Global Steel and Mining Conference ArcelorMittal Presentation

advertisement

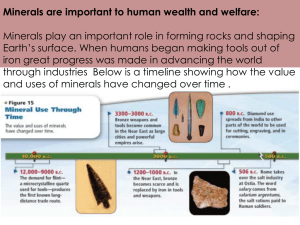

Global Steel and Mining Conference 2013 A platform for value creation Aditya Mittal, Chief Financial Officer 18-19 September 2013 Disclaimer Forward-Looking Statements This presentation may contain forward-looking information and statements about ArcelorMittal and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “target” or similar expressions. Although ArcelorMittal‟s management believes that the expectations reflected in such forward-looking statements are reasonable, investors and holders of ArcelorMittal‟s securities are cautioned that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and generally beyond the control of ArcelorMittal, that could cause actual results and developments to differ materially and adversely from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the filings with the Luxembourg Stock Market Authority for the Financial Markets (Commission de Surveillance du Secteur Financier) and the United States Securities and Exchange Commission (the “SEC”) made or to be made by ArcelorMittal, including ArcelorMittal‟s Annual Report on Form 20-F for the year ended December 31, 2012 filed with the SEC. ArcelorMittal undertakes no obligation to publicly update its forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures This presentation may contain supplemental financial measures that are or may be nonGAAP financial measures. Definitions of such supplemental financial measures and a discussion of the most directly comparable IFRS financial measures can be found on ArcelorMittal's website at http://www.arcelormittal.com/corp/investors/presentations/. 1 Takeaways • ArcelorMittal retains the core attributes to deliver value through the cycle • The balance sheet is repositioned • Our West European business is optimised and delivering improved results • We are focussed on protecting our global cost position with a new $3bn Management Gains program by end 2015 • Mining growth capex now delivering growth volumes • Concentrating our investments to protect and expand our “franchise businesses” such as Global autos, Mining and Brazil • We have a roadmap to normalised EBITDA of $150/t ArcelorMittal: the industry leader with a global presence backed by raw materials 2 Progress • Safety improvement • Balance sheet repositioned Focus • Footprint optimisation • Cost improvement • Franchise development Outlook • Roadmap to $150/t EBITDA 3 Progress Improving LTIF rate reflects group-wide focus on Safety Health and safety frequency rate* for mining and steel • Significant improvement in injury frequency reflects a Group-wide focus on safety 3.1 2.5 1.9 • The Group‟s focus is now on further reducing severity and fatality rates 1.8 2013 target 1.4 1.0 1.0 2007 2008 2009 2010 2011 2012 0.9 0.9 1Q 2013 2Q 2013 Safety of our employees remains the No1 priority LTIF = Lost time injury frequency defined as Lost Time Injuries per 1.000.000 worked hours; based on own personnel and contractors 4 Balance sheet repositioned Progress Net debt progression $billion -8.7 25 20 15 24.9 21.8 10 18.0 16.2 15.0 Medium term target 5 0 Net debt/LTM EBITDA* 3Q‟11 4Q‟12 1Q‟13 2Q‟13 2.3x 2.8x 2.5x 2.6x Significant net debt reduction achieved medium term target of $15bn * Ratio of Net debt/LTM EBITDA is based on last twelve months reported EBITDA. Figures based on recast EBITDA as per new accounting standards adopted. 5 Progress • Safety improvement • Balance sheet repositioned Focus • Footprint optimisation • Cost improvement • Franchise development Outlook • Roadmap to $150/t EBITDA 6 German IFO reading Signs that Europe was returning to “crisis” prompted internal reassessment 60 55 50 Asset Optimisation announced 45 40 35 Nov-12 Jul-12 Mar-12 Nov-11 Jul-11 Mar-11 Nov-10 Jul-10 Mar-10 Nov-09 Jul-09 Mar-09 Nov-08 Jul-08 Mar-08 Nov-07 30 Jul-07 • We responded quickly to the deepening crisis in Europe • We responded appropriately by seeking to remove unproductive capacity through Asset Optimization • We have maintained our course, taking those actions necessary to protect our business • $1bn targeted savings achieved Mar-07 Focus Footprint optimisation creates value Management responded quickly and decisively to the deepening crisis in Europe 7 – Dunkirk – Ghent – Bremen – FOS – Asturias New “Footprint” in Western Europe*: # Blast furnaces # Hot strip mills # Cold rolling mills • Idled least competitive rolling & coating lines • Asset optimization ensures FCE achieves: – Savings through fixed cost removal – Well loaded assets with stable working points Lower variable cost Lower and more stable working capital requirements Better service and quality Reduce capex requirements 2011 15 8 18 2013 11 7 16 Working Cap needs • Concentrated slab production in 5 coastal sites: Transformation costs Focus Western Europe Footprint now Optimised Post optimization: FCF positive in current market environment * Note: this is the prospective footprint once all proposals implemented 8 Relentless cost focus – new $3bn cost improvement underway Focus New $3bn management gains program ($ billion) Annualized savings 3.0 Savings targets 2Q 13 achieved 2.0 3.0 1.0 Bottom up plan across the group Leveraging extensive benchmarking opportunities within the group Improvements in reliability, fuel rate, yield, productivity, etc. 2.0 0.4 0.6 2013F 2014F 2015F Business units plans rolled out and key personnel accountable for delivery Gap analysis completed in 2012 defined the priorities for 2013-2015 plan 9 Focus Steel capex must be disciplined in order to create value • The economics of building new steel capacity have not changed ArcelorMittal growth capex split – Typical Greenfield capacity would require $250 EBITDA/t to deliver 15% post tax ROI – Margins need to improve before new capacity is built outside China – As a result we expect ex-China capacity growth to lag growth in demand • We must be disciplined