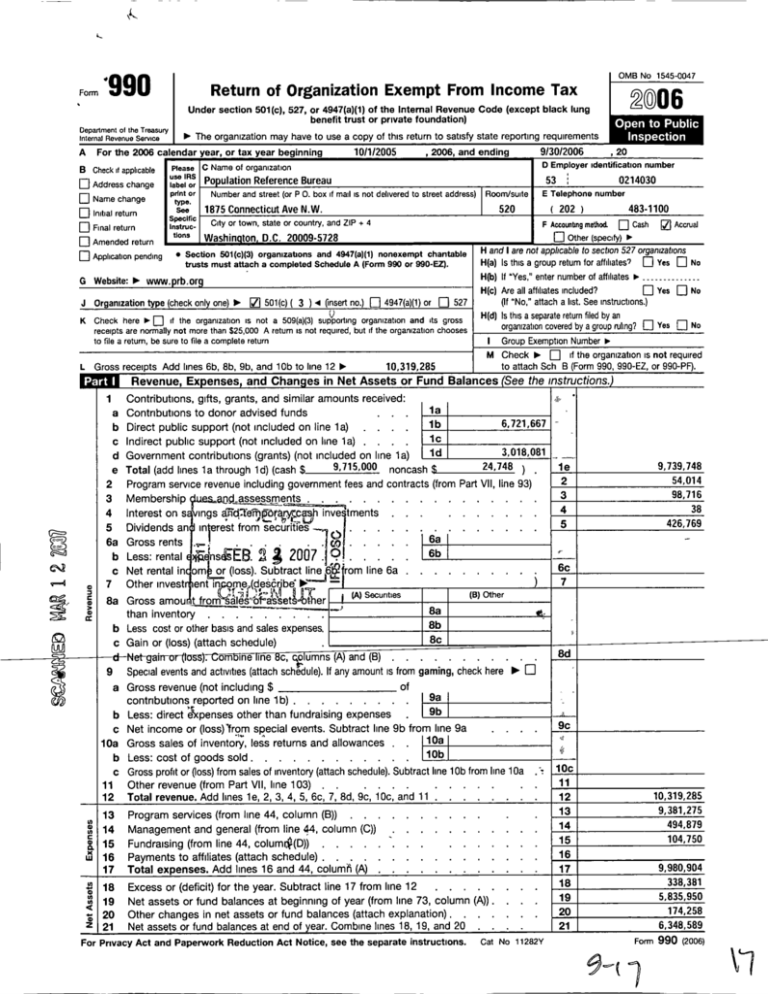

Return of Organization Exempt From Income Tax

coos

Under section 501(c ), 527, or 4947 (a)(1) of the Internal Revenue Code (except black lung

benefit trust or private foundation)

Department of the Treasury

^ The organization may have to use a copy of this return to satisfy state reporting requirements

Internal Revenue Service

For the 2006 calendar year , or tax year beginning

A

❑ Address change

Please C Name of organization

°se IRS

fabef or Po p ulation Reference Bureau

❑ Name change

pint or

B Check if applicable

❑ initial return

❑ Final return

10/1/2005

53

Number and street (or P 0. box if mail is not delivered to street address)

❑ Application pending

t1en'

520

F Accounting method.

K

Check here ^ [] it the organization is not a 509(a)(3) supporting organization and its gross

receipts are normally not more than $25,000 A return is not required , but if the organization chooses

to file a return, be sure to file a complete return

U 501(c) ( 3 ) .4 (insert no.) LJ 4947(a)(1) or

Gross receipts Add lines 6b, 8b, 9b, and 10b to line 12 ^

❑ Yes ❑ No

H(c) Are all affiliates included?

(If "No," attach a list. See instructions.)

U 527

H(d) Is this a separate return filed by an

organization covered by a group ruling? ❑ Yes ❑ No

Group Exemption Number ^

M Check ^ U it the organization is not required

to attach Sch B (Form 990, 990-EZ, or 990-PF).

10,319 , 285

Revenue , Exp enses , and Chan g es in Net Assets or Fund Balances (See the instrt

Contributions , gifts, grants , and similar amounts received:

1a

, , ,

Contributions to donor advised funds

lb

Direct public support (not included on line 1a)

. .

1c

Indirect public support (not included on line 1a) . .

Government contributions (grants) (not included on line 1a)

Id

9 , 715,000 noncas h

Total (add lines 1a through 1d) (cash $

6,721,667

3,018,081

24,748 ) ,

Program service revenue including government fees and contracts (from Part VII , line 93)

Membership y ues-a[)O - assessm ents

. . . . . . . . . . .

Interest on s ings and:fdmp-br8ry cash

etments . . .

. . . .

2

3

4

5 Dividends an interest from securities

6a Gross rents .^ :

m

c

m

0 .

b Less: rental

nsf EB .

20 0 19 1c Net rental in om or (loss) . Subtract lineJ6^ rom line 6a .

7

Other invest r ent in me (descr be ^

°

,t

p

(A) Securities

.

.

.

.

.

.

le

2

3

4

5

9,739,748

54,014

98,716

38

426,769

6c

.

)

7

(B) Other

f

8a Gross amou , t from ales ofassetdber

mbme line 8c, columns (A) ana (b)

-

6b

.

8a

8b

8c

than i n ve n t o ry ...

b Less cost or other basis and sales expenses .

c Gain or (loss) (attach schedule)

.

.

.

.

.

.

.

.

.

.

.

Special events and activities (attach schedule). If any amount is from gaming, check here ^ ❑

9

of

a Gross revenue (not including $

b

c

10a

b

c

11

12

N

13

14

a 15

w 16

17

co

Z

Z

©Accrual

H(b) If "Yes," enter number of affiliates ^ ..............

Organization type (check only one) ^

a

b

c

d

e

483-1100

❑ Cash

H and I are not applicable to section 527 organizations

H(a) is this a group return for affiliates, ❑ Yes ❑ No

• Section 501 (c)(3) organizations and 4947 (a)(1) nonexempt chartable

trusts must attach a completed Schedule A (Form 990 or 990-EZ).

J

1

0214030

❑ Other (specify) ^

Washin g ton , D.C. 20009 -5728

Website: ^ www.

61

( 202

City or town, state or count ry, and ZIP + 4

y

G

L

;

E Telephone number

Room/suite

1875 Connecticut Ave N .W.

❑ Amended return

, 20

D Employer identification number

type.

Specific

tngta+c -

9/30/2006

, 2006 , and ending

18

19

20

21

9a

contributions reported on line 1 b) . . . . . . . . .

9b

.

Less: direct e°Cpenses other than fundraising expenses

, . ,

Net income or (loss)''from special events . Subtract line 9b from line 9a

10a

Gross sales of inventory , less returns and allowances .

10b

Less: cost of goods sold . . . . . . . . . .

Gross profit or (loss) from sales of inventory (attach schedule). Subtract line 1 Ob from line 1 Oa

.

. . . . .

Other revenue (from Part VII, line 103) . .

. . . .

Total revenue. Add lines 1e, 2, 3, 4, 5, 6c, 7, 8d, 9c, 1Oc, and 11

Program services (from line 44 , column (B)) . . .

Management and general (from line 44 , column (C))

Fundraising (from line 44 , columr, '•(D)) . . . . .

. .

Payments to affiliates (attach schedule) .

