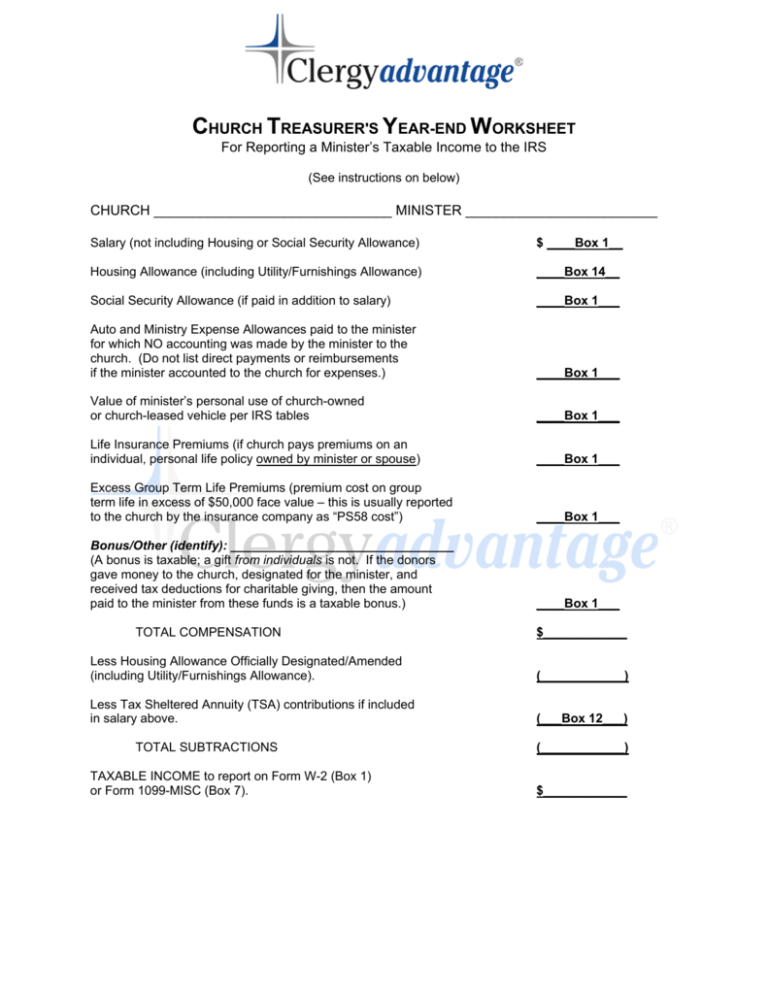

church treasurer's year-end worksheet

advertisement

CHURCH TREASURER'S YEAR-END WORKSHEET For Reporting a Minister’s Taxable Income to the IRS (See instructions on below) CHURCH _______________________________ MINISTER _________________________ Salary (not including Housing or Social Security Allowance) $ ____Box 1__ Housing Allowance (including Utility/Furnishings Allowance) ____Box 14__ Social Security Allowance (if paid in addition to salary) ____Box 1___ Auto and Ministry Expense Allowances paid to the minister for which NO accounting was made by the minister to the church. (Do not list direct payments or reimbursements if the minister accounted to the church for expenses.) ____Box 1___ Value of minister’s personal use of church-owned or church-leased vehicle per IRS tables ____Box 1___ Life Insurance Premiums (if church pays premiums on an individual, personal life policy owned by minister or spouse) ____Box 1___ Excess Group Term Life Premiums (premium cost on group term life in excess of $50,000 face value – this is usually reported to the church by the insurance company as “PS58 cost”) ____Box 1___ Bonus/Other (identify): ________________________________ (A bonus is taxable; a gift from individuals is not. If the donors gave money to the church, designated for the minister, and received tax deductions for charitable giving, then the amount paid to the minister from these funds is a taxable bonus.) ____Box 1___ TOTAL COMPENSATION $____________ Less Housing Allowance Officially Designated/Amended (including Utility/Furnishings Allowance). (____________) Less Tax Sheltered Annuity (TSA) contributions if included in salary above. (___Box 12___) TOTAL SUBTRACTIONS TAXABLE INCOME to report on Form W-2 (Box 1) or Form 1099-MISC (Box 7). (____________) $____________ CHURCH TREASURER'S YEAR-END WORKSHEET For Reporting a Minister’s Taxable Income to the IRS Instructions This worksheet is for year-end computing of the correct amount of ministry taxable income to report to the IRS. Only taxable income is reported. Report either on Form W-2 as Employee Wages (IRS-preferred and CFS-recommended) or Form 1099-MISC as Non-employee Compensation. If ministry income was reported on Form 941, Employer’s Quarterly Federal Tax Return, then Form W-2 must be used at year end and the amounts reported on Form 941 and Form W-2 should match. Form W-2 may also be issued even if the minister’s wages were not reported on a Form 941. (If the IRS were ever to ask why the wages reported on W-2 exceed the wages reported on 941, a simple note should be sent to the IRS stating, “Ministry wages of $ __________ were omitted from Form 941.”) Do NOT report the following eleven items associated with ministry employment because they are qualified tax-deferred or tax-free items. 1. Job expenses paid or reimbursed under an Accountable Plan 2. Church contributions to qualified church or denominational retirement plan 3. Church-paid contributions, including voluntary salary reductions, to a minister’s Tax-Sheltered Annuity (called TSA, TDA or 403(b) Annuity). However, salary reduction contributions to a 403(b) or TSA plan should be reported in Box 12 of the W-2 with Code E. 4. Parsonage/manse/rectory rental value 5. Housing allowance (housing allowance is not required to be reported on the W-2 or 1099 Form. The only proper place to report it is in Box 14 of the W-2. This is optional. It must not be reported in Box 1 of the W-2, or in any box of the 1099 Form). 6. Housing utility payments made directly by the church 7. Disability insurance premiums 8. Medical insurance premiums if the minister’s income is reported on a W-2. However, if income is reported on a 1099-MISC, then medical insurance premiums are reported in Box 7 of Form 1099-MISC. 9. Health Reimbursement Arrangement (also called Medical Reimbursement Plan) payments if the minister’s income is reported on a W-2. However, if income is reported on a 1099-MISC, then Health Reimbursement Arrangement payments are reported in Box 7 of Form 1099-MISC. 10. Group term life insurance premiums (for up to $50,000 face value) 11. Bona fide gifts (money or goods given to the minister unrelated to services rendered or expected to be rendered, and for which the donor received no tax deduction for giving to the church) NOTE: The minister personally reports and pays Social Security Self-Employment tax on the housing allowance, church-paid utilities, and parsonage rental value including utilities. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com W-2 ILLUSTRATOR FREQUENTLY ASKED QUESTIONS Are churches required to withhold income tax on ministry income? No! Minister’s wages are exempt from income tax withholding (IRC Section 3402(p)). Treasury Regulation 31.340(a)(9)-1 states, "Remuneration paid for services performed by a duly ordained, commissioned, or licensed minister of a church ... is excepted from wages and hence is not subject to withholding.” Churches are subject to payroll tax withholding requirements for its lay or non-minister employees. While exempt from withholding tax on ministry income, ministers can enter into a voluntary withholding arrangement with their church (IRC Sec. 3402(p)). Under such an arrangement, the church withholds federal income taxes from the minister’s wages. The amount of Federal income tax withheld should be sufficient to cover both income tax and social security, self-employment tax liabilities and is reported on Form W-2, Box 2 and should reconcile with the total amount reported as withheld on the Form 941. Here is an illustration of voluntary tax withholding. If a minister expects to owe $1,000 Federal income tax and $6,000 Social