in allocating capital to growth in steel • Our focus is to back our franchise businesses to protect our developed market position and expand in new markets e.g. Autos and Brazil 2010A 2011A Steel 2012A 2013F Mining We continue to have options to invest in steel growth and create value 10 • The growth plan to 84Mt own capacity is on track • AMMC expansion from 16Mt to 24Mt ramping up • Sale of 15% stake in AMMC for crystallizes value that is to be re-invested in the growth plan • $1.1bn represents ~75% of required capex to add 15Mt of concentrate capacity in Liberia • Liberia Phase 1 achieving production and shipment records in 2013 Own iron ore growth plan – production and capacity (Mt) 84 54 56 2011 2012 CAPACITY Focus Mining expansions now delivering growth and value 49 2010 2013 2015 The Group‟s progress on deleveraging has not come at the expense of the Group‟s Mining growth plans Capex investments made in 2011/12 now driving shipment growth in 2013/14 11 Focus Automotive steel is a franchise business: we will invest • ArcelorMittal is the leading supplier to the automotive industry • We will continue to invest in R&D to stay ahead of the product development curve • We will increase participation in emerging markets to maintain global market share Market share* – Automotive Steel (indexed 2008 = 100) ArcelorMittal JV partnership in China 120 • 110 Overall market share growing in US and stable in EU • 100 90 US 80 2008 2009 2010 2011 EU 2012 Market share* – Advanced High Strength Steels (indexed 2008 = 100) 130 120 Share of fast-growing HSS market has increased since 2008 110 100 90 US 80 2008 2009 2010 2011 EU 2012 China‟s automotive market expected to grow by >50% to ~25mn vehicles by 2018** ArcelorMittal to participate in this market by: JV with Hunan Valin (VAMA) Expansion of exports of auto steel into China Local presence of commercial and technical teams VAMA: 1.5Mtpa facility due to start production in 2015. Main components are state-of-theart pickling tandem CRM, continuous annealing line and hot dip galvanizing line We will continue to invest to protect and grow our Automotive steel franchise * Based on ArcelorMittal estimates; Regional ArcelorMittal Auto market intelligence; LMC auto/CSM ** Source: LMC auto 12 Progress • Safety improvement • Balance sheet repositioned Focus • Footprint optimisation • Cost improvement • Franchise development Outlook • Roadmap to $150/t EBITDA 13 Outlook Demand prospects improving • Leading indicators have rebounded early 2H‟13, particularly in developed markets. AM weighted global PMI highest since 1H‟11 • US manufacturing up y-o-y having stabilised during H1‟13. However, Aug PMI suggests rising output in H2‟13 supported by robust automotive sales and rising manufacturing orders 55 Expansion • 2H2‟13 outlook improving with Czech Republic, Poland & UK PMI >50. Eurozone PMI at 51.4 the highest since June‟11, albeit only modestly expanding 60 Contraction • European manufacturing output began to increase in 2Q‟13, with June‟13 output up yo-y, the first time since 2011 ArcelorMittal weighted global manufacturing PMI* 50 45 40 • Chinese industrial output growth slowed during Q2‟13 but output growth rebounded in July‟13 and PMI moved back above 50 Jan-06 May-06 Sep-06 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 35 Global indicators signal improved 3Q‟13 growth particularly in developed markets Source: *Markit. ArcelorMittal estimates 14 Outlook Prices supported by low inventories & recovering raw materials Key benchmark HRC prices ($/tonne)* 1300 China domestic Shanghai (Inc 17% VAT) N.America FOB Midwest N.Europe domestic ex-works 1200 1100 130 120 110 100 90 80 70 60 50 40 30 Spot Iron Ore Coaking Coal Scrap Jan 08 Apr 08 Jul 08 Oct 08 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10 Oct 10 Jan 11 Apr 11 Jul 11 Oct 11 Jan 12 Apr 12 Jul 12 Oct 12 Jan 13 Apr 13 Jul 13 1000 Key raw material prices (index 1H 2008=100)* 900 US service centre inventories (000 MT) 800 3.6 14000 700 12000 10000 600 USA (MSCI) Months Supply 2.8 6000 2.6 4000 2.4 2000 2.2 0 2 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Apr 11 Jul 11 Oct 11 Jan 12 Apr 12 Jul 12 Oct 12 Jan 13 Apr 13 Jul 13 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10 Oct 10 Jan 11 Jan 08 Apr 08 Jul 08 Oct 08 400 3.2 3 8000 500 3.4 Destocking in Q2‟13 has provided stronger foundations for 2H‟13 * Source: SBB; prices are monthly average 15 Outlook 2H‟13 should be significantly better than 2H‟12 • We are guiding to FY‟13 EBITDA greater than $6.5bn • This implies 2H‟13 EBITDA at or above 1H‟13 levels • This is contrary to the normal “seasonal” pattern of EBITDA… • … and very different to the experiences of 2011 and 2012 where 2H EBITDA was significantly lower than 1H levels • 2H EBITDA at or above $3.2bn would compare to an underlying level of $2.3bn* in 2H 2012 We continue to believe that 2H‟12 represents the low point in this cycle * 2H 2012 reported EBITDA of $3.0bn includes $0.7bn one-off adjustments including gains from CO2 sale, Paul Wurth divestment and DDH income offset by USW labour agreement adjustment. The underlying 2H 2012 EBITDA is therefore $2.3bn. 16 Outlook Roadmap back to normalised profitability $150/t • If steel shipments increase by ~15% then we believe $150/t EBITDA is achievable • Driven by: – Leverage to incremental volumes ($200250/t margin on incremental tonne given limited additional fixed cost) – Cost benefits from Asset Optimisation (completed $1bn sustainable savings) – Cost benefit from new $3bn Management gains 2013-2015 – Execution of mining growth plan (+28MT new production capacity by 2015) – Offsetting impact of lower iron ore price – Improved industry utilization rates driving higher margins and profitability Management Gains (cost cutting) Steel Volume Recovery Mining Volume Growth Asset Optimization Average EBITDA/tonne 2010-2012* $90/t We believe EBITDA/tonne of $150 is an achievable normalized target * Note: EBITDA is