Total expenses. Add lines 16 and 44, colum/i (A)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . ,

Excess or (deficit) for the year . Subtract line 17 from line 12

Net assets or fund balances at beginning of year (from line 73 , column (A)) .

Other changes in net assets or fund balances (attach explanation) . . . .

Net assets or fund balances at end of year. Combine lines 18, 19, and 20

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

.

.

.

.

.

.

9c

. .

.

.

.

,

.

.

.

.

.

.

Cat No 11282Y

102

11

12

13

14

10,319,285

9,381,275

494,879

15

104,750

16

17

18

19

20

21

9,980,904

338,381

5,835,950

174,258

6,348,589

Form 990 (2006)

kil

ti

Form 990 (2006)

Page 2

Statement of

Functional Expenses

All organizations must complete column (A). Columns (B), (C), and (D) are required for section 501(c)(3) and (4)

organizations and section 4947(a)(1) nonexempt chartable trusts but optional for others. (See the instructions.)

Do not include amounts reported on line

6b, 8b, 9b, 10b, or 16 of Part 1.

(B) Program

services

(A) Total

22a Grants paid from donor advised funds (attach schedule)

(cash $

noncash $

)

If this amount includes foreign grants, check here ^ ❑ 22a

(C) Management

and general

0

0

0

0

(D) Fundraising

22b Other grants and allocations (attach schedule)

(cash $

noncash S

)

If this amount includes foreign grants, check here ^ ❑ 22113

23

(attach

. . .

23

0

0

Benefits paid to or for members (attach

schedule) . . . . . . . . . . . .

24

0

0

Specific assistance to individuals

. . . . . . . .

schedule)

24

25a Compensation of current officers, directors,

key employees, etc. listed in Part V-A (attach

schedule) . . . . . . . . . .

25a

291,019

48,385

234,268

8,366

b Compensation of former officers, directors,

key employees, etc. listed in Part V-B (attach

schedule) . . . . . . . .

25b

0

0

0

0

c Compensation and other distributions, not included above, to

disqualified persons (as defined under section 4958(0(1)) and

persons described in section 4958(c)(3)(B) (attach schedule)

25c

0

0

0

0

26

2,590,136

2,148,077

434,035

8,024

27

210,262

160,294

48,772

1,196

28

29

30

31

32

33

34

35

36

743,445

244,717

575,805

186,561

163,627

56,764

4,013

1,392

17,000

28,121

68,312

49,602

247,561

616,312

26,834

290,800

1 , 347 , 533

289,416

0

0

40,016

9,470

231,566

20,090

8,383

270,213

1,300,496

244,545

17,000

1,934

28,296

40,132

8,428

596,222

18,451

10,329

41,122

39,926

0

26,187

0

0

7,567

0

0

10,258

5,915

4,945

51,207

0

51,207

0

43a

43b

43c

43d

43e

43f

43g

21,505

95,657

2,723,691

27,774

0

0

42,768

2,454,291

13,831

1,626,484

21,505

52,889

254,650

13,943

-1,638,621

0

0

14,750

0

12,137

44

9,980,904

9,381,275

494,879

104,750

Salaries and wages of employees not included

on lines 25a , b , and c . . . .

Pension plan contributions not included on

lines 25a , b , and c . . . . . . .

26

27

28

Employee benefits not included on lines

29

30

31

32

33

34

35

36

37

38

25a - 27

. . . . . . . .

Payroll taxes . . . . . . .

Professional fundraising fees . .

Accounting fees

. . . . .

Legal fees .

. . . . . .

Supplies

. . . . . . . .

Telephone . . . . . . . .

Postage and shipping . . . .

Occupancy

. . . .

Equipment rental and maintenance

Printing and publications . . .

40

41

42

43

a

b

c

d

e

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Conferences , conventions , and meetings

Interest . . . . . . . . . . .

Depreciation , depletion , etc. (attach schedule)

Other expenses not covered above (itemize):

ORGANIZATIONAL INSURANCE

_________

NON_CAPITALIZEDEQUIPMENT - -- ------------------------ -------CONTRACTUAL SERVICES ________________________

STAFFDEVELOPMENTlMISC - -- ------------OVERHEADALLOCATION

-

-----------

f

44

.

.

----

------- ------- -

37

38

40

41

42

Total functional expenses. Add lines 22a

through

43g.

(Organizations

completing

columns (BHD), carry these totals to lines

13-15)

Joint Costs. Check ^ ❑ if you are following SOP 98-2.

Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? . ^ ❑ Yes

; (i) the amount allocated to Program services $

If "Yes," enter (i) the aggregate amount of these joint costs $

; and (iv) the amount allocated to Fundraising $

(iii) the amount allocated to Management and gen eral $

© No

Form 9 90 (2006)

ti

Form 9.90 (2006)

FURITT

Page 3

Statement of Program Service Accomplishments (See the instructions.)

Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a

particular organization. How the public perceives an organization in such cases may be determined by the information presented

on its return. Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's

programs and accomplishments.

What is the organization's primary exempt purpose? ^

SEE STATEME-NT- 3

- - - - - - - ------------------------------------------

All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number

of clients served, publications issued, etc Discuss achievements that are not measurable. (Section 501 (c)(3) and (4)

organizations and 4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others)

Pro g ram Service

Expenses

( Required for 501(c)(3) and

and 4947(x)(1)

ores,

(4)

trusts , but optional for

others

a INTERNATIONAL PROGRAMS -SEE SCHEDULE 3

------------------------------------------------------------------------------------------ -- - -- -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------(Grants and allocations

$

0) If this amount includes foreign grants, check here ^ ❑

,553,395

b COMMUNICATIONS - SEE SCHEDULE 3

-- ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------(Grants and allocations

$

0) If this amount includes foreign grants, check here ^ ❑

,650,702

c DOMESTIC PROGRAMS -SEE SCHEDULE 3

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------(Grants and allocations

0) If this amount includes foreign grants, check here ^ ❑

$

,177,178

d -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- -----------------------------------------------------------------------------(Grants and allocations

$

) If this amount includes foreign grants, check here ^ ❑

0

e Other program services (attach schedule)

(Grants and allocations

$

❑

) If this amount includes foreign grants, check here ^

line 44, column (B), Program services).

.

^

0

9,381,275

el

k

Page 4

Form 990 (2006)

Balance Sheets (See the instructions. )

Note:

45

46

Where required, attached schedules and amounts within the descnption

column should be for end-of-year amounts only

Cash-non-interest-bearing

. . . . .

Savings and temporary cash investments .

47a Accounts receivable . . .

b Less: allowance for doubtful accounts

.

.

.

.

.

.

.

(A)

Beginning of year

.

.

.

.

47a

47b

48a

48a Pledges receivable

. .

48b

b Less: allowance for doubtful accounts

49 Grants receivable . . . . . . . . . . . . . . . . .

50a Receivables from current and former officers, directors, trustees, and

key employees (attach schedule) . . .

. . . . . . . .

b Receivables from other disqualified persons (as defined under section

4958(f)(1)) and persons described in section 4958(c)(3)(B) (attach schedule)

U)

51a Other notes and loans receivable (attach

51a

. .

schedule) .

51b

b Less: allowance for doubtful accounts

Inventories for sale or use . . .

52

. . . . . .

53

Prepaid expenses and deferred charges

. . . .

FMV

.

^ ❑ Cost

54a Investments-publicly-traded securities .

b Investments-other securities (attach schedule) ^ ❑ Cost ❑ FMV

buildings,

and

55a Investments-land,

. .

equipment: basis . . .

b Less: accumulated depreciation (attach

schedule) . . . . . . .