Security SE tax, the minister and church may agree for the church to withhold $7,000 Federal income tax ($1,000 + $6,000). The excess income tax withholding will, when the minister files his or her tax return, apply automatically to the minister's Social Security tax liability. The advantage of this procedure is that the minister avoids having to make quarterly estimated tax payments and thus, the church ensures that the minister will not fall behind on his or her tax payments. The disadvantage of the voluntary withholding arrangement is that the church treasurer must make timely and accurate tax deposits. If there are other church staff members for whom taxes are being withheld, this is a minor issue. But if the minister is the only employee of the church, it can be a major responsibility. If the treasurer is not accustomed to making payroll tax deposits and payments, this could be a burden. In the latter case, it may be simpler for the minister to make quarterly estimated tax payments. Voluntary withholding arrangements may be terminated at any time by either the church or the minister or by mutual consent of both. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com Can 100% of Compensation be Designated as Housing Allowance? Yes! The U.S. Tax Court ruled that it is not abusive to designate most or all of the income paid to a minister as a housing allowance. (Warren v. Commissioner, 114 T.C. 23 (2000) The Tax Court's decision will serve as strong legal support for the legitimacy of such housing allowances. It is permissible to designate the entire minister's compensation as clergy housing allowance leaving no taxable salary to report on the Form W-2. However, the nontaxable portion of a church-designated housing allowance for ministers cannot exceed the lesser of 1) actual housing expenses, or, 2) the fair rental value of the home plus the fair rental value of the furnishings, plus utilities. Therefore, a church ordinarily should not designate a housing allowance that significantly exceeds the above limits. Increasing the designated housing allowance may reduce the annual retirement contributions of ministers who participate in a retirement plan that imposes contribution limits tied to a minister's taxable income (excluding the nontaxable portion of a housing allowance). Can churches withhold FICA tax on ministry income? Churches are prohibited from paying and withholding Social Security FICA tax for a minister. Ministers, except government-employed chaplains, are self-employed for Social Security purposes. This is not optional. The laws are clear and specific. Withholding FICA and Medicare tax from a minister's pay indicates a non-minister status and could nullify the minister's clergy housing allowance exclusion. Social Security legislation has these two parts -- SECA (Self-Employment Contribution Act) for self-employment income and FICA (Federal Insurance Contribution Act) for employee wages. A minister, in regard to "service performed in the exercise of his ministry," is subject to SECA (IRC Sec. 1402(a)(8)). A minister and his or her ministry employer are exempt from FICA (IRC Sec. 3121 (b)(8)). "Service performed in the exercise of his ministry" is a precise phrase defined and illustrated in Reg. 1.1402(c)5(b). It identifies five types of ministry services subject to Social Security self employment tax: (1) The conduct of religious worship and the ministration of sacerdotal functions in accordance with the tenets and practices of his or her particular church or denomination; (2) The control, conduct, and maintenance of religious organizations -- directing, managing, or promoting the organization's activities -- that are under the authority of a church or church denomination; Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com (3) The conduct of religious worship or ministration of sacerdotal functions even if not performed for a religious organization; (4) Performing ministry service for an organization which is operated as an integral agency of a religious organization under the authority of a church or denomination; and (5) Performing service under an assignment or designation by a church or denomination, even if the organization being served is not a religious organization nor an integral agency of a church, and even if the service being performed is not the conduct of religious worship or ministration of sacerdotal functions. Being self-employed for Social Security and being eligible for the housing allowance are coordinated. Except for government employed chaplains, a minister eligible for the housing allowance exclusion is self-employed for Social Security. That is the impact of the cross-referencing of tax regulations which define and implement a minister's housing allowance (Regulation 1.107-1) and define a minister's self employment status (Regulation 1.1402(c)-(5)(b)). Government employed chaplains who receive the housing allowance are not selfemployed but are employees under FICA or state pension plans. Military chaplains are FICA employees who receive the housing allowance associated with their rank. Veterans Administration chaplains are FICA employees but are not entitled to a housing allowance. Social security self-employment tax is a major tax burden for ministers. For lay employees, churches are required to pay 7.65% and withhold 7.65% FICA and Medicare tax. But ministers pay the full 15.3% social security self-employment tax. The Social security self-employment tax rate of 15.3% applies to net self-employment earnings, including a minister's housing, up to a ceiling on earnings. The ceiling increases annually due to inflation adjustments. Since January 1,1994 the 2.9% Medicare portion is