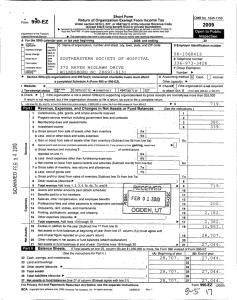

Return of Organization Exempt From Income Tax

advertisement

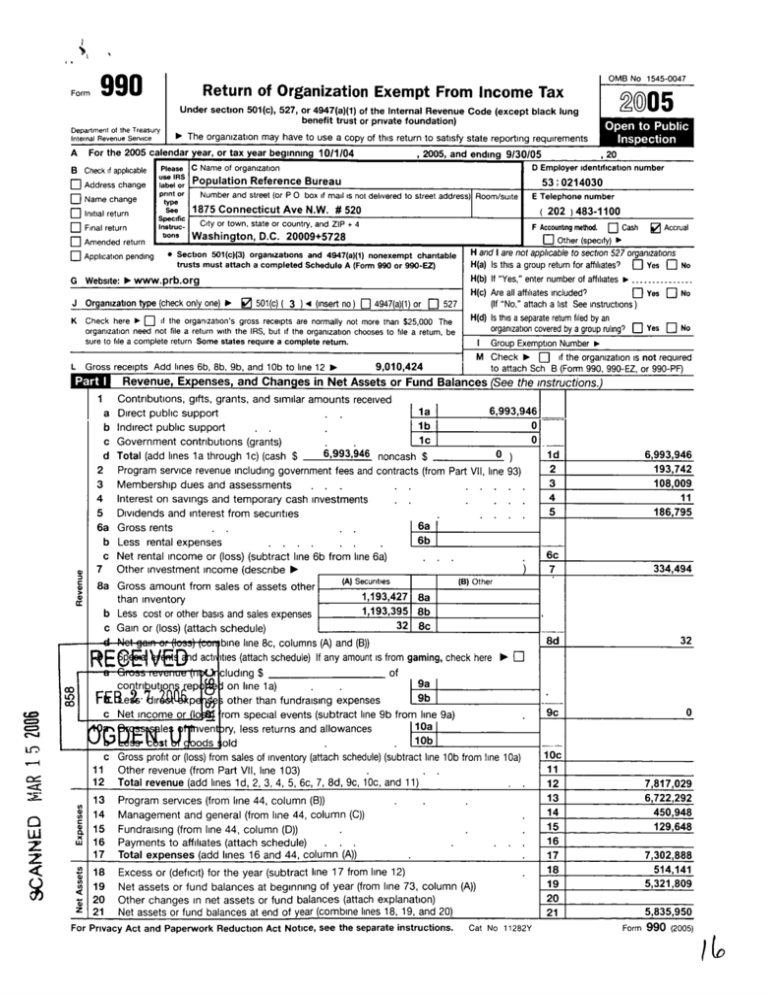

bt , Form OMB No 1545-0047 990 Return of Organization Exempt From Income Tax 20005 Under section 501(c), 527, or 4947( a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) Department of the Treasury ► The organization may have to use a copy of this return to satisfy state rep o rt ing requirements Internal Revenue Service For the 2005 calendar year , or tax year beginning 10/1/04 A Check if applicable B ❑ Address change ❑ Name change P lease typ see ❑ Final return Specific Instruc- bons ❑ Amended return , 20 D Employer identification number 53:0214030 Room/suite I E Telephone number 1875 Connecticut Ave N .W. # 520 ( 202 ) 483-1100 City or town, state or country, and ZIP + 4 F Accounting method . Washington , D.C. 20009+5728 ❑ Cash ® Accrual ❑ Other (specify) ► • Section 501 (c)(3) organizations and 4947 ( a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ) G Website: ► www.prb.org E/ 501(c) ( 3 ) 4 (insert no) ❑ 4947(a)(1) or ❑ 527 J Organization type (check only one) ► K Check here ► ❑ it the organization's gross receipts are normally not more than $25,000 The organization need not file a return with the IRS, but if the organization chooses to file a return, be sure to file a complete return Some states require a complete return. L 9/30/05 use IRS label or Population Reference Bureau print or Number and street (or P 0 box if mail is not delivered to street address ❑ Initial return ❑ Application pending , 2005, and C Name of organization Gross receipts Add lines 6b, 8b, 9b, and 10b to line 12 ► H and I are not applicable to section 527 organizations H(a) Is this a group return for affiliates? ❑ Yes ❑ No H(b) If "Yes," enter number of affiliates No---------------H(c) Are all affiliates included? ❑ Yes ❑ No (If "No," attach a list See Instructions ) H(d) Is this a separate return filed by an organization covered by a group ruling? ❑ Yes ❑ No I Group Exemption Number ► M Check ► ❑ if the organization is not reoulred to att ach Sch B (Form 990, 990-EZ, or 990-PF) 9,010 ,424 Revenue, Expenses, and Changes in Net Assets or Fund Balances (See the instructions. Contributions, gifts, grants, and similar amounts received 6,993,946 la Direct public support 0 lb Indirect public support 0 is Government contributions (grants) 6,993 ,946 noncash $ Total (add lines 1a through 1c) (cash $ 0 2 Program service revenue including government fees and contracts (from Part VII, line 93) Membership dues and assessments 3 . . . 4 Interest on savings and temporary cash investments . . . . . Dividends and interest from securities 5 6a 6a Gross rents 6b b Less rental expenses . . . . c Net rental income or (loss) (subtract line 6b from line 6a) 1 a b c d 7 Other investment income (describe ► 8a Gross amount from sales of assets other (A) Securities 6 , 993,946 193,742 108,009 11 186,795 6c 7 334,494 8d 32 9C 0 (B) Other 1,193,427 1,193,395 8a 8b b Less cost or other basis and sales expenses 32 8c c Gain or (loss) (attach schedule) b ine l ine 8 c, co l umns ( A ) an d ( B )) REG V Otd acts ties (attach schedule) If any amount is from gaming , check here ► ❑ of eluding $ conqtnbuton rep 9 on line 1a) 9a 9b F��egs �llrcp other than fundraising expenses than inventory id 2 3 4 5 (F- 10 olo c Net income or I rom special events (subtract line 9b from line 9a) 10a le ven ry , less returns and allowances 10b ppst ods old c Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 1Ob from line 1 Oa) 11 Other revenue (from Part VII, line 103) 12 Total revenue (add lines 1d, 2, 3, 4, 5, 6c, 7, 8d, 9c, 1Oc, and 11) CA= c 0 C'V Co Dg Cj= Q iK 0 W z z X ;, z 13 14 15 16 17 Program services (from line 44 , column ( B)) Management and general (from line 44 , column (C)) Fundraising (from line 44 , column ( D)) Payments to affiliates (attach schedule) . . . Total expenses (add lines 16 and 44, column (A)) 18 19 20 21 Excess or (deficit) for the year (subtract line 17 from line 12) Net assets or fund balances at beginning of year (from line 73, column (A)) Other changes in net assets or fund balances (attach explanation) Net assets or fund balances at end of year (combine lines 18, 19, and 20) For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions . . . Cat No 11282Y 10c 11 12 13 14 15 16 17 18 19 20 21 7,817,029 6 , 722,292 450,948 129,648 7 ,302,888 514,141 5 , 321,809 5,835,950 Form 990 (2005) Form 990 (2005) 1:M-011 Page 2 Statement of All organizations must complete column (A). Columns (B), (C), and (D) are required for section 501(c)(3) and (4) Functional Expenses organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others. (See the instructions) Do not include amounts reported on line 6b, 8b, 9b, 10b, or 16 of Part I. 22 Grants and allocations (attach schedule) 0 noncash $ (cash $ 0) If this amount includes foreign grants, check here ► ❑ Specific assistance to individuals (attach schedule) . . . Benefits paid to or for members (attach schedule) - 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Compensation of officers, directors, etc. Other salaries and wages Pension plan contributions Other employee benefits Payroll taxes Professional fundraising fees Accounting fees Legal fees Supplies . . Telephone . . Postage and shipping Occupancy Equipment rental and maintenance Printing and publications Travel Conferences, conventions, and meetings . . Interest . . Depreciation, depletion, etc (attach schedule) Other expenses not covered above (itemize) a •INSURANCE ------------------------------------b NON .CAPITALIZED EQUIPMENT c .CONTRACTUAL SERVICES d STAFF DEVELOPMENT / MISC ------------------------------------------e _OVERHEAD ALLOCATION _ -------------------------------------------- f 44 ----------------------------------------------------- (s) Program services (A) Total (C) Management and general (D) Fundraising , 22 0 0 23 0 0 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 0 293 , 138 2,003,003 163 ,395 591 , 295 191 ,730 0 32,378 488 62 , 450 40 , 816 229 , 251 541 , 352 14 , 984 323,832 538 , 712 139 , 796 0 54 , 587 0 14 ,243 1 , 716,610 123 , 169 445 , 724 144, 528 0 0 0 36 , 442 4,838 213 ,792 21 , 357 1,691 307 , 196 500,760 82 , 801 0 0 277,171 267 , 735 38 , 776 140 , 322 45,500 0 32,378 488 25 , 725 35,978 7, 862 519,995 13,293 11,896 33,367 51 , 295 0 54,587 1,724 18,658 1,450 5,249 1,702 0 0 0 283 0 7,597 0 0 4,740 4,585 5,700 0 0 20 , 208 78 , 433 1,965 , 093 17 , 947 0 0 46 , 779 1 , 628,068 1 , 892 1 , 432,402 20,208 31,654 275 , 932 16,055 - 1,449 , 269 0 0 61,093 0 16,867 _ 40 41 42 43a 43b 4.3c 43d 43e 43f 43g Total functional expenses . Add lines 22 through 43 (Organizations completing columns (B)-(D), carry these totals to lines 13-15) ,302 , 888 , 722,292 4 50,948 29,648 Joint Costs . Check ► ❑ if you are following SOP 98-2 Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services'? ► ❑ Yes 0 No If "Yes," enter (i) the aggregate amount of these joint costs $ ; (ii) the amount allocated to Program services $ (iii) the amount allocated to Management and general $ , and (iv) the amount allocated to Fundraising $ Form 990 (2005) Form 990 (2005) Page 3 FOEM Statement of Program Se rvice Accomplishments (See the instructions.) Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization How the public perceives an organization in such cases may be determined by the information presented on its return. Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments Program Service Wh at is the organization's primary exempt purpose? ► SEE STATEMENT 3 Expenses All organizations must describe their exempt purpose achievements in a clear and concise manner State the number ( Required for 501(c)(3) and of c lients served, publications issued, etc Discuss achievements that are not measurable (Section 501(c)(3) and (4) (4) ores, and 4947(a)(1) optional for org anizations and 4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others) trusts but others INTERNATIONAL PROGRAMS : SEE SCHEDULE 3 --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------(Grants and allocations $ --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------) If this amount includes foreign grants, check here 10, ❑ ,823,314 COMMUNICATIONS: SEE SCHEDULE 3 ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ------------------------------------------------------------ --------------------------------------------------------------- -------------------------------------------------------------------------------------------------------------------------- -----------------------------------------------------------(Grants and allocations $ ) If this amount includes foreign grants, check here 10, ❑ DOMESTIC PROGRAMS : SEE SCHEDULE 3 --------------------------------------------------------------- ------------------------------------------------------------ 1,575,173 --------------------------------------------------------------- -------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------------------------------------------------------------- -----------------------------------------------------------(Grants and allocations $ ) If this amount includes foreign grants, check here ► ❑ 1,323,805 d --------------------------------------------------------------- ------------------------------------------------------------ --------------------------------------------------------------- -----------------------------------------------------------Grants and allocations $ Other program services (attach schedule) (Grants and allocations $ If this amount includes forei n rants, check here 10, ❑ ) If this amount includes foreign grants, check here Op- f Total of Program Se rv ice Expenses (should equal line 44, column (B), Program services ) E] ► 6,722,292 Form 990 (2005) Form 990 (2005) FU.WM Note : 45 46 Page 4 Bala n ce Sheets (See the Instructions.) Where required, a tt ached schedules and amounts within the description column should be for end-of-year amounts only Cash-non-interest-bearing Savings and temporary cash investments 47a Accounts receivable b Less allowance for doubtful accounts . . . 47a 47b 582,565 0 b Less accumulated depreciation (attach , , . , . . schedule) 56 Investments-other (attach schedule) 57a Land, buildings, and equipment basis 51a 51b ► ❑ Cost 21 FMV 55b 57a 417, 359 ) Total assets (must equal line 74) Add lines 45 through 58 Accounts payable and accrued expenses Grants payable Deferred revenue . . . . . . . . . 63 Loans from officers , directors , trustees , and key employees (attach schedule) - - . . 64a Tax-exempt bond liabilities (attach schedule) b Mortgages and other notes payable (attach schedule ) 65 Other liabilities (describe ► SEE-STATEMENT 7-------------------) 66 v M c Li 0 0 y Z 16,996 976,183 457,764 47c 582,565 0 48c 0 49 0 0 50 0 0 51c 0 52 34,430 53 5 ,201,431 54 0 0 31,421 7,600,262 0 55c 0 56 0 0 148 , 434 57c 58 99,031 883,567 0 516,390 60 61 62 m 45 46 SSa b Less accumulated depreciation (attach 57b schedule) 58 Other assets (describe ► - DUE FROM PRB ASSOCIATES 59 (B) End of year 46,679 422,671 48a Pledges receivable 48a 48 b b Less: allowance for doubtful accounts 49 Grants receivable , , . . . . . . Receivables from officers, directors, trustees, and key employees 50 (attach schedule) 51a Other notes and loans receivable (attach schedule) b Less* allowance for doubtful accounts Inventories for sale or use 52 Prepaid expenses and deferred charges 53 Investments-securities (attach schedule) 54 55a Investments-land, buildings, and equipment. basis (A) Beginning of year Total liabilities . Add lines 60 through 65 Organizations that follow SFAS 117, check here ► 0 and complete lines 67 through 69 and lines 73 and 74 67 Unrestricted 68 Temporarily restricted 69 Permanently restricted Organizations that do not follow SFAS 117, check here ► ❑ and complete lines 70 through 74 70 Capital stock, trust principal, or current funds 71 Paid-in or capital surplus, or land, building, and equipment fund 72 Retained earnings , endowment , accumulated income, or other funds 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72, column (A) must equal line 19, column ( B) must equal line 21) 74 Total liabilities and net assets/fund balances . Add lines 66 and 73 883,215 7,194, 534 193,014 0 1,276, 438 59 60 61 62 10,190,025 96,514 0 3 , 898,490 0 0 0 403, 273 63 64a 64b 65 0 0 0 359,071 1,872, 725 66 4 , 354,075 5,279, 929 0 41,880 5,794,070 67 68 69 41,880 70 71 72 5,321 , 809 73 7,194,534, 74 5,835,950 10, 190,025 Form 9 90 (2005) Form 990 (2005) Page 5 Reconciliation of Revenue per Audited Financial Statements With Revenue per Return (See the Total revenue, gains, and other support per audited financial statements Amounts included on line a but not on Part I, line 12 a b . 