Chapter 20

advertisement

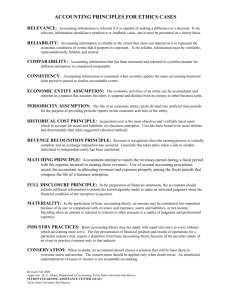

FUNDAMENTALS OF IFRS CHAPTER 20 Investment Property (IAS 40) an Amitabha Mukherjee endeavour www.ifrsdemystified.com an Amitabha Mukherjee endeavour www.ifrsdemystified.com INVESTMENT PROPERTY (IAS 40) FUNDAMENTALS OF IFRS 20.1 INVESTMENT PROPERTY (IAS 40) 20.2 20.2 CHAPTER TWENTY Investment Property (IAS 40) 20 Introduction Investment property is property (land or a building – or part of a building – or both) held (by the owner or by the lessee as a right-of-use asset) to earn rentals or for capital appreciation or both, rather than for – use in the production or supply of goods or services or for administrative purposes; or sale in the ordinary course of business. The following are examples of investment property – land held for long-term capital appreciation rather than for short-term sale in the ordinary course of business. land held for currently undetermined future use. (If an entity has not determined that it will use the land as owner-occupied property or for short-term sale in the ordinary course of business, the land is regarded as held for capital appreciation.) Owner-occupied property Owner-occupied property is property held (by the owner or by the lessee as a rightof-use asset) for use in the production or supply of goods or services or for administrative purposes. a building owned by the entity (or held by the entity as a right-of-use asset) and leased out under one or more leases. a building that is vacant but is held to be leased out under one or more leases. property that is being constructed or developed for future use as investment property. The following are examples of items that are not investment property – property intended for sale in the ordinary course of business or in the process of construction or development for such sale, eg, property acquired exclusively with a view to subsequent disposal in the near future or for development and resale. owner-occupied property, including (among other things) property held for future use as owner-occupied property, property held for future development and subsequent use as owner-occupied property, property occupied by employees (whether or not the employees pay rent at market rates) and owner-occupied property awaiting disposal. property that is leased to another entity under a lease. Some properties comprise a portion that is held to earn rentals or for capital appreciation and another portion that is held for use in the production or supply of goods or services or for administrative purposes. If these portions could be sold separately (or leased out separately), an entity accounts for the portions separately. If the portions could not be sold separately, the property is investment property only if an insignificant portion is held for use in the production or supply of goods or services or for administrative purposes. an Amitabha Mukherjee endeavour www.ifrsdemystified.com 20.3 FUNDAMENTALS OF IFRS 20.3 An entity owns a 10 floor building, in which it has given the first 3 floors on lease to some retailers and uses the rest of the building for its own office use. The entity can easily sell off the retail space in the first 3 floors and, therefore, it can account for these 3 floors as an investment property. The remaining 7 floors of the building are used by the entity for its own office use and, therefore, are accounted for as owner-occupied property. In some cases, an entity provides ancillary services to the occupants of a property it holds. An entity treats such a property as investment property if the services are insignificant to the arrangement as a whole. Example 2 The owner of an office building provides security and maintenance services to the lessees who occupy the building. Since these ancillary services are less significant, the property is accounted for as an investment property. Example 3 An entity owns and manages a hotel. The services provided to the guests are an integral part of the whole arrangement. Therefore, the hotel is an owner-occupied property, rather than an investment property. It may be difficult to determine whether ancillary services are so significant that a property does not qualify as investment property. Judgement is needed to determine whether a property qualifies as investment property. An entity should, therefore, develop a set of consistent criteria on the basis of which investment property classification can be determined appropriately. An entity should also disclose these criteria. Example 4 The owner of a hotel sometimes transfers some responsibilities to third parties under a management contract. The terms of such contracts very widely. At one end of the spectrum, the owner’s position may, in substance, be that of a passive investor. At the other end of the spectrum, the owner may simply have outsourced day-to-day functions while retaining significant exposure to variations in the cash flows generated by the operations of the hotel. Example 5 An entity purchases a farming land for its investment potential. Planning permission has not yet been obtained for building any kind of construction. Though planning permission is not obtained, the land is still quite high on the scale as far as investment potential is concerned. Therefore, the land should be classified as investment property for its long-term capital appreciation. In some cases, entity owns