payable on all earnings, without regard to the ceiling. Churches are prohibited from paying and withholding Social Security FICA tax for a minister, but are encouraged to pay a Social Security Allowance to a minister. To do so is to acknowledge the very high cost of Social Security self-employment tax and to distinguish it from the minister's spendable income for personal and family needs. Can Withholding reported on Box 2 exceed Wages reported on Box 1? In cases where most or all of the minister's compensation has been designated as clergy housing allowance, it is technically correct for the minister's withholding to exceed the wages shown in Box 1 of the Form W-2. It is possible for the wages to be $-0- and have Federal income tax withholdings in Box 2 of the Form W-2. The situation of federal withholdings exceeding the wages is rare and unusual but is technically correct. We are Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com not aware of any instances where the IRS scrutinized or issued an IRS notice solely due to the federal income tax withholding exceeding the wages shown in Box 1 of the W-2. In cases where the federal income tax withholding exceeds 50% of the wages, the minister’s tax return generally is not eligible for electronic filing. If a minister’s entire salary has been designated as a housing allowance resulting in no wages, does the church need to report and file a Form W-2 for that minister? Submitting to the IRS a Form W-2 that identifies a minister by name social security number but has blank boxes for income and withholding is not consistent with the purpose of the W-2 form which is to report wages and withholdings to the IRS to ensure that the correct amount of taxes are paid. IRS Revenue Ruling 2000-6 suggests that a church may not be required to issue a W-2 to a minister whose entire income is designated as a housing allowance. We are not aware of any adverse IRS action in this regard. A W-2 form may still be required if other issues apply such as reported elective deferrals to a Tax Sheltered Annuity (403(b) plan) or withholding. Gift v. Taxable Compensation The answer to these two questions provides a common sense approach to what can be a very technical issue: Was the gift given out of love and affection with no strings attached? A yes answer is generally a tax-free gift. Was the gift given for compensation for services rendered for the past, present or future? A yes answer is generally a taxable wages. General Principles of tax-free Gift vs. Taxable Compensation: 1. Special occasion "gifts" made to a minister by the church out of the general fund should be reported as taxable compensation and included on the ministers W-2 Form (or 1099 if applicable). 2. Members are free to make personal gifts to clergy, such as a card at Christmas accompanied by a check or cash. Such payments may be tax-free gifts to the minister (though they are nondeductible by the donor). 3. Special occasion and "gifts" to a minister funded through member's contributions to the church (i.e., the contributions are entered and recorded in the church's books as Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com cash received and the members are given charitable contribution credit), should be reported as taxable compensation and included on the ministers W-2 Form (or 1099 if applicable). The same rules applies to any non-minister church worker. 4. Members who contribute to special occasion offerings may deduct their contributions if, 1) the contributions are to the church and are entered or recorded in the church's books as cash received, and 2) they are able to itemize deductions on Schedule A (Form 1040). 5. A church can collect an all-cash, special occasion offerings, with the express understanding that the entire proceeds will be paid directly to the minister and that no contributions will be tax-deductible. It is possible that in some cases such direct "member to minister" transfers would satisfy the definition of the gift set forth in the Supreme Court's Duberstein decision. Members wishing to contribute checks in such an offering should be advised to issue their checks payable to the pastor and not the church. All donors should be further advised that no contributions to the offering will be tax-deductible. In such cases, the critical questions, as the Supreme Court observed in its Bogardus decision, is whether the donors intended that "services rendered in the past shall be requited more completely, though full acquittance has been given." Or, did the donors, "intend simply to show goodwill, esteem, or kindliness toward persons who happen to have served, but who are paid without thought to make requittal for the service"? If so, the contributions are tax-free gifts. The reason for these rules is that churches, being nonprofit and tax-exempt organizations, may not make any distribution of their funds other than as reasonable compensation for services rendered or as payments and direct furtherance of their exempt purposes. They cannot make "gifts" to ministers. Therefore, to avoid any jeopardy to a church's tax-exempt status, it is imperative that special occasion distributions from a church to its minister be characterized as compensation for services rendered and reported on the minister's W-2 and 1099 Forms. (Reference for this section: Church & Clergy Tax Guide, Richard R. Hammar, J.D., LL.M., CPA) Moving Expenses Deductible Moving Expenses: An employer can reimburse (as a tax-free fringe benefit) the reasonable expenses of: 1. Deductible moving of household goods and personal effects (including in transit storage expenses). • The cost of painting, crating, and transporting household goods and personal effects and those of the members of the household from the former home to the new home. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com • • • • • The costs of storing and insuring household goods and personal effects within any period of 30 consecutive days after the day of the move from the former home and before they are delivered to the new home. The costs of connecting or disconnecting utilities required because of moving household goods, appliances, or personal effects. The cost of shipping a car and household pets to the new home. The cost of moving household goods and personal effects from a place other than the former home. The deduction is limited to the amount that it would have cost to move from the former home. (Caution: the cost of moving furniture purchased on the way to the new home cannot be reimbursed as a tax-free fringe benefit. The cost of driving personally owned vehicles during the move may be reimbursed at the standard IRS (moving) mileage rate. 2. Deductible travel expenses (but not meals): • • The costs of transportation and lodging for household members while traveling from the former home to the new home. This includes expenses for the day of arrival. The costs of lodging expenses incurred in the area of the former home within one day after the employee could not live in the former home because the furniture had been moved. Expenses may be reimbursed for only one trip to the new home for the members of the household. However all of the family members do not have to travel together or at the same time. Nondeductible Moving Expenses: (Note: These expenses may be reimbursed to the employee but must be included as taxable wages.) • • • • • • • • • • • • • Any part of the purchase price of the new home. Expenses of buying or selling a home; expenses of getting or breaking a lease. Home improvements to help sell the former home. Loss on the sale of former home. Meal expenses. Mortgage expenses. Pre move housing expenses. Real estate taxes. Refitting of carpets and drapes. Security deposits (including any given up due to the move). Storage charges except those incurred in transit. Temporary living expenses. Relocation costs. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com Is a Social Security Allowance taxable? A Social Security Allowance paid to a minister is taxable income. It is subject to both income tax and Social Security, self-employment tax. A Social Security Allowance is included in taxable wages on Form W-2, Box 1. Some churches pay a “Social Security offset allowance” which is approximately half the social security, self-employment tax. The theory is, if the minister was a lay employee, the church would have to pay on half the FICA and Medicare tax. The purpose for paying a Social Security allowance is for clarity rather than for tax savings. Many members of congregation do not realize how much Social Security, selfemployment tax a minister pays. They assume that whatever is identified in the budget as salary is spendable income for the minister to meet personal and family needs. Unfortunately, usually this is not true. The Social Security Allowance is not spendable income for personal and family living needs. It is received by the minister and then paid out for taxes. Recommendations if FICA/Medicare tax has been withheld for a minister. Have the church (a) stop withholding social security taxes from the minister's pay, (b) stop reporting the minister's income as social security wages on the quarterly 941 payroll reports, and (c) stop paying the employer share of social security taxes on the minister's income, with the quarterly 941 payroll reports. Have the church agree to pay a "Social Security Allowance" to the minister, equal to 7.65% of his/her salary. This Allowance will be equal to what the church has already been paying as its employer share of social security taxes, when filing the 941 payroll reports. The Allowance is taxable to the minister and needs to be reported as income on the minister's W-2 Form. Have the church keep the minister's net paycheck the same as before, by withholding extra federal income tax from the minister's pay. This will cover the social security, selfemployment tax which the minister will be required to pay with Schedule SE of his/her Federal tax return. Note that the minister's net paycheck should not change since the extra federal withholding will be offset by a) the decrease in social security tax withheld, and b) the Social Security Allowance that the church will pay you (see preceding paragraph). Also note that the church's cost should not change, because the Social Security Allowance paid will be equal to the church's savings from not paying the employer social security taxes on Form 941 Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com W-2 or Form 1099-MISC? (Employee or Self-employed?) Reporting income taxes as an employee. Most clergy should report their federal income taxes as employees, because they will be considered employees under the tests currently used by the IRS and the courts. Most clergy will be "better off' reporting as employees (W-2), because: 1. The value of various fringe benefits will be excludable, including the cost of an earlier paid health insurance premiums on the life of the minister. On the other hand, self-employed ministers (Form 1099), risk having their "employer" paid medical insurance premiums included in taxable income subject to State, Federal and Social Security tax. 2. The risk of an IRS audit is substantially lower. 