1 Net unrealized gains on investments b1 2 3 4 Donated services and use of facilities Recoveries of prior year grants b2 b3 Other (specify) 1 2 Add lines bl through b4 Subtract line b from line a Amounts included on Part I, line 12, but not on line a: Investment expenses not included on Part I, line 6b Other (specify) --------------------------------------------------------------- , ----------------------------------------------------------------------------------- 1 2 3 4 c d 1 2 e Add lines b1 through b4 Subtract line b from line a Amounts included on Part I, line 17, but not on line a: Investment expenses not included on Part I, line 6b - - d e 7,817,029 er Return a 7,303,238 b c 350 7 ,302,888 d e 7,302,888 b1 b2 b3 b4 350 di --------------------------------------------------------------- Add lines d1 and d2 Total expenses (Pa rt I, line 17) Add lines c and d 3 d2 ► Total expenses and losses per audited financial statements Amounts included on line a but not on Part I, line 17 Donated services and use of facilities Prior year adjustments reported on Part I, line 20 Losses reported on Part I, line 20 Other (specify) -----------------------•--------------•--•--------------•--•---PRB ASSOCIATES Other (specify) 7,817,029 d1 Reconciliation of Expenses per Audited Financial Statements With Expenses a b b c 3 Add lines dl and d2 . . Total revenue (Pa rt I, line 12) Add lines c and d e 7,817,032 PRB ASSOCIATES......................................... b4 c d a . . . d2 . ► Current Officers, Directors , Trustees, and Key Employees (List each person who was an officer, director, trustee, or key employee at any time during the year even if they were not c ompensated.) (See the instructions ) (A) Name and address (B) Title and average hours per week devoted to position WILLIAM P. BLITZ --- PRES/CEO; 50 HRS 1875 CONNECTICUT AVE N.W. # 520 WDC 20009 JAMES E. SCOTT --- CFO/COO; 50 HRS 1875 CONNECTICUT AVE N.W. # 520 WDC 20009 (C) Compensation ( If not paid , enter -0-. (0) Contributions to employee (E) Expense account benefit plans & deferred and other allowances compensation plans 203,290 14,466 0 131,909 9,387 0 SEE ATTACHED LIST OF BOARD OF TRUSTEES PRB BOARD SERVES WITHOUT COMPENSATION ---------------------------------------------------------------- ------------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------Form 990 (2005) Form 990 (2005) Page 6 Current Officers , Directors , Trustees and Key Employees (continued) Yes No 75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at board meetings 17 ► b Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest --compensated -------------employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, related to each other through family or business relationships? If "Yes," attach a statement that identifies the individuals and explains the relationship(s) - . - 75b ✓ c Do any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, receive compensation from any other organizations, whether -- -J tax exempt or taxable, that are related to this organization through common supervision or common control,? 75c Note Related organizations include section 509(a)(3) supporting organizations. If "Yes," attach a statement that identifies the individuals, explains the relationship between this organization and the other organization(s), and describes the compensation arrangements, including amounts paid to each individual by each related organization d Does the organization have a written conflict of interest policy? ✓ � 75d ✓ EEO-Former Officers , Directors , Trustees, and Key Employees That Received Compensation or Other Benefits (If any former officer, director, trustee, or key employee received compensation or other benefits (described below) during the year, list that person below and enter the amount of compensation or other benefits in the appropriate column See the instructions ) (A) Name and address (B) Loans and Advances (C) Compensation (D) ContnbWons to employee benefit plans & deferred ( E) Expense account and other N/A ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------' Other Information (See the instructions) 76 Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed . . descrlptlon of each activity . . 77 Were any changes made in the organizing or governing documents but not reported to the IRS? . . If "Yes," attach a conformed copy of the changes 78a Did the organization have unrelated business gross Incom this return? b If "Yes," has it filed a tax return on Form 990 -T for this ye 79 Was there a liquidation, dissolution, termination, or substan a statement . 80a Is the organization related (other than by association with common membership, governing bodies, trustees, office organization'? b If "Yes," enter the name of the organization ► •PRB ASSC --------------•--------------------------....-----...... and checl 81a Enter direct and indirect political expenditures (See line 81 b Did the organization fil e Form 1120 -POL for this year? Yes --- 76 77 No ✓ ✓ Form 990 (2005) Page 7 FMIF Other Information (continued) 82a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value? b If "Yes," you may indicate the value of these items here Do not include this amount as revenue in Part I or as an expense in Part II 82b (See instructions in Part III) 83a Did the organization comply with the public inspection requirements for returns and exemption applications'? b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? 84a Did the organization solicit any contributions or gifts that were not tax deductible? b If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible? 85 501(c)(4), (5), or (6) organizations a Were substantially all dues nondeductible by members' b Did the organization make only in-house lobbying expenditures of $2,000 or less' If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year. 85c c Dues, assessments, and similar amounts from members 85 d d Section 162(e) lobbying and political expenditures 85 e e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices 85f f Taxable amount of lobbying and political expenditures (line 85d less 85e) g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f'? . • . . h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? Yes No ✓ 82a • ✓ 83a 83b 84a ✓ ✓ -- -� 84b 85a 85 b 85 g 85h 501(c)(7) Digs Enter a Initiation fees and capital contributions included on 86a line 12 86b b Gross receipts, included on line 12, for public use of club facilities 87a 87 501(c)(12) orgs Enter- a Gross income from members or shareholders b Gross income from other sources. (Do not net amounts due or paid to other 87b . . sources against amounts due or received from them) 86 At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301.7701-2 and 301 7701-3? If "Yes," complete Part IX . . . . . . . . . . . . . . 89a 501 (c)(3) organizations Enter- Amount of tax imposed on the organization during the year undersection 4911 ►..•..••••-.•.-•-•----9_ , section 4912 ► ..................... _ , section 4955 ►................. . 88 b 501(c)(3) and 501(c)(4) orgs Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach a statement explaining each transaction 88 '� ✓ 89b c Enter, Amount of tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 ► 0 d Enter Amount of tax on line 89c, above, reimbursed by the organization ► 0 90a List the states with which a copy of this return is filed ► PC ------------------------------------------------------------------------b Number of employees employed in the pay period that includes March 12, 2005 (See 190b 1 40 instructions) 483:1100 ......... 