Adviser alert—Leases

Exposure Draft

July 2013

Overview

In May 2013, the International Accounting Standards Board (IASB) and US Financial

Accounting Standards Board (FASB) published revised joint Exposure Drafts Leases

(ED) that, if finalized as proposed, would significantly change the accounting for

leasing arrangement by both lessees and lessors. The IASB’s ED, if finalized, would

replace the current standard, IAS 17 Leases (IAS 17), and related Interpretations. The

comment period for the ED closes on September 13, 2013.

Summary of the proposals

Under the current requirements in IAS 17, the accounting for a lease depends upon its

classification. Classification as an operating lease results in the lessee not recording any

assets or liabilities in the Statement of Financial Position (balance sheet). The ED

proposes to remove this distinction by requiring lessees to recognize assets and

liabilities for the rights and obligations created by leases. We discuss the proposals in

more detail below.

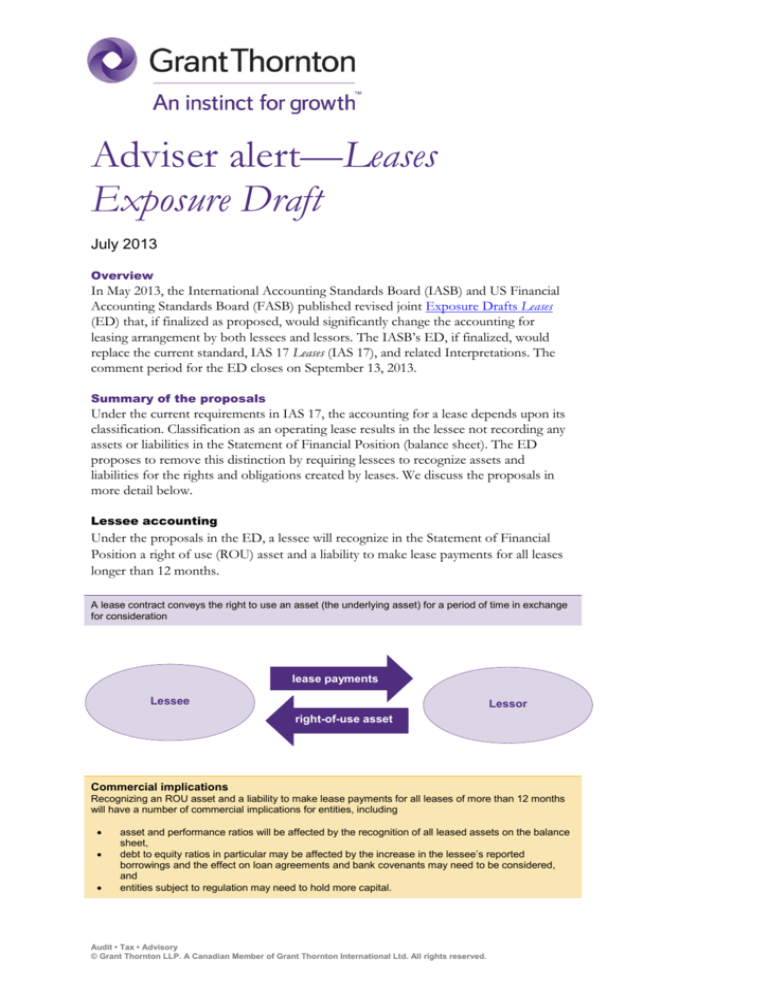

Lessee accounting

Under the proposals in the ED, a lessee will recognize in the Statement of Financial

Position a right of use (ROU) asset and a liability to make lease payments for all leases

longer than 12 months.

A lease contract conveys the right to use an asset (the underlying asset) for a period of time in exchange

for consideration

lease payments

Lessee

Lessor

right-of-use asset

Commercial implications

Recognizing an ROU asset and a liability to make lease payments for all leases of more than 12 months

will have a number of commercial implications for entities, including

asset and performance ratios will be affected by the recognition of all leased assets on the balance

sheet,

debt to equity ratios in particular may be affected by the increase in the lessee’s reported

borrowings and the effect on loan agreements and bank covenants may need to be considered,

and

entities subject to regulation may need to hold more capital.

Audit • Tax • Advisory

© Grant Thornton LLP. A Canadian Member of Grant Thornton International Ltd. All rights reserved.

