Improve your productivity

Address your staffing challenges

Save you time and money

Keep you current on relevant changes

Streamline your business processes

Integrate with your existing

systems and workflow

CCH Solutions Catalog

Products for your every need

4025 W. Peterson Avenue

Chicago, IL 60646-6085

1-888-CCH-REPS

CCHGroup.com

ACS 90088574 5/07

© 2007 CCH. All Rights Reserved.

Your Strategic Partner in Workflow Integration

Dear Tax and Accounting Professional:

It seems that every day the tax and accounting business becomes more complex. We all

face stricter compliance requirements. Staffing is always a challenge. Adding value for

clients is a never-ending search.

CCH is committed to being your strategic partner to help you meet these demands. We

relentlessly push the envelope to develop forward-looking solutions and increase workflow

integration through cutting-edge technology.

Among our new products this past year, we introduced Tax Zone Locator to help you quickly find location-based federal

and state tax incentives and credits throughout the country. We also made enhancements to Tax Research Consultant

to give you even more in-depth coverage of federal income, estate and gift, payroll and excise tax topics.

In accounting and audit, the new Accounting Research Manager® (ARM) Internal Controls Library is the accounting

industry’s comprehensive online resource of internal controls guidance. And ProSystem fx® Engagement has a powerful

new Knowledge Tools module to streamline your compliance with the new AICPA risk assessment standards. ARM and

Engagement are fully integrated, so you can quickly move from one to the other for a seamless workflow and increased

productivity.

Equally important is our customer commitment. To deliver more value, we initiated our annual CCH User Conference,

featuring CCH and industry speakers, innovative workshops and informative discussions on the latest technology and trends.

I am quite confident that our comprehensive selection of products will provide the solutions you need to move

ahead in the evolving tax and accounting environment. Take some time to review the products in this catalog,

and call a CCH representative at 1-888-CCH-REPS

to see how we can help your organization

1-800-461-5308 or (1-888-224-7377)

1-800-268-4522

become more productive.

Sincerely,

Mike Sabbatis

President

CCH, a Wolters Kluwer business

CCH, a Wolters Kluwer business

About Our Products:

CCH Customer Support:

CCH products are available in a variety of formats

to meet your research needs. Simply look for

the following icons throughout the catalog for

format availability:

n To

contact your CCH Account Representative:

1-888-CCH-REPS (1-888-224-7377)

n To

place an order, or for Product Information:

1-800-344-3734

n Billing

PRINT

CD -ROM

and Account Issues:

1-800-449-6439

INTERNET

TAX

RESEARCH

NETWORK

n Technical

Support:

1-800-835-0105

n

BOOK

NEWSLETTER

AUDIO

ARM

PLATFORM

Table of Contents

TAX RESEARCH NETWORK™............................................................................................................................... 2

THE PROSYSTEM fx® OFFICE.............................................................................................................................10

SALES AND USE TAX............................................................................................................................................ 12

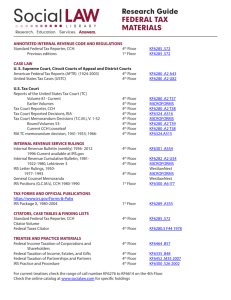

FEDERAL TAX......................................................................................................................................................... 13

Standard Federal Tax Reporter n Tax Research ConsultantTM n ClientRelateTM n Federal Tax Guide n U.S. Master Tax Guide®

n Federal Tax Compliance Manual n Business Strategies n Information Returns Guide n Code and Regulations n Tax Court Reports

n IRS Letter Rulings Reporter n IRS Positions n IRS Publications n Federal Excise Tax Reporter n Family Law Tax Guide

n Internal Revenue Manual n Federal Tax Audio Advisor n Business Valuation Guide n Current Law Handybooks n U.S. MasterTM Guide

Subscription Library Plan n Fiduciary Tax Guide n Federal Tax Articles n Accounting Articles n Oil and Gas Tax Reporter

STATE TAX..............................................................................................................................................................26

STATE SPECIALIZED LIBRARIES........................................................................................................................ 34

Sales Tax Research & Compliance ManagerTM n State Business Income Tax Research & Compliance ManagerTM

TM

n Property Tax Research & Compliance Manager

ACCOUNTING AND AUDITING...................................................................................................................... 38

Accounting Research Manager® n GAAP Library n Governmental GAAP Library n GAAS Library n Engagement Library

n Governmental and Not-for-Profit Audit Library n International Accounting Library n News and Developments

U.S. INTERNATIONAL AND MULTINATIONAL TAX ................................................................................... 44

Global Transactions Library n Transfer Pricing Library n International Tax Planning Library n International Tax Commentaries

n International Tax Treaty Expert LibraryTM n U.S. International Tax Guide Library n GlobalVATOnline

COUNTRY-SPECIFIC TAXATION . ................................................................................................................... 50

British Tax Library n Canadian Federal Tax Libraries n Canadian Provincial Tax Library n Canadian Goods and Services Tax Reporter

n China Laws for Foreign Business n Japan-U.S. International Tax Transactions n Latin American Tax Library n Mexican Tax Guide

n Mexican Tax, Customs and Foreign Investment Laws n Mexico Law & Business Report Newsletter

FINANCIAL AND ESTATE PLANNING ............................................................................................................55

Federal Estate and Gift Tax Reporter n Financial & Estate Planning n U.S. MasterTM Estate and Gift Tax Guide n FinEst CalcsTM

TM

n Estate Planning Expert Library

n Financial and Estate Planning Library n Inheritance, Estate and Gift Tax Reporter — State

n Estate Planning Review n New York Estates, Wills and Trusts n Wealth Management Library n ViewPlan® Advanced

PRACTICE AREAS.................................................................................................................................................. 61

Mergers & Acquisitions Expert LibraryTM n Business Entity Planning Library n S Corporations Guide n Partnership Tax

Planning and Practice n Limited Liability Company Guide n Real Estate Tax Commentaries n Tax Practice and Procedure

Commentaries n Nonprofit Organizations Library n Exempt Organizations Reporter

FORMS................................................................................................................................................................... 66

perform plus IIITM

n

Federal Tax Forms

JOURNALS............................................................................................................................................................ 68

TAXES — The Tax Magazine® n Journal of Tax Practice & Procedure n Journal of Passthrough Entities n Corporate Business

Taxation Monthly n International Tax Journal n Journal of Taxation of Financial Products n Journal of State Taxation

n Journal of Practical Estate Planning n Journal of Retirement Planning n CPA Practice Management Forum n M&A Tax Report

n Federal Tax Course Letter n Public Accounting Report

CONTINUING PROFESSIONAL EDUCATION...............................................................................................72

CCH Learning Center

ADDITIONAL PUBLICATIONS........................................................................................................................... 74

Pension Plan Guide

n

Payroll Management Guide

n

Capital Changes

TABLE OF CONTENTS

State Tax Reporters n Tax Zone Locator n Business Incentives Guide n Multistate Property Tax Guide n Multistate Corporate Income

Tax Guide n Multistate Sales Tax Guide n State Tax Guide n State Tax Cases Reporter n Liquor Control Law Reporter n State Tax

Guidebook Subscription Library Plan n Puerto Rico Tax Reporter n Guidebook to California Taxes n California/Federal Conformity Code

n Property Tax Alert n Sales & Use Tax Alert n Tax Shelter Alert n State Income Tax Alert n State Tax Review

Tax Research NetWork™

Fast, accurate and complete tax searches

Tax Research NetWork™ combines exceptional CCH

federal, state and international tax content with

superior Internet functionality. Its convenient, easyto-use interface enhances the productivity of your tax

information searches and produces superior results.