91a The books are in care of ► THE ORGANIZATION •------------------------Telephone no. 10Located at ► .1875 CONNECTICUT AVE N . W # 520 WASH D.C. ZIP + 4 0- -___________ ?0009 5728 b At any time during the calendar year, did the organization have an interest in or a signature or other authority Yes over a financial account in a foreign country (such as a bank account, securities account, or other financial 91b , , account)' If "Yes," enter the name of the foreign country ► _________________________________________________________________ See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts _ c At any time during the calendar year, did the organization maintain an office outside of the United States? 91c 92 If "Yes," enter the name of the foreign country ► .................................................................. Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041-Check here . . ► 1 92 I and enter the amount of tax-exempt interest received or accrued during the tax year . No ✓ ✓ ► ❑ Form 990 (2005) Form 990 (2005) Page 8 Analysis of Income-Producing Acti vities See the instructions. Note : Enter gross amounts unless otherwise indicated Program service revenue. 93 Unrelated bu siness income (A) Business code (B) Amount Excluded by sec tion 512, 513, or 514 (C) Exclusion code (D) Amount PUBLICATION SALES ANNIVERSARY EVENT a b (E) Related or exempt function income 97,331 96,411 C d e f Medicare/Medicaid payments g Fees and contracts from government agencies a b Membership dues and assessments Interest on savings and temporary cash investments Dividends and interest from securities Net rental income or (loss) from real estate. debt-financed property not debt-financed property 94 95 96 97 98 Net rental income or (loss) from personal property 99 Other investment income 108,009 14 11 14 186,795 14 334,526 Gain or (loss) from sales of assets other than inventory Net income or (loss) from special events Gross profit or (loss) from sales of inventory Other revenue a 100 101 102 103 b c d e 521,332 104 Subtotal (add columns (B), (D), and (E)) Total (add line 104, columns (B), (D), and (Q. 105 Note : Line 105 plus line 1d. Part I. should equal the amount on line 12. Part I . ► 301,751 823,083 Relationship of Activities to the Accomplishment of Exempt Purposes (See the instructions.) Line No . y Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization's exempt purposes (other than by providing funds for such purposes) 93a,b ; 94 MEMBERS ARE INTERESTED IN THE SOCIAL , ECONOMIC AND ENVIRONMENTAL IMPACTS OF POPULATION ISSUES , AND SUPPORT THE EXEMPT PURPOSES OF THE ORGANIZATION Ki� Information Regarding Taxable Subsidiaries and D isregarded Entities (See the instructions. (A) (13) (C) Name, address, and EIN of corporation, Percentage of Nature actrvlties Total(Dcome partnership, or disregarded entity ownership interest PRB ASSOCIATES 100 % RESEARCH 3 1875 CONNECTICUT AVE N . W. # 520 % WASHINGTON , D.C. 20009 % EIN 52 - 1278952 La W.0 Information Regarding Transfers Associated with Personal Benefit Contracts (See the instructions) (E) End-of-year assets 1,922 (a) Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract9 ❑ Yes 21 No (b) Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? ❑ Yes ® No Note : If "Yes" to (b), file Form 8870 and Form 4720 (see instructions) Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge claration reparer (other than officer) is based on all information of which preparer has any knowledge and belief, it i rue correct, and complete ,x=06 Please Sign Here Sin re of officer W ILLIAM P. BUTZ Date RESIDENT I CEO Type or print name and title Paid Preparer 's Use Only Preparers' signature Firm's name (or yours if self-employed), address, and ZIP + 4 ck if Date Preparer's SSN or PTIN (See Gen Inst W) self- employed ► ❑ EIN ► Phone no ► I t Form 990 (2005) SCHEDULE A Organization Exempt Under Section 501(c)(3) (Form 990 or 990-EZ) (Except Private Foundation) and Section 501(e), 501(f), 501(k), 501(n), or 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Internal Revenue Service Name of the organization 2005 Supplementary Information-(See separate instructions.) ► MUST be completed by the above organizations and attached to their Form 990 or 990-EZ Employer identification number Population Reference Bureau , JJ OMB No 1545-0047 53 : 0214030 Compensation of the Five Highest Paid Employees Other Than Officers , Directors , and Trustees (See page 1 of the instructions List each one. If there are none, enter "None ") (a) Name and address of each employee paid more than $50 , 000 (b) Title and average hours per wee k d evote d t o position YINGER NANCY .............•----------------1875 CONNECTICUT AVE NW WDC 20009 JACOBSEN LINDA . -.... - - - - --- ........ - •--1875 CONNECTICUT AVE NW WDC 20009 (c) Compensation DIR, INTL PROGRAMS (d) Contributions to employee benefit plans & (e) Expense account and other deferred compensation allowances 125,094 8,902 0 6,589 ,873 0 CARNEVALE ELLEN .................................................... DIR, COMMS PRGS A C 94,645 6,735 0 SMITH RHONDA.............................................. DEPUTY DIR, INTL 91,954 6,544 0 86 , 065 6 , 124 0 50 HIRS L WK IR, DOMESTIC PRGS 1875 CONNECTICUT AVE NW WDC 20009 1875 CONNECTICUT AVE NW WDC 20009 CARL HAUB --------------•------------WD, C 20009 Total number of other employees paid over $50,000 SR DEMOGRAPHER 1 50 HIRS / WK ► 16 Compensation of the Five Highest Paid Independent Contractors for Professional Se rv ices (See page 2 of the instructions List each one (whether individuals or firms). If there are none, enter "None.") (a) Name and address of each independent contractor paid more than $50,000 (b) Type of service PC AID -- ...... •-•--•--••--•-•--•---------------------- IT SERVICES 1875 CONNECTICUT AVE NW WDC 20009 JACKSON & ASSOCIATES HR SERVICES - •----- ---------------------1875 CONNECTICUT AVE NW WDC 20009 (c) Compensation - 119,860 68,250 ---------------------------------------------------------------------------------------Total number of others receiving over $50,000 for professional services . ► ,r . 0 - , J Compensation of the Five Highest Paid Independent Contractors for Other Se rvices (List each contractor who performed services other than professional services, whether individuals or firms If there are none, enter "None." See page 2 of the instructions.) ( a) Name and address of each independent contractor paid more than $50,000 (b) Type of se rv ice (c) Compensation NONE ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------- Total number of other contractors receiving over ► $50,000 for other services For Paperwork Reduction Act Notice , see the Instructions for Form 990 and Form 990-EZ. f Cat No 11285E Schedule A (Form 990 or 990-EZ) 2005 Page 2 Schedule A (Form 990 or 990-EZ) 2005 Yes No Statements About Activities (See page 2 of the instructions.) During the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influence public opinion on a legislative matter or referendum's If "Yes," enter the total expenses paid 0 (Must equal amounts on line 38, or incurred in connection with the lobbying activities ► $ 1 Part VI-A, or line I of Part VI-B) . . 