underlying number excluding one-time items, CO2 gains and DDH 17 ArcelorMittal is in a position of strength to capitalise on opportunities & deliver value Cost competitive assets Exposed to fastest growing markets Industry leading returns World-class mining business Leading supplier to automotive industry Components are in place to deliver industry leading returns and value 18 Q&A 19 Strategy 20 ArcelorMittal‟s strategy Our strategy is to leverage our distinctive attributes that enable us to achieve a leading position in the most attractive components of the steel value chain In steel, capture a leading position in attractive businesses by leveraging our technical capabilities and global scale and scope • Be the supplier of choice for customers who value distinctive products and services • Grow in markets with attractive structures • Minimize costs in commodity businesses to lower risks and capture boom-market potential Enablers A clear licence to operate In operations, achieve bestin-class competitiveness by leveraging our technical capabilities and diverse portfolio of assets and businesses • Be the safest • Concentrate production at the best assets and run them well • Be cost competitive by benchmarking, sharing best practices, and investing to optimize our multi-site footprint • Innovate (product/process) A strong balance sheet An effective organisational structure In mining, grow a world-class business utilising our financial strength and diverse portfolio of assets and businesses • Invest to expand output at Tier I and Tier II assets • Optimize the value proposition associated with our products‟ value in use • Be the supplier of choice for a balanced mix of internal and external customers • Provide a natural hedge against market volatility and potential oligopolies Active portfolio management The best talent French Media Day - Sept 2013 Positioned for industry-leading returns and value • A global champion well positioned for new market opportunities and servicing globalising customer industries Leading market position in developed world Access to high growth markets Ability to service global customers Diversified Leading supplier to premium markets Leading supplier to high-growth markets Significant self sufficiency in raw materials Higher and more stable returns through the cycle Access to own raw materials ArcelorMittal: the industry leader with a global presence backed by raw materials 22 Focussing on value drivers New $3bn management gains plan Cost Leadership Product Leadership Improved EBITDA/tonne ($150/t normalised target) Best-in-class service Portfolio Optimisation Returns > WACC Capital Efficiency Focussed investment Focussing on “Franchise” businesses All levels of ArcelorMittal aligned with one goal improved returns on Capital 23 Focussed capital allocation • We are backing our franchise businesses with capital Franchise steel Approximate EBITDA split: 55% of steel shipments from businesses identified as “Franchise” e.g. • Global Autos, • Brazil long, • Sheet Piles “Franchise” businesses contribute 80% of “steel EBITDA Other steel Mining Non-Franchise Other steel Franchise Steel shipment split: Capital priority Invest to protect and expand Focus on cost cutting and optimisation Franchise steel Franchise businesses are receiving the required capital to protect and expand 24 Cost cutting is in our DNA • In addition to the >$1.6bn merger synergies achieved • A further $4.8bn of “Management Gains” have been achieved Management gains savings plan achieved since 2008 (USD billion annualized) Variable cost savings breakdown 4.8 Other 35% Variable cost Fixed cost 37% Yield 3.4 9% Energy Fixed cost per ton (index 100 = 2008)* Productivity 100 110 80 100 90 60 80 40 70 20 0 60 2008 2009 shipments 2010 2011 19% 2012 Fixed cost per tonne lower than 2008 levels despite lower shipments 50 Fixed cost per ton Focus on achieving internal best practice remains a source of opportunity * On actual dollar basis and excludes mining 25 Cost improvement underway New $3bn management gains program ($ billion) Annualized savings 3.0 Savings targets Gap Analysis for Cost Savings per Main Drivers Others Yield 2Q 13 achieved 28% 29% 2.0 3.0 1.0 0.4 • • • • • 22% 2.0 Productivity Energy 0.6 2013F 21% Gap Analysis for Cost Savings by Process 2014F 2015F Bottom up plan across the group 2/3 variable cost and 1/3 fixed cost focussed Improvements in reliability, fuel rate, yield, productivity etc Business units plans rolled out and key personnel accountable for delivery Leveraging extensive benchmarking opportunities within the group Others Cold rolling mill & HDG Sinter & BF 11% 10% 34% 20% Hot strip mill 25% Steel shop Gap analysis completed in 2012 defined the priorities for 2013-2015 plan 26 Capex and growth plans • STEEL • Most steel growth capex remains temporarily suspended • Monlevade expansion project in Brazil restarted in 2 phases: – – Phase 1 focuses on downstream facilities: • a new wire rod mill in Monlevade (additional capacity of 1050 ktpy of coils) with capex estimate of $140m; • Juiz de Fora rebar capacity increase from 50 to 400 ktpy and meltshop capacity increase by 200 ktpy with capex estimate of $40m Phase 2 will focus on the upstream facilities in Monlevade (sinter plant, blast furnace and melt shop – additional crude steel capacity of 1.2mtpa). Restart decision to be taken in future . MINING • AMMC: Expansion from 16mtpa iron ore to 24mtpa by 2013 – completed 1H‟13. Capex of $1.6bn • AMMC: Further expansion to 30mtpa iron ore under study • Liberia: Phase 2 project underway for 15mtpa premium sinter feed to replace 4Mtpa DSO by 2015. • Baffinland: Early Revenue Phase (ERP) underway: 3.5mtpa production capacity by 2015 Upgrade railway line linking mine to port in Liberia Capex focus remains on iron ore growth plan 27 Market outlook 28 Outlook and guidance framework – In line with our guidance framework, underlying profitability is still expected to improve in 2013, driven