3. Reporting as an employee avoids the additional taxes and penalties that often applied to self-employed clergy who are audited by the IRS and reclassified as employees. Additional considerations: 1. It is vital that churches establish an accountable plan for the payment or reimbursement of automobile and other ministry professional expenses for (W-2) clergy employees. An accountable plan that pays or reimburses all ministry expenses will avoid; 1) the 50 % business meals and entertainment loss, 2) the 2% adjusted gross income loss. 2. The IRS has a definite bias in favor of treating taxpayers as employees. 3. Ministers who may be self-employed for income tax purposes: • Itinerant evangelists. • Guests speaking. • Supply pastors. • Direct services. • Church polity. 4. Some clergy insist on reporting their income taxes as self-employed for theological reasons. 5. Clergy who report their federal income taxes as employees do not lose the housing allowance exclusion. Weber v. Commissioner, 103 T.C. 378 (1994) The Tax Court concluded that a Methodist minister was an employee and not self employed for federal income tax reporting purposes. The court noted that Rev. Weber had the burden of proving that he was in fact self-employed for federal income tax purposes and not an employee. The Tax Court announced the following 7 factor test for determining whether a minister is self-employed or an employee for federal income tax reporting purposes: 1. The degree of control exercised by the employer over the details of the work. 2. Which party invests in the facilities used for work. 3. The opportunity of the individual for profit or loss. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com 4. Whether or not the employer has the right to discharge the worker. 5. Whether the work is part of the employer's regular business. 6. The permanency of the relationship. 7. The relationship the parties believes they are creating. • What is "Magnetic Media?" "Magnetic media" is required of employers who submit more than 250 W-2 forms. Most churches aren't required to submit W-2 forms using magnetic media. • Where on the W-2 form is the clergy housing allowance reported? Reporting the clergy housing allowance in box 14 is not required and is optional. IRS Publication 517 provides an example of a completed W-2 form that reports the clergy housing allowance in Box 14. The IRS instructions for Form W-2 states, "You may include the minister's parsonage and/or utilities allowance in box 14." Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com GENERAL W-2 INFORMATION W-2 General Requirements for Churches: The W-2 form must be completed and issued to each employee by January 31st. A W-2 form must be issued to any employee that was paid any wages in the previous calendar year. Form 1099 does not need to be filed if payments to an independent contractor are less than $600. There is no such minimum income threshold for W-2 employees.) The W-2 forms must be submitted to Social Security Administration prior to March 1. W-2 forms are not submitted to the IRS. Copies of the W-2 form may be obtained from a local IRS office or by calling 1-800-TAX-FORM. The W-2 form must be submitted on a "red, scannable" form. This is because the Social Security Administration processes paper forms by special "scanner" machines. Therefore, churches cannot file W-2 or W-3 forms that were printed from this web site or the IRS web site. Be Sure To Add Cents To All Amounts Make all dollar entries without a dollar sign and comma, but with a decimal point and cents. For example, $36,000 should read "36000.00." Government scanning machines assumes that the last two figures of any amount are cents. If you report $36,000 of income as "36000," the scanning machines would interpret this as 360.00 ($360)! If a W-2 box does not apply, leave it blank - do not insert "0." W-2 Changes Considerations 1. Copy A of the W-2 form has been resized and reformatted for more accurate scanning. 2. Dollar signs have been added to many boxes. 3. Many boxes have been deleted. • Old Box 12 has been deleted. (Old Box 12 stated, "benefits included in box 1." • Former Box 13 is now Box 12 and has been reformatted. • Old Box 15 has been deleted and the old "Deceased," "Legal rep.," and "Deferred Compensation" check boxes are gone. The old "Pension Plan" checkbox has been renamed "Retirement plan" (now located in new Box 13.) • The old Box 16 used for State information has been renamed Box 15. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com LlNE-BY-LINE GUIDELINE FOR PROPER REPORTING OF W-2 Box a: This box is optional and requires no entry. Large organizations sometimes use this box for tracking. Box b: The Employer's Identification Number (EIN) is a nine-digit number that is assigned by the IRS. [Insert this new sentence.] The EIN can be found on any correspondence from the IRS such as a preprinted Form 941, letters or notices. Some churches have more than one EIN. Be sure to use the same EIN that is reported on the 941 forms. An EIN can be obtained by submitting a completed Form SS-4 to the IRS. Box c: Report name of church and address. Box d: Report the employee's social security number. Box e: Report the employee by name. Do not use titles or degrees such as "Pastor," "Rev.," "Dr.," "PhD." Box f: Report employee's address and zip code. Box 1: (Report all items listed below. Do NOT include Housing Allowance in Box 1.) • Bonus A bonus is taxable; a gift from individuals is not. If the donors gave money to the church, designated for the minister, and received tax deductions for charitable giving, then the amount paid to the minister from these funds is a taxable bonus. (For more details see Gift v. Taxable Compensation) • Business expense reimbursements paid under a "non-accountable plan" Business expense reimbursements paid under a "non-accountable plan" are taxable to the minister. A non-accountable business expense reimbursement arrangement is one that does not require substantiation of business expenses. Business expense reimbursements paid under an Accountable Plan are not taxable to the minister. • Church provided car If a church provides a car to its minister, the minister's personal use of the car is a taxable non-cash fringe benefit. The church must determine the actual value of this fringe benefit so that it can be included in the minister's income and reported on his or her W-2. The church may use either general valuation principles or one of three special valuation rules to value the personal use of the vehicle. You must use general valuation principles to value the personal use of the vehicle unless your employer chooses to use one of the three special valuation rules. 