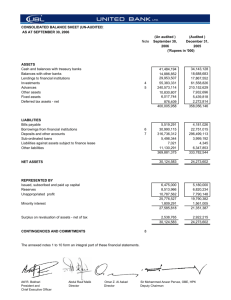

The Punjab Provincial Cooperative Bank Ltd.

advertisement