Investments-other (attach schedule)

56

57a Land , buildings , and equipment. basis .

d

63

'j

65

66

y

0

M

V

u.

o

S

Accounts payable and accrued expenses .

Grants payable . . . . . . . . . .

Deferred revenue

. . . . .

. .

Loans from officers, directors, trustees, and

schedule) . .

. .

. . . . . .

.

.

.

57a

.

37,759

4,274,310

465,742

0 48c

0 49

0

0

0 50a

0

0 50b

0

0 51c

0 52

31,421 53

4,702,432 54a

0

0

43,072

5,395,326

54b

5c

56

. .

648,054

468,566

.

. . . .

.

. . . . .

. . . .

key employees (attach

. . .

. .

.

.

.

b Mortgages and other notes payable (attach schedule) . . . . .

Other liabilities (describe ^ STATEMENT. 7_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _)

Total liabilities . Add lines 60 through 65

72

Retained earnin g s , endowment , accumulated income , or other funds

73

Total net assets or fund balances . Add lines 67 through 69 or lines

70 through 72 (Column (A) must equal line 19 and column (B) must

. . .

equal line 21)

. . . . . . . . . . . .

Total liabilities and net assets/fund balances. Add lines 66 and 73

74

45

46

__

582,565 47c

b

Organizations that follow SFAS 117 , check here ^ ❑ and complete lines

67 throu g h 69 and lines 73 and 74

67

Unrestricted . . . . . . . .

. . . . .

. . .

. . . .

68 Temporarily restricted

. . .

Permanently restricted

69

.

. . . . . . . . . . . .

Organizations that do not follow SFAS 117, check here ^ ❑ and

complete lines 70 through 74 .

70 Capital stock , trust principal , or current funds . . . . . . . .

Paid-in or capital surplus , or land , building , and equipment fund

71

d

Z

16,996

3,874,013

55a

b Less. accumulated depreciation (attach

57b

schedule) . . .

. . . . .

58 Other assets, including program-related investments

(describe ^ -DUE_FROM PRB ASSOCIATES__

59 Total assets (must equal line 74). Add lines 45 through 58

60

61

62

(B)

End of year

99,031 57c

883,567

10,190,025

96,514

0

3,898.490

58

59

60

61

62

179,488

883,667

11,279,364

227,416

0

4,397,977

63

359, 071

b4D

65

305,382

4,354, 075

66

4,930,775

5,794,070

67

6,306,709

68

41,880

69

41,880

70

71

72

5,835 ,950

10,190,025

73

74

6,348,589

11,279,364

Form 990 (2006)

Page 5

Form 990 (2006)

a

b

1

2

3

4

c

d

1

2

Reconciliation of Revenue per Audited Financial Statements With Revenue per Return (See the

instructions )

10,319,288

a

Total revenue , gains , and other support per audited financial statements .

. . . . .

Amounts included on line a but not on Part I, line 12•

b1

. . .

Net unrealized gains on investments

b2

Donated services and use of facilities

. . . . . . . . .

b3

grants

Recoveries of prior year

. .

Other (specify): PRB ASSOCIATES

3

b4

--------------------------------------------------------------------------------3

b

Add lines b1 through b4 . . . . . . .

. . . . . . . . . . .

10

,319,285

C

Subtract line b from line a

. . . . . . . . . .

Amounts included on Part I, line 12, but not on line a:

. . , , ,

Investment expenses not included on Part I, line 6b

Other (specify)- -------------------------------------------------------------

di

d2

--------------------------------------------------------------------------------Add lines di and d2

Total revenue (Part I, line 12). Add lines c and d .

e

Reconciliation of Ex p enses p er Audited Financial Statements With Exp enses

1

2

3

4

Total expenses and losses per audited financial statements

Amounts included on line a but not on Part I, line 17.

. . . . .

Donated services and use of facilities

Prior year adjustments reported on Part I, line 20 . . . .

Losses reported on Part I, line 20 . . . . . . . . .

ASSOCIATES

Other (specify)* PRB

------- -- ----

1

Add lines b1 through b4 . . . . .

Subtract line b from line a

. .

. .

Amounts included on Part I, line 17, but not on line a:

Investment expenses not included on Part I, line 6b .

a

b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10 , 319,285

er Return

a

9,981,004

b

C

100

9,980,904

b1

b2

b3

100

b4

c

d

d

e

. 0-

.

.

.

.

.

.

.

.

.

.

.

k

di

2 Other (specify) : .............................................................

e

--------------------------------------------------------------------------------Add lines dl and d2

. . . . . . .

Total expenses (Part I, line 17). Add lines c and d

d2

.

-.

.

.

.

d

.

- 0-

9 ,980,904

e

Current Officers, Directors, Trustees , and Key Employees (List each person who was an officer, director, trustee,

or key employee at any time during the year even if they were not compensated.) (See the instructions)

(A) Name and address

WILLIAM P. BUTZ ----------------------------------------1875 CONNECTICUT AVE NW # 520 WASH DC 20009

(B)

Title and average hours per

week devoted to p os i tion

(C) Compensation

(If not paid , enter

-0-.)

(0) Contributions to employee ( E) Expense account

and other allowances

benefit plans 8 deferred

compensation plans

PRES/CEO; 50 HRS

--------------------------------------------------------------1875 CONNECTICUT AVE NW # 520 WASH DC 20009

-- ---- -- -- ---

193,220

14,108

0

97,699

7,130

0

--------------------------------------------------------------SEE ATTACHED LIST OF BOARD OF TRUSTEES

- ----------------------------------------------------------PRB BOARD SERVES WITHOUT COMPENSATION

---------------- ----------------------------------------------

Form 990 (2006)

61

Form 990 (2006)

Page 6

Yes No

Current Officers, Directors, Trustees, and Key Em p loyees (continued)

75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at board

meetings .

. . . . . . .

. . . . .

. .

^ -------------------16

b Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated

employees listed in Schedule A, Part I, or highest compensated professional and other independent

contractors listed in Schedule A, Part II-A or II-B, related to each other through family or business --- - 75b

✓

relationships? If "Yes , " attach a statement that identifies the individuals and explains the relationship(s) .

c Do any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest

compensated employees listed in Schedule A, Part I, or highest compensated professional and other

independent contractors listed in Schedule A, Part II-A or II-B, receive compensation from any other

organizations, whether tax exempt or taxable, that are related to the organization? See the instructions for -✓

the definition of "related organization.". . . . . . . . . . . . . . . . . . . . . . . ^ 75c

If "Yes," attach a statement that includes the information described in the instructions.

d Does the organization have a written conflict of interest policy?

75d ✓

Former Officers, Directors, Trustees , and Key Employees That Received Compensation or Other Benefits (If any former

officer, director, trustee, or key employee received compensation or other benefits (described below) during the year, list that

person below and enter the amount of compensation or other benefits in the appropriate column. See the instructions.)

(B) Loans and Advances

(A) Name and address

I

I

(C) Compensation I

(if not paid,

enter -0-)

(D) Contributions to employee

benefit plans & defend

compensation plans

(E) Expense

account and other

allowances

NONE

-------------------------------------------------------------

Did the organization make a change in its activities or methods of conducting activities? If "Yes," attach a

detailed statement of each change . .

. . . . . . .

. . . . . . .

. . .