by three factors: a) a 1-2% increase in steel shipments; b) an approximate 20% increase in marketable iron ore shipments; and c) the realized benefits from Asset Optimization and Management Gains initiatives – Nevertheless, due largely to lower than forecast apparent demand and lower than anticipated raw material prices, the Company now expects to report 2013 EBITDA greater than $6.5 billion – Due to an expected investment in working capital and the payment of the annual dividend, net debt is expected to increase in 2H 2013 to approximately $17 billion; the $15 billion medium term net debt target is unchanged – 2013 capital expenditures are now expected to be approximately $3.7 billion The Company expects to report FY 2013 EBITDA greater than $6.5 billion 29 Strong rise in developed markets indicators • Leading indicators have rebounded early 2H‟13, particularly in developed markets. AM weighted global PMI highest since 1H‟11 • US manufacturing up y-o-y having stabilised during H1‟13. However, Aug PMI suggests rising output in H2‟13 supported by robust automotive sales and rising manufacturing orders 55 Expansion • 2H2‟13 outlook improving with Czech Republic, Poland & UK PMI >50. Eurozone PMI at 51.4 the highest since June‟11, albeit only modestly expanding 60 Contraction • European manufacturing output began to increase in 2Q‟13, with June‟13 output up yo-y, the first time since 2011 ArcelorMittal weighted global manufacturing PMI* 50 45 40 • Chinese industrial output growth slowed during Q2‟13 but output growth rebounded in July‟13 and PMI moved back above 50 Jan-06 May-06 Sep-06 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 35 Global indicators signal improved 3Q‟13 growth particularly in developed markets Source: *Markit. ArcelorMittal estimates 30 Inventory levels during 2Q‟13 US service centre total steel Inventories (000 MT) Europe service centre inventories (000 MT)* 3.6 Mo n th s S u p p ly 3.4 2200 3.2 12000 2000 3 10000 2.8 1800 2.6 1600 2.4 1400 1200 3.2 2.8 2.6 2.2 4000 2.4 2 2000 2.2 0 China service centre inventories (Mt/mth) with ASC% Brazil service centre inventories (000 MT) Flat stocks at service centres Months of supply (RHS) 1,300 1,200 1,100 1,000 900 800 700 4.5 22 20 4.0 18 16 3.5 14 3.0 12 10 2.5 8 600 500 2.0 400 1.5 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 2 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Nov-12 Jun-12 Jan-12 Aug-11 Mar-11 Oct-10 May-10 Dec-09 Jul-09 Feb-09 Sep-08 Apr-08 Nov-07 Jun-07 Jan-07 3.4 3 6000 1.6 1,400 USA (MSCI) Months Supply 8000 1.8 1000 3.6 14000 Flat and Long % of ASC (RHS) 6 4 2 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 2400 EU (EA S S C) Inventory drawdown in US and China during 2Q‟13 * Europe inventory updated data not available. Latest data point December 2012 31 Raw material prices have strengthened Spot iron ore, coking coal and scrap price (index IH 2008=100)* Regional steel price HRC ($/t)* 130 Spot Iron Ore Coaking Coal Scrap 120 110 1300 China domestic Shanghai (Inc 17% VAT) N.America FOB Midwest N.Europe domestic ex-works 1200 1100 100 1000 90 900 80 800 70 700 60 Apr 11 Jul 11 Oct 11 Jan 12 Apr 12 Jul 12 Oct 12 Jan 13 Apr 13 Jul 13 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10 Oct 10 Jan 11 400 Apr 11 Jul 11 Oct 11 Jan 12 Apr 12 Jul 12 Oct 12 Jan 13 Apr 13 Jul 13 30 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10 Oct 10 Jan 11 500 Jan 08 Apr 08 Jul 08 Oct 08 40 Jan 08 Apr 08 Jul 08 Oct 08 600 50 Raw material prices have rebounded from end 2Q‟13 lows * Source Steel Business Briefing. Note prices shown reflect average of the latest month: 32 Global apparent steel consumption +55% China +4.5 to +5.5% +2% 700 EU27 -30% -1.5 to -2.5% 200 600 180 500 160 -9% 140 400 120 300 100 200 80 100 60 0 40 2007 2008 2009 2010 2011 2012 2013F NAFTA 2007 2008 2009 2010 2011 2012 2013F Rest of World +9% 160 -8% +1% +7% 140 120 100 80 60 40 2007 2008 2009 2010 2011 2012 2013F +2% +4% 550 500 450 400 350 300 250 200 150 100 50 2007 2008 2009 2010 2011 2012 2013F Global ASC growth of +1.6% 2012; estimated 2013 ASC growth of ~3% ArcelorMittal estimates; 2013 figures shown mid range expectations 33 2Q‟13 apparent demand growth driven by robust China demand Global apparent steel consumption (ASC)* (million tonnes per month) 60 US and European apparent steel consumption (ASC)** (million tonnes per month) Developing ex China China Developed 55 17 50 15 45 13 40 11 35 9 30 7 • • • • Global ASC +2.7% in 2Q‟13 vs. 1Q‟13 Global ASC +3.1% in 2Q‟13 vs. 2Q‟12 China ASC +2.2% in 2Q‟13 vs. 1Q‟13 China ASC +8.2% in 2Q‟13 vs. 2Q‟12 EU27 • • • • May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 USA May-07 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 3 Sep-07 15 May-07 5 Jan-07 20 Jan-07 25 US ASC +1.3% in 2Q‟13 vs. 1Q‟13 US ASC -5.6% in 2Q‟13 vs. 2Q‟12 EU ASC +0.3% in 2Q‟13 vs. 1Q‟13 EU ASC -4.1% in 2Q‟13 vs. 2Q‟12 Europe and US declined YoY in 2Q; developed market growth expected in 2H‟13 * ArcelorMittal estimates ** AISI, Eurofer and ArcelorMittal estimates 34 US construction improving; Europe beginning to stabilise US residential and non-residential construction indicators (SAAR) $bn* • Pickup in USA strengthening – US residential construction continues to grow strongly (up 20% y-o-y Jan-July‟13). Housing permits back to highest level since H1‟08, underpinned by home sales at H1‟07 levels 750 700 650 600 550 500 450 400 350 300 250 200 – Public non-residential output declining, private slowly improving; Architectural Billings index (ABI) remains >50 suggesting pickup into 2014 Residential • In Europe, weak demand continues to impact construction, but output stabilising Sep-13 Feb-13 Jul-12 Dec-11 May-11 Oct-10 Mar-10 Aug-09 Jan-09 Jun-08 Nov-07 Apr-07 Sep-06 Feb-06 Jul-05 Dec-04 May-04 Oct-03 Mar-03 Aug-02 Jan-02 Non-residential – Construction PMI almost 48 suggesting output continues to contract but at a reduced rate Expansion Eurozone and US construction indicators** 