1. General valuation principles. The taxable value of the vehicle may be determined by applying general valuation principles. This is the amount that an Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com unrelated third party would charge to lease or purchase the same comparable vehicle on the same comparable terms and the same geographic area times the percentage of total vehicle miles for the period that were of a personal (rather than business) nature. You ordinarily cannot use a "cents-per-mile rate" to determine the value of the availability of the employer provided car unless the same or comparable vehicle could be leased on a cents-per-mile basis for the same period of time that the vehicle was available to you. 2. Special Annual-Lease Value Rule. This special rule allows the use of the Annual-Lease Value Table to determine the annual benefit based on the fair market value (FMV) of the auto. The amounts shown in the table must be adjusted to reflect the percent of non-business use to compute the amount to be included as income of the employee. The amounts shown in the table include maintenance and insurance, they do not include fuel. If the employer provides fuel for personal use of the employee then the income of the employee must be increased by 5 1/2 cents per mile or by the actual cost of fuel so provided. ANNUAL LEASE VALUE TABLE (1) (2) ANNUAL AUTOMOBILE FAIR LEASE MARKET VALUE VALUE --------------- -----$0 to 999 $600 1,000 to 1,999 850 2,000 to 2,999 1,100 3,000 to 3,999 1,350 4,000 to 4,999 1,600 5,000 to 5,999 1,850 6,000 to 6,999 2,100 7,000 to 7,999 2,350 8,000 to 8,999 2,600 9,000 to 9,999 2,850 10,000 to 10,999 3,100 11,000 to 11,999 3,350 12,000 to 12,999 3,600 13,000 to 13,999 3,850 14,000 to 14,999 4,100 15,000 to 15,999 4,350 16,000 to 16,999 4,600 17,000 to 17,999 4,850 18,000 to 18,999 5,100 19,000 to 19,999 5,350 20,000 to 20,999 5,600 21,000 to 21,999 5,850 22,000 to 22,999 6,100 Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com 23,000 to 23,999 6,350 24,000 to 24,999 6,600 25,000 to 25,999 6,850 26,000 to 27,999 7,250 28,000 to 29,999 7,750 30,000 to 31,999 8,250 32,000 to 33,999 8,750 34,000 to 35,999 9,250 36,000 to 37,999 9,750 38,000 to 39,999 10,250 40,000 to 41,999 10,750 42,000 to 43,999 11,250 44,000 to 45,999 11,750 46,000 to 47,999 12,250 48,000 to 49,999 12,750 50,000 to 51,999 13,250 52,000 to 53,999 13,750 54,000 to 55,999 14,250 56,000 to 57,999 14,750 58,000 to 59,999 15,250 For vehicles with an FMV of more than $59,999, the annual lease value equals (.25 x the FMV of the automobile) + $500. The annual lease value rule must be adopted on the first day the auto is made available for use and cannot be changed except for switching to or from the commuting valuation rule. The annual lease value shown in the table remains unchanged from the date the auto is first made available through December 31st, of the fourth full calendar year following that date. If the same auto is still available the annual lease value is redetermined on January 1st of each subsequent four-year period based on the current fair market value. If the auto is available for personal use for 30 days or more, but less than an entire year, you can prorate the annual lease value to determine the benefit amount. If the auto is available for less than 30 days then use the daily lease value. This is determined by multiplying the number of days used by four and prorating the annual lease value to the number of days so determined. Note: if the number of days is greater than seven but less than 30, always elect to treat the auto is having been available for 30 days. 3. Special cents-per-mile Valuation Rule. The cents-per-mile valuation rule allows the benefit from personal use to be calculated simply by multiplying total personal miles driven by the standard mileage rate. The cents-per-mile rule cannot to be used if the fair market value of the auto is more than $15,500. The cents-per-mile valuation rule cannot be used unless: 1) the vehicle is used at least 50 percent for trade or business; or, 2) The vehicle is Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com used to drive at least three or more employees to and from work in an employer sponsored commuting pool; or, 3) The vehicle is actually driven at least 10,000 miles in the year and is used primarily by employees including personal use. The cents-per-mile rate includes fuel. If the employer does not to provide fuel then the rate should be reduced by 5 1/2 cents per mile. The cents-per-mile valuation rule must be adopted on the first day the vehicle is available for use by an employee and must continue to be used as long as the above requirements are met. It is permissible, however, to switch to or from the commuting valuation rule. 4. Special Commuting Valuation Rule. The special commuting valuation rule allows the benefit for personal use of the vehicle provided for commuting to be valued at $1.50 per one-way commute regardless of distance between home and work. In order to use this method to calculate the commuting value it is necessary to meet all of the following requirements: 1) The vehicle must be owned or at least and provided tothe employee for use in the trade or business. 