Frequently Asked Questions

advertisement

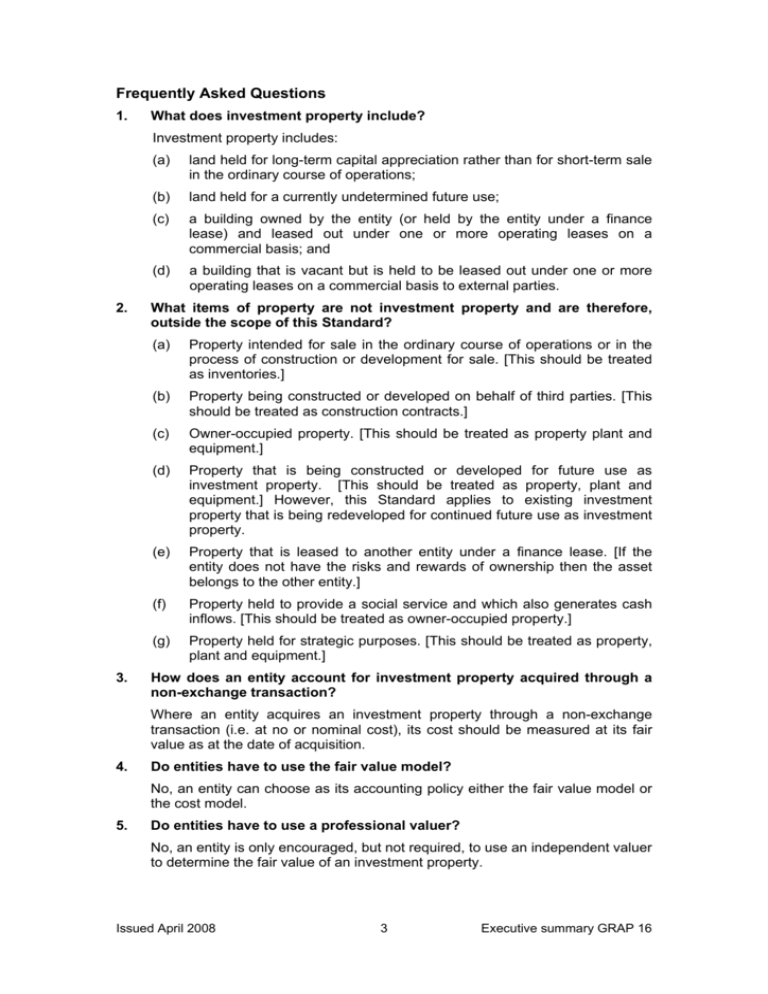

Frequently Asked Questions 1. What does investment property include? Investment property includes: 2. 3. (a) land held for long-term capital appreciation rather than for short-term sale in the ordinary course of operations; (b) land held for a currently undetermined future use; (c) a building owned by the entity (or held by the entity under a finance lease) and leased out under one or more operating leases on a commercial basis; and (d) a building that is vacant but is held to be leased out under one or more operating leases on a commercial basis to external parties. What items of property are not investment property and are therefore, outside the scope of this Standard? (a) Property intended for sale in the ordinary course of operations or in the process of construction or development for sale. [This should be treated as inventories.] (b) Property being constructed or developed on behalf of third parties. [This should be treated as construction contracts.] (c) Owner-occupied property. [This should be treated as property plant and equipment.] (d) Property that is being constructed or developed for future use as investment property. [This should be treated as property, plant and equipment.] However, this Standard applies to existing investment property that is being redeveloped for continued future use as investment property. (e) Property that is leased to another entity under a finance lease. [If the entity does not have the risks and rewards of ownership then the asset belongs to the other entity.] (f) Property held to provide a social service and which also generates cash inflows. [This should be treated as owner-occupied property.] (g) Property held for strategic purposes. [This should be treated as property, plant and equipment.] How does an entity account for investment property acquired through a non-exchange transaction? Where an entity acquires an investment property through a non-exchange transaction (i.e. at no or nominal cost), its cost should be measured at its fair value as at the date of acquisition. 4. Do entities have to use the fair value model? No, an entity can choose as its accounting policy either the fair value model or the cost model. 5. Do entities have to use a professional valuer? No, an entity is only encouraged, but not required, to use an independent valuer to determine the fair value of an investment property. Issued April 2008 3 Executive summary GRAP 16 6. Under the fair value model, how often should fair value be determined? Fair value of investment property should be determined at each reporting date. 7. An entity owns a building that it partly uses for its own purposes and rents out a portion – is this an investment property? If the entity cannot sell the parts separately, the property is not an investment property unless the entity holds only an insignificant part for use in the production or supply of goods or services, or for administrative purposes. 8. How does an entity account for a property interest held by it as a lessee under an operating lease? An entity accounts for a property interest held by it as a lessee under an operating lease as an investment property only if the property would otherwise meet the definition of an investment property and the lessee uses the fair value model. 9. What costs does an entity include in the cost of purchased and selfconstructed investment property? The cost of a purchased investment property comprises its purchase price and any directly attributable expenditure. Directly attributable expenditure includes, for example, professional fees for legal services, property transfer fees, agents’ commission and other transaction costs. The cost of a self-constructed investment property is its cost at the date when the construction or development is complete. 10. How does an entity account for gains and losses arising from the change in fair value of investment property? Is this different from the treatment if it was property, plant and equipment? A gain or loss arising from a change in the fair value of investment property should be included in surplus or deficit for the period in which it arises. Revaluation of property, plant and equipment would normally result in the creation of a revaluation reserve, which is part of the statement of changes in net assets. 