77 Were any changes made in the organizing or governing documents but not reported to the IRS? . . . .

If "Yes," attach a conformed copy of the changes.

78a Did the organization have unrelated business gross income of $1,000 or more during the year covered by

. . . .

this return?

. . . . . . . . . . .

. . . . . . .

. . . .

b If "Yes," has it filed a tax return on Form 990-T for this year? . . . . . . . . . . . . . . . .

79 Was there a liquidation, dissolution, termination, or substantial contraction during the year? If "Yes," attach

a statement

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

76

--76

77

78E

78t

-79

80a Is the organization related (other than by association with a statewide or nationwide organization) through

common membership, governing bodies, trustees, officers, etc, to any other exempt or nonexempt 8W

. . .

. . . . . . . . . .

organization? .

. . .

ASSOCIATES

_PRB

of

the

organization

^

b If "Yes," enter the name

-------------------------------------------------------------------------------------------- and check whether it is ❑ exempt or ❑✓ nonexempt

1 81a

81a Enter direct and indirect political expenditures. (See line 81 instructions.)

. . . . . . . . . . . . . . . . . 811

b Did the organization file Form 1120 -POL for this year?

Form 990 (2006)

Page 7

Form 990 (2006)

Yes

Other Information (continued)

No

82a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge

. . . . . .

or at substantially less than fair rental value? . . . . . . . . . . . . .

b If "Yes," you may indicate the value of these items here. Do not include this

amount as revenue in Part I or as an expense in Part II.

182b

. . .

(See instructions in Part III.) . . . .

. . . . . . .

for

returns

and

exemption applications?

inspection

requirements

comply

with

the

public

83a Did the organization

b Did the organization comply with the disclosure requirements relating to quid pro quo contributions?

.

84a Did the organization solicit any contributions or gifts that were not tax deductible?

b If "Yes," did the organization include with every solicitation an express statement that such contributions or

. . . . . . . .

gifts were not tax deductible?

. . . . . . . . . . . . . . . . .

. . . . .

85 501(c)(4), (5), or (6) organizations. a Were substantially all dues nondeductible by members?

. . . . . . . .

b Did the organization make only in-house lobbying expenditures of $2,000 or less?

If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization

received a waiver for proxy tax owed for the prior year.

a5c

. .

c Dues, assessments, and similar amounts from members

85d

. . . . . .

d Section 162(e) lobbying and political expenditures

85e

. .

e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices

85f

less

expenditures

(line

85d

85e)

.

.

f Taxable amount of lobbying and political

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f?

.

.

.

.

.

.

h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f

to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the

I85hI

. . .

following tax year? . . . . .

. . .

86a

86 501(c)(7) orgs. Enter. a Initiation fees and capital contributions included on line 12 . .

86b

b Gross receipts, included on line 12, for public use of club facilities . .

87a

. .

87 501(c)(12) orgs. Enter: a Gross income from members or shareholders

other

or

paid

to

not

net

amounts

due

other

sources.

(Do

b Gross income from

87b

sources against amounts due or received from them) . . . . . .

88a At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or

partnership, or an entity disregarded as separate from the organization under Regulations sections

. . . . .

. . . . .

301.7701-2 and 301.7701-3? If "Yes," complete Part IX . . . . . .

b At any time during the year, did the organization, directly or indirectly, own a controlled entity within the

. . . . . . . . . . ^

meaning of section 512(b)(13)? If "Yes," complete Part XI . . . . .

89a 501(c)(3) organizations. Enter: Amount of tax imposed on the organization during the year under:

--; section 4955

section 4911

-.; section 4912

b 501(c)(3) and 501(c)(4) orgs. Did the organization engage in any section 4958 excess benefit transaction

during the year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach

.

. . . . .

a statement explaining each transaction . . . . . . . . . . .

c Enter: Amount of tax imposed on the organization managers or disqualified

er sec ions

, an

58 . . . . . ^

0

d Enter: Amount of tax on line 89c, above, reimbursed by the organization . . ^

e All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter - - -89e

. . . . . . . . . . . . . . .

transaction ? . . . . . . . . .

. . .

✓

✓

f All organizations. Did the organization acquire a direct or indirect interest in any applicable insurance contract? 89f

g For supporting organizations and sponsoring organizations maintaining donor advised funds. Did the

supporting organization, or a fund maintained by a sponsonng organization, have excess business holdings -----. . . . . S9g

. . . . .

. . . .

at any time during the year? . .

. . . . .

-----------------------90a List the states with which a copy of this return is filed ^ DC

b Number of employees employed in the pay period that includes March 12, 2006 (See

48

190b 1

instructions.)

)..---.483-1100

Z9?.

THE

ORGANIZATION

Telephone

no.

....

^ C91a The books are in care of ^

20009-5728

# 520 WASHINGTON, D.C

ZIP + 4 ^

Located at ^ .1875 CONNECTICUT AVE N .W --•--------•--••---....

-••------------•-•-•-•-•

•b At any time during the calendar year, did the organization have an interest in or a signature or other authority

Yes No

over a financial account in a foreign country (such as a bank account, securities account, or other financial

91

b

✓

account)? . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

If "Yes," enter the name of the foreign country No ................................................................

See the instructions for exceptions and filing requirements for Form TD F 90-22 .1, Report of Foreign Bank

and Financial Accounts.

Form 990 (2006)

Form 990 (2006)

FTIM

Page 8

Yes

Other Information (continued)

c At any time during the calendar year, did the organization maintain an office outside of the United States? 91c

If "Yes," enter the name of the foreign country ^ ................................................................

92 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041-Check here

^

92

and enter the amount of tax-exempt interest received or accrued during the tax year

No

✓

^ ❑

COWTVATAnal ysis of Income - Producin g Activities See the instructions. )

Note: Enter gross amounts unless otherwise

indicat ed.

93

Program service revenue:

a

b

c

d

e

f

9

94

95

96

97

a

b

98

99

100

101

102

103

Excluded by section 512, 513, or 514

Unrelated bu siness income

(A)

Business code

(B)

Amount

(C)

Exclusion code

(D)

Amount

(E)

Related or

exempt function

income

54,014

PUBLICATION SALES

Medicare/Medicaid payments

. . . .

Fees and contracts from government agencies

Membership dues and assessments .

Interest on savings and temporary cash investments

Dividends and interest from securities .

Net rental income or (loss) from real estate.

debt-financed property

98,716

14

38

14

426,769

not debt-financed property

Net rental income or (loss) from personal property

Other investment income .

Gain or (loss) from sales of assets other than inventory

Net income or (loss) from special events .

Gross profit or (loss) from sales of inventory

Other revenue: a

b

c

d

e

104

Subtotal (add columns (B), (D), and (E))

Total (add line 104, columns (B), (D), and (E)) . . . . . . . . . .

105

Note : Line 105 ,plus line le. Part 1. should equal the amount on line 12, Part I.

426,807

.

.

.

.

.

^

152,730

579,537

Relationshi p of Activities to the Accom plishment of Exem pt Purp oses (See the instructions.)

Line No .

y

93a,b ; 94

Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment

of the organization's exempt purposes (other than by providing funds for such purposes).

MEMBERS ARE INTERESTED IN THE VARIOUS IMPACTS OF POPULATION, HEALTH AND ENVIRONMENTAL ISSUES,

EMPTPURP

Information Re g ardin g Taxable Subsidiaries and Disre g arded Entities see the instructions.