1 Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A Other organizations checking "Yes" must complete Part VI-B AND attach a statement giving a detailed description of the lobbying activities. During the year, has the organization, either directly or indirectly, engaged in any of the following acts with any substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority owner, or principal beneficiary? (If the answer to any question is "Yes," a ttach a detailed statement explaining the 2 transactions ) Sale , exchange , or leasing of property? . , . . Lending of money or other extension of credit? . . . . . . . . Furnishing of goods , services , or facilities? Payment of compensation (or payment or reimbursement of expenses if more than $1 , 000)? Transfer of any part of its income or assets' . . . . 3a Do you make grants for scholarships, fellowships, student loans, etc ? (If "Yes," attach an explanation of how . . . . . . you determine that recipients qualify to receive payments) . b Do you have a section 403(b) annuity plan for your employees? c During the year , did the organization receive a contribution of qualified real property interest under section 170(h)'? 4a Did you maintain any separate account for participating donors where donors have the right to provide advice on the use or distribution of funds' b Do you provide credit counseling, debt management, credit repair, or debt negotiation services' a b c d e ✓ ✓ 2a 2b 2c 2d ✓ ✓ 2e ✓ ✓ 3a 3b 3c ✓ ✓ ✓ 4b ✓ Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions ) The organization is not a private foundation because it is. (Please check only ONE applicable box ) 5 6 7 8 9 ❑ ❑ ❑ ❑ ❑ 10 ❑ 11a ® 11b ❑ 12 ❑ A church, convention of churches, or association of churches Section 170(b)(1)(A)(i) A school Section 170(b)(1)(A)(u) (Also complete Part V.) A hospital or a cooperative hospital service organization Section 170(b)(1)(A)(ui) A Federal, state, or local government or governmental unit. Section 170(b)(1)(A)(v). A medical research organization operated in conjunction with a hospital Section 170(b)( 1)(A)(ili) Enter the hospital's name, ci ty, and state ► .............................................................................................................................. An organization operated for the benefit of a college or university owned or operated by a governmental unit Section 170(b)(1)(A)(Iv) (Also complete the Support Schedule in Part IV-A) An organization that normally receives a substantial part of its support from a governmental unit or from the general public Section 170(b)(1)(A)(vl) (Also complete the Support Schedule in Part IV-A) A community trust Section 170(b)(1)(A)(vl) (Also complete the Support Schedule in Part IV-A) An organization that normally receives (1) more than 33'/3% of its support from contributions, membership fees, and gross receipts from activities related to its charitable, etc , functions-subject to certain exceptions, and (2) no more than 331/3% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975 See section 509(a)(2) (Also complete the Support Schedule in Part IV-A) 13 ❑ An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in (1) lines 5 through 12 above, or (2) sections 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2) Check ❑ Type 1 ❑ Type 2 ❑ Type 3 the box that describes the type of supporting organization ► Provide the following information about the support ed organizations (See page 6 of the instructions.) (b) Line number (a) Name(s) of supported organization(s) from above 14 ❑ An organization organized and operated to test for public safety Section 509(a)(4) (See page 6 of the instructions) Schedule A (Form 990 or 990-EZ) 2005 Schedule A (Form 990 or 990-EZ) 2005 Page 3 Support Schedule (Complete only if you checked a box on line 10, 11, or 12) Use cash method of accounting. Note : You may use the worksheet In the instructions for converting from the accrual to the cash method of accounting. Calendar year (or fiscal year beginning in) ► (a) 2004 (b) 2003 (c) 2002 (d) 2001 Gifts, grants, and contributions received (Do 15 not include unusual grants See line 28) 192,813 172 , 970 165 , 160 166 ,433 Membership fees received 16 123,902 127 ,753 134,972 143, 310 17 Gross receipts from admissions, merchandise sold or services performed, or furnishing of facilities in any activity that is related to the organization's charitable, etc , purpose 6,203 , 195 6 , 665,576 6,603,153 7,381 ,307 Gross income from interest, dividends, 18 amounts received from payments on securities loans (section 512(a)(5)), rents, royalties, and unrelated business taxable income (less section 511 taxes) from businesses acquired by the organization after June 30, 1975 300,813 502 ,793 -223, 488 -240 ,417 19 Net income from unrelated business activities not included in line 18 0 0 0 0 (e) Total 697,376 529,937 26, 853,231 339,701 0 20 Tax revenues levied for the organization's benefit and either paid to it or expended on its behalf .. 0 0 0 0 0 21 The value of services or facilities furnished to the organization by a governmental unit without charge Do not include the value of services or facilities generally furnished to the public without charge 0 0 0 0 0 22 23 24 25 Other income Attach a schedule Do not include gain or (loss) from sale of capital assets Total of lines 15 through 22 Line 23 minus line 17 Enter 1 % of line 23 0 6,820 ,723 617 ,528 68,207 0 7, 469,092 803 , 516 74,691 0 6 ,679,797 76 , 644 66,798 0 28 , 420,245 1 , 567,014 26 Organizations described on lines 10 or 11 : 0 7,450,633 69 , 326 74 ,506 26a ► a Enter 2% of amount in column (e), line 24 Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly supported organization) whose total gifts for 2001 throu g h 2004 exceeded the amount shown in line 26a Do not file this list with your return . Enter the total of all these excess amounts ► c Total support for section 509(a)(1) test Enter line 24, column (e) ► 339,701 19 d Add Amounts from column (e) for lines 18 295,650 ► 22 26b e Public support (line 26c minus line 26d total) ► f Public suppo rt percentage (line 26e (numerator) divided by line 26c (denominator)) . ► 1 31,340 b 27 26d 26e 26f 295,650 1,567,014 J 635,351 931,663 59.5 % Organizations