TAX RESEARCH NETWORK

Full-text primary source documents, explanations,

analysis and current tax news are fully integrated to

ensure that you get complete, authoritative answers to

your most important tax questions. Moving between

documents is easy. Links take you directly from one

source to another, increasing your efficiency and giving

you access to the in-depth coverage you need.

CCH@Hand,™ which is included with every Tax Research

NetWork subscription, allows you to search multiple

publications simultaneously and gives you one-click

access to Tax Research NetWork documents from

Microsoft® Office 2003 programs.

For 90 years, CCH has delivered the most reliable

guidance and analysis in the industry from experienced

CCH editors and through our partnerships with hundreds

of industry experts. Tax Research NetWork makes

accessing this valuable information easier than ever.

Find your research areas quickly.

The tab organization helps you find the information you

need quickly and efficiently. Just click on a tab to reveal

its full menu of documents.

nThe easy-to-use navigator bar is always visible at

the top of your screen so you can quickly start a new

search at any time.

nUse the search window, or click on the Check Citator,

Find by Citation or Search Tools buttons for alternate

search methods.

2

For more information visit CCHGroup.com

Tax Research NetWork™

Keep up to date on new developments.

n

Top tax news highlights, selected each day by CCH

editors, plus weekly in-depth articles on hot tax issues,

are readily available on the convenient “News” tab.

n

You can automatically track progress of legislation and

developments in quickly evolving tax areas with Tax

Trackers. Choose from over 40 topics.

n

Tax news emails include headlines with links to fulltext articles.

TAX RESEARCH NETWORK

CCH reports on Congress, the IRS, state governments

and court releases that affect federal and state taxes

every day. This material is immediately available in Tax

Research NetWork through Tax Tracker News™ and

quickly integrated into explanations.

Tax news and emails include headlines

with links to full-text articles.

View your customized Tax Tracker

News and daily tax highlights on the

convenient “News” tab.

For more information call 1-888-CCH-REPS

3

Tax Research NetWork™

Go directly to source material.

Documents are well-organized and include tools to help you locate related news, full-text source documents and

analysis quickly and easily.

n

Documents include an easy-to use document toolbar for quick access to common tasks.

nIntegrated documents and related links help you easily locate and review related news, documents and explanations

so you can find a complete answer fast.

Efficiently manage frequently used documents with tools such as Link Express™.

TAX RESEARCH NETWORK

n

Search the most

useful publications.

Tax Research NetWork can easily be

customized to put publications that help

you the most right at your fingertips. Your

“Favorite Research Publications” can be set

up and directly accessed from the “My CCH” tab.

4

For more information visit CCHGroup.com

Maximize your research efficiency.

Powerful search tools ensure that you get the answers you need quickly and reliably.

n

Start a new search any time from the navigation bar –­ always available at the top of your screen.

n Tax Thesaurus ensures that you locate all relevant documents without the need to enter all the

possible tax terms separately. The Tax Thesaurus finds singular and plurals automatically, too.

nSearch by word, phrase or citation – whichever you prefer. Narrow your search with options such as date restrictions

TAX RESEARCH NETWORK

or document types.

Enhance your results.

Hundreds of Practice Aids, Lookup Tables, Quick Answer Charts and Calculators are available on the Tax Tools tab to

increase your search capabilities.

n

Practice aids and Lookup Tables include:

n FinEst Calcs™

n Client Letter Toolkit

n Depreciation Toolkit

n Federal Sales Tax Deduction Toolkit

n Interactive Research Aids

n Topic Navigator

n Tax Calendar

n ZIPSales® Lookup

n Estate Planning Election & Compliance Toolkit

n

IRS Actuarial Factors

n

Quick Answer Charts include:

n Federal Tax Rates and Tables

n Multistate Quick Answer Charts

n Multistate Sales Tax Smart Charts

n Healy & Schadewald’s Annual Revenue Department

Surveys (Sales Tax) Smart Charts

n Yetter’s Drop Shipments Survey Smart Charts

n Calculators include:

n Federal Withholding Calculator

n IRA Comparison Calculator

n Paycheck Calculator

n Payroll Bonus Calculator (Aggregate Method)

n Tax Rates/Phase-Out Calculator

For more information call 1-888-CCH-REPS

5

CCH@Hand™

Search without interrupting your workflow.

CCH@Hand™ is the powerful productivity tool on Tax Research NetWork that helps you find your tax answers without

opening a browser or interrupting your workflow. It is included as part of every Tax Research NetWork subscription.

CCH@Hand simplifies your work by giving you one-click access through the CCH@Hand console. You can search

multiple sources simultaneously, all from one location. You’ll even have convenient access to your Tax Tracker News™

and other key functionality with no log-in required. And you can use the Citation tab to search for CCH documents

by citation.

Search several sources at once.

TAX RESEARCH NETWORK

CCH@Hand lets you research faster by searching Google,™ your desktop, your full CCH subscription and even key

industry websites simultaneously — without leaving your current document.

n

Multiple search areas are on the left of the CCH@Hand console “Search” screen.

n

Check the areas you want to search, type in your search term and click “Go.”

n

You can easily toggle back and forth between your results.

nThe split-screen display below shows summaries of results in the top preview pane. You can drill down to details in

your results by clicking on a Tax Research NetWork document in the top pane to display its full-text in the bottom

pane. This document may also be viewed in full screen.

Numerous state, federal and other industry websites can

be accessed by selecting the “Tax & Accounting Web Sites”

search option.

6

For more information visit CCHGroup.com

CCH@Hand

Find your tax answers by topic.

The new CCH@Hand Topical Index Finder

allows you to search content by topic. All of

your subscribed Topical Indices are merged

into a single topical tree for quick access to

the topics you need

n Simply type in the topic you are

looking for.

n You’ll then see a list of areas covering

your topic.

n Once you click on your result, a more

detailed list appears in the right pane.

TAX RESEARCH NETWORK

n Choose the document you wish to see,

and it will be displayed.

Expand your Microsoft® Office capabilities.

CCH@Hand provides revolutionary integration with Microsoft® Office documents. You get one-click access from

Microsoft® Office 2003 programs — Word, Excel, PowerPoint and Outlook — to fast answers in Tax Research NetWork.

And you can seamlessly integrate your results into your Microsoft® document.

n

The CCH@Hand Research Task Pane opens in a frame on the right side of your Microsoft® Office 2003 application,

making it quick and easy to add CCH excerpts.

nThe Citation Smart Tags menu appears in the left frame. Use Citation Smart Tags to add authority to your Microsoft®

documents.

nCitations are automatically recognized

within the text of Microsoft® 2003 Word,

Outlook, Excel or PowerPoint documents,

marked with a purple underline.

n

Retrieve the full text of the cited document

and insert it into your Microsoft® document.

nLink to explanations, annotations,

committee reports, and more if the citation

is to an IRC section or Regulation section.

n

Link to the citator listing in the Citator if the

citation is a case or ruling.

For more information call 1-888-CCH-REPS

7

Smart Charts™

Save time on state tax content searches.

TAX RESEARCH NETWORK

Smart Charts™ allow you to quickly and easily chart state tax issues in one jurisdiction or compare tax treatments across

multiple tax jurisdictions. Convenient display options ensure easy integration with your workflow. Plus, you even have

the choice to export your Chart results into either Microsoft® Word or Microsoft® Excel. Smart Charts are included as

part of subscriptions to State Tax Reporters, Sales Tax Research & Compliance Manager™, State Business Income Tax

Research & Compliance Manager™ and Property Tax Research & Compliance Manager™.

n

Display Your Results as a Matrix. If you choose the Matrix display option, you will be able to show multiple states and multiple topics, all in the same spreadsheet display.

8

n

Save Your Chart Searches. You can

save your chart searches and easily

access your search criteria in the

future without having to re-enter

selections. Links remain “live” in

your saved version for easy access

to support materials like laws,

regulations and explanations

within Tax Research NetWork.

n

When you access the same chart

again, you’ll automatically be

alerted by highlighted text as to

whether any of the answers have

changed within the past 30 days.