A

(B)

Name, address, and )EIN of corporation,

Percentage of

Nature of activities

Total(Dcome

ownershi p interest

p artnershi p , or disre g arded enti ty

Lj^

PRB ASSOCIATES

1875 CONNECTICUT AVE N.W. # 520

WASHINGTON, D.C 20009

EIN 52 -1278952

(a) Did the organization, during the year, receive any funds, directly or

(b) Did the organization, during the year, pay premiums,

Note : If "Yes" to (b), file Form 8870 and Form 4720 (see

100 % RESEARCH

End-op

(E year

assets

3

1925

Form 990 (2006)

Kj^

Page 9

Information Regarding Transfers To and From Controlled Entities . Complete only if the organization

Is a controlling organization as defined in section 512(b)(13).

Yes No

Did the reporting organization make any transfers to a controlled entity as defined In section 512(b)(13) of

the Code? If "Yes," complete the schedule below for each controlled entity.

106

a

(C)

Description of

transfer

(B)

Employer Identification

Number

(A)

Name, address , of each

controlled entity

✓

(D)

Amount of transfer

-----------------------------------------

-----------------------------------------

b

---------------------------------------------------------------------------------

c

--------------------------------------------------------------------------------Totals

=

Yes

Did the reporting organization receive any transfers from a controlled entity as defined in section

512(b)(13) of the Code? If "Yes," complete the schedule below for each controlled entity.

107

(C)

Description of

transfer

(B)

Employer Identification

Number

(A)

Name, address , of each

controlled entity

a

No

✓

(D)

Amount of transfer

-----------------------------------------

-----------------------------------------

b

---------------------------------------------------------------------------------

c

--------------------------------------------------------------------------------Totals

Yes

108

Did the organization have a binding written contract in effect on August 17, 2006, covering the interest,

rents, royalties, and annuities described in question 107 above?

and b

Please

Plea

Here

f, it isktr

,

orrect and

✓

that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

mplete.

claration of preparer of er t an o icer is base d on a i nform

45 7

Da

Signature of officer

WILLIAM P. BUTZ PRESIDENT I CEO

Type or pr i nt name

Paid

P reparer ' s

Use Only

No

nd title

Date

Preparer 's

signature '

Check if

self

Preparer's SSN or MIN (See Gen. inst X)

em p loy ed ^ ❑

Firm ' s name (or yours

EIN

^

if self-employed),

address, and ZIP + 4 '

Phone no

0, l

1

Form 990 (2006)

®

Printed on recyciedpaper

t

Organization Exempt Under Section 501(c)(3)

SCHEDULE A I

OMB No 1545-0047

(Except Private Foundation) and Section 501(e), 501(f), 501(k), 501(n),

or 4947(a)(1) Nonexempt Charitable Trust

(Form 990 or 990-EZ)

©O6

Supplementary Information-(See separate instructions.)

Department of the Treasury

Internal Revenue Serace

Name of the organization

^ MUST be completed by the above organizations and attached to their Form 990 or 990-EZ

Employer identification number

Population Reference Bureau

12,701

53

0214030

;

Compensation of the Five Highest Paid Employees Other Than Officers , Directors , and Trustees

(See oaae 2 of the instructions. List each one. If there are none. enter "None.")

(a) Name and address of each employee paid more

than $50,000

NANCY YINGER

-------------------------------------------------------1875 CONN AVE NW # 520, WASH DC 20009

LINDA JACOBSEN

•------------------------------------------------------1875 CONN AVE NW # 520, WASH DC 20009

KENDRA DAVENPORT

- -- ---------- ----- 1875 CONN AVE NW # 520, WASH DC 20009

RACHEL NUGENT

----------------------------------------------------1875 CONN AVE NW # 520, WASH DC 20009

CARL HAUB

--------1875 CONN AVE NW # 520, WASH DC 20009

Total number of other employees paid over $50 ,000. ^

( b) Title and average hours

per week devoted to position

DIR INTL PROGRAMS; 50

DIR DOMESTIC PRGS; 50

DEVELOPMENT DIR, 50

PROGRAM DIR; 50

SR DEMOGRAPHER; 50

( c) Compensation

(d) Contributions to

employee benefit plans &

(e) Expense

account and other

deferred compensation

allowances

129,904

9,480

0

114,369

8,346

0

105 , 506

7,700

0

99,984

7,297

0

6,271

0

85 , 925

°; iki

,-

-

9:FTaIlFJ Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See oaae 2 of the instructions. List each one (whether individuals or firms). If there are none. enter "None ")

(a) Name and address of each independent contractor paid more than $50,000

(b) Type of service

PC AID

•-------------------------------------------------------------------------------------- TECHNOLOGY

1875 CONN AVE NW # 520 , WASH DC 20009

JACKSON & ASSOCIATES

---------- HUMAN RESOURCES

-SON AS

-1875 CONN AVE NW # 520, WASH DC 20009

(c) Compensation

145,719

74,250

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------Total number of others receiving over $50 , 000 for

professional services

. . . .

. . . ^

LialIj -

0

Compensation of the Five Highest Paid Independent Contractors for Other Services

(List each contractor who performed services other than professional services, whether individuals or

firms. If there are none, enter "None." See page 2 of the instructions.)

NONE

--------------------------------------------------------------------------------------

Total number of other contractors receiving over

$50,000 for other services . .

. .

. ^

For Paperwork Reduction Act Notice, see the Instructions for Form 990 and Form 990-EL

Cat No 11285F

Schedule A (Form 990 or 990-EZ) 2006

Schedule A (Form 990 or 990- EZ) 2006

Page 2

Yes

Statements About Activities (See page 2 of the instructions .)

1

No

During the year , has the organization attempted to influence national , state , or local legislation , including any

attempt to influence public opinion on a legislative matter or referendum ? If "Yes," enter the total expenses paid

or incurred in connection with the lobbying activities ^ $

( Must equal amounts on line 38,

Part VI - A, or line i of Part VI-B) .

.

.

.

.

.

.

.

. . . . . .

. .

. .

. .

.

.

. .

1

✓

2a

✓

2b

✓

Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A. Other

organizations checking " Yes" must complete Part VI-B AND attach a statement giving a detailed description of

the lobbying activities.

During the year, has the organization, either directly or indirectly, engaged in any of the following acts with any

substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or

with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority

owner, or principal beneficiary's (If the answer to any question is "Yes," attach a detailed statement explaining the

transactions)

2

a Sale , exchange, or leasing of property? .

.

.

b Lending of money or other extension of credit ?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d Payment of compensation (or payment or reimbursement of expenses if more than $1,000)? .

.

.

.

.

e Transfer of any part of its income or assets?

.

.

.

.

c Furnishing of goods, services, or facilities? .

3a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2d

✓

3a

✓

3b

✓

.

Did the organization make grants for scholarships, fellowships, student loans, etc.' (If "Yes," attach an explanation

of how the organization determines that recipients qualify to receive payments ) . . . . . . . . .

b Did the organization have a section 403(b) annuity plan for its employees ? .

20

.

c Did the organization receive or hold an easement for conservation purposes, including easements to preserve open

space, the environment, historic land areas or historic structures? If "Yes," attach a detailed statement . ,

d Did the organization provide credit counseling, debt management, credit repair, or debt negotiation services?

Did the organization maintain any donor advised funds ? If "Yes," complete lines 4b through 4g. If "No," complete

lines 4f and 4g

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

i th e organization ma ke any taxabl e d ist ri b u t ions un d er sect ion 49bb ? . . . . . . . . . . . .