described on line 12 : a For amounts included in lines 15, 16, and 17 that were received from a "disqualified person," prepare a list for your records to show the name of, and total amounts received in each year from, each "disqualified person " Do not file this list with your return . Enter the sum of such amounts for each year b (2004) .......................... (2003) --------------------------- (2002) --------------------------- (2001) .......................... For any amount included in line 17 that was received from each person (other than "disqualified persons"), prepare a list for your records to show the name of, and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000 (Include in the list organizations described in lines 5 through 11 b, as well as individuals) Do not file this list with your return . After computing the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these differences (the excess amounts) for each year (2004) -------------------------- (2003) .......................... (2002) --------------------------- (2001) --------------.....------- c Add Amounts from column (e) for lines 17 d e f g h 28 26b 26c 15 16 20 21 . , Add Line 27a total and line 27b total Public support (line 27c total minus line 27d total) . . . ► 27f Total support for section 509(a)(2) test Enter amount from line 23, column (e) Public suppo rt percentage (line 27e (numerator ) divided by line 27f (denominator)) . . Investment income percentage (line 18, column (e) (numerator) divided by line 27f (denominator)) ► 27c ► 27d 27e ► ► ► __ _ 27g A 27h _ % % Unusual Grants : For an organization described in line 10, 11, or 12 that received any unusual grants during 2001 through 2004, prepare a list for your records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant Do not file this list with your return . Do not include these grants in line 15 Schedule A (Form 990 or 990-EZ) 2005 Schedule A (Form 990 or 990-EZ) 2005 JjM Page 4 Private School Questionnaire (See page 7 of the instructions.) (To be completed ONLY by schools that checked the box on line 6 in Pa rt IV) Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing instrument, or in a resolution of its governing body's . . 29 Does the organization include a statement of its racially nondiscriminatory policy toward students in all its brochures, catalogues, and other written communications with the public dealing with student admissions, programs, and scholarships? . . . . . . . . . . . Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period of solicitation for students, or during the registration period if it has no solicitation program, in a way that makes the policy known to all parts of the general community it serves? 30 31 Yes No 29 30 -• --J 31 If "Yes," please describe, if "No," please explain (If you need more space, attach a separate statement) -•-------•-•-•------•--------- -•--------•-••- ----•---------•-----•-----------•---•-•-•••-----------••-•--•-------Does the organization maintain the following. 32 Records indicating the racial composition of the student body, faculty, and administrative staff ? b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory , , basis'? c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing with student admissions, programs, and scholarships? , , , d Copies of all material used by the organization or on its behalf to solicit contributions' a 32a 32b 32c 32d If you answered "No" to any of the above, please explain (If you need more space, attach a separate statement ) -------------------------------------------------------------------------------------------------------------------------Does the organization discriminate by race in any way with respect to. 33 a Students' rights or privileges? . . . b Admissions policies? . . . c Employment of faculty or administrative staff? d Scholarships or other financial assistance? e Educational policies? f Use of facilities? . . . . . . . . . . . . . 33 a . . 33 b 33 c . 33e . . . . . g Athletic programs? h Other extracurricular activities? . . . . . . . 33 h . If you answered "Yes" to any of the above, please explain (If you need more space, attach a separate statement ) ---------------------------------------------------------------------------------------------------------------------------...---•----•-------- -••---•-----------•-------•-----------••--•--..-..--•-----•-------------------------•-•-•--•--•---- 34a b 35 Does the organization receive any financial aid or assistance from a governmental agency? Has the organization's right to such aid ever been revoked or suspended'? If you answered "Yes" to either 34a or b, please explain using an attached statement . . . . Does the organization certify that it has complied with the applicable requirements of sections 4 01 through 4 05 of Rev Proc 75-50, 1975-2 C B 587, covering racial nondiscrimination? If "No," attach an explanation p 35 Schedule A (Form 990 or 990-EZ) 2005 Schedule A (Form 990 or 990-EZ) 2005 Page 5 Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions) (To be completed ONLY by an eligible organization that filed Form 5768) Check ► a ❑ if the organiz ation belongs to an affiliated group Check ► b ❑ if you checked "a" and "limited control" provisions apply Limits on Lobbying Expenditures totals (The term "expenditures" means amounts paid or incurred ) 36 37 38 39 40 41 42 43 44 b To be completed for ALL electing organizations Affiliated group Total lobbying expenditures to influence public opinion (grassroots lobbying) Total lobbying expenditures to influence a legislative body (direct lobbying) Total lobbying expenditures (add lines 36 and 37) Other exempt purpose expenditures Total exempt purpose expenditures (add lines 38 and 39) Lobbying nontaxable amount Enter the amount from the following tableIf the amount on line 40 isThe lobbying nontaxable amount isNot over $500,000 20% of the amount on line 40 Over $500,000 but not over $1,000,000 $100,000 plus 15% of the excess over $500,000 Over $1,000,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000 Over $1,500,000 but not over $17,000,000 $225,000 plus 5% of the excess over $1,500,000 Over $17,000,000 $1,000,000 Grassroots nontaxable amount (enter 25% of line 41) Subtract line 42 from line 36 Enter -0- if line 42 is more than line 36 . . . Subtract line 41 from line 38 Enter -0- if line 41 Is more than line 38 . . . 