The notification period can be

adjusted as needed.

For more information visit CCHGroup.com

Training and Support

Learn right from your desktop.

CCH provides world-class training and CPE credits through Customer Training on CCHGroup.com. Our experienced

consultants and trainers bring years of industry experience to each online course to help you maximize the effectiveness

of your CCH products.

Sign up for FREE training classes right from your desktop.

TAX RESEARCH NETWORK

n

Training and Support can also be found on Tax Research NetWork.

nTraining, customer service

and customer support is

available through customer

service professionals and

comprehensive online

support tools.

nOnline help and training are

always close at hand on the

“Training and Support” tab.

nProduct and Technical Support

is just a phone call away for

other product or technical

questions.

For more information call 1-888-CCH-REPS

9

PROSYSTEM fx OFFICE

The ProSystem fx® Office

The ProSystem fx® Office offers the most advanced,

tightly integrated suite of tax, accounting, and workflow

tools available to professionals. These award-winning

products feature across-the-board accuracy, efficiency,

and security to ensure your peace of mind, help

add value to your client relationships, and increase

productivity and profitability.

ProSystem fx® Engagement —Increase the efficiency

of tax, assurance and consulting engagements and

move your firm toward a paperless office with reduced

administrative costs. ProSystem fx Engagement

electronic binders mimic your physical files to provide

convenient access to workpapers from any location,

dramatically increasing productivity in your firm.

Each module of The ProSystem fx Office suite is

designed for ultimate integration with Tax Research

NetWork, Microsoft® Office and ClientRelate.™ This gives

you instant access to all the latest tax research and

information when and where you need it.

ProSystem fx® Fixed Assets — This complete asset

tracking, management and reporting solution features

exclusive bi-directional integration with ProSystem fx

Tax and Global fx. It allows you to streamline all your

depreciation tasks, and integrates with ProSystem

fx Engagement to help simplify your document

management.

ProSystem fx® Tax — This award-winning tax

preparation software will increase your firm’s

productivity by automating computation and reportgeneration. ProSystem fx Tax is a complete solution that

addresses all your tax compliance requirements with the

most comprehensive system in the industry.

ProSystem fx® Document — Maximize your

productivity, reduce costs and move your firm toward

a paperless office with secure document retrieval from

any location at any time. Plus, reduce the risk involved

in manual file management by meeting Sarbanes-Oxley

and other regulatory compliance rules.

Global fx® — Using advanced ASP and thin client

technology, Global fx is an excellent alternative if your

firm is interested in providing 24/7 ProSystem fx Tax

access to your employees. With Global fx, applications

and client data reside on secure CCH servers, so the time

and resources formerly required to install, update, and

maintain software on your local system are eliminated.

COMPREHENSIVE INTEGRATION

BRINGS EVEN MORE VERSATILITY.

With the continuing integration between Document

and The ProSystem fx Office suite, Microsoft Office,

QuickBooks, and other applications,

ProSystem fx Document provides

an electronic repository for all

documents generated within the

firm. This enables streamlined

workflows, lower costs for storing

documents, and the opportunity

to create more time for staff to

generate revenue from new

clients or provide additional

services to your existing clients.

10

For more information visit CCHGroup.com

ProSystem fx® Outsource — Leverage highly-trained

domestic and offshore tax professionals to help your

firm streamline time-consuming tax return processing

operations. Years of experience enable CCH to deliver an

efficient, accurate, and secure outsourcing solution, so

that you can focus your staff on higher-value tasks.

ProSystem fx® Planning — Quickly review multiple tax

scenarios and optimize your 1040 tax planning activities

with ProSystem fx Planning. Now, you can easily

generate comprehensive multi-year forecasts and view

or print results in streamlined, side-by-side forecasting

reports, which can be customized to meet your needs.

ProSystem fx® Practice Management — This complete

time and billing, client, and project management system

supports your entire firm, allowing you to manage your

firm more effectively by monitoring project tracking and

appointments. Double entry of information is eliminated

through the integration of Practice Management with

other ProSystem fx Tax and Accounting products.

ProSystem fx® Profit Driver — Take financial analysis

to the next level and facilitate financial projections using

dynamic comparisons between performance, budget

and strategy. Providing robust projections can increase

your firm’s value and build client confidence in an everchanging business environment — and you’ll reinforce

your role as a trusted advisor to your clients and expand

the services you offer them.

ProSystem fx® Trial Balance — Streamline reviews,

compilations, and audits, then link to ProSystem fx

Tax for unbeatable reliability and workplace efficiency.

Our traditional trial balance system helps you provide

better client service while controlling your engagement

costs. This is the most complete and convenient trial

balance system available, producing accurate financial

statements and a solid set of workpapers in just minutes.

ProSystem fx® Write-Up — Provide increased client

services while saving time with the most technologically

advanced write-up package in the market, featuring a

robust database and streamlined data mining capabilities

that simplify data entry and overall management of

detailed transactions.

XCM — This third-party workflow application enhances

productivity with your ProSystem fx Office products.

You’ll no longer have to spend countless non-billable

hours chasing returns or looking for files — XCM will

show you where everything is, while streamlining your

completion of all tasks related to a project.

GainsKeeper® Pro — This online portfolio management

solution allows you to better advise and collaborate with

your clients. Now, you’ll have the tools you need to track

and manage clients’ investment activity, and to keep

concise, organized records of their investment portfolios.

For more information regarding The ProSystem fx

Office, visit CCHGroup.com/ProSystem or call

1-800-PFX-9998 (1-800-739-9998).

ProSystem fx® Scan — Winner of the 2006 Tax &

Accounting Technology Innovation Award as awarded by

CPA Technology Advisor, ProSystem fx Scan automates

the time-consuming preparation process for client source

documents. In a matter of minutes, an unsorted pile of

scanned documents is automatically rotated, identified,

and organized by document type into a bookmarked PDF.

ProSystem fx® Site Builder — The quick, easy and

affordable way to market your firm’s capabilities

online, helping you develop a customized website with

all the professional elements you need. Leverage the

convenience and flexibility of the Internet using the

highest level of security in the industry.

For more information call 1-888-CCH-REPS

11

PROSYSTEM fx OFFICE

ProSystem fx® Knowledge Tools — These helpful tools

provide a streamlined, easy-to-follow audit methodology

for implementing the AICPA’s new Risk Assessment

Standards effectively and efficiently. New practice aids

and tools support the new audit process and help your

firm achieve optimal results.

Sales and Use Tax

Sales and Use Tax

CCH offers a selection of Sales and Use Tax products

to ensure that your tax compliance is as painless — and

accurate — as possible. CCH offers everything from the

latest, most accurate tax information and tax forms

through integrated software tools that optimize how

quickly and easily you put that data to work. Sales and

Use compliance solutions include:

n CertiTAX

– a Web-based sales tax calculation engine

– Real-time address validation and tax rate application

based on CCH supplied rates and taxability research

SALES AND USE TAX

– Simply map your product SKUs to CCH tax categories

and stop manually researching and maintaining sales

and use tax rates!

– Seamless integration with Microsoft Dynamics GP,

AX, SL and NAV

– Eliminates the need to install and maintain

expensive software

– Produces signature ready returns and EDI e-filing

n ZIPSales®

Database and Lookup – provides correct tax

rates…guaranteed

– Decrease your chance of a sales tax audit with

accurate and complete data delivered in a userfriendly format

– Includes sales and use tax information for every

location throughout the U.S., its territories

and Canada

n Sales Tax

Load Utilities – automatically populate your

ERP tax rate tables with CCH supplied rates

– Monthly updates via automated download

– Eliminate risks and worries associated with compliance

–CertiTax Plug-ins seamlessly

integrate CertiTax with

your accounting order

entry process

– Seamless integration with Microsoft Dynamics GP,

AX, SL & NAV and with Sage Software MAS 90,

MAS 200, MAS 500 and ACCPAC

Returns – an automated web-based sales and

use tax filing solution

For more information regarding CCH Sales and Use

Compliance solutions visit CCHGroup.com/salestax or

call 1-800-630-2218.