4a

c Did the organization make a distribution to a donor , donor advisor , or related person ?

d Enter the total number of donor advised funds owned at the end of the tax year .

.

.

.

.

.

.

.

.

.

.

.

e Enter the aggregate value of assets held in all donor advised funds owned at the end of the tax year

f

g

.

.

.

^

.

.

^

Enter the total number of separate funds or accounts owned at the end of the tax year (excluding donor advised

funds included on line 4d) where donors have the right to provide advice on the distribution or investment of

amounts in such funds or accounts . . . . . . . . . . . . . . . . . . . . . . . ^

0

Enter the aggregate value of assets held in all funds or accounts included on line 4f at the end of the tax year ^

0

Schedule A (Form 990 or 990-EZ) 2006

Schedule A (Form 990 or 990-EZ) 2006

P age 3

Reason for Non - Private Foundation Status (See pages 4 through 7 of the instructions.)

I certify that the organization is not a private foundation because it is: (Please check only ONE applicable box )

5

❑ A church, convention of churches, or association of churches Section 170(b)(1)(A)(i)

6

❑ A school Section 170(b)(1)(A)(ii). (Also complete Part V)

7

❑ A hospital or a cooperative hospital service organization Section 170(b)(1)(A)(nl).

8

❑ A federal, state, or local government or governmental unit. Section 170(b)(1)(A)(v).

9

❑ A medical research organization operated in conjunction with a hospital Section 170(b)(1)(A)(iii) Enter the hospital's name, city,

and state ^ ---------------------------------------------------------------------------------------------------------------------------

10

❑ An organization operated for the benefit of a college or university owned or operated by a governmental unit. Section 170(b)(1)(A)(iv)

(Also complete the Support Schedule in Part IV-A.)

11a © An organization that normally receives a substantial part of its support from a governmental unit or from the general public Section

170(b)(1)(A)(vi). (Also complete the Support Schedule in Part IV-A)

11b ❑ A community trust. Section 170 (b)(1)(A)(vi) (Also complete the Support Schedule in Part IV-A.)

12

❑ An organization that normally receives. (1) more than 331/3% of its support from contributions, membership fees, and gross receipts

from activities related to its charitable, etc , functions-subject to certain exceptions, and (2) no more than 33'/3% of its support

from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the

organization after June 30, 1975 See section 509(a)(2) (Also complete the Support Schedule in Part IV-A)

13

❑ An organization that is not controlled by any disqualified persons (other than foundation managers) and otherwise meets the

requirements of section 509(a)(3). Check the box that describes the type of supporting organization,

❑ Type I

❑ Type II

III -Functionally Integrated

III-Other

Provide the following information about the supported organizations . (See page 7 of the instructions)

(a)

(b)

(c)

(d)

(e)

Name (s) of supported organization (s)

Employer

Type of

Is the supported

Amount of

organization

organization listed in

support

identification

(described in lines

the supporting

number ( EIN)

organization's

5 through 12

above or IRC

governing documents?

section)

Total

14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

I,. I

❑ An organization organized and operated to test for public safety. Section 509(a)(4) (See page 7 of the instructions.)

Schedule A (Form 990 or 990-EZ) 2006

Schedule A (Form 990 or 990-EZ) 2006

Page 4

LZOM Support Schedule (Complete only if you checked a box on line 10, 11, or 12) Use cash method of accounting.

Note : You may use the worksheet in the instructions for converting from the accrual to the cash method of accounting

^

Calendar year (or fiscal year beginning in)

15

Gifts , grants , and contributions received (Do

not include unusual grants See line 28 ) .

16

Membership fees received

17

Gross receipts from admissions , merchandise

sold or services performed , or furnishing of

facilities in any activity that is related to the

organization ' s charitable , etc., purpose

18

Gross income from interest , dividends,

amounts received from payments on securities

loans (section 512(a)(5 )), rents , royalties, and

unrelated business taxable income (less

section 511 taxes) from businesses acquired

by the organization after June 30, 1975

Net income from unrelated

activities not included in line 18.

19

(a) 2005

(b) 2004

(c) 2003

(e) Total

(d) 2002

118,475

108,009

192,813

123,902

172,970

127,753

165,160

134,972

649,418

494,636

6,972 , 802

6 , 203,195

6,665,576

6 , 603,153

26 , 444,726

334 , 526

300 , 813

502 , 793

-223 , 488

914,644

0

0

0

0

0

business

20

Tax revenues levied for the organization's

benefit and either paid to it or expended on

its behalf . . . . . . . . . . .

0

0

0

0

0

21

The value of services or facilities furnished to

the organization by a governmental unit

without charge . Do not include the value of

services or facilities generally furnished to the

public without charge

0

0

0

0

0

22

23

24

25

Other Income . Attach a schedule. Do not

include gain or (loss) from sale of capital assets

Total of lines 15 through 22 .

Line 23 minus line 17 .

Enter 1 % of line 23

0

7,533,812

561 , 010

0

6 , 820,723

617,528

0

7 , 469,092

803 , 516

0

6,679,797

76,644

0

28 , 323.424

1 , 758,698

26

Organizations described on lines 10 or 11:

26a

35,174

a Enter 2% of amount in column (e) , line 24 .

.

.

. ^

Prepare a list for your records to show the name of and amount contributed by each person (other than a

governmental unit or publicly supported organization ) whose total gifts for 2002 through 2005 exceeded the

amount shown in line 26a. Do not file this list with your return. Enter the total of all these excess amounts ^

^

. .

c Total support for section 509 (a)(1) test : Enter line 24 , column (e)

914 , 644

19

d Add : Amounts from column (e) for lines : 18

238 , 116

. . . . . . ^

22

26b

. ^

. . . . . . .

e Public support (line 26c minus line 26d total) . . .

. ^

f Public support percentage (line 26e (numerator) divided by line 26c (denominator))

---•

26b

26c

{

- -----j

238,116

1,758,698

26d

26e

26t

1 , 152,760

605,938

34 %

b

Organizations described on line 12 :

a For amounts included in lines 15, 16, and 17 that were received from a "disqualified

person," prepare a list for your records to show the name of, and total amounts received in each year from, each "disqualified person "

no not file this list with your return . Enter the sum of such amounts for each year-

27

b

(2005) ......................... (2004)

...... (2003) .......................... (2002) ------------------------For any amount included in line 17 that was received from each person (other than "disqualified persons"), prepare a list for your records to

show the name of, and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000

(Include in the list organizations described in lines 5 through 11 b, as well as individuals.) Do not file this list with your return . After computing

the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these differences (the excess

amounts) for each year:

(2005) ......................... (2004) .......................... (2003) -------------------------- (2002)

16

c Add: Amounts from column (e) for lines- 15

21

20

17

and line 27b total

d Add Line 27a total

e Public support (line 27c total minus line 27d total) . . .

f Total support for section 509(a)(2) test. Enter amount from line 23, column (e) . . ^

g Public support percentage (line 27e (numerator) divided by line 27f (denominator ))

h Investment income percentage (line 18 , column (e) (numerator) divided by line 27f

28

^

. ^

^

27c

27d

27e

271

. . . . . . ^

(denominator)). ^

279

27h

.

.

.

.

.

.

.

,

.

