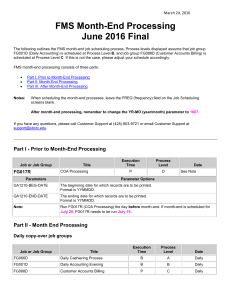

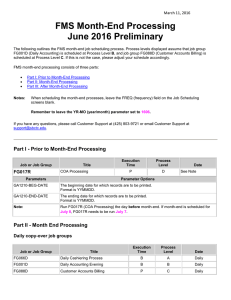

sample foreign assets worksheet

advertisement

Please note that while the CRA has accepted the worksheet itself, the related instructions and French version are with the CRA for formal sign-off and should not be construed as advice. We are sharing this example that we hope will answer many of the questions about the calculation of aggregate fair market value by country of property in accounts with Canadian registered securities dealers and trust companies. Slide 17 of the November 18, 2014 webinar presentation showed a T1135 worksheet reflecting the different ways people were interpreting the requirements that highlighted the confusion at the time. An example the IIAC prepared has now been confirmed with the CRA, and the CRA agreed we can share this version publicly in advance of it being posted on the CRA website. SAMPLE FOREIGN ASSETS WORKSHEET Instructions for Section 7 of Form T1135: Step 1: Identify the Canadian registered securities dealer or trust company. Step 2: List each security with values at month-end grouped by country. Step 3: Total all security values by country by month. Step 4: Transcribe the highest month-end and year-end market values by country onto Form T1135 and select the appropriate country code for each from the accompanying dropdown box as shown in the sample completed T1135 below. Step 5: Insert and total the income (loss) and the capital gains (losses) on disposition by country and transcribe onto Form T1135. Step 6: Repeat for any foreign holdings at another Canadian registered securities dealer or trust company. Security January February March April May June July August September October November Income (Loss) December Capital Gains (Losses) Country: USA AT&T INC $56,000 $60,000 $56,000 $58,000 $60,000 $65,000 $0 $0 $0 $0 $0 $0 APPLE INC $12,000 $15,000 $12,000 $16,000 $12,000 $18,000 $12,000 $19,000 $12,000 $20,000 $25,000 $24,000 $3,000 $750 BERKSHIRE H $12,000 $15,000 $13,000 $16,000 $12,000 $11,000 $12,000 $19,240 $12,000 $25,020 $23,000 $20,000 $250 Subtotal USA $80,000 $90,000 $81,000 $90,000 $84,000 $94,000 $24,000 $38,240 $24,000 $45,020 $48,000 $44,000 $1,000 $12,000 $3,000 Country: GBR RBS $12,000 $0 $0 $0 $0 $0 $12,000 $19,000 $12,000 $20,000 $25,000 BR DREDGING $51,000 $15,000 $12,000 $16,000 $12,000 $61,000 $12,000 $19,000 $12,000 $20,000 $12,000 $25,000 $500 Subtotal GBR $63,000 $15,000 $12,000 $16,000 $12,000 $61,000 $24,000 $38,000 $24,000 $40,000 $37,000 $37,000 $500 $0 Country: CHN $0 $0 $0 $0 $0 $0 $12,000 $19,000 $12,000 $20,000 $12,000 $25,000 CH PETE/CHEM ADR BAIDU INC S/ADR $13,000 $15,000 $13,000 $11,000 $13,000 $15,000 $50,000 $11,000 $13,000 $15,000 $13,000 $11,000 CHINA MOBILE $15,000 $20,000 $15,000 $25,283 $15,000 $22,283 $0 $0 $0 $0 $0 $0 Subtotal CHN $28,000 $35,000 $28,000 $36,283 $28,000 $37,283 $62,000 $30,000 $25,000 $35,000 $25,000 $36,000 $0 ($2,500) $171,000 $140,000 $121,000 $142,283 $124,000 $192,283 $110,000 $106,240 $73,000 $120,020 $110,000 $117,000 $1,500 $500 Total for Month ($2,500) Note: Summary: USA GBR CHN HIGH HIGH HIGH $94,000 $63,000 $62,000 $219,000 Year-end Year-end Year-end $44,000 $37,000 $36,000 $117,000 Use the above worksheet to complete Form T1135 as shown below: 1. This sample spreadsheet is provided as an example of how to calculate the correct highest-month-end by country for non-Canadian financial assets held with Canadian registered securities dealers. 2. Report the highest month-end values by country ($94,000, $63,000 and $62,000), which sum to $219,000. Do NOT use the highest account month-end balance ($192,283) and then country month-ends for that month ($94,000, $61,000 and $37, 283 = $192,283).