36 37 38 39 40 41 42 43 44 Caution : If there is an amount on either line 43 or line 44, you must file Form 4720 ' 4-Year Averaging Period Under Section 501(h) (Some organizations that made a section 501(h) election do not have to complete all of the five columns below. See the instructions for lines 45 through 50 on page 11 of the instructions ) Lobbying Expenditures During 4-Year Averaging Period Calendar year (or fiscal year beginning in) ► 45 Lobbying nontaxable amount 46 Lobbying ceiling amount (150% of line 45(e)) 47 Total lobbying expenditures 48 Grassroots nontaxable amount 49 Grassroots ceiling amount (150% of line 48(e)) 50 Grassroots lobbying expenditures jjQjUj U- (a) 2005 (b) 2004 (c) 2003 (d) 2002 (e) Total - , Loooying Activity Dy Nonelecting Nunllc cnarities (For reporting only by organizations that did not complete Part VI-A) (See page 11 of the inst ructions.) During the year, did the organization attempt to influence national, state or local legislation, including any Yes attempt to influence public opinion on a legislative matter or referendum, through the use of. a Volunteers b Paid staff or management (Include compensation in expenses reported on lines c through h.) c Media advertisements . . . d Mailings to members, legislators, or the public . e Publications, or published or broadcast statements . . . . . . . f Grants to other organizations for lobbying purposes . . g Direct contact with legislators, their staffs, government officials, or a legislative body In Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means i Total lobbying expenditures (Add lines c through h.) . . If "Yes" to any of the above, also attach a statement giving a detailed description of the lobbying activities No Amount Schedule A (Form 990 or 990-EZ) 2005 Schedul e A (Form 990 or 990-E Z) 2005 II 51 Pane 6 Information Regarding Transfers To and Transactions and Relationships With Noncharitable Exempt Organizations (See page 12 of the instructions.) Did the reporting organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations? Yes No a Transfers from the reporting organization to a noncharitable exempt organization of ✓ _ 51a(i) (I) Cash ✓ (il) Other assets a(H) . , . , . b Other transactions b (I) Sales or exchanges of assets with a nonchantable exempt organization ✓ b(H) (ii) Purchases of assets from a noncharitable exempt organization ✓ b(iii) (iii) Rental of facilities, equipment, or other assets ✓ b rv (Iv) Reimbursement arrangements . . ✓ b(v) (v) Loans or loan guarantees . . . . . ✓ b(vi) (vi) Performance of services or membership or fundraising solicitations _ ✓ c c Sharing of facilities, equipment, mailing lists, other assets, or paid employees d If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market value of the goods, other assets, or services given by the reporting organization If the organization received less than fair market value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received 52a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? ► ❑ Yes ❑ No Schedule A (Form 990 or 990-EZ) 2005 POPULATION REFERENCE BUREAU , IN C FYE 9/30/05 53 - 0214030 GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES FORM 990 DESCRIPTION SALES PRICE SEE ATTACHED SCHEDULE 1 1,193 ,427 1, 193,395 0 32 TO FORM 990, PART I, LINE 8d 1,193,427 1, 193,395 0 32 FORM 990 COST OR OTHER BASIS STATEMENT 2 NET GAIN OR (LOSS) EXPENSE STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE STATEMENT 3 EXPLANATION DATA Alin INNFORMATlONN FOR O TO GATHER ANALY 7 E AND DISSEMINATE POPULATION SCIENTIFIC AND EDUCATIONAL PURPOSES. POPULATION REFERENCE BUREAU, INC FYE 9/30/05 53-0214030 FORM 990 NON-GOV ERNMENT SECURITIES STATEMENT 4 DESCRIPTION VALUE TOTAL NONGOVT SECS MUTUAL FUNDS CD'S MKT MKT CORP STOCKS CORP BONDS 0 0 OTHER PUB OTHER TRA DED SECS 0 0 4,278 , 274 3,321 , 988 TOTAL TO FORM 990, LN 54, COL B FORM 990 VALUE U.S. BONDS MKT TOTAL TO FORM 990, LN 54, COL B 4,278,274 3 , 321,988 7 , 600,262 GOVERNMENT SEC U RITIES DESCRIPTION 0 U.S. GOVT STATEMENT 5 STATE GOVT 0 TOTAL GOVT 0 0 0 POPULATION REFERENCE BUREAU, INC FYE 9/30/05 FORM 990 OTHER ASSETS DESCRIPTION 53-0214030 STATEMENT 6 AMOUNT DUE FROM PRB ASSOCIATES 883,567 TOTAL TO FORM 990, LINE 58 , COLUMN B 883,567 FORM 990 OTHER LIABILITIES DESCRIPTION STATEMENT 7 AMOUNT DEFERRED DUES ACCRUED ANNUAL LEAVE IIFFFRRFII RENT 57,457 137,413 16A ') n1 TOTAL TO FORM 990 , PART IV, LINE 65, COL B 359,071 POPULATION REFERENCE BUREAU SCHEDULE OF INVESTMENTS - MARKETABLE SECURITIES 10/1/04 - 9/30/05 BALANCE MKT VAL BOUGHT SECURITIES 9/30/04 9/30/04 FY 05 SCHEDULE1 52-0214030 COST SOLD FY 05 GAIN (LOSS ) BALANCE MKT VAL 9/30/05 9/30/05 LONG TERM FUND: S & P 500 SPDR's Wash Mutual LM SIT Euro Pacific Royce Fund Bond Fund of Amer Total - Long Term 1,067,144 1,028,028 484,099 453,246 285,832 451,616 396,674 191,746 103,596 44,813 438,905 62,346 182,862 256,463 265,513 265,271 2,682,123 2,893,529 23,900 93,969 520,370 8,071 8,071 12,356 12,356 20,427 20,427 0 1,291,374 1,352,656 0 600,974 598,577 367,912 0 578,562 0 466,955 637,900 198,921 309,441 0 375,534 370,433 0 0 3,301,670 3,847,569 INTERMEDIATE TERM FUND: Cash - LM CD's Total - Intermediate 33,464 882, 968 916,432 33,465 882 ,968 916,433 175,991 215,000 215,000 497,000 957 ,968 958 ,000 672,991 1,172,968 1,173,000 SHORT TERM INVESTMENTS : INVESTMENT TOTAL 0 32 32 8,705 422,000 430,705 8,705 422,000 430,705 3,321 ,988 3 , 321,988 3,598 ,556 3, 809,962 1 ,193,361 1,193,395 1,193,427 32 7,054,363 7,600,262 POPULATION REFERENCE BUREAU, INC FYE 9/30/05 53-0214030 FORM 990, PART IV, LINE 57B DE SCRIPTION SCHEDULE2 COST ACQ METHOD YRS FURN & EQUIP LEASEHOLD 271,621 VARIOUS S/L 244,769 VARIOUS S/L TOTALS 516,390 5-10 5-10 DEPREC NET 246,331 171,028 25,290 73,741 417, 359 99,031 POPULATION REFERENCE BUREAU, INC. 1875 CONNECTICUT AVE., N.W., SUITE 520 WASHINGTON, D.C. 20009 EIN 53-0214030; FYE 9/30/05 FORM 990, PAGE 3, PART III: PROGRAM SERVICE ACCOMPLISHMENTS: SCHEDULE 3 a) COMMUNICATIONS. In fiscal year 2005 , four Population Bulletins were published: Global Demographic Divide ; Ameri ca ' s Military Population ; Global Aging: The Challenge of Success ; and New Marriages , New Families : U.S. Racial and Hispanic Intermarriage . More than 200 ,000 copies of PRB publications were distributed to audiences worldwide , and to our members and others interested in population issues-an increase of 50,000 publications over 2004 The 2005 World Population Data Sheet, PRB's most popular publication , was released at a press conference in August 2005, and hundreds of stories were published in newspapers and broadcast media around the world. For the first time, PRB provided a live webcast of the press conference . PRB's website. www.prb.org, served 2.5 million web visitors during 2005 - 1 million more visitors than in 2004 . PRB's library continued to handle information requests from jou rnalists, other libraries , and both public -sector and private-sector organizations , including NGOs, government agencies , and media . PRB also helped dozens ofjou rnalists and reporters find data and analysis on a wide range of population topics, including U.S. population