property that is leased to, and occupied by, its parent or another subsidiary. The property does not qualify as investment property in the consolidated financial statements, because the property is owner-occupied from the perspective of the group. However, from the perspective of the entity that owns it, the property is investment property if it meets the definition. Therefore, the lessor treats the property as investment property in its individual financial statements. Example 6 ABC Ltd is the parent and XYZ Ltd is its subsidiary. XYZ has an office building whose rent as per market rate would be 10 per month, But XYZ Ltd gives it on rent to ABC Ltd at 5 per month. In XYZ Ltd’s individual financial statements, this office building would be accounted for as investment property, but in the group’s consolidated financial statements, the property would be accounted for as owner-occupied property. an Amitabha Mukherjee endeavour www.ifrsdemystified.com INVESTMENT PROPERTY (IAS 40) Example 1 INVESTMENT PROPERTY (IAS 40) 20.4 20.4 CHAPTER TWENTY Recognition Investment property shall be recognised as an asset when, and only when – it is probable that the future economic benefits that are associated with the investment property will flow to the entity; and the cost of the investment property can be measured reliably. An entity evaluates all investment property cost at the time they are incurred. These costs include costs incurred initially to acquire an investment property and costs incurred subsequently to add to, replace part of, or service a property. An entity does not recognise in the carrying amount of an investment property the costs of the day-to-day servicing of such a property. Rather, these costs are recognised in profit or loss as incurred. Costs of day-to-day servicing are primarily the costs of labour and consumables, and may include the costs of minor parts. The purpose of these expenditures is often described as for the “repairs and maintenance” of the property. Parts of investment properties may have been acquired through replacement, eg, the interior walls may be replacements of original walls. An entity recognises in the carrying amount of an investment property the cost of replacing part of an existing investment property at the time that cost is incurred. The carrying amount of those parts that are replaced is derecognised. Example 7 ABC Ltd has a furnished office which it has given on rent to XYZ Ltd, with a clause that the interior walls of the office would be replaced every 5 years. Thus, ABC Ltd recognises in the carrying amount of the investment property the cost of replacement (interior walls) at the time the cost is incurred. The carrying amount of those parts that are replaced is derecognised first. Example 8 ABC Ltd has an office building, which is given on rent to XYZ Ltd. The building has a central security system which needs replacement after every 3 years. The replacement cost is 10. The carrying amount of the existing security system is 5. XYZ needs to pass the following entries to – derecognise the carrying amount of the investment property replaced : Depreciation 5 Accumulated depreciation 5 and, recognise the cost of replacement. Building 10 Cash 10 Measurement at recognition An investment property shall be measured initially at cost, which comprises its purchase price and any directly attributable expenditure which includes, eg, professional fees for legal services, property transfer taxes. Transaction costs shall be included in the initial measurement. The cost of an investment property is not increased by – start-up costs (unless they are necessary to bring the property to the condition necessary for it to be capable of operating in the manner intended by management); Example 9 ABC Ltd has built a commercial complex to be given on rent to retailers. The company advertises to attract tenants. Since this cost cannot be capitalised, it should not be included in the cost of the investment property. an Amitabha Mukherjee endeavour www.ifrsdemystified.com 20.5 FUNDAMENTALS OF IFRS 20.5 Operating losses incurred before the investment property achieves the planned level of occupancy; or Example 10 In continuation of the previous example, after advertising it was found out that only 25 office spaces were rented out of total 100 office spaces. ABC Ltd has a huge interest payment obligation and, therefore, was incurring operating losses. These operating losses cannot be included in the carrying amount of the building. abnormal amounts of wasted material, labour and other resources incurred in constructing or developing the property. Example 11 A part of the construction site had to be demolished, because it was found out that it did not match specifications. In effect, a huge amount of material, labour and other resources were wasted. This abnormal wastage cannot be included in the cost of the building. If payment for an investment property is deferred, its cost is the cash price equivalent. The difference between this amount and the total payments is recognised as interest payment over the period of credit. Example 12 An entity wants to purchase a machine on deferred payment option. The payment above the cash down price will be treated as interest expense and is to be recognised in profit or loss. Therefore, the cost of the machine will be its cash down price. Journal Machinery Interest expense