Presentation

advertisement

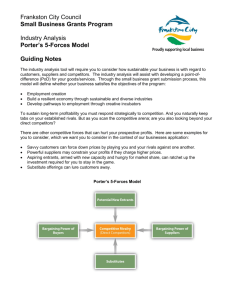

THEME 4: EXTERNAL ANALYSIS (II). PARTICULAR ENVIRONMENT: COMPETITIVE STRUCTURE OF THE INDUSTRY © Alfonso VARGAS SÁNCHEZ 1 Strengths & Weaknesses INTERNAL FACTORS Company’s own values COMPETITIVE STRATEGY Opportunities & Threats EXTERNAL FACTORS Society’s expectations 2 ANALYSIS of the PARTICULAR ENVIRONMENT DIMENSIONS: •Political & legal. •Economic. •Social & cultural. •Technological. COMPETITIVE FORCES: •Current competitors. •Potential entrants. •Agents at the boundaries. •Consumers (users). SECTOR / INDUSTRY OPPORTUNITIES & THREATS 3 COMPETITIVE FORCES: COMPETITIVE STRUCTURE of the INDUSTRY POTENTIAL COMPETITORS (threat of new entrants) SUPPLIERS (bargaining power) EXISTING COMPETITORS (rivalry) BUYERS (bargaining power) SUBSTITUTE PRODUCTS (threat) GOVERMENT ACTION 4 POTENTIAL RIVALRY (competitive threats) NEW COMPETITORS NEW PRODUCTS 2 3 4 5 NEW COMPANIES RIVALS IN OTHER COUNTRIES RIVALS IN OTHER SECTORS SUBSTITUTE PRODUCTS 6 1 7 BARGAINING POWER OF SUPPLIERS CURRENT RIVALRY (existing competitors) BARGAINING POWER OF BUYERS 9 8 10 GOVERNMENTS ECONOMIC POWER OF OWNERS SOCIAL POWER (social agents) BARGAINING POWER OF “BOUNDARY AGENTS” 5 INDUSTRY STAKEHOLDERS AS DETERMINANTS OF BUSINESS ATTRACTIVENESS Stakeholders whose actions influence the company in a direct and permanent manner Stakeholders whose actions influence the company in an indirect and periodic manner Existing and potential competitors. Suppliers. Distribution channels. Consumers. Governments. Unions. Political parties. Universities. Consumers Associations. Commercial and Industrial Associations. Ecological Movements. Mass Media. Etc. 6 THE THREAT OF NEW ENTRANTS DEPENDS ON: ENTRY BARRIERS EXPECTED RETALIATION FROM EXISTING COMPETITORS ECONOMIES OF SCALE OTHER DISADVANTAGES IN COSTS DIFFERENTIATION CAPITAL/INVESTMENT REQUIREMENTS SWITCHING COSTS ACCESS TO DISTRIBUTION CHANNELS GOVERMENT REGULATIONS 7 •History of tendency to retaliate fiercely? •Resources available to companies for defending themselves? •Degree of commitment (big investments)? •Slow industry growth? 8 •Many small or several equal-sized competitors. •Slow industry growth. •High fixed or storage costs. •Lack of differentiation. •Overcapacity situation. •Strong strategic interests. •High exit barriers. 9 1. Highly specialized assets. 2. Fixed costs for exiting. 3. Strategic inter-dependencies with other important businesses of the company. 4. Emotional barriers. 5. Social and governmental restrictions. 10 BARRIERS EXIT LOW LOW ENTRY HIGH Low & stable returns Low returns & high-risk activity HIGH High & stable High returns returns & high-risk activity 11 Those that can perform the same function or meet the same need as the product of the sector under study Defense against possible substitutes can be fortified by means of collective actions Watch out for: -Trends improving the position and price of substitutes. -Substitutes coming from highly profitable sectors. 12 → Degree to which sales are concentrated in few buyers. → Importance of product for the buyer (cost, quality). → Product differentiation. → Switching costs. → Buyers’ profitability. → Threat of buyers’ backward integration. → Availability of substitutes. → Information held by buyers. 13 Concentration of supply among few suppliers Availability of substitute inputs Bargaining power of suppliers depends on: Is the industry a key market sector for supplier? Relative importance of inputs supplied Differentiation & switching costs Threat of forward integration 14 15 KEYS TO POSSIBLE ACTIONS ON COMPETITIVE FORCES →Product-market segmentation: → Collaborating with suppliers: • Current and potential growth. § • Margins. Working together to get cheaper, better quality supplies; and better service. • Fewer competitors. § Concentrating the operations in those suppliers for which your company is important. § Not dealing with suppliers unwilling to collaborate. → Establishing entry barriers: • Distribution channels. • Patents. • Economies of scale. → Concentrating on solvent buyers: § Reward their loyalty. § Make cost of switching unacceptable. → Remain alert to emergence of substitutes; try to offer them before the competitors. 16 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE COMPONENTS SECTOR IN SPAIN RIVALRY FACTORS DESCRIPTION ATTRACTIVENESS Market growth Slow market growth, less than GDP growth rate Low Number of competitors Many competitors Very low Product differentiation Product designed to specifications provided by client Very low Exit barriers Relatively lows, particularly for medium-sized companies able to reorientate their operations Intermediate 17 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE COMPONENTS SECTOR IN SPAIN ENTRY BARRIERS FACTORS DESCRIPTION ATTRACTIVENESS Capital requirements Moderately high Intermediate Access to technology Moderately high Intermediate Government limitations Do not exist The likelihood of retaliation from Quite small existing industry players Very low Low 18 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE COMPONENTS SECTOR IN SPAIN BARGAINING POWER OF SUPPLIERS FACTORS DESCRIPTION ATTRACTIVENESS Number of suppliers Enough suppliers Intermediate Supplier switching costs Low High Possibility of forward integration Low High Importance of the sector for suppliers Medium Intermediate 19 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE COMPONENTS SECTOR IN SPAIN BARGAINING POWER OF BUYERS FACTORS DESCRIPTION ATTRACTIVENESS Number of buyers Few