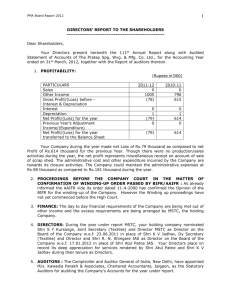

AnnUAl RepoRt 2013 - 2014 - Resins and Plastics Limited

advertisement