Liability for machinery Investment property can also be acquired in exchange for non-monetary asset (s) or a combination of monetary and non-monetary assets. The cost of such an investment property is measured at fair value unless – the exchange transaction lacks commercial substance; or the fair value of neither the asset received nor the asset given up is reliably measurable. The acquired asset is measured in this way even if an entity cannot immediately derecognise the asset given up. If the acquired asset is not measured at fair value, its cost is measured at the carrying amount of the asset given up. Example 13 An entity would give up a warehouse whose fair value is 10 and pay 5 cash in exchange for a building. The building is to be given on rent. Building (Investment property) 15 Cash 5 Warehouse (Property, plant and equipment) 10 (Building received in exchange for a combination of monetary and non-monetary assets) Example 14 An entity would give up a warehouse whose fair value is 10 and pay 5 cash, but the fair value of the building received is found to be 18. The building is to be given on rent. Building (Investment property) 18 Cash 5 Warehouse (Property, plant and equipment) 10 Profit or loss (Gain on exchange) 3 (Building received in exchange for a combination of monetary and non-monetary assets) an Amitabha Mukherjee endeavour www.ifrsdemystified.com INVESTMENT PROPERTY (IAS 40) INVESTMENT PROPERTY (IAS 40) 20.6 20.6 CHAPTER TWENTY Measurement after recognition Accounting policy An entity shall choose as its accounting policy either the fair value model or the cost model and shall apply that policy to all its investment property. This Standard requires all entities to measure the fair value of investment property, for the purpose of either measurement (if the entity uses the fair value model) or disclosure (if it uses the cost model). An entity is encouraged, but not required to measure the fair value of investment property on the basis of a valuation by an independent valuer who holds a recognised and relevant professional quailification and has recent experience in the location and category of the investment property being valued. Fair value model After initial recognition, an entity that chooses the fair value model shall measure all of its investment property at fair value. Exposure Draft on Leases amends the model in this Standard to replace the requirements relating to lease accounting as follows : After initial recognition, a lessor of investment property (whether freehold or leasehold) chooses to account for investment property using a cost or fair value model. A lessor that uses the cost model recognises lease income arising on investment property in accordance with Exposure Draft on Leases. A lessor that uses fair value model recognizes lease income arising on the investment property (other than the fair value gains or losses) on a straight-line basis over the lease term. A right-of-use asset is within the scope of this Standard if it meets the definition of investment property. Any right-of-use asset is accounted for at initial recognition in accordance with Exposure Draft on Leases. After initial recognition, a lessee chooses to account for the right-ofuse asset using a cost or fair value model. A lessee that uses the cost model accounts for the right-of-use asset in accordance with Exposure Draft on Leases. A lessee that uses the fair value model accounts for the right-of-use asset in accordance with this Standard and recognises any changes in the liability to make lease payments in profit or loss. When measuring the fair value of investment property in accordance with IFRS 13, an entity shall ensure that the fair value reflects, among other things, rental income from current leases and other assumptions that market participants would use when pricing investment property under current market conditions. In determining the carrying amount of investment property under the fair value model, an entity does not double-count assets or liabilities that are recognised as separate assets or liabilities. an Amitabha Mukherjee endeavour www.ifrsdemystified.com 20.7 FUNDAMENTALS OF IFRS 20.7 The following are the examples – Equipments such as lifts or air-conditioning are often an integral part of a building and is generally included in the fair value of the investment property, rather than recognised separately as property, plant and equipment. If an office is leased on a furnished basis, the fair value of the office generally includes the fair value of the furniture, because the rental income relates to the furnished office. When furniture is included in the fair value of investment property, an entity does not recognise that furniture as a separate asset. The fair value of investment property held under a lease reflects expected cash flows (including contingent rent that is expected to become payable). Accordingly, if a valuation obtained for a property is net of all payments expected to be made, it will be necessary to add back any recognised lease liability, to arrive at the carrying amount of the investment property using the fair value model. In some cases, an entity expects that the present value of its payments relating to an investment property (other than payments relating to recognised liabilities) will exceed the present value of the related cash receipts. An entity applies IAS 37 to determine