trends , immigration , HIV/AIDS, and reproductive health. b) INTERNATIONAL. In fiscal year 2005, with funding from USAID and other organizations , staff in PRB ' s International Programs continued to facilitate the Women's Edition network for senior- level women jou rnalists ; wrote and disseminated three policy briefs to enhance understanding of marriage , family law, and reproductive health in the Middle East and North Africa ; and, through a partnership with USAID' s Interagency Working Group , published a CD-ROM "Abandoning Female Genital Mutilation/Cutting: Information from Around the World ." With funding from the Bill & Melinda Gates Foundation, PRB developed materials to provide information on communi ty-based strategies to promote healthy behavior, and several Web-exclusive articles on global health. We also continued to expand the electronic library represented by InfoShare, a database of documents supplied by 127 member organizations (expanded from 60 in 2003 ) working in reproductive health and child health , HIV/AIDS, and population. PRB helped establish a Population Health and Environment coalition in the Philippines, and participated in an International Earth Day Celebration in Manila. POPULATION REFERENCE BUREAU FYE 9/30/05 SCHEDULE 3 53-0214030 c) DOMESTIC. In fiscal year 2005, the staff in Domestic Programs worked on projects related to three continuing themes: Children and Families, Population Aging, and Public Information on Population Research. PRB also obtained funding to launch three new projects: The Scientific and Engineering Workforce, The Well-Being of Immigrant Children, and Dissemination of Research on the Demography and Economics of Aging. PRB expanded its work on the KIDS COUNT project, funded by the Annie E. Casey Foundation, designed to call attention to U.S children's issues. We provided technical assistance to their network of child advocacy organizations, and continued to publish working papers that describe social and demographic trends in the United States, using data from Census 2000. We obtained funding from a different part of the Annie E. Casey Foundation to launch a new project to develop key indicators of the well-being of immigrant children. In addition, PRB publicized research from the journal Demography through the Center for Public Information on Population Research, funded by the National Institute of Child Health and Hnman Development (NICHD) PRR also continued its popular monthly policy seminars, which give audiences a chance to hear experts analyze important demographic topics. We held a symposium on immigration in September, and posted a Webcast of the speakers' presentations. POPULATION REFERENCE BUREAU 53-0214030 ; FYE 9/30/05 SCHEDULE 4 PRB BOARD OF TRUSTEES September 2005 *Patty Perkins Andringa Consultant and Facilitator 9122 Kittery Lane Bethesda, MD 20817 Tel: (301) 365-5672 Fax: (301) 365-0815 *Michael P. Bentzen Hughes & Bentzen, PLLC 1100 Connecticut Avenue, Suite 340 Washington, DC 20036 Tel: (202) 293-8975 C: (703) 217-5291 Fax: (202) 293-8973 E-mail: mbentzen(a)aol.com Home: 1050 N. Stuart, Apt. 504 Arlington, VA 22201 Tel: Tel: (703) 248-9181 *William P . But7_ President Population Reference Bureau TPl (7(171 9 t9-54UQ 1875 Connecticut Avenue, Suite 520 Washington, DC 20009 Joel E. Cohen Professor Laboratory of Populations Rockefeller University & Columbia University 1230 York Avenue, Box 20 New York, NY 10021-6399 Fax: (202 328-3937 E-mail: bbutz6Dprb.org Home Tel: (301) 946-5934 Tel: (212) 327-8883 Fax: (212) 327-7974 Email: cohen@rockefeller.edu *Bert T. Edwards Executive Director Office of Historical Trust Accounting Department of the Interior 1801 Pennsylvania Avenue, NW Suite 500 Washington, DC 20006 Tel: (202) 327-5300 Fax: (202) 327-5375 E-mail (W): Bert Edwards(iDios.doi.gov E-mail (H): BertTEdwards(a),verizon.net Home: 309 Casey Lane Rockville, MD 20850-4733 Home Tel: 301-838-3105 Home Fax: 301-838-3152 Wray Herbert Assistant Managing Editor U.S. News & World Report 1050 Thomas Jefferson Street NW Washington, DC 20007 Tel: (202) 955-2000 Fax: (202) 955-2634 E-mail: (H) wrayherbert cgmail.com Home: 3609 38th Street, NW, #310 Washington, DC 20016 Home Tel: 202-362-5691 *Member of Executive Committee *Richard F. Hokenson, Treasurer Hokenson & Company 51 Gervin Road Lawrenceville, NJ 08648 E-mail: rhokenson@hokenson.biz Home: 51 Gervin Road Lawrenceville, NJ 08648 Tel: (609) 888-5101 Cell: (609) 516-7780 Fax: (609) 716-1425 Netherlands Richard Hokenson Guido Gezellelaan 79 5051 MK Goirle The Netherlands Tel: 011-31-13-530-2936 Fax: 011-31-84-741-1989 James H. Johnson Jr. Distinguished Professor Kerar. Flagler Business School University of North Carolina at Chapel Hill CB#3440, Kenan Center Chapel Hill, NC 27599-3440 Tel: (919) 962-2214 Fax: (919 962-8202 E-mail: Jim_Johnson;_ unc.edu Wolfgang Lutz Professor and Leader World Population Project International Institute for Applied Systems Analysis (IIASA) Room S26 A-2361 Laxenburg, Austria Tel: 43-2236-807-294 Fax: 43-2236-71313 Email: lutz(c@iiasa.ac.at Elizabeth Maguire President and CEO Ipas 143 Graylyn Drive Chapel Hill, NC 27516 Tel: (919) 967-7052 Fax: (919) 929-0258 Email : ma uirel (a-ipas.org Home : 919-960-4503 Faith Mitchell Senior Program Officer The Institute of Medicine National Academies 500 Fifth Street, NW Washington , DC 20001 Tel: (202) 334-3352 Fax: (202) 334-1329 Email: FMitchell (a-)nas.edu *Terry D. Peigh , Vice Chair Executive Vice President and Director of Corporate Operations Foote, Cone and Belding 101 East Erie Street Tel: (312) 425-5204 Fax: (312) 425-6871 E-mail: tpeigh a,fcb.com *Member of Executive Committee Chicago, IL 60611-2897 *Douglas Richardson, Chair Executive Director Association of American Geographers 1710 Sixteenth Street, NW Washington , DC 20009 Tel: (202) 234-1450 Fax: (202) 234-2744 E-mail: drichardson (c)aag.org Gary B. Schermerhorn Managing Director of Technology Goldman , Sachs and Company 30 Hudson Street , 23rd Floor Jersey City, NJ 07302 Tel: (212) 902-3662 Fax: (212) 428-9672 E-mail: gary.schermerhorn () sg com *Barbara Boyle Torrey, Secretary Visiting Scholar Population Reference Bureau 1875 Connecticut Avenue, NW, Ste. 520 Washington, DC 20009 Tel: (202) 939-5455 Fax: (202) 328-3937 E-mail: btorrey�aprb.org Home: 6204 Ridge Drive Bethesda, MD 20816 Home Tel: 301-320-5812 Leeia Visaria Professor Gujarat Institute of Development Research Gota, Ahmedabad 380 060 Gujarat, India tel: 91 271 % 242366 Fax: 91 2717 242365 E-mail: visaria (c�gidr.ac.in *Montague Yudelman Senior Fellow World Wildlife Fund 1h 125024 Street, NW Washington, DC 20037 Tel: (202) 965-4642 Fax: (202) 965-4642 E-mail: zintalmy�a),aol.com Home: 3108 Garfield Street, NW Washington, DC 20008 *Member of Executive Committee