65 Eurozone construction PMI 60 USA Architectural Billings Index – German construction output rebounded in 2Q‟13 from weather related 1Q‟13 weakness, supported by strong labour and residential markets 55 50 – Construction markets in South continue to be weak, with double digit declines in 1H‟13 in Greece, Italy and Portugal 40 35 Jul-13 Feb-13 Sep-12 Apr-12 Nov-11 Jun-11 Jan-11 Aug-10 Mar-10 Oct-09 May-09 Dec-08 Jul-08 Feb-08 Sep-07 Apr-07 Nov-06 Jun-06 30 Jan-06 Contraction 45 – Official data indicates construction stabilised in Q2‟13 over 1Q‟13, but steel intensity declines due to increased share of renovation US residential construction improving, early signs of stabilisation in Europe * Source: US Census Bureau ** Source: Markit and The American Institute of Architects 35 Chinese steel demand recovery in 3Q‟13 China infrastructure investment 3mma* (Y-o-Y) 75% • Recent data shows industrial output slowed in 2Q‟13 to 9.1% y-o-y (4Q‟12 +10%) impacted by weaker exports. However, growth in July has rebounded and PMI signal a recovery in 3Q‟13 • Infrastructure investment growth continues to be robust but we expect growth to slow into 2014 • Rebound in newly started construction has picked-up pace with starts up 16.7% y-o-y in 3 mths to July as strong residential sales have cut developers inventory and improved cash flows • Flat products demand is robust, despite shipping weakness, as both automotive and domestic appliances grow strongly • Despite high 1H‟13 steel production, steel inventory particularly longs, has declined due to seasonality, down y-o-y in August • Mill inventories have declined as well, as demand has improved, supporting stronger steel production during 2H‟13 than previously expected 60% 45% 30% 15% 0% Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 -15% 100 Steel inventory at warehouses (RHS) Crude steel finished production and inventory (mmt)** 90 Finished steel production (LHS) 80 Steel inventory at mills (RHS) 21 18 70 15 60 12 50 9 40 30 6 20 3 10 Jul-13 Apr-13 Oct-12 Jan-13 Jul-12 Apr-12 Jan-12 Jul-11 Oct-11 Apr-11 Jan-11 Jul-10 Oct-10 Apr-10 Jan-10 Jul-09 Oct-09 Apr-09 Jan-09 Jul-08 Oct-08 Apr-08 Jan-08 Jul-07 Oct-07 Apr-07 0 Jan-07 0 Underlying demand robust in China, supporting elevated production levels * Mma refer to months moving average ** Source: China Iron and Steel Association: Steel inventory in warehouse in 35 cities; steel inventory in 70 mills 36 Balance Sheet 37 Cash flow priorities Maintain competitive position Fund Mining growth plan Reduce NFD to target level Strong operations with sustainable balance sheet Increase Dividends Increase CAPEX Further reduce NFD Dividends and growth capex will only be increased further once NFD ≤$15bn 38 Balance sheet structurally improved Average maturity (years) Net debt ($ billion) 32.5 6.4 -50% 16.2 2.6 3Q 2008 Liquidity ($ billion) 2Q 2013 16.9 3Q 2008 2Q 2013 Bank debt as component of total debt* (%) 84% 12.0 10% 3Q 2008 2Q 2013 3Q 2008 2Q 2013 Balance sheet fundamentals improved * ArcelorMittal estimates 39 Deleveraging progress Net debt progression $billion -8.7 25 20 15 24.9 21.8 10 18.0 16.2 15.0 Medium term target 5 0 Net debt/LTM EBITDA* 3Q‟11 4Q‟12 1Q‟13 2Q‟13 2.3x 2.8x 2.5x 2.6x Significant net debt reduction achieved medium term target of $15bn * Ratio of Net debt/LTM EBITDA is based on last twelve months reported EBITDA. Figures based on recast EBITDA as per new accounting standards adopted. 40 Liquidity and debt maturity profile Liquidity at June 30, 2013 ($ billion) Debt maturities ($ billion) 16.9 12 10.1 10 Unused credit lines 10.0 8 6 3.5 4 Cash 6.9 1.4 0.8 0.1 0.5 Liquidity at 30/6/13 2.7 2.5 2015 2016 Short term & others Commercial paper 2 2.9 1.4 Bonds Debt due in 2013 0 2013 2014 Commercial Paper Other 2017 Convertibles >2017 Bonds Liquidity lines: Debt maturity: Ratings • $4bn syndicated credit facility matures 06/05/15 • $6bn syndicated credit facility matures 18/03/16 • Continued strong liquidity • Average debt maturity 6.4 years • S&P – BB+, negative outlook • Moody‟s – Ba1, negative outlook • Fitch – BB+, stable outlook Continued strong liquidity position and average debt maturity of 6.4 years 41 Working capital is fuel for our business OWCR and rotation days* ($ billion and days) 28 24 Working capital ($ billion) - LHS Rotation days - RHS • Current working capital at low levels 90 20 16 120 55 60 • 55 days is record low 12 8 30 4 0 1Q 07 2Q 07 3Q 07 4Q 07 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 0 • Expectation that 3Q‟13 levels to increase due to seasonal factors • We will invest in working capital as required – Higher sales volumes requires more working capital (but same days) – Days can be impacted by price Business will invest in working capital as conditions necessitate * Rotation days are defined as days of accounts receivable plus days of inventory minus days of accounts payable. Days of accounts payable and inventory are a function of cost of goods sold of the quarter on an annualized basis. Days of accounts receivable are a function of sales of the quarter on an annualized basis. 42 Asset disposal program • Asset sales of $4.2 billion* since Sept 2011 (non-comprehensive list): MacArthur Coal and BNA stake disposals, $0.9 billion in 4Q‟11 Erdemir: 1/4 of 25% stake sold raising $264 million cash in 1Q‟12 Skyline: sale to Nucor of 100% of ArcelorMittal‟s stake in Skyline Steel‟s operations in NAFTA/Caribbean for $684 million in 2Q‟12 Enovos: sale to AXA of 23.5% interest for €330 million (Initial 50% payment received in 3Q‟12 with balance (+ interest) over subsequent periods) Paul Wurth**: sale to SMS Holding of 48.1% interest for €300 million Kalagadi: agreed sale of 50% stake for R3.9 billion (approximately $460 million) AMMC: agreed sale of 15% stake with off take agreement to Posco and China Steel for $1.1 billion Reduced ownership of Baffinland to 50% with Nunavut Iron ore increasing its share of funding for the project Asset sales of $4.2 billion since September 2011 * Includes Macarthur, Boasteel-NSC/Arcelor (BNA) Automotive, Erdemir, Skyline, Enovos, Kalagadi, AMMC and Paul Wurth . ** Paul Wurth divestment had $70 million impact on ArcelorMittal net debt as sale cash proceeds were more than offset by the deconsolidation of Paul Wurth‟s cash balance minus its debt on balance sheet . Paul Wurth‟s cash balance primarily represented customer advances held by customers of Paul Wurth. 