Seamless integration with EFI™ Digital StoreFront®

CorpSystem Sales Tax Online™ by CCH® is a Software as a Service (SaaS) product that enables tax calculation

functionality within the Digital StoreFront Shopping Cart. Sales Tax Online™ is driven by tax rates and taxability

decisions researched and maintained by CCH, the industry standard in tax research.

Sales Tax Online takes the work and worry out of sales tax compliance. The web-based design of Sales Tax

Online allows you to off load all the system maintenance and updating responsibilities to CCH, so you can

focus on growing your business through Digital Storefront. Since it is already integrated, Sales Tax Online will

validate your shipping addresses, apply CCH taxability rules, and calculate sales tax for each line item on your

sales orders.

Take the work and worry out of sales and use taxes

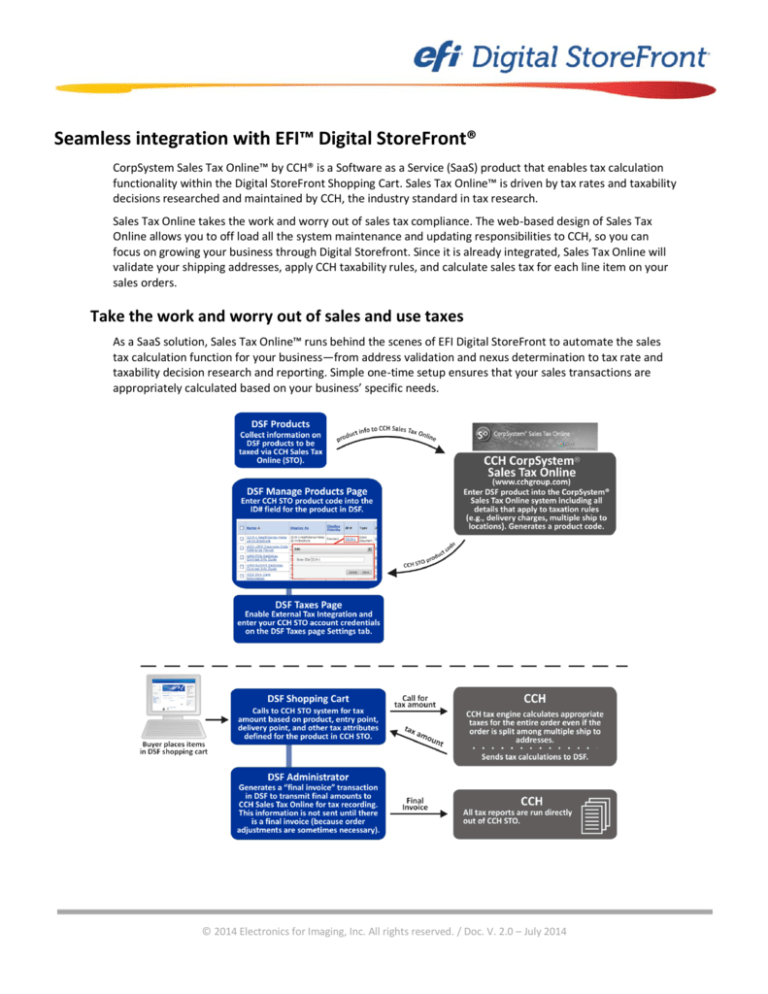

As a SaaS solution, Sales Tax Online™ runs behind the scenes of EFI Digital StoreFront to automate the sales

tax calculation function for your business—from address validation and nexus determination to tax rate and

taxability decision research and reporting. Simple one-time setup ensures that your sales transactions are

appropriately calculated based on your business’ specific needs.

© 2014 Electronics for Imaging, Inc. All rights reserved. / Doc. V. 2.0 – July 2014

2 EFI Digital StoreFront | Digital StoreFront – CCH Tax Integration Quick Reference

Frequently Asked Questions (FAQs)

Digital StoreFront® provides plug-in integration support for CCH’s CorpSystem® Sales Tax Online, a system that

calculates, tracks, and verifies all sales transactions on your site.