2) The employee must be required to commute in the vehicle for bona fide non-compensatory business reasons (e.g., for 'safekeeping of the auto). 3) There must be a written policy prohibiting personal use other than commuting or de minimis personal use (e.g., stop for personal errands on the way home). 4) The employee must comply with the written policy. 5) The employee cannot to be a control employee. The regulations define a control employee (for purposes of the commuting valuation rule) as an employee who satisfies anyone or more of the following : 1) A board appointed, confirmed, or elected officer with annual compensation of $75,000 or more. 2) A director (regardless of compensation). 3) Any employee with annual compensation of $150,000 or more. Senior ministers ordinarily will not be able to take advantage of the special commuting rule, since they typically are directors of the church, and in some cases they are appointed or confirmed by the church board and receive compensation of $70,000 or more during the year. In some cases, however, ministers may be eligible for the special commuting rule. • Excess Group Term Insurance Premiums Term life insurance premiums paid as part of a 9IQ!d.P. plan that has a face value of $50,000 or less are not taxable. Normally a group term life insurance plan is a component of a denominational pension plan. The premium cost of group term life Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com insurance in excess of $50,000 face value is usually reported to the church by the insurance company or pension board and is reported on Box 1 of the W-2 form. It is also reported on Box 12 using code "C." For example: C 136.22. Normally, the pension plan that provides the insurance coverage will provide the church with the correct amount. The excess coverage can also be calculated using the table in section 5 of IRS Publication 15. (Note that Medical Insurance premiums paid by the church are not reported on the W-2 form.) • Gifts paid by the church (See Gift v. Taxable Compensation) • Nondeductible Moving Expenses (See Moving Expenses) • Salary • Social Security Allowance A Social Security allowance paid to a minister is taxable income. It is subject to both income tax and Social Security, Self-employment tax. However, it is not spendable income for personal and family living needs. It is received by the minister and then paid out for social security taxes Churches and religious organizations are encouraged to pay a Social Security allowance to ministers on staff. Ministers, by law, pay Social Security self-employment tax (SE tax) rather than the employer withholding and matching Social Security FICA tax. The purpose for paying a Social Security allowance is educational rather than financial. Most employers, especially members of a congregation, do not realize how much Social Security SE tax a minister pays. They assume that whatever is identified in the budget as salary is spendable income for the minister to meet personal and family needs. Unfortunately, this is not true unless there is a Social Security allowance. The idea is to segregate from salary that amount the minister pays for SE tax. For example, if the salary is $25,000 and the minister pays $5,000 SE tax for salary and housing, then change the salary to $20,000 and add a $5,000 Social Security allowance. Why? Then everyone readily understands the reality of the situation. In either case the minister actually receives $20,000 for family living needs. But with the Social Security allowance separately identified, the reported salary is really what most people understand to be salary - money to live on. The employer's cost is the same either way. Most benefits are tax-free or tax-deferred. A Social Security allowance paid to a minister is taxable income. It is subject to both income tax and Social Security SE tax. However, it is not spendable income for personal and family living needs. It is received by the minister and then paid out for taxes. Some churches pay a "Social Security offset" which is approximately half the Social Security tax. The theory is, if the minister was a lay employee, the church would have to pay one half the FICA tax. However, it works out to less than half the actual Social Security tax because the offset is taxable for both income and SE tax. The offset is very helpful and appreciated by ministers who receive it. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com If a minister has elected exemption from Social Security on ministry income, the employer is encouraged to distinguish and pay a Social Security allowance anyway. The first reason is to keep the concept in the system. Most ministers are in Social Security and the next one to serve in the current ministry position will probably be paying SE tax. The second reason is to keep the amount clearly identified because these are the funds the minister should be using to provide alternative programs as Social Security replacements. • Wages earned in one calendar year but paid in the next Report wages in the year actually paid, not the year the wages were earned. If an employee worked for only the last week of December, and is paid in January of the next year, the wages are reported on the W-2 based on when the wages are paid. Box 2: List all federal income taxes that were withheld from the minister's wages in year. Be sure that the amounts reported in this box correspond to the amount of withheld income taxes reported on Form 941, Line 3. • Are churches required to withhold income tax on ministry income? • Can Withholding reported on Box 2 exceed Wages reported on Box 1? Box 3. 