Annual Report and Financial Statements 2013

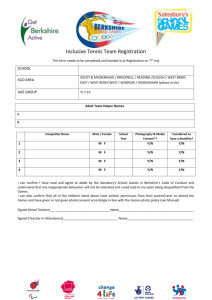

advertisement