43 China 44 China‟s steel demand following precedents Economic development is characterized by strong, early phase steel demand growth – China is no different Cumulative crude steel apparent consumption (kg/capita) 40000 Germany 35000 30000 USA 25000 S. Korea France 20000 15000 10000 China 5000 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 1945 1940 1935 1930 1925 1920 1915 1910 1905 1900 0 China steel demand grwoth is sustainable near term Note: Between 1900 and 1949 crude steel production per capita as approximation for demand as no data available Sources: WSA for crude steel ASC; IHS Global Insight and UN Data statistics for population; ArcelorMittal Corporate Strategy team analysis 45 Steel demand growth rates in China have trended down China annual growth rates of GDP and ASC (apparent crude steel consumption), (%) Ratio ASC/GDP Growth (LHS) ASC growth (RHS) The announced slowing of China‟s GDP growth rate is consistent with 12th 5-Year Plan 14.2% Real GDP growth (RHS) 3.5 35 3 30 2.5 25 12.7% 11.3% 10.5% 9.6% 2 20 1.5 15 1 10 0.5 5 0 0 2001 2002 2003 2004 2005 2006 2007 '08/09 2010 2011 2012 2013F 9.3% 9.2% 7.8% 7.8% 7.5% 7.0% 11th plan 2005 2006 2007 2008 2009 2010 12th plan 2011 2012 2013F China‟s steel demand growth have trended down Source: GDP: IHS Global Insight, ASC: ArcelorMittal Corporate Strategy estimates (Q2‟2012) 46 China still has some way to go on its infrastructure development path USA, 2008 China, 2008 China, 2011 Key development parameters China vs USA Absolute levels Per capita/Per land area Urban residential floor space (billion m2) 23.8 18.7 21.7 227 Railway (thousand km) Subway (thousand km) 79.7 94 1.2 0.8 1.9 Airport* (units) 3730 4146 1452 160 175 78 16 19 8.3 9.7 3.9 0.6 1.4 658 Total road (km per 1000 sq km) Airport transport passenger carried (bln) Equal to 30, 33, m2 per urban residential 23 Railway (km per 1000 sq km) Subway per 1000 capita (m) 6466 Total road (thousand km) Urban residential floor space (m2 per capita) 390 430 1.5 0.2 0.3 * Airport of USA is for paved runways > 1524 to 2437 m Sources: China National Bureau of Statistics; Macquarie Research, ArcelorMittal Corporate Strategy 47 China will keep global raw material supplies tight • China steel demand growth is expected to continue to absorb new supply of iron ore, keeping global supply/demand tight Global iron ore supply/demand outlook (Mn tonnes) 3300 Iron Ore Demand/Production World Iron Ore Demand World Iron Ore Production 2800 2300 1800 1300 800 2010 2011 2012 2013 2014 2015 2016 Supply/Demand projections Iron ore supply forecast to keep pace with demand, with no significant excess Source: ArcelorMittal Corporate Strategy 48 China net export data • China net exports of 4.8mt In August. • China net exports up 23% m-o-m and up 61% YoY Chinese imports rising 49 Mining Mont Wright, Canada 50 Mining business portfolio Key assets and projects Canada Baffinland 50%(1) Ukraine Iron Ore 95.13% Bosnia Iron Ore 51% Russian Coal 98.64% Kazakhstan Iron Ore 4 mines 100% Canada AMMC 100% (2) USA Coal 100% USA Iron Ore Minorca 100% Hibbing 62.31%* Non ferrous mine Mexico Iron Ore Las Truchas & Volcan 100%; Pena 50%* Kazakhstan Coal 8 mines 100% Algeria Iron Ore 70% Mauritania Iron Ore exploration license Indian Iron Ore & Coal exploration license Liberia Iron Ore 70% Iron ore mine Coal of Africa 15.75% Coal mine Existing mines New projects / exploration Brazil Iron Ore 100% South Africa Manganese 50% (3) South Africa Iron Ore** Geographically diversified mining assets * Includes share of production ** Includes purchases made under July 2010 interim agreement with Kumba (South Africa) (1) Following an agreement signed off in December 2012, on February 20th, 2013, Nunavut Iron Ore subscribed for new shares in Baffinland Iron Mines Corporation which diluted AM‟s stake to 50% (2) January 2nd, 2013 AM entered into an agreement to sell 15% of its stake in AM Mines Canada to a consortium lead POSCO and China Steel Corporation (CSC). (3) In November 2012, ArcelorMittal signed a share purchase agreement with Mrs. Mashile-Nkosi providing, subject to various conditions, for the acquisition by her or her nominee of ArcelorMittal‟s 50% interest in 51 Kalagadi Manganese. Iron ore reserve and resource estimates Strong reserve and resource basis to support sustainable growth 2012 Iron ore reserves and resources (million metric tonnes) Region Proven & probable reserves Mtonnes %Fe Measured & Inferred indicated resources resources Mtonnes %Fe Mtonnes %Fe Canada (AMMC) 1,952 28 4,931 29 1,082 29 Canada (Baffinland) 375 65 41 65 444 66 USA Central America South America West Africa Eastern Europe Central Asia TOTAL 473 395 121 526 301 188 4,331 20 26 58 48 36 40 35 421 146 321 39 866 1,455 8,219 20 26 38 44 38 40 32 92 78 131 2,061 0 123 4,010 23 27 36 41 0 34 39 2012 Geographical breakdown of iron ore reserves & resources Eastern Europe Central Asia 7% West Africa 4% 12% 45% Canada (AMMC) South America 3% 9% Central America 11% USA 9% Canada (Baffinland) • Highlights of 2012: – Resource to Reserve conversion exceeded mining depletion to provide a net increase of ~500Mt in iron ore reserves – Resource to reserve conversion was largely offset by resource additions due to exploration and re-evaluation of known mineralization • Resource and reserve estimates supported by internal technical reports • Updated life of mine plans with discounted cash flows to support demonstration of economic viability for all ore reserve estimates • All resource estimates have potential for economic extraction to support future potential growth 2012 Iron ore reserves of 4.3bn metric tonnes 52 Comparable margin to peers ArcelorMittal Mining EBITDA ($ Millions) Iron ore EBITDA margin 2012 FY* 100% 3,500 90% 80% 3,000 70% 2,500 60% 2,000 50% 40% 1,500 30% 1,000 2009 2010 2011 2012 ArcelorMittal* 2008 Producer 5 0% Producer 4 0 Producer 3 10% Producer 2 500 Producer 1 20% ArcelorMittal Mining is competitive on cost and quality * Notes: ArcelorMittal EBITDA margin based on market-priced tonnes (i.e. excludes cost-plus tonnes from Revenue and EBITDA); “Producers” include BHP, Fortescue, Kumba, Rio Tinto and Vale. Competitor data sourced from public information and has been prepared on a comparable periodic basis. 