2

Initial measurement

The ROU asset and the liability to make lease payments are recognized at the date the

underlying asset is made available to the lessee. The liability is initially measured as the

present value of lease payments discounted using the rate charged by the lessor or, if

this is not available, the lessee's incremental borrowing rate. To determine the lease

payments, an entity will first have to determine the lease term. The lease term will

include any optional period to extend the lease, if there is a significant economic

incentive for the lessee to exercise the option.

Once the lease term is calculated, the entity will then need to review the lease payments

to determine those that are to be included in the initial recognition of the lease liability.

The liability will include

fixed payments,

variable payments that depend on an index or rate,

variable payments that are in substance fixed payments, and

amounts expected to be paid under residual value guarantees and the exercise price

of extension/termination options if there is a significant economic incentive for the

lessee to exercise those options.

Having determined the initial measurement of the liability, the initial measurement of

the ROU asset is simply the value of the liability plus any initial direct costs incurred by

the lessee plus any payments made to the lessor at or before the commencement of the

lease less any lease incentives.

Lease liability

Right of use asset

(at cost)

(present value of

lease payments)

Subsequent measurement

The dual approach

Unlike the 2010 ED, the new ED does not apply a single lessee accounting model but

instead applies a dual approach for lease expenses. This dual approach determines the

subsequent accounting for the recognition of the lease expense.

The principle for determining which approach to apply is based on the consumption of

the underlying asset. This reflects the IASB’s view that there is a difference between a

lease for which the lessee pays for consuming a significant part of the underlying asset

during the lease term, and a lease for which the lessee merely pays for using the asset.

The ED applies this concept in a simplified way, distinguishing between “Type A” and

“Type B” leases. This determination will depend on whether or not the lease is a real

estate (property) lease, on the basis that for most leases of real estate the lessee merely

uses the underlying asset without consuming more than an insignificant part of it. By

way of contrast, the ED asserts that a lessee typically consumes a significant part of any

equipment or vehicle that it leases.

Audit • Tax • Advisory

© Grant Thornton LLP. A Canadian Member of Grant Thornton International Ltd. All rights reserved.

3

Lease classification test

Leases for equipment/

vehicles are Type A unless

Leases for real estate are

Type B unless

lease term is insignificant

relative to total economic

life of asset, or

present value of lease

payments is insignificant

relative to fair value of

asset.

lease term is a major part of

the remaining life of asset,

or

present value of lease

payments is substantially all

of fair value of asset.

After initial recognition, the liability for lease payments is accounted for at amortized

cost subject to certain adjustments, while the ROU asset is recognized at cost less

accumulated amortization and impairment. Classification of the lease as either Type A

or Type B affects both the calculation and the presentation of the lessee's lease expense.

Type A leases

For Type A leases, a finance charge for the unwinding of the discount on the lease

liability will be recognized separately from an amortization charge for the ROU asset.

The unwinding of the lease liability will be measured using the effective interest

method. The ROU asset will be amortized on a straight line basis unless another basis is

more representative of the pattern in which the lessee expects to consume the ROU

asset's future economic benefits. As a result, the lessee's total cost for a Type A lease

will be higher in the earlier years of the lease and lower in later years (so-called “front

loading”). Most current non-property operating leases are expected to become Type A

leases.

Type B leases

Type B leases will result in a straight-line total lease cost in each year of the lease. The

total lease cost will combine both the unwinding of the discount on the lease liability

and the amortization of the ROU asset. The unwinding of the discount on the lease

liability will be calculated using the effective interest method. The amortization of the

ROU asset will be a balancing figure to ensure the total lease expense is recognized

straight line over the lease term.

Lessee accounting overview

Statement of

Financial

Position

Type A

Most leases

of equipment

/vehicles

Type B

Most leases

of real estate

Right-of-use

asset

Lease

liability

Right-of-use

asset

Lease

liability

Income

statement

Amortisation

expense

Interest

expense

asset

Single

lease

Lease liability

expense on

a straightline basis

Audit • Tax • Advisory

© Grant Thornton LLP. A Canadian Member of Grant Thornton International Ltd. All rights reserved.