How can I determine whether a CCH taxation solution is right for my business?

To determine if a CCH solution best suits your business taxation needs, review complete product information

at http://www.salestax.com. You may also want to discuss your business requirements with a CCH sales

representative (866-513-CORP, Option 3).

How do I set up a merchant account with CCH?

To establish your CCH Sales Tax Online merchant account contact Jim Padrino at

james.padrino@wolterskluwer.com or 877-913-9965 (Mobile: 949-599-899) who will assist you in setting up

your account.

Is CCH taxation calculated in DSF or in CCH CorpSystem’s Sales Tax Online?

All taxation information is collected and monitored in CCH’s CorpSystem® Sales Tax Online. Note that DSF does

not maintain transaction data on CCH taxation. To see the tax information for DSF transactions, you will log on

to your CCH Merchant Account to view your transaction data in the Transaction List (select status Final to view

all completed transactions).

Who provides support for CCH CorpSystem’s Sales Tax Online?

EFI and DSF Technical Support do not provide sales or technical support for CCH’s CorpSystem® Sales Tax

Online. Any problems or questions regarding a CCH account should be directed to your CCH sales

representative or CCH Customer Support at 866-513-2677 (Option 3) or online at:

http://support.cch.com/productsupport/productSupport.aspx?path=%2fTopics%2fproduct_support%2fcorpsy

stem%2fsales_tax_online

What will I need to integrate my CCH CorpSystem Sales Tax Online account with DSF?

You will need the CCH Account Serial Number that your CCH account rep will provide. You will enter this

number in DSF to enable communication between DSF and CCH.

What will I need to do to set communication between DSF and CCH CorpSystem’s Sales Tax Online?

In setting up your Sales Tax Online account (and before you integrate CCH with DSF), you will need to provide

some basic information to ensure that the integration with DSF works smoothly:

Location Information (on the Locations page in your Sales Tax Online merchant account page on the

www.esalestax.com web site):

This will be the default location for calculating taxes if no other location (such as the print shop

address) is sent to CCH for a taxable transaction.

Business Rules (on the Business Rules page in your Sales Tax Online merchant account page on the

www.esalestax.com web site):

Make sure that the Tax Calculation Method is set to “Calculate using Line Items.”

SKU (on the SKU page in your Sales Tax Online merchant account page on the www.esalestax.com web

site). Products created in DSF with a SKU 0099 will be considered as tax-free (tax exempt) in CCH. You

must map your product SKUs to the SKUs (product categories) in CCH. There is a default product category

(e.g., printed matter) that all DSF products without a recognized SKU will be identified by in CCH. For

assistance with mapping your product SKUs from DSF to CCH, contact your CCH sales representative or

contact CCH customer support at 866-513-2677 (Option 3).

© 2014 Electronics for Imaging, Inc. All rights reserved. / Doc v. 2.0 – July 2014

EFI Digital StoreFront | 3

Digital StoreFront Contact Information

Digital StoreFront Support

US Phone:

888.334.8650 (select option 4 then option 1)

Hours:

8 a.m.–8 p.m. EST

US E-mail:

dsfhelp@efi.com

Europe

Phone:

+31 20 658 8080 (NL)

+49 2102 745 4500 (DE)

+44 12462 98085 (UK)

Hours:

9 a.m. – 5 p.m. CET

dsfhelp@efi.com

Outside of these hours, you may leave a voice mail message and an on-call support representative will be

paged. Response time is based on the severity of the issue.

EU E-Mail:

Note

For problems involving infrastructure (i.e., computers, networks, operating systems, backup software,

printers, third-party software, etc.), contact the appropriate vendor. EFI cannot support these types

of issues.

EFI Professional Services

US Phone:

651.365.5321

US Fax:

651.365.5334

ProServices@efi.com

EFI Professional Services can help you perform EFI software installations, upgrades, and updates. This group

can also help you implement, customize, and optimize your EFI software plus offer a range of training options.

E-Mail:

© 2014 Electronics for Imaging, Inc. All rights reserved. / Doc v. 2.0 – July 2014