53 Iron ore growing; plans on track CAPACITY AMMC • Spirals replacement project completed in 1Q‟13 • Capacity expansion from 16Mt to 24Mt: • In June 2013 first concentrate from new Line 7 produced • Ramp up underway • Capex of $1.6bn Liberia • Phase 1 achieved new production record in 2Q‟13 at 1.1Mt • Phase 2 project underway for 15Mtpa premium sinter feed to replace 4Mtpa DSO by 2015 • Product specification changed to sinter feed; engineering scope change required • Major equipment procurement complete • Civil works at the port are advancing and will be completed this year Baffinland • Early Revenue Phase underway • 3.5Mtpa of DSO trucked to Milne Inlet for export during openwater season by 2015 • $700m* project capex in 50:50 JV Iron ore growth target on track – 84MT capacity by 2015 * Includes consideration from JV partner (Nunavut Iron Ore) for additional equity stake increase from 30% to 50%. 54 ArcelorMittal Mines Canada (AMMC) AMMC expansion from 16Mt to 24Mt complete • • • Iron ore production and capacity (million Mt) Expansion of Mont Wright mine at AMMC and concentrate capacity to total 24Mt p.a. (from 16Mtpa post operational improvements) concentrate and pellets • Potential for future expansion given size of resource base and existing infrastructure • Port infrastructure 30-32Mtpa without significant additional capex • Ability to expand production capacity beyond 30Mtpa 24 Spirals 6 8 Expansion capitalising on existing infrastructure, product quality, experienced workforce and advantageously located with easy access to European/US markets Capex $1.6bn* for mine, concentrator plant expansion and infrastructure upgrade with cash cost of circa $38/tonne post expansion 30 Concentrator 15 1 2012 2013F Potential Expansion • Low cost, efficient operations with further improvement potential • Ongoing initiatives to continue improving operating equipment efficiency • Access to low-cost, long-term hydro electric generating station Strategic advantage from exclusive use of own rail and port facilities * Capex of $1.6bn excludes expansion of Pellet line which has not yet been committed to. 55 ArcelorMittal Mines Canada (AMMC) Expansion from 16Mt to 24Mt complete Expansion • Commission of new spirals line at concentrator • New trucks operational • Additional rail sidings completed Railway • Wholly-owned 420-km railway infrastructure • Longer train with two locomotives commenced • Linking mining operations to Port-Cartier Port-Cartier • One of Canada‟s largest private ports • Handling 160,000+ tonne ships • Currently running at ~350 vessels per year • Ability to handle cape-size vessels all year round Expansion supported by captive infrastructure with operating leverage 56 56 Liberia Phase 1 completed Phase 1 DSO („Direct Shipping Ore‟) Industrial location of mine Guinea • Construction: • 240km rail rehabilitation completed • Buchanan port and material handling facilities initial upgrade completed • Shipment details • First DSO product shipped Sept 2011 • 40% to Europe (natural market), 60% to Asia • Costs • Competitive cash cost • Cape size trans-shipment facilities started • Offshore loader • Commenced cape size off shore loading Dec 2012 to further increase margins • Scheduled to load largest cape size in Western Africa • Focus on long haul customers All marketable tonnes Sierra Leone Atlantic Ocean Yekepa Ivory Coast Buchanan Railway link from Yekepa to Buchanan (240km) Liberia Liberia trans-shipment Liberia expansion progress on track 57 Liberia Phase 2 rationale Phase 2 – Higher grade material • Expansion to 15mtpa capacity by 2015 • Investment in a concentrator approved • Project and mine planning currently underway Production capacity (Million tonnes) Phase 1 60% 60% grade grade (highsilica) silica) DSO (high DSO capex $0.7bn capex $0.7bn Phase 2 66%grade grade 66% (low silica) (low silica) concentrate Sinter feed capex ~$1.5bn • Fully utilizing our wholly owned infrastructure • Managing project implementation to reduce near term capex without compromising Phase 2 15 • Staged approach 4 • Align product to market 2012 2015 Focus on Phase 2 to develop 15Mt of higher quality sinter feed 58 Baffinland Iron Ore Mines expansion update Background • In Dec. 2012, ArcelorMittal agreed with minority shareholder Nunavut Iron Ore (NIO) to increase NIO‟s interest in Baffinland from 30% to 50% • ArcelorMittal will retain a 50% interest in the project as well as operator and marketing rights Project progress • In Dec. 2012, completed the environment assessment process and received approval of “The Project Certificate”* by the Canadian government • Negotiations are progressing with the Qikiqtani Inuit Assoc. on the completion of the Inuit Impact and Benefits Agreement (IIBA), prioritizing Inuit participation in the project Early Revenue Phase (ERP) underway: Road route 3.5MT production capacity p.a. in 2015 ERP phase underway : Road route Proposed phase 2: Rail Foxe Basin Product • High grade: 66%+ Fe iron – „direct shipping pellet‟ and fine ore (no processing or pelletization required) • Products expected to achieve full premium value Early Revenue Phase (ERP) has been approved * The Project Certificate relates to the full original scope of the Mary River project