Cash flow

statement

Principal

Interest

Single

lease

payments

4

Lessor accounting

For practical purposes, the ED would have only a minor impact on the accounting by

lessors for finance leases. Under IAS 17, lessors recognize a lease receivable and

derecognize the underlying asset. These leases would be Type A under the proposed

model and lessors would apply the “receivable and residual” model described below.

However, the residual asset would be relatively small.

For leases that are considered operating leases under IAS 17, the extent of change

would depend on whether the underlying asset is property or equipment. A lessor

would distinguish between most property and most equipment leases in the same way

that a lessee would under the proposals. Operating leases of property would be Type B

leases and the proposed lessor accounting model would be essentially unchanged.

Operating leases of equipment or vehicles would typically be Type A and, for these, the

changes proposed are significant.

A lessor of most equipment or vehicles leases would apply the “receivable and residual

approach” and would:

a) recognize a lease receivable and a retained interest in the underlying asset (the

residual asset), and derecognize the underlying asset; and

b) recognize interest income on both the lease receivable and the residual asset over

the lease term.

A manufacturer or dealer lessor might also recognize profit on the lease when the

underlying asset is made available for use by the lessee.

Lessor accounting overview

Type A

Most leases

of equipment

/vehicles

Statement of

Financial

Position

Lease

receivable

Income

statement

Interest income and

any profit on the lease

Residual asset

Type B

Most leases

of real estate

Continue to

report asset

being leased

Rental income

Exceptions

The ED would permit simplified accounting for short-term leases, defined as leases

where the maximum possible term (including any option periods) is 12 months or less.

For such leases, an entity may elect on a class by class basis to account in essentially the

same way as for operating leases in accordance with IAS 17.

The ED also proposes a number of scope exceptions that are broadly in line with IAS

17's (for example, leases of intangible assets and leases to explore for or use mineral

resources and similar non-regenerative resources).

Audit • Tax • Advisory

© Grant Thornton LLP. A Canadian Member of Grant Thornton International Ltd. All rights reserved.

5

The link between the leasing model and IAS 40 Investment Property (IAS 40) also remains

important. Under the ED

A lessee would be obliged to apply IAS 40 in measuring ROU assets that are

investment property, and can choose IAS 40's cost or fair value model. This would

change the current position under which a lessee with an operating lease interest in

investment property can choose to apply IAS 40 but must use fair value if it does.

A lessor that owns an investment property and leases it under a Type B lease would

apply IAS 40 to the asset.

Disclosures

The proposed Standard sets out extensive numerical and narrative disclosure

requirements for both lessees and lessors designed to enable users of the financial

statements to understand the amount, timing and uncertainty of cash flows arising from

leases.

Transition

The ED proposes what is referred to as a modified retrospective approach. Entities

applying the modified retrospective approach would use certain shortcut calculations to

initially measure lease-related assets and liabilities. They also would be able to use

hindsight to determine the lease term or whether an existing arrangement contains a

lease. Entities will adjust the statement of financial position at the beginning of the

earliest comparative period presented, as if the entity had always applied the proposed

Standard.

For finance leases existing at the date of initial application, lessees and lessors will be

permitted to use the existing carrying amounts of lease-related assets and liabilities as

the initial measurements under the proposal.

Resources

Exposure Draft ED/2013/6 Leases

Audit • Tax • Advisory

© Grant Thornton LLP. A Canadian Member of Grant Thornton International Ltd. All rights reserved.

About Grant Thornton

in Canada

Grant Thornton LLP is a

leading Canadian

accounting and advisory

firm providing audit, tax

and advisory services to

private and public

organizations. Together

with the Quebec firm

Raymond Chabot Grant

Thornton LLP, Grant

Thornton has

approximately 4,000

people in offices across

Canada. Grant Thornton

LLP is a Canadian

member

of Grant Thornton

International Ltd,

whose member firms

operate in close to 100

countries worldwide.

The information in this

publication is current as

of July 30, 2013.

We have made every

effort to ensure

information in this

publication is accurate as

of its issue date.

Nevertheless, information

or views expressed

herein are neither official

statements of position,

nor should they be

considered technical

advice for you or your

organization without

consulting a professional

business adviser. For

more information about

this topic, please contact

your Grant Thornton

adviser. If you do not

have an adviser, please

contact us. We are happy

to help.