Try our free, 30-day trial

and see for yourself,

www.esalestax.com/CERTITAX

n ZIPSales®

– Saves time and money with improved filing accuracy

and timeliness

– Fully integrated with CertiTAX

12

For more information visit CCHGroup.com

Federal Tax

Standard Federal Tax Reporter

n Code

arrangement allows you to find your answers

quickly and easily.

n Full text of

all proposed, temporary and final regulations follow the applicable Code sections to help you

interpret the law.

n More

annotations of cases and IRS rulings than any

other available publication provide you with the complete authority necessary to make sound,

accurate decisions.

n CCH

Explanations cut through the technicalities and

give you a clear, complete picture of the law.

n Weekly

updates of full-text IRS regulations and current

revenue rulings and procedures, cases and other source

documents ensure you’re in compliance with the law.

and Other Documents provides the full text of

federal administrative rulings and documents, including Revenue Rulings, Revenue Procedures, Treasury

Decisions, Notices of Proposed Rulemaking, IRS Announcements, and more.

n CCH

comprehensive tax legislation information is easy

to locate and use under the Tax Legislation blue bar on

Tax Research NetWork.

n The

most timely and thorough coverage of new developments, including tax legislation, allows for the most

effective tax research.

Topics Include:

n Personal

n Returns

n Corporate

Income

Income

n Business Expenses

and Deductions

n Mergers and Acquisitions

n Employee Benefit Plans

n Tax Accounting

n Partnerships

n Foreign Income and Credit

n S Corporations

n Exempt Organizations

n Capital Gains and Losses

n Tax-Free

Exchanges

Planning Checklists

n Procedure

and Administration

n Circular 230

n Collections

n New Matters

n U.S. Tax Cases

n Citator Listings

n Tax Tables

n Finding Devices

n Tax

n Rulings

n Letter

Rulings and IRS Positions include insights on the

IRS’ interpretation of tax laws on a myriad of previous

taxpayer situations.

n An

electronic publication, Tax Rates and Tables,

compiles commonly-used material, such as tax rates,

Applicable Federal Rates (AFRs) and savings bond

redemption tables, into one publication.

Your Subscription Includes:

n Taxes on Parade

newsletter

n U.S. Master Tax Guide®

n CPE Credit Service

— Covers timely, hot topics and

offers subscribers 12 hours of CPE credit each year

n ...and

much more

25 Loose-Leaf Volumes

Weekly Updates

PRINT

n An

electronic search tool, SmartRelate, lets you easily

navigate between the Code, Committee Reports, regulations, annotations and CCH Explanations.

n Client Letter Toolkit™

allows you to quickly find and

adapt appropriate client communications — search by

topic, type of client or type of letter for maximum flexibility.

Weekly Updates/

Daily Tax News

TAX

RESEARCH

NETWORK

n Election and Compliance Toolkit™

provides

coverage of more than 730 tax elections and gives you

the filing requirements for each tax election. You can

even create and print customized, filing-ready plain

paper election and compliance statements.

For more information call 1-888-CCH-REPS

13

FEDERAL TAX

Standard Federal Tax Reporter is the most comprehensive and current federal income tax authority in the

industry, providing you with a complete and up-to-date

picture of federal income tax law, organized in the way

most logical to many practitioners — by Internal Revenue

Code section.

Federal Tax

Tax Research Consultant™

Written by CCH editorial staff and leading tax practitioners, Tax Research Consultant™ offers a practical,

real-world focus on income, estate, gift, excise and Social

Security tax laws and the important issues that you face

every day. It’s loaded with Interactive Research Aids,

practical examples, sample calculations, compliance

pointers, comments, planning notes and other features

provided by our outstanding group of authors to show

you exactly how critical tax principles apply.

Topics Include:

n Individual

Income Taxes

Individual Returns, Paying Tax and AMT

n Real Estate Transactions

n C Corporations

n LLCs

n Partnerships

n RICs, REITs, REMICs and Banks

n S Corporations

n Net Operating Losses

n Consolidated Groups

n Corporate Reorganizations

n Deductions and Credits

n Business Stages from Start-Up to Termination

n Depreciation and Cost Recovery

n Farming and Natural Resources

n Filing Business Returns and Paying Taxes

n Compensation and Benefits

n Payroll Tax Reporting

n Retirement Plans

n Sales and Exchanges

n Tax Accounting

n Valuation for Tax Purposes

n Estate and Gift Taxes

n Estate and Trust Income Taxes

n Americans Abroad and Foreign Individuals

n International Taxation – Generally

n International Taxation – Inbound Transactions

n International Taxation – Outbound Transactions

n Audits, Collection and the IRS

n Penalties and Interest

n Tax Litigation

n Tax Exempt Organizations

n Excise Taxes

n Social Security Taxes

FEDERAL TAX

n Filing

14

Your Subscription Includes:

n Interactive Research Aids — Interactive web applications

designed to help you quickly reach sound decisions,

with decision trees that allow you to narrow your focus

and avoid irrelevant legal discussions, identify related

issues or special exceptions, and more

n Practice and Procedure Guides — Comprehensive

guidance for handling controversies with the IRS

n Election and Compliance Toolkit™ — Helps you create

and print customized, filing-ready, plain-paper election

and compliance statements

n Client Letter Toolkit™ — Allows you to quickly find and

adapt appropriate client communications

n U.S. Master Tax Guide® — Provides a clear, concise

summary of the tax laws, with links to comprehensive

discussion in Tax Research Consultant

n Federal Tax Weekly — A weekly newsletter including

such features as Washington Report and

Practitioners’ Corner

n Depreciation Toolkit™ — An interactive tool allowing you

to quickly create a depreciation schedule for any business asset and providing information on depreciation

n IRS Actuarial Factors Finding Tool — Instantly finds or

calculates the exact actuarial factor you need

n Internal Revenue Code and Regulations — Includes

complete CCH legislative history

n Tax Legislation — Helps you easily locate and apply the

latest tax legislation

n IRS Publications — Over 150 titles covering specific

areas of the tax law from the IRS’ perspective

n perform plus III™ — A complete, timely and extensive

collection of federal tax forms and instructions that

allow you to do calculations within each form, link from

form to relevant portion of instructions, and more

n Rulings and Other Documents, and Letter Rulings and

IRS Positions

n TAXES — The Tax Magazine® — Provides thorough,

accurate analysis of current tax issues, trends and

legislative developments from top tax experts

n Business Calculators

n Tax Preparation Calculators

n Tax Calendar

— Used to create a customized calendar

of federal and state due dates

Weekly Updates/

Daily Tax News

TAX

RESEARCH

NETWORK

For more information visit CCHGroup.com

Federal Tax

ClientRelate™

n Alerts you to

new tax developments and quickly identifies affected clients

n Targets clients that may benefit from additional services

n Identifies

new client service areas and opportunities for

your practice

With ClientRelate, you’ll have all the expert analytical

support and tools you need to improve your efficiency

and complete your client services:

n Bulletins

— Give you timely coverage of new developments in federal tax law

— Provide comprehensive analysis of step-bystep procedures for tax planning engagements

n Client

Letters — Include mail merge functionality,

formatted with address and contact information extracted from your ProSystem fx Tax or Global fx Tax data

— so communicating with your clients is easier than ever

ClientRelate allows you to perform three types of

searches that provide you with fast answers to your

clients’ tax questions:

n Search

by Tax Bulletin — Check across your entire

client base to see which clients are impacted by

specific developments.

n Search

by Service — Check across your entire client

base to see which clients might benefit from specific

services or engagements.

n Search

by Clients — Determine which services or

bulletins might be most beneficial to a particular client

or a group of clients. For added convenience, you can

even select your searches by year.