whether to recognise a liability and, if so, how to measure it. Inability to measure fair value reliably If an entity determines that the fair value of an investment property under construction is not reliably measureable but expects the fair value of the property to be reliably measurable when construction is complete, it shall measure that investment property under construction at cost until either its fair value becomes reliably measureable or construction is complete (whichever is earlier). If an entity determines that the fair value of an investment property (other than an investment property under construction) is not reliably measureable on a continuing basis, the entity shall measure that investment property using the cost model in IAS 16. The residual value of the investment property shall be assumed to be zero. The entity shall apply IAS 16 until disposal of the investment property. If an entity has previously measured an investment property at fair value, it shall continue to measure the property at fair value, it shall continue to measure the property at fair value until disposal (or until the property becomes owner-occupied property or the entity begins to develop the property for subsequent sale in the ordinary course of business) even if comparable market transactions become less frequent or market prices become less readily available. A gain or loss arising from a change in the fair value of investment property shall be recognised in profit or loss for the period in which it arises. Income taxes The tax law may specify a tax rate applicable to the taxable amount derived from the sale of an asset that differs from the tax rate applicable to the taxable amount derived from using an asset. Therefore, the manner in which an entity recovers the carrying amount of an asset either or both of – the tax rate applicable when the entity recovers the carrying amount of the asset; and the tax base of the asset. If a deferred tax liability or asset arises from investment property that is measured using the fair value model of this Standard, there is a rebuttable presumption that the carrying amount of the investment property will be recovered through sale. Accordingly, unless the presumption is rebutted, the measurement of the deferred tax liability or asset shall reflect the tax consequences of recovering the carrying amount of investment property entirely through sale. This presumption is rebutted if the investment property is depreciable and is held within an Amitabha Mukherjee endeavour www.ifrsdemystified.com INVESTMENT PROPERTY (IAS 40) Example 15 INVESTMENT PROPERTY (IAS 40) 20.8 20.8 CHAPTER TWENTY a business model whose objective is to consume substantially all of the economic benefits embodied in the investment property over time, rather than through sale. If the presumption is rebutted, then the measurement of deferred tax liabilities and assets shall reflect the tax consequences that would follow from the manner in which the entity expects, at the end of reporting period, to recover the carrying amount of its assets. Example 16 Profit (before fair value determination of investment property) 100 per year. Investment property acquired at the beginning of year 1 : 100. Year-end fair value of investment property : Year 1 – 110; 2 – 120; 3 – 130; 4 – 150. Disposal of investment property : Year 5 – 150. Depreciation rate for income tax (SLM) 25%. Unrealised changes in the fair value of investment property do not affect taxable profit. If the investment property is sold for more than cost, the reversal of the accumulated tax depreciation will be included in taxable profit and taxed at an ordinary tax rate of 30%. For sale proceeds in excess of cost, tax law specifies tax rate of 40% for assets held for more than 3 years. Fair Value Model Statement of Profit or Loss 1 2 3 4 5 Profit Fair value increase Year 100 10 100 10 100 10 100 20 100 – Accounting Profit Tax expense – Current tax Deferred tax expense / (liability) 110 110 110 120 100 22.5 11.5 Profit for the Period 34 22.5 11.5 34 76 22.5 11.5 76 22.5 34 15.5 38 80 (50) 76 82 70 30 Cost Model Statement of Profit or Loss Year 1 2 3 4 5 Profit Profit on disposal 100 – 100 – 100 – 100 – 100 50 Accounting Profit Tax expense – Current tax Deferred tax expense / (liability) 100 100 100 100 150 Profit for the Period 22.5 7.5 30 22.5 7.5 30 70 22.5 7.5 30 70 22.5 7.5 70 30 80 (30) 70 50 100 Current Tax 1 2 3 4 5 Profit Depreciation allowed Year 100 25 100 25 100 25 100 25 100 – Depreciation reversal 75 – 75 – 75 – 75 – 100 100 Profit on disposal 75 – 75 – 75 – 75 – 200 50 Taxable profit 75 75 75 75 250 22.5 22.5 22.5 22.5 80 Current tax Cost Model After initial recognition, an entity that chooses the cost model shall measure all if its investment properties in accordance with IAS 16’s requirement for that model, other than those that meet the criteria to be classified as held for sale (or are included on a disposal group that is classified as held for sale) in accordance with IFRS 5. Investment properties that meet the criteria to be classified as held for sale (or are included in a disposal group that is classified as held for sale) shall be measured in accordance with IFRS 5. an Amitabha Mukherjee endeavour www.ifrsdemystified.com 20.9 FUNDAMENTALS OF IFRS 20.9 Transfers to, or from, investment property shall be made when, and only when, there is a change in use, evidenced