-_._I

%

Unusual Grants : For an organization described in line 10, 11, or 12 that received any unusual grants during 2002 through 2005,

prepare a list for your records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief

description of the nature of the grant. Do not file this list with your return . Do not include these grants in li ne 15

Schedule A (Form 990 or 990 - EZ) 2006

Schedule A (Form 990 or 990-EZ) 2006

Page 5

Private School Questionnaire (See page 9 of the instructions.)

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

Yes

29

Does the or g anization have a racially nondiscriminatory polic y toward students by statement in its charter , bylaws ,

other governing instrument , or in a resolution of its governing body

. . . . . . . . . . . . .

30

Does the organization include a statement of its racially nondiscriminatory policy toward students in all its

brochures , catalogues , and other written communications with the public dealing with student admissions,

. .

programs , and scholarships ? . .

. . .

. . . .

. . . . . . .

30

Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during

the period of solicitation for students , or during the registration period if it has no solicitation program , in a way

that makes the policy known to all parts of the general community it serves? . . . . . . . . . .

31

31

No

29

-j

--

If "Yes ," please describe ; if "No," please explain ( If you need more space , attach a separate statement )

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------32

Does the organization maintain the following:

. ,

a Records indicating the racial composition of the student body , faculty , and administrative staff?

b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory

basis?

. . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Copies of all catalogues , brochures , announcements , and other written communications to the public dealing

with student admissions , programs , and scholarships ? . . . . . . . . . . . . .

d Copies of all material used by the organization or on its behalf to solicit contributions ? . . . . . . . .

32a

32b

32c

32d

If you answered "No" to any of the above, please explain (If you need more space, attach a separate statement )

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Does the organization discriminate by race in any way with respect to:

33

a Students' rights or privileges" .

.

.

.

.

.

.

.

.

.

.

.

b Admissions policies? .

.

.

.

.

.

.

.

.

.

.

.

c Employment of faculty or administrative staff? .

.

.

.

.

.

.

d Scholarships or other financial assistance? .

.

.

.

.

.

.

.

e Educational policies?

.

.

.

.

.

f

Use of facilities?

g Athletic programs?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

h Other extracurricular activities?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

33e

.

.

.

.

33f

.

.

.

.

-iia

.

.

.

.

33h

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

33a

.

.

33b

.

33c

33d

If you answered "Yes" to any of the above, please explain (If you need more space, attach a separate statement )

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------34a Does the organization receive any financial aid or assistance from a governmental agency?

. . .

b Has the organization's right to such aid ever been revoked or suspended?

If you answered "Yes" to either 34a or b, please explain using an attached statement

35

.

.

.

.

.

34a

.

.

.

.

.

Does the organization certify that it has complied with the applicable requirements of sections 4 01 through 4 05

of Rev. Proc 75-50, 1975-2 C.B. 587, covering racial nondiscrimination? If "No," attach an explanation

_

35

Schedule A ( Form 990 or 990-EZ) 2006

Schedule A (Form 990 or 990-EZ) 2006

Page 6

Lobbying Expenditures by Electing Public Charities (See page 10 of the instructions.)

(To be completed ONLY by an eligible organization that filed Form 5768)

Check ^ a

❑ if the organization belongs to an affiliated group.

Check ^

b

❑ if you checked "a" and "limited control" provisions apply

Limits on Lobbying Expenditures

(a)

Affiliated group

totals

(The term "expenditures" means amounts paid or incurred.)

Total lobbying expenditures to influence public opinion (grassroots lobbying) . . .

Total lobbying expenditures to influence a legislative body (direct lobbying). . .

Total lobbying expenditures (add lines 36 and 37)

. . . . .

Other exempt purpose expenditures . . . . . . . . .

. . . . . .

Total exempt purpose expenditures (add lines 38 and 39) . . .

. . . . .

Lobbying nontaxable amount Enter the amount from the following tableThe lobbying nontaxable amount isIf the amount on line 40 is.

Not over $500,000 . . . . . . . 20% of the amount on line 40 .

Over $500,000 but not over $1,000,000

. $100,000 plus 15% of the excess over $500,000

$175,000 plus 10% of the excess over $1,000,000

Over $1,000,000 but not over $1,500,000

Over $1,500,000 but not over $17,000,000. $225,000 plus 5% of the excess over $1,500,000

$1,000,000 . . . . . . . . . . .

Over $17,000,000 . . . . . . .

Grassroots nontaxable amount (enter 25% of line 41). . . . . . . . . . .

Subtract line 42 from line 36. Enter -0- if line 42 is more than line 36. . . . . .

Subtract line 41 from line 38 Enter -0- if line 41 is more than line 38. . . . . .

36

37

38

39

40

41

42

43

44

To be completed

for all electing

organizations

.

.

.

.

.

AKI

Caution : If there is an amount on either line 43 or line 44, you must file Form 4720.

4-Year Averaging Period Under Section 501(h)

(Some organizations that made a section 501(h) election do not have to complete all of the five columns below.

See the instructions for lines 45 through 50 on page 13 of the instructions.)

Lobbying Expenditures During 4-Year Averaging Period

(a)

2006

Calendar year (or

fiscal year beginning in) ^

45

Lobbying nontaxable amount

46

Lobbyin g ceilin g amount ( 150% of line 45 (e ))

47

Total lobbying expenditures .

.

.

.

.

.

48

Grassroots nontaxable amount .

.

.

.

.

49

Grassroots ceilina amount (150% of line

50

Grassroots lobbying expenditures .

.

.

.

.

(b)

2005

(d)

2003

(c)

2004

(e)

Total

.

Lobbying Activity by Nonelecting Public Charities

(For reporting only by organizations that did not complete Part VI -A) (See page 13 of the instructions.)

During the year, did the organization attempt to influence national , state or local legislation , including any

attempt to influence public opinion on a legislative matter or referendum , through the use of:

a

b

c

d

e

f

g

h

i

Yes

Volunteers . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Paid staff or management (Include compensation in expenses reported on lines c through h.) . . .

Media advertisements . . . . . . . . . . . . . . . . . . . . . . .

. .

Mailings to members , legislators , or the public . . . . . . . . . . . . . . . . . .

. . . . . . .

Publications, or published or broadcast statements . . . . . .

Grants to other organizations for lobbying purposes . . . . . . . . . . . . . . . .

Direct contact with legislators , their staffs , government officials , or a legislative body . . . . . .

. .

Rallies , demonstrations, seminars, conventions , speeches , lectures , or any other means

Total lobbying expenditures (Add lines c through h.)

. . . . . . . . . . . .

If "Yes" to any of the above , also attach a statement giving a detailed descripti on of the lobbying activities

No

✓

Amount

__ ^

`^

0

Schedule A (Form 990 or 990-EZ) 2006

Schedule A (Form 990 or 990-E1) 2006

Paoe 7

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See page 13 of the instructions.)

51

Did the reporting organization directly or indirectly engage in any of the following with any other organization d escribe d in section

501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organization s

Yes No

a Transfers from the reporting organization to a noncharitable exempt organization of51a

i

✓

(I) Cash

. . . . . . . . . . . . . . . . . . . .

. . . . . . . .

ail

✓

(ii) Other assets . . . . . .

. . . .

. . . . . . . . . . . . .

b Other transactions:

b i

✓

(i) Sales or exchanges of assets with a noncharitable exempt organization . . . .

b ii

✓

(ii) Purchases of assets from a noncharitable exempt organization . . . . . .

. . . . . .