Weekly Updates

n Services

n Service Summaries

— Summarize and identify clients

that might be eligible for a service by automatically

searching your client data

n Explanations of the

Law — Ensure you’re providing

your clients with the most accurate information

n Step-by-Step Analyses

— Guide your staff through client services, freeing up your time

n Practice Aids

— Help you develop spreadsheets, create

elections and fill in forms — reducing the time it takes

to produce an end product

TAX

RESEARCH

NETWORK

First year subscription includes ClientRelate consulting

to help you discover how ClientRelate will streamline

your firm’s planning and client communications. Private

consultation sessions are available — via Microsoft®

Office Live Meeting PlaceWare or in person with

one of our product experts. Call your CCH Account

Representative for details.

For more information call 1-888-CCH-REPS

15

FEDERAL TAX

ClientRelate™ is an innovative productivity tool for

accounting firms that integrates the power of Tax

Research NetWork with the power of ProSystem fx® Tax

and Global fx® Tax. ClientRelate helps you manage your

resources and easily integrates with your daily workflow, allowing you to save time and money, generate

revenue, and focus on the most important element of

your practice — your clients.

Federal Tax

Federal Tax Guide

Federal Tax Guide is an easy-to-use, concise resource

that explains federal income, estate and gift, payroll and

selected excise taxes — and points out tax savings and

tax planning opportunities.

n CCH

Explanations clearly explain all the rules relating

to the tax issues most important to you.

n References to the

Internal Revenue Code, regulations,

court decisions and IRS rulings provide the authority to

support your positions.

n Practical

examples illustrate how the laws apply to client situations.

are integrated with explanations so that

you can see, at a glance, the compliance implications

of the tax laws.

FEDERAL TAX

n Filled-in forms

With the Guide, you may choose between two options:

explanations only (Federal Tax Guide — Control

Edition) or the full service (Federal Tax Guide — Regular

Edition), consisting of the explanations, plus the IRC and

tax regulations.

Topics Include:

Tax Computations

n Tax Credits

n Gross Income

and Exclusions

n Sales & Exchanges

n Individual Taxation

n Business Income

and Expenses

n Depreciation

n Qualified

and Nonqualified Plans

n Corporations

n S Corporations

n Partnerships

n

16

Your Subscription Includes:

n Tax Week

newsletter — Summarizes and comments on

new developments to keep you up-to-date.

n Individuals’ Filled-In Tax Return Forms

— Provides

sample filled-in reproductions of many of the tax forms

and schedules that individual taxpayers must file with

the IRS for the 2006 tax year.

n Corporation-Partnership-Fiduciary Filled-In Tax Returns

Forms — Provides sample reproductions of several

commonly-used business tax forms, along with helpful

coordinated explanations.

n Tax Terms

— Provides definitions of commonly-used

tax phrases

n Tax Calendar

— Provides professionals and their clients

with a tool to plan for and track important tax dates.

n Forms

package — Includes copies of tax forms for

individuals and businesses.

n Tax

Legislation — Helps you easily locate and apply the

latest tax legislation.

n Tax Planning Strategies

n Limited

Liability

Companies (LLCs)

n Tax Accounting

n Exempt Organizations

n Foreign Income

and Taxpayers

n Withholding

n Estate and Gift Taxes

n Returns and Procedure

n Excise Taxes

n Tax Return Preparers

n Special Taxpayer

n Tax Planning

n Tax Practice Before the

IRS and Federal Courts

— Provides clear and concise

explanations of new planning opportunities available

to individuals and families.

n CPE Credit Service

— Covers timely, hot topics and

offers subscribers 12 hours of CPE credit each year.

Weekly Updates/

Daily Tax News

PRINT

TAX

RESEARCH

NETWORK

For more information visit CCHGroup.com

Federal Tax

U.S. Master Tax Guide®

Federal Tax Compliance Manual

The leading guide in the industry

for more than 90 years, U.S. Master Tax Guide® provides tax practitioners with fast, accurate answers

to a wide range of tax questions

— in one compact volume.

This all-in-one, quick-reference manual offers practical,

line-by-line instructions on the preparation of federal tax

returns, as well as discussions on tax planning, covering

the basic federal tax rules and forms affecting individuals

and businesses.

With Monthly Reports

n Explanations

written by expert

CCH editors offer concise and

reliable interpretation of the

federal tax laws.

n The monthly Return Talk newsletter and additional

checklists, rate tables and depreciation

tables help you find information quickly and show you

how the latest rules apply.

n The

exclusive Quick Tax Facts card provides an at-aglance reference to key tax figures.

n Top Tax Issues Course

analyzes the most significant new

developments and offers practitioners 18 hours of

CPE credit.

n Cross-references to the

Internal Revenue Code,

Income Tax Regulations, Standard Federal Tax

Reporter, Tax Research Consultant and Federal Tax

Guide ensure you know where to find in-depth coverage when you need it.

Topics Include:

n Individuals

n Corporations

n S Corporations

n Partnerships

n Trusts/Estates

n Tax Accounting

n Exempt

n Depreciation

Organizations

n Income

Updated

Monthly

Daily Tax

TAX

News

RESEARCH

NETWORK

BOOK

n Tax Credits

n ...and

Book Edition

864-Pages, Paperback

or Hardbound Volume

Updated Annually

n Illustrative

examples integrated into the explanations,

along with over 150 filled-in forms, clarify tax return

preparation and demonstrate how specific rules apply.

n A

special tax planning section offers specialized tax

advice and basic tax-saving techniques for individuals,

employees, families, businesses and estates.

FEDERAL TAX

n Examples,

reports bring the latest news on important changes and

new developments in the federal tax law, with special

emphasis on how they impact tax return preparation.

n A topical

index, a case table, and helpful finding lists

and checklists enable you to quickly track down the

information you need.

Topics Include:

n Tax Planning

n Individuals

n Corporations

n Partnerships

n Income and Expenses

n Gains and Losses

more

n Deductions

n Credits

n Accounting

Rules

& Exchanges

n Exempt Organizations

n ...and more

n Sales

1 Loose-Leaf Volume

Updated Monthly

PRINT

Business Strategies

Business Strategies is a total business planning system that provides business advisors and entrepreneurs with the

information necessary to successfully start and manage a small business. Business Strategies provides a unique blend

of business and tax law, human resources and accounting information, plus vital, often hard-to-find forms for a variety

of business transactions and checklists to aid in making business and planning decisions. Covers more than 160 areas

that are critical to day-to-day operations and long-term management of your business.

Includes explanations and forms, planning aids, guidelines, checklists and client letters to help you

make the right decisions.

3 Loose-Leaf

Volumes

Monthly Updates

PRINT

Topics Include:

n

n

n

n

Starting or Buying a Business

Administration and Recordkeeping

n Managing a Business

n

n

Employment Issues

Sales and Marketing

n Compensation and Benefits

For more information call 1-888-CCH-REPS

Retirement Planning

Business, Legal, Accounting and

Tax Impact

17

Federal Tax

Information Returns Guide

This handy guide gathers together all the requirements for reporting transactions affecting the tax

liabilities of payees including:

n Tabbed divisions

n Interest, dividend

n Separate, detailed

n Pensions

n Real

and original issue discount reporting

indexes lead to proposed, temporary

and final regulations by subject for quick location of

pertinent provisions.

and IRA reporting

estate and property reporting

n Broker

reporting

n Employee

and employer non-wage reporting

(including tip income)

n Requirements for filing on

magnetic media

and electronically

n Backup

withholding requirements

ship interest transfer reporting rules, higher education

expense reporting, the Bank Secrecy Act currency

reporting rules and the governmental reporting rules

for establishing anti-money laundering programs and

reporting suspicious activity

n Official

IRS forms and instructions

Research aids, such as a topical index, a tax calendar and

finding lists, make locating information a breeze and help

practitioners avoid filing errors that can result in

serious penalties.