11. When does the Standard allow an entity to transfer property to, or from, investment property? Are there specific measurement considerations? An entity can make a transfer to, or from, investment property when there is a change in use. The following indicates when a transfer is appropriate, as well as any measurement considerations: Investment property becomes owner-occupied property A transfer should be made from investment property to owner-occupied property at the commencement of owner-occupation. Where the investment property has been carried at fair vale, the fair value at the date of transfer becomes the deemed cost for subsequent accounting under the Standard of GRAP on Property, Plant and Equipment. An entity develops investment property for sale A transfer should be made from investment property to inventory at the date of commencement of development with a view to sale. Where the investment property has been carried at fair value, the fair value at the date of transfer becomes the deemed cost for subsequent accounting under the Standard of GRAP on Inventories. Issued April 2008 4 Executive summary GRAP 16 Owner-occupied property becomes investment property A transfer should be made from owner-occupied property to investment property when owner-occupation ceases. If the owner-occupied property is to be carried at fair value, the Standard of GRAP on Property, Plant and Equipment is applied up to the date of transfer. The property is valued at the date of transfer and any revaluation gain or loss, being the difference between the fair value and the previous carrying amount, is accounted for as a revaluation surplus or deficit under the Standard of GRAP on Property, Plant and Equipment. Property held as inventory becomes investment property When an operating lease is granted to a third party on a property held as inventory, the property should be transferred to investment property as soon as the operating lease commences. If the investment property is to be held at fair value, any difference between the fair value and the previous carrying amount at the date of transfer is recognised in surplus or deficit. Self constructed or developed property becomes investment property When construction or development of self-constructed investment property is complete it should be transferred to investment property. Until this point, the property is accounted for under the Standard of GRAP on Property, Plant and Equipment. If the investment property is to be carried at fair value, any difference between fair value and the previous carrying amount at the date of transfer should be recognised in surplus or deficit. Transfers under the cost model Where an entity has a policy of carrying investment property at cost less depreciation (the cost model), properties are transferred in the same way and under the same circumstances as described above. However, such transfers do not change the carrying amount of the property transferred, that is, no revaluation gains or losses arise, nor do they change the cost of the property for measurement purposes. 12. Under what circumstances does an entity remove investment property as an asset from its financial statements? An investment property should be derecognised (eliminated from the statement of financial position) on disposal or when the investment property is permanently withdrawn from use, and no future economic benefits or service potential are expected from its disposal. 13. How does an entity account for gains and losses arising from the retirement or disposal of investment property? An entity shall recognise gains or losses arising from the retirement or disposal of investment property in surplus or deficit in the period of the retirement or disposal. If the disposal is to a third party, then the entity recognises the gross proceeds. 14. If an entity receives compensation for the impairment, loss or giving up of an investment property, how does it account for the compensation? An entity should recognise compensation from third parties for investment property that was impaired, lost or given up in surplus or deficit when the compensation becomes receivable. The impairment, loss or giving up of the asset, the receipt of the compensation, and replacement of the asset should be treated as distinct economic transactions and not accounted for on a net basis. Issued April 2008 5 Executive summary GRAP 16