✓

b (i i i)

(iii) Rental of facilities , equipment , or other assets . . . . . . . . . . . . . . . . . .

✓

b

(iv)

(iv) Reimbursement arrangements

. . . . . . . . . . . . .

. . .

.

b

(v)

✓

(v) Loans or loan guarantees . .

. . . . . . . . . . . . . . . . . .

✓

b (v i)

(vi) Performance of services or membership or fundraising solicitations

. . . . . . . . . . ,

c

✓

. . . . . . .

c Sharing of facilities , equipment , mailing lists , other assets , or paid employees

d If the answer to any of the above is "Yes," complete the following schedule. Column (b) should always show the fair market value of the

goods, other assets , or services given by the reporting organization. If the organization received less than fair m arket v alue i n any

transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received.

Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

. . . . . . 0described in section 501(c) of the Code (other than section 501(c)(3)) or in section 527?

b If " Yes, complete th e f o II owing schedule:

52a

10

Name of organization

IN

Type of organization

E] Yes

[:3 No

(c)

Description of relationship

Schedule A (Form 990 or 990-EZ) 2006

®

Printed on recycled Paper

POPULATION REFERENCE BUREAU, INC

FYE 9/30/06

FORM 990

EIN 53-0214030

CASH CONTRIBUTIONS OF $5,000 OR MORE

INCLUDED IN PART 1, LINE 1D

STATEMENT 1

*** NOT OPEN TO PUBLIC INSPECTION***

CONTRIBUTOR'S NAME & ADDRESS

TYPE

DATE

21,414

CASH

12/08/05

18,000

CASH

1/30/05

5,000

CASH

3/31/05

AMT

-POPULATION REFERENCE BUREAU, IN C

FYE 9/30/06

FORM 990

PART 1 LINE 20 OTHER CHANGES IN NET ASSETS

53-0214030

STATEMENT 2

EXPLANATION

174,258

NET REALIZED AND UNREALIZED GAINS ON INVESTME NTS

FORM 990

STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE

STATEMENT 3

EXPLANATION

TO GATHER, ANALYZE AND DISSEMINATE INFORMATION ON POPULATION, HEALTH AND THE

ENVIRONMENT FOR SCIENTIFIC AND EDUCATIONAL PURPOSES.

53-0214030

POPULATION REFERENCE BUREAU, INC

FYE 9/30/06

FORM 990

NON-GOVERNMENT SECURITIES

DESCRIPTION

VALUE

MUTUAL FUNDS

CD'S

MKT

MKT

OTHER PUB OTHER

TRADED

SECS

CORP

BONDS

CORP

STOCKS

0

0

STATEMENT 4

0

0

4,243, 489

1,151 , 837

VALUE

U.S. BONDS

MKT

TOTAL TO FORM 990, LN 54, COL B

4 , 243,489

1 , 151,837

STATEMENT 5

GOVERNMENT SECURITIES

DESCRIPTION

0

5,395,326

TOTAL TO FORM 990, LN 54, COL B

FORM 990

TOTAL NONGOVT SECS

STATE

GOVT

U.S.

GOVT

0

TOTAL

GOVT

0

0

0

POPULATION REFERENCE BUREAU, INC

FYE 9/30/06

OTHER ASSETS

FORM 990

53-0214030

STATEMENT 6

AMOUNT

DESCRIPTION

DUE FROM PRB ASSOCIATES

883,667

TOTAL TO FORM 990, LINE 58 , COLUMN B

883,667

OTHER LIABILITIES

FORM 990

STATEMENT 7

AMOUNT

DESCRIPTION

DEFERRED DUES

ACCRUED ANNUAL LEAVE

DEFERRED RENT

58,721

148,797

97,864

TOTAL TO FORM 990, PART IV , LINE 65, COL B

305,382

FORM 990A

LINE 3a:

PART III STATEMENT ABOUT ACTIVITIES

STATEMENT 8

PRB SOLICITS FELLOWSHIP APPLICATIONS FROM A VARIETY OF SOURCES,

TARGETING ACADEMICS WITH A BACKGROUN IN ECONOMICS. THE APPLICATION

INCLUDES A CV, PROPOSAL, AND LETTERS OF RECOMMENDATION. EACH

APPLICATION IS REVIEWED BY AT LEAST TWO REVIEWERS. APPLICATIONS

ARE EVALUATED FOR SCIENTIFIC QUALITY, POLICY IMPACT, OVERALL QUALITY

ONFER AS A GROUP

TO SELECT THE FINALISTS. ALL CANDIDATES ARE PROVIDED FEEDBACK ON THE

STRENGTHS AND WEAKNESSES OF THEIR PROPOSALS.

Sched 1

POPULATION REFERENCE BUREAU

SCHEDULE OF INV ESTMENTS - MARK ETABLE SE URITIES

10/01/05 - 9/30/06

COST

MKT VAL BOUGHT

FY 06

9/30/2005 9/30/2005

SECURITIES

SCHEDULE 1

53-0214030

COST

SOLD

FY 06

COST

9/30/2006

GAIN

( LOSS )

MKT VAL

9/30/2006

INT

DIVS

CAP GNS

LM LONG TERM:

Cash

S & P 500 SPDR's

Wash Mutual

LM SIT

Touchstone

Euro Pacific

Royce Fund

Royce Penn

Bond Fund

Total - LM LT:

120

1,291,254

600,974

367,912

0

466,955

198,921

0

375,534

3,301,670

3,301,670

119.60

1,352,536

598,577

578,562

0

637,900

309,441

0

370,433

3,847,569

3,847,569

123

478,241

559,790

0

0

0

81,549

212,565

328,221

0

115,656

888,134

690,929

888,134

0

197,205

355,000

867,000

277,000

945,000

277,000

945,000

1,222,000 1,222,000

1,222,000

2,110,134 1,912,929

2,110,134

2,110,134 1,912,929

2,110,134

123

559,913

328,221

0.11

1,316,360

621,904

0

559,913

499,285

0

328,221

394,844

3,720,527

011

1,494,930

675,004

0

587,153

765,818

0

333,175

387,409

4,243,489

3.82

25,105.40

12,608.50

11,378.07

501.86

3.82

8,321.64

110,328.18

20,952.10

13,142.84

19,310.37

68,904.20 152,744.76

LM INT TERM:

Money Market - LM

CD's

Money Market

Total - LM Int Term:

TOTAL LEGG MASON :

INVESTMENT TOTAL

8,704.60

8,704.60

422,000 422,000.00

0

0

430,705

430,705

430,705

3,732,374 4,278,273

3,732,374 4,278,273

545,899 1

4,278,273 1

Page 1

0 100,434.67

344,000

0

0

0

444,435

0

100,435 13,730.07

344,000

0

444,435 13,730.07

197,205

4,164,962

4,687,924 13,733.89

197,205

4,164,962

522,962

1

1 4,687,924

0.00

0.00

68,904.20 152,744.76

4,687,924 13,733.89 68,904.20 152,744.76

-22,937 GAIN/LOSS

POPULATION REFERENCE BUREAU, INC

FYE 9/30/06

53-0214030

FORM 990, PART IV, LINE 57B

DESCRIPTION

SCHEDULE2

COST

ACQ

METHOD YRS

FURN & EQUIP

LEASEHOLD

403,285 VARIOUS S/L

244,769 VARIOUS S/L

TOTALS

648 ,054

5-10

5-10

DEPREC

NET

264,772

203,794

138,513

40,975

468,566

179,488