1 Loose-Leaf Volume

Monthly Updates

Bound Book Editions

Updated Biannually

TAX

RESEARCH

NETWORK

BOOK

Tax Court Reports

This authoritative publication offers weekly, full-text

reporting of Tax Court Regular and Memorandum

decisions, along with daily, electronic-only reporting of

Tax Court Summaries. Tax Court Reports provides you

with current, complete access to decisions made by the

nation’s specialized tax tribunal.

n Coverage of

important petitions filed with the U.S. Tax

Court is included.

n CCH

headnotes summarize every decision for fast,

efficient answers.

n CCH Analysis

points out current trends, helping you

stay up to speed with the latest developments.

PRINT

Code and Regulations

Code and Regulations provides practitioners with a

quick reference to statutory federal tax law and to the

regulations that prescribe the rules and procedures that

make the law effective. In seven loose-leaf volumes, it

presents the full text of the Internal Revenue Code in its

entirety — complete with historical coverage and the

income, excise, employment, and estate and gift tax

regulations, including temporary and proposed regulations.

n Updated monthly, Code

and Regulations provides

subscribers with the most up-to-date official material

available, as amended — including the latest proposals,

provisions and amendments.

including a topical index, rate

tables, and status tables on proposed regulations and

law changes not yet reflected in the regulations, make

information easy to locate and use.

Volume 1 — Current Memo Decisions. Contains all memorandum opinions, along with the Table of Decisions put

forth since 1942, including the Board of Tax Appeals (BTA).

Volume 2 — Current Regular Decisions. Contains all

regular decisions, along with CCH cross-reference tables

listing page numbers and names of the opinions, and the

Decision number assigned by CCH.

Volume 3 — Dockets, Petitions, Index-Digest. Contains

biographies of all Tax Court judges, the Tax Court Rules of

Practice, selected petition abstracts, and an alphabetical

list of all Tax Court petitions filed, as well as a monthly listing

of trial calendars and the cities where they are being held.

Weekly Updates/

Daily Tax News

3 Loose-Leaf Volumes

Weekly Updates

n Handy finding devices,

18

Monthly Updates/

Daily Tax News

7 Loose-Leaf Volumes

Monthly Updates

PRINT

n Miscellaneous income reporting, including partner-

FEDERAL TAX

clearly organize the Code by tax

category and follow the official plan of the Code, with

the Code sections presented in numerical sequence.

PRINT

TAX

RESEARCH

NETWORK

Volumes 1 and 2 also available separately as Tax Court Decisions.

For more information visit CCHGroup.com

IRS Letter Rulings Reporter

IRS Publications

The IRS Letter Rulings Reporter features the full text of

IRS responses to inquiries concerning application of the

tax rules to specific situations, along with the text of revenue

procedures relating to the IRS Letter Rulings, including:

n Technical Advice Memoranda

n Private Letter Rulings

n General Counsel’s Memoranda

n Field Service Advice

n Chief Counsel Advice

n Service Letter Advice

n Litigation Guideline Memorandum

This handy resource provides approximately 150 current

IRS publications intended for public use by taxpayers

and their advisors — and reproduces them in an 81/2” x 11”

format for easy access. Here’s a sampling of the

publications you’ll receive:

n Publication 15: “Circular E, Employer’s Tax Guide”

n Publication 17: “Your Federal Income Tax”

n Publication 334: “Tax Guide for Small Business”

n Publication 509: “Tax Calendars for 2006”

n Publication 535: “Business Expenses”

n Publication 541: “Partnerships”

n Publication 542: “Corporations”

n Publication 553: “Highlights of 2004 Tax Changes”

To keep you on top of all the latest developments, each

of our weekly Report Letters provides summaries of all

the private rulings released by the IRS on the Friday of

the preceding week. Two convenient finding devices are

included to allow you to ascertain the status of a ruling:

n Alphabetical List — To locate LTRs by subject or key words

n Code

Finding List — To locate letter rulings that involve a particular Code Section

IRS Publications is included with many of our federal tax

Internet libraries — be sure to ask your CCH Representative

for details.

Weekly Updates/

Daily Tax News

1 Loose-Leaf Volume

Weekly Updates

PRINT

So that you’re always up-to-date on the new and revised

publications issued by the IRS, we send them to you

immediately upon release by the IRS. They’re topically

indexed and keyed to applicable IRS forms.

TAX

RESEARCH

NETWORK

Periodic Updates/

Daily Tax News

3 Loose-Leaf Volumes

Periodic Updates —

Monthly During Tax Season

PRINT

TAX

RESEARCH

NETWORK

IRS Positions

If it’s the “working law” of the IRS as embodied in the

agency’s General Counsel’s Memoranda and Actions on

Decisions that you need, IRS Positions is the Reporter

for you. Here, you’ll receive the official texts of these IRS

documents, providing you with first-time, “behind-thescenes” reasoning of the IRS in an easy-to-use, timely

format. Finding devices help you locate topics easily.

IRS Positions also includes Litigation Guideline

Memoranda (LGM), Service Center Advice (SCA), Market

Segment Specialization Program (MSSP) audit guides,

and Industry Specialization Program (ISP) coordinated

issue papers — tax compliance reference material used

by IRS examiners.

Monthly Updates/

Daily Tax News

1 Loose-Leaf Volume

Periodic Updates

PRINT

TAX

RESEARCH

NETWORK

For more information call 1-888-CCH-REPS

19

FEDERAL TAX

Federal Tax

Federal Tax

Federal Excise Tax Reporter

This convenient desktop reference offers complete,

timely coverage of federal excise taxes, with monthly

reports to keep you apprised of the latest developments

and tax law changes.

n CCH

Explanations cut through the technicalities of

complex excise tax issues and procedural rules —

allowing you to find your answers faster than ever.

n Information

is presented in Code Section order with

related committee reports, followed by final, temporary

and proposed regulations, as well as CCH Explanations

annotations of federal court decisions, IRS rulings and

IRS private letter rulings.

n Quarterly

reports keep you up-to-date on tax law

changes, administrative rulings, court decisions and

other current developments in the family law practice.

n With

a logical organization, case table, finding lists

and a topical index, the Guide is designed so pertinent

information can be readily located for quick reference.

Topics include:

n Alimony

n Child Support

n Dependency Exemption

n Family Businesses

n Caution

lines alert you to new provisions and

effective dates.

FEDERAL TAX

n A

monthly newsletter highlighting what’s new in

excise taxes and alerts you to trends.

Topics Include:

n Fuels and Transportation

n Heavy Trucks and Trailers

n Tires, Coal and Chemicals

n Telephone Taxes and Refunds

n Sports Equipment

n Vaccines

n Foreign Insurance Policies

n Water Transportation Taxes

n Wagering

n Air Transportation Taxes

n Refunds and Credits

1 Loose-Leaf Volume

Quarterly Updates

PRINT

Internal Revenue Manual

n Administration

Monthly Updates/

Daily Tax News

TAX

RESEARCH

NETWORK

Family Law Tax Guide

Family Law Tax Guide provides full and continuing

coverage of the tax issues and planning opportunities in

marriage, separation and divorce situations. C. Garrison

Lepow, JD, LLM, Professor of Law, Loyola University New

Orleans, explains the fundamental principles in divorce

situations, provides planning insights and practical

examples that illustrate the concepts discussed.