4. 5. 6: These boxes are left blank for ministers in regards to their ministry income. Churches are prohibited from paying and withholding Social Security FICA tax for a minister. Ministers, except government-employed chaplains, are self-employed for Social Security purposes. This is not optional. The laws are clear and specific. Withholding FICA and Medicare tax from a minister's pay indicates a non-minister status and could nullify the minister's clergy housing allowance exclusion. • Can churches withhold FICA tax on ministry income? • Recommendations if FICA/Medicare tax have been withheld for a minister. Box 12: General instructions for Box 12. The codes most commonly used by nonprofit organizations are listed below. Complete and code this box for all items described below. Do not report in Box 12 any items that are not listed as codes "A through V." Do not enter more than four items in Box 12. If more than four items need to be reported in Box 12, use a separate W-2 to report the additional items. It is very rare that a church would have more than four codes. Use the IRS code designated below for the item you are entering followed by the dollar amount for that item. Even if only item is entered, you must use the IRS code designated for that item. Enter the code using a capital letter. Leave at least one blank space after the code, and enter the dollar amount on the same line. Use decimal points but not dollar signs or commas. Report the IRS code to the left of the vertical line inboxes 12a - 12d and money amount to right of the vertical line. For example,contributions of $3,600 to a Tax ,Sheltered Annuity (403(b) plan) pursuant to a salaryreduction agreement is reported as follows: E 3600.00. (Do not report entry as code "A"even though it is the entry or perhaps the only entry in Box 12. Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com A complete list of all codes A - V are listed in the instructions of the W-2 Form. Code C: Excess Group Term Insurance Premiums. Term life insurance premiums paid as part of a 9IQ!!P plan that has a face value of $50,000 or less are not taxable. Normally a group term life insurance plan is a component of a denominational pension plan. The premium cost of group term life insurance in excess of $50,000 face value is usually reported to the church by theinsurance company or pension board and is reported on Box 1 of the W-2 form. It is also reported on Box 12 using code "C." For example: C 136.22. Normally, the pension plan that provides the insurance coverage will provide the church with the correct amount. The excess coverage can also be calculated using the table in section 5 of IRS Publication 15. (Note that Medical Insurance premiums paid by the church are not reported on the W-2 form.) Code E: Contributions to a Tax Sheltered Annuity (403(b)) If the church (or other nonprofit organization) made contributions to a Tax Sheltered Annuity pursuant to a salary reduction agreement, you must report the amount of contributions paid in Box 12. For example: E 3600.00. This amount is not reported in Box 1. Code L: Employee business expense reimbursements that exceed IRS approved amounts. Use this code only if the church (or nonprofit organization) reimbursed the minister for employee business expenses using a per diem or mileage allowance that exceeds the IRS approved rates. For example: L 864.33. This amount should also be reported in Box 1. Do not include any mileage or per diem reimbursements that are less than or equal to the amount under the IRS approved standard mileage rates or per diem rates. Code P: Excludable moving expense reimbursements paid directly to employee. Show the total moving expense reimbursements you paid directly to your employee for qualified (deductible) moving expenses. For example: P 2466.44. Do not report reimbursements of qualified moving expenses that the church (or other nonprofit organization) paid directly to a third party on behalf of the employee such as a moving company. See also Moving Expenses Code S: Employee salary reduction contributions to a SIMPLE (IRA). Report employee salary reduction contributions to a SIMPLE (IRA) retirement account. For example: S 3600.00. Code T: Adoption Benefits. Show the total amount church (or other nonprofit organization) paid or reimbursed for qualified adoption expenses furnished to the employee under an adoption assistance program. Box 13: Check the appropriate box. Statutory employee. Churches rarely, if ever, have statutory employees. These include certain delivery drivers, insurance agents, and salespeople. Retirement Plan. Mark this checkbox if the employee was an active participate (for any part of the year) in any of the following: 1) a qualified pension plan; 2) anannuity contract such as a Tax Sheltered Annuity (403(b) plan); 3) a Simplified Employee Pension (SEP) plan; or Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com 4) a SIMPLE (IRA) retirement account. Third-party sick pay. This normally does not apply to churches. Box 14: This box is optional. 4) Where on the W-2 form is the clergy housing allowance reported? Box 14: This box is optional. Where on the W-2 form is the clergy housing allowance reported? Improving the financial future of ministers and their families since 1980 2093 East 11th Street, Suite 200 ◊ Loveland, CO 80537-3239 ◊ V: 970.667-5819 ◊ F: 970.663-4950 Clergy@ClergySupport.com ◊ www.ClergyAdvantage.com