expansion 59 Baffinland Early Revenue Phase: 3.5MT production rate in 2015 Proposed Early Revenue Phase rationale • ERP budget approx. US$700m commenced in 1Q 2013 • Enables an early mining phase that requires less capital investment than full project, creating training, employment, business opportunities for local region • ERP will demonstrate quality of product and ability to operate ERP components and difference between full rail project • ERP requires trucking of ore to Milne Inlet, loading of ore in Milne Inlet, and shipping of ore from Milne Inlet to markets • Requires upgrades of the road connecting Milne Inlet and mine site • Mining and trucking of 3.5mtpa from Deposit 1 to Milne Inlet throughout the year • Shipping of ore from Milne Inlet during “open water season” • Anticipate first ore to be shipped in 2H 2015, all product tonnage targeted for Europe Environment permitting • Existing permits allow work to commence in 3Q‟13 • Planned modification to existing permit to allow further optimization: doubling of fuel capacity at Milne Inlet in 2013 • Completion of ERP amendments to “The Project Certificate” and licenses scheduled in 1H 2014 Mary River Project is now a phased project – ERP underway, Rail Phase to be considered according to market conditions 60 Potential growth beyond current plan Growth project pipeline (million tonnes) 160,000 Cost plus tonnage Marketable tonnage Total Potential 140,000 120,000 Tonnes 100,000 Potential brownfield and greenfield projects under study, primarily marketable 2015 iron ore target of 84MT production capacity (excluding “potential” projects and strategic contracts) 80,000 60,000 40,000 20,000 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Growth supported by pipeline of brownfield and greenfield projects 2010 to 2012 represents actual production. 2013 onwards, capacity is being reflected in the above graph. 61 Focus on cost as well as growth Illustrative cash cost curve (marketable tonnes) post expansion US$ FOB Cost per ton Positioning key assets low on the cost curve Focus on value and OEE initiatives Focus on quality 1st 2nd ArcelorMittal Liberia 3rd AMMC 4th Relentless focus on cost control • Operational excellence, rigour and discipline underway across assets • Share and apply best practice leveraging internal and external benchmarks • Key focal points: • Labour productivity • Maintenance and reliability • Mining plan optimization Rigorous capex investment management • Focus on on-time and budget delivery • Central project management office • Regular expert project reviews • Standardised projects controls • Tracking time/cost divergence and risks Quartile Post capex FOB cash cost Relentless focus on costs and capex monitoring * Focus on AMMC and ArcelorMittal Liberia as our largest marketable tonnes assets. Illustrative for post expansion of AMMC 62 Coal business Key assets and projects for coal business Coal mine Existing mines Russian Coal 98.64% USA Coal 100% New projects Kazakhstan Coal 8 mines 100% Indian Iron Ore & Steam Coal 2012 Coal reserves and resources (Million metric tonnes) Region Mtonnes Kazakhstan Kuzbass Princeton TOTAL %Yield Measured & indicated resources Mtonnes 48 64 59 53 551 60 92 703 Proven & probable reserves 173 29 116 318 Inferred resources Mtonnes 8 38 4 50 Coal of Africa 15.75% interest Coal asset geographically diversified 318 million tonnes of reserves 63 Auto 64 Steel grades and process optimization support OEMs‟ effort towards safety, fuel economy and reduced CO² emission Global CO2 (or equivalent) regulation trends No 1 in automotive steel Grams CO²/km normalised to NEDC* • • • • • • Global automotive manufacturing presence through own facilities and JVs Global distribution network Unique product offerings to meet OEMs demand for safety, fuel economy and reduced CO2 emission (S-in Motion 20% weight reduction) Relative stability of margin: 20-30% of average selling price is attributable to the value added nature of the product Strong market share in our core markets Strong and consistent investment in R&D 2012 auto shipment by geography Europe 54% Source: ICCT Nafta 38% South America 6% South Africa 2% Worldwide ArcelorMittal R&D involving automotive suppliers / industrial partners *New European Driving Cycle is designed to assess the emission levels of car engines and fuel economy in passenger cars New ultra lightweight car door solutions C-segment vehicle Baseline Front Door Door Baseline Front 18.3kg S-in motion motion S1 S1 S-in 14.5kg Lightweight steel door 13.3kg 10.5-12kg Short term Medium term Medium-term steel solutions for C & D-segment cars to get closer to Aluminum Thin gauge approach: • • • 29% to 34% weight savings for D & C segment doors Performance validation of thin gauge outer till 0.5mm thanks to multilayered patch for stiffness purpose New steel grades development identified for outer panel, door beam New design approach: • • • • 28% weight savings for D segment door Structural holistic load path optimization Use of available steel grades Accent on manufacturing technologies development 1. Door inner AM05 0.8mm /0.6mm 2. Waist beam MS1500 0.9mm & DP780 3. Door beam Usibor®1500P 4. Hinge reinforcements Usibor®1500P 5. Outer panel FF280DP (490DP) 0.6mm Short & medium term ULSS show that steel remains the most cost-effective material for automotive applications Source: AM estimates as per annual report Contacts Daniel Fairclough – Global Head Investor Relations daniel.fairclough@arcelormittal.com +44 207 543 1105 Thomas A McCue – US Investor Relations thomas.mccue@arcelormittal.com +312-899-3927 Hetal Patel – UK/European Investor Relations hetal.patel@arcelormittal.com +44 207 543 1128 Lisa Fortuna – US Investor Relations lisa.fortuna@arcelormittal.com +312-899-3985 Valérie Mella – European and Retail Investor Relations valerie.mella@arcelormittal.com +44 207 543 1156 Maureen Baker – Fixed Income/Debt Investor Relations maureen.baker@arcelormittal.com +33 1 71 92 10 26 67