20

Home

n Marital Status

n Property Settlements

n Transfer Taxes

Depending on your particular needs, this two-part product

includes all the necessary text you’ll need from the Internal

Revenue Manual — Administration and Audit. If you’re

a print subscriber, you may purchase one or both — it’s

your choice. If you’re an Internet subscriber, the entire

manual is included, with the exception of Official Use

Only material. The entire manual contains personnel procedures, the Chief Counsel Directives Manual and some

paper and electronic filing processing rules, in addition to

the data available in print format.

1 Loose-Leaf Volume

Monthly Updates

PRINT

n Marital

— Six volumes cover the IRS organization, the collecting process, rulings and agreements,

appeals, criminal investigations, taxpayer education

and assistance, and the taxpayer advocate service,

including the division on penalties and interest.

n Audit

— Four volumes contain Audit Technique Guides

and procedural information pertaining generally to examination principles and audits on specific tax issues,

such as the retail industry.

Monthly Updates/

Daily Tax News

6 Loose-Leaf Volumes

Monthly Updates

(Administration)

PRINT

4 Loose-Leaf Volumes

Monthly Updates

(Audit)

PRINT

For more information visit CCHGroup.com

TAX

RESEARCH

NETWORK

Federal Tax

Federal Tax Audio Advisor

Every other month, you’ll receive:

n The

Federal Tax Audio Advisor multimedia CD. This

enhanced CD contains an audio program tied to the

accompanying Outline. This CD also contains PDF

and RTF files of the Outline, Quizzer, Client Letter

and Bulletin accessible on a PC. The Outline contains

citations that are directly linked to Tax Research

NetWork, enabling Internet subscribers to access

cases, Revenue Rulings and other valuable information.

n A

comprehensive Outline of the subjects discussed,

with references to the Standard Federal Tax Reporter,

Federal Tax Service and Federal Tax Guide for

further study

n A

ready-to-reproduce Client Letter that communicates

important tax news and tips to your clients

n A

bulletin that alerts your staff to important tax

changes, so they can quickly answer client questions

n A Quizzer

worth four hours of CPE credit upon

successful completion

Bimonthly Updates

AUDIO

Business Valuation Guide

Business Valuation Guide provides you with everything you’ll need to know to take advantage of the rapid

growth in business valuations. Authors George Hawkins

and Michael Paschall — who perform business valuations

for a wide variety of privately-held corporations, partnerships and professional practices — provide practical

insights, fundamental know-how and detailed, step-bystep guidance to help professionals at all levels meet the

challenges and succeed in business valuation.

The Guide combines an annually updated loose-leaf

reference with quarterly newsletters highlighting the

latest developments and trends to give you the most

comprehensive, up-to-date information available.

Topics Include:

n Valuation Fundamentals

& Approaches

n Addressing and

Analyzing Risk

n Reaching a Conclusion

on Value

n Discounts and Premiums

n Professional Practical

Valuations

1 Loose-Leaf

Volume Annual

Updates

n Family

Limited

Partnership Valuations

n ESOP Valuations

n Estate and

Gift Tax Valuations

n Litigation Valuations

n Sample Valuation

Report

Annual Updates/

Daily Tax News

TAX

RESEARCH

NETWORK

PRINT

Quarterly

Newsletter

NEWSLETTER

Current Law Handybooks

Build a strong library of powerful, authoritative resources

with this premier tax book subscription plan — all at a

tremendous savings (more than half off what you would

pay to buy these titles individually). As a subscriber, you’ll

receive an initial shipment containing many of the popular

and currently available CCH book titles. Then, throughout

the year, you’ll receive additional titles and new editions

as they’re printed and released.

Subscribers to Current Law Handybooks will receive the

most current editions of such titles as:

n U.S. Master Tax Guide®

n U.S. Master™ Depreciation Guide

n U.S. Master™ Excise Tax Guide

n Income Tax Regulations (six volumes)

n Internal Revenue Code (two volumes)

n Federal Estate and Gift Taxes — Code and Regulations

n U.S. Master™ Estate and Gift Tax Guide

n Federal Income Taxes of Decedents, Estates and Trusts

n Corporation Partnership Fiduciary Filled-In Tax

Return Forms

n Individuals’ Filled-In Tax Return Forms

n State Tax Handbook

n Guide to Record Retention Requirements

n Tax Calendar

n Car, Travel and Entertainment and Home

Office Deductions

n Current Legislation Law, Explanation and Analysis

n …and more

Most titles are updated annually

and are paperback volumes.

BOOK

For more information call 1-888-CCH-REPS

21

FEDERAL TAX

This bimonthly tax update and practice development

tool is loaded with tax planning ideas, tips and reminders

— all designed to help you better serve your clients. Written by noted tax experts Sidney Kess and Barbara Weltman, each issue focuses on a timely tax-planning topic by

first discussing the complex rules, and then showing you

how to apply them to your practice.

Federal Tax

U.S. Master™ Guide Subscription

Library Plan

The U.S. Master Guide Subscription Library Plan

brings you the complete CCH line of industry-leading

federal and state tax and accounting U.S. Master Guide

Series at a substantial discount — more than half off the

regular cover price, if titles were purchased individually.

When you subscribe to the Plan, you’ll receive all of the

U.S. Master Guides currently available. Then, throughout

the year, you’ll receive all new editions and new Master

Guides published within your subscription period. As a

bonus, you’ll also receive several free “Top Issues” CPE

course books.

™

You’ll get the most current editions of all titles in our

U.S. Master Guide Series:

FEDERAL TAX

n U.S. Master Tax Guide®

n U.S. Master™ Accounting Guide

n U.S. Master™ Bank Tax Guide

n Monthly

reports provide timely coverage of important

court decisions, regulations, final and proposed Code

changes, and IRS rulings.

n Full text of

pertinent court decisions and IRS rulings is

included, along with headnotes for quick reference.

n Current filled-in forms

and examples walk practitioners

through real-world compliance issues.

n State

law explanations are separated into summaries

of the income tax and the inheritance, estate and gift

tax rules for each state.

n Topical index, case table and finding lists facilitate

easy research.

n Income Taxation of

n U.S. Master™ Depreciation Guide

Estates and Trusts Overview

Final Income Tax Return

n Income in Respect of a Decedent

n Distributable Net Income

n Charitable Deductions

n Alternative Minimum Tax

n Terminations

n Depreciation

n Distributions

n Charitable Trusts

n Grantor Trusts

n Filled-In Income Tax Returns

n Estate, Gift and Generation-Skipping Transfer Taxes

n Filled-In Estate and Gift Tax Returns

n Post-Mortem Tax Planning

n State Tax Law Survey

n Fiduciary Responsibilities

n Decedent’s

n U.S. Master™ Employee Benefits Guide

n U.S. Master™ Estate and Gift Tax Guide

n U.S. Master™ Finance Guide

n U.S. Master™ Auditing Guide

n U.S. Master™ Excise Tax Guide

n U.S. Master™ GAAP Guide

n U.S. Master™ Multistate Corporate Tax Guide

n U.S. Master™ Property Tax Guide

n U.S. Master™ Sales and Use Tax Guide

n U.S. Master™ State Tax Practice and Procedure Guide

BOOK

This handy practitioner’s reference offers expert analysis

of fiduciary tax issues that can help estate and trust

administrators avoid turning personal responsibility into

personal liability.

Topics Include:

n U.S. Master™ Compensation Tax Guide

Most titles are updated annually

and are paperback volumes.

Fiduciary Tax Guide

1 Loose-Leaf Volume

Monthly Updates

PRINT

22

For more information visit CCHGroup.com

Federal Tax

Federal Tax Articles

Oil and Gas Tax Reporter

Summaries of law review and professional journal articles

covering federal tax issues comprise this quick-reference

reporter.