by – commencement of owner-occupation, for a transfer from investment property to owneroccupied property; Example 17 An office space was previously rented to a third party. The entity would now use that for its own human resources department. Therefore, change in use leading to a transfer from investment property to owner-occupied property. commencement of development with a view to sale, for a transfer from investment property to inventories; Example 18 A real estate company had a building which it had given on rent for residential purpose. But, after 10 years, there was huge development in that locality and, therefore, the company decides to build a commercial complex to sale. Thus, change in use, evidenced by commencement of re-development with a view to sale in ordinary course of business leads to transfer from investment property to inventories. end of owner-occupation, for a transfer from owner-occupied to investment property; Example 19 A building previously used as corporate office was vacated for an office in a better location. The previous building was given on rent to another party. Thus, change in use leads to transfer from owner-occupied property to investment property. Or, commencement of a lease to another party, for a transfer from inventories to investment property. Example 20 A real estate company decides not to sell a building, and give it on a lease to a third party, thus transfer from inventories to investment property. However, if an investment property is re-developed for future use as investment property only, then the property remains as an investment property only and not reclassified as owneroccupied property during re-development. Example 21 An entity has a building which was given on a lease for 5 years. On the completion of 5 years, the entity decided to renovate the building in order to charge higher rent. Thus, investment property re-development for future use as investment property remains investment property during re-development period as well as in the later period. When an entity uses the cost model, transfers between investment property, owner-occupied property and inventories do not change the carrying amount of the property transferred and they do not change the cost of that property for measurement or disclosure purposes. For a transfer from investment property carried at fair value to owner-occupied property or inventories, the property’s deemed cost for subsequent accounting in accordance with IAS 16 or IAS 2 shall be its fair value at the date of change in use. If an owner-occupied property becomes an investment property that will be carried at fair value, an entity shall apply IAS 16 up to the date of change in use. The entity shall treat any difference at that date between the carrying amount of the property in accordance with IAS 16 and its fair value in the same way as a revaluation in accordance with IAS16. an Amitabha Mukherjee endeavour www.ifrsdemystified.com INVESTMENT PROPERTY (IAS 40) Transfers INVESTMENT PROPERTY (IAS 40) 20.10 20.10 CHAPTER TWENTY For a transfer from inventories to investment property that will be carried at fair value, any difference between the fair value of the property at that date and its previous carrying amount shall be recognised in profit or loss. When an entity completes the construction or development of a self-constructed investment property that will be carried at fair value, any difference between the fair value of the property at that date and its previous carrying amount shall be recognised in profit or loss. Disposals An investment property shall be derecognised (eliminated from the Statement of Financial Position) on disposal or when the investment property is permanently withdrawn from use and no future economic benefits are expected from its disposal. The disposal of an investment property may be achieved by sale or by entering into a lease under derecognition approach. The date of disposal for investment property is the date the recipient obtains control of the investment property in accordance with the requirements for determining when a performance obligation is satisfied in Revenue from Contracts with Customers. Gains or losses arising from the retirement or disposal of an investment property shall be determined as the net disposal proceeds and the carrying amount of the asset and shall be recognised in profit or loss in the period of the retirement or disposal. The amount of consideration to be included in the gain or loss arising from the derecognition of an investment property is determined in accordance with the requirements for determining the transaction price in Revenue from Contracts with Customers and shall not exceed the amount to which the entity is reasonably assured to be entitled in accordance with Revenue from Contracts with Customers. Subsequent changes to the estimated amount of the consideration that is reasonably assured shall be recognised as a gain or loss in the period of the change in accordance with Revenue from Contracts with Customers. An entity applies IAS 37 or other standards, as appropriate, to any liabilities that it retains after disposal of an investment property. Compensation from third parties for investment property that was impaired, lost or given up shall be recognised in profit or loss when the compensation becomes receivable. an Amitabha Mukherjee endeavour www.ifrsdemystified.com