Low Possibility of backward integration Quite high Low Buyers profitability Normally good, but cyclical Intermediate Supplier switching costs for buyers Quite high Intermediate 20 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE COMPONENTS SECTOR IN SPAIN SUBSTITUTES FACTORS DESCRIPTION Availability of substitutes Quite small until the client radically changes the design and the materials used ATTRACTIVENESS Intermediate 21 CASE STUDY: COMPETITIVE PROFILE OF THE AUTOMOBILE AUXILIARY SECTOR IN SPAIN COMPETITIVE ATRACTIVENESS LEVEL Rivalry Entry barriers Suppliers bargaining power Buyers bargaining power Substitutes 7/4 = 1'75 9/4 = 2'25 14/4 = 3'50 10/4 = 2'50 3/1 = 3'00 Quite low Between low and intermediate Intermediate-High Between low and intermediate Intermediate Score 43/17 = 2'53 Between low and intermediate Watch out for: Very low = 1. Low = 2. Intermediate = 3 . High = 4. 22 Because the companies operating in the same sector pursue out different strategies and obtain different market shares and different returns on their investments. 23 ZARA VS BENETTON Advertising Only in-store and with Advertising. conventional display: almost pure information. The group has always preferred discretion. Design: The Zara motto is to copy Design trend setters. They visit the fashion shows and they offer their customers the sort of clothes worn by top-models at a reasonable price. Franchising. Only when this Franchising formula is strictly necessary to enter a selected country market. In this case they choose partners who can justify their leadership in the market. Only first brands. Advertising Aggressive, creative, Advertising. bold, controversial. The image of Benetton has always been linked to provocative advertising campaigns. Design. Original, like a good Italian Design company. The Benetton approach has always been casual and sporty clothes made well, to its own designs. Franchising This is the formula Franchising. preferred by the group for growth in any new country market. There are more than 2,000 partners around the world and strict norms, even for the design of the stores. 24 ZARA VS BENETTON Diversification None at all. The Diversification. Inditex group manufactures and sells fashion, and that is all. As an exception, it runs its own logistics. Diversification Very high. The Diversification. group is not just in fashion: sport, cinema, telecommunications, catering or transport are other activities. Culture Inbred, following the purest Culture. “El Corte Inglés” style. From management to product design, the policy on hiring is strictly closed, as its shareholding was until its entry on the Stock market. Culture Open and imaginative. It Culture. has taken risks more than once by hiring innovators and has created around its leader a public image of versatility and commitment to social and human values that it transfers to the company as a whole. Source: Dinero, September 2002, nº 910. 25 Specialization Relations with Government Brand identification Distribution channel Relationship with parent company Quality Leverage Technological leadership Price Vertical integration Service Costs 26 Characterization of the strategy of all the competitors of importance on the basis of a series of explanatory dimensions of their competitive behavior. Set of companies in a particular industry pursuing the same or similar strategies. A unique group Several groups Each company is a group -Different strengths and weaknesses. -Different moments of market entry. -Historical accidents. 27 -Entry barriers do not affect all strategic groups with the same intensity. -Factors which impede the movement from one strategic group to another within an industry. Mobility barriers: • Protect against a key change in the strategy of other competitors. • Explain why certain companies are persistently more profitable than others and why different strategies coexist. 28 Changes in the environment Strategic choices made by companies 29 METHODOLOGY 1.-Why some industries are persistently more profitable than others? 2.-Within a particular industry, why do some companies are persistently more profitable than others? 3.-And why do different strategies coexist? 4.-Methodology for strategic groups identification. 30 METHODOLOGY Identification of all competitors of importance. Characterization of their strategies: strategic dimensions. Graphic representations: strategic maps (symbols, arrows,…). 31 DIMENSIONS SPECIALIZATION VERTICAL INTEGRATION COSTS SERVICE QUALITY PRICE DISTRIBUTION CHANNEL FIRM A Low High Low Low Low Low Own (partially) FIRM B High Low High (1) High High High Specialized FIRM C High High Low Intermediate Low (2) Low (1) Generic FIRM D Intermediate Low Intermediate (1) High Intermediate Intermediate Generic (mainly) (1) These data are not contained explicitly in the text, but it is possible to deduce them. (2) A direct correlation between cost-price and quality is observed. 32 Full line (Low) SPECIALIZATION A D Reduced line (High) B C Low High VERTICAL INTEGRATION 33 Full line (Low) SPECIALIZATION A D Reduced line (High) C B Low High COSTS-PRICE-QUALITY POSITION 34 Full line (Low) SPECIALIZATION A D C Reduced line (High) Low B High LEVEL OF SERVICE 35 Full line (Low) SPECIALIZATION A D Reduced line (High) C Generic B Specialized DISTRIBUTION CHANNEL Own 36 37 “Coming together is a beginning. Keeping together is progress. Working together is success.” (Henry Ford, 1863-1947, American founder of the Ford Motor Company and father of modern assembly lines used in mass production) 38