From the acquisition of the mineral rights, to the exploration and development of the property and ultimate

production of the mineral, the Reporter addresses the

challenging federal tax aspects along every step of the

way. Patrick Hennessee, PhD, CPA, and Sean Hennessee,

JD, MS Taxation, MBA, provide a thorough analysis of oil

and gas tax issues, expert commentary, helpful planning

insights and practical examples illustrating the concepts

discussed. This is a practice-friendly resource.

are surveyed for tax-related articles to

provide you with information on all the issues.

n A

synopsis of every applicable article in these publications is prepared and includes basic information about

the article and a summary highlighting the significant

points made by the author. Coverage of current procedures, new regulations and cases is emphasized in the

article selection.

n The

synopses are arranged in Code Section order. If

you know the Code Section you’re interested in, you

can turn directly to an article on that particular topic.

If not, we provide a topical index that allows you to

search for your subject. An alphabetical list of authors

is also included for quick referencing.

1 Loose-Leaf Volume

Monthly Updates

PRINT

Accounting Articles

This convenient resource offers monthly reporting on new

articles and comments appearing in accounting, financial

and business periodicals — helping you stay up-to-date

on the practices, analyses, opinions and ideas of others in

the field and providing you with possible solutions to specific

accounting situations. Each issue of Accounting Articles

describes the new articles and comments as they become

available, and indexes the descriptions by topic and author.

Detailed summaries of relevant state and local oil and gas

tax provisions are included, along with the IRS Oil and Gas

Handbook from the Internal Revenue Manual.

Topics Include:

n Economic Interests

n Lease and Purchase Arrangements

n Royalties

n Working or Operating Mineral Interest

n Production Payments

n Net Profits Arrangements

n Geological and Geophysical Expenses

n Dispositions of Interests

n Coverage of Legislation

n …and more

FEDERAL TAX

n Publications

1 Loose-Leaf Volume

Quarterly Updates

PRINT

n Monthly

reports summarize articles, notes and

comments appearing currently in accounting, financial

and business periodicals, with Report Letters highlighting new developments for quick reference.

n Statements and amendments published by the Government

Accounting Standards Board (GASB) and Financial

Accounting Standards Board (FASB) are summarized.

1 Loose-Leaf Volume

Monthly Updates

PRINT

For more information call 1-888-CCH-REPS

23

FIN 48 Solutions from CCH

Everything you need to simplify

FIN 48 implementation and compliance

Trust CCH for the comprehensive and reliable solutions you need to get fast, accurate answers relating

to the implementation and planning for FIN 48.

FIN 48 Manager™

Streamline your workday with this all-in-one tool for simplifying and clarifying complex FIN 48

requirements. FIN 48 Manager brings together all the support materials, tools and information

necessary to meet all the new financial requirements for federal, state and international taxes.

Only FIN 48 Manager provides this level of coverage:

n Common Questions

and Answers — More than 80 Q & As guide you through the most common

and complex issues relating to FIN 48 requirements.

n Multistate FIN 48 Smart Charts™ — Quickly chart state tax issues in one jurisdiction, or compare

tax treatments across multiple jurisdictions.

n Easy-to-Use Practice Aids — Comprehend tough FIN 48 issues with tools like the Compliance

Workflow Plan, International Tax Issues Sample Memo, Inventory Tracker Templates, and more.

n FIN 48 Best Practices — Includes a series of interviews with Tax Directors at Large Corporations

discussing implementation of FIN 48 and their compliance plans.

n FASB Interpretation No. 48 — The PDF document issued by FASB has been organized into separate

sections so you can locate relevant information more easily

n FIN 48 Related Documents — All FIN 48-related filings and disclosure documents are integrated

into FIN 48 Manager for easy access, anytime.

n FIN 48 Archive — Includes FASB Interpretation No. 48 as originally issued; FIN 48A (the appendix);

and the official PDF of the amended version.

Also available:

Accounting Research Manager® (ARM)

The largest and most comprehensive financial reporting online database, ARM provides complete,

interpretive guidance on FIN 48 and FASB Statement 109, along with clarity on how FIN 48 impacts

Statement 109. See page pp. 36–37 for more information.

CCH Accounting for Income Taxes

This handy reference gives you the in-depth and current analysis you need to comply

with Statement 109 and FIN 48

Call your Account Representative at 1-888-CCH-REPS (1-888-224-7377) today to find

out more about how you can meet all FIN 48 requirements — quickly and easily.

24

For more information visit CCHGroup.com

Improve my productivity

Increase the value I deliver clients

Maximize my firm’s value

Save me time and money

Improve my efficiency

Work with my existing systems and

workflow

Streamline my business processes

I needed solutions to:

Keep me current on relevant

changes

Address my staffing challenges

And CCH delivered:

Accounting Research Manager®

Tax Research NetWork™

CCH understands the challenges you face every day,

like the need for timely, accurate tax and accounting information. That’s why we design leading-edge,

easy-to-use solutions that keep you automatically

updated on the latest developments in federal, state,

and international tax, as well as GAAP, GAAS and SEC

rules.

Gain the strategic advantage you need to stay ahead

of the competition with our award-winning products,

and partnerships with key organizations like the IRS.

What business need can we help you solve?

Please see page 38 for more details.

For more information call 1-888-CCH-REPS

25

State Tax

State Tax Reporters

State Tax Reporters tie together detailed explanations, primary source materials and practical guidance

to provide complete and definitive answers that help

you plan tax strategies and resolve complex tax issues in

every state. With an unparalleled team of CCH editors,

you can be sure of timely coverage of hot and emerging

tax issues, current material and in-depth analysis. And

because everything is linked together via SmartRelate,

finding your answer couldn’t be easier. Selected federal

topics may be linked, too.

Subscribe to any combination of State Tax Reporters (subscriptions available for each state, plus

Washington D.C.)

n Superior CCH

STATE TAX

search software that allows you to search by

tax type, document type and across states

n Coverage of

proposed legislation and state regulatory

activities, from introduction through enactment

n Archives of

Laws and Regulations, beginning with 1994

Topics Include:

n Practice

and Procedure

n Corporate

n Personal

n Sales

Income

Income

& Use

n Property

Each State Tax Reporter includes:

Explanations, organized by tax type,

with references that take you directly to related laws,

regulations, court decisions and administrative rulings,

providing one-stop shopping for all your needs

n The full text of

state tax statutes, regulations, rulings

and releases, court decisions and attorney general

opinions for reliable, authoritative support

n SmartRelate,

which allows you to assemble all material

related to an explanation or document in one state and

review explanations on the same topic in other states

as well

n Daily

n Powerful

and weekly news coverage of the latest state tax

developments affecting all 50 states and the District

of Columbia through Tax Tracker News, State Tax Day,

Cases and Rulings in the News and State Tax Review

newsletter

n Franchise/Capital Stock

n Incorporation

n Inheritance,

n Alcoholic

n Motor

and Qualification

Estate and Gift

Beverages

Fuels

n Severance

n Cigarettes

n Gross

and Tobacco

Receipts

n Insurance/Gross

Premiums

n Selected City Taxes

n Public Utilities/Transportation

n Unemployment Compensation

n Unclaimed

Property

n Miscellaneous

Licenses and Fees

Your Subscription Includes:

n Weekly

State Tax Review newsletter

Twice-monthly Updates/

Daily Tax News

TAX

RESEARCH

NETWORK

26

For more information visit CCHGroup.com

State Tax

Tax Zone Locator

Tax Zone Locator is a valuable tool for quickly locating

federal, state and local tax incentive areas to obtain a

variety of lucrative tax benefits. There are thousands of

these specifically designated zones throughout the U.S.

Businesses operating in them can enjoy significant tax

savings, in some cases, paying little or no income, property

or sales taxes.

Tax Zone Locator provides:

Tax Zone Locator is the most extensive database