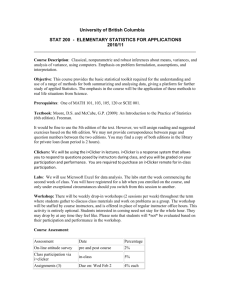

EC223 course outline 2016 - WLU

advertisement

Economics 223 (D, E, F)– Economics of the Canadian Banking and Financial System Syllabus– Winter 2016 Instructor: Wendy Wu Office: P3130 Telephone: (519) 8840710, ext. 2925 Office hours: Tuesdays 1:30-2:30, Thursdays 1:30-2:30 or by appointment Website: https://mylearningspace.wlu.ca Contains lecture notes, readings, course related information, and grades. Email: wwu@wlu.ca You must include EC223 in the subject line if you expect to receive a response. I will check emails regularly during the day. You should not expect to hear from me evenings or weekends. Note that I will not check emails sent to MyLearningSpace email address. Course Description: The purpose of the course is to introduce the fundamental knowledge on financial markets, financial institutions, central banking, and the conduct of monetary policy mainly within the context of the Canadian financial system. The first part of the course provides a general overview of the financial system and explains what money is and how it is measured. The second part examines the inner workings of financial markets, particularly interest rate dynamics. The third part of the course examines the purpose, structure and regulation of the financial institutions. The fourth part focuses on the motivation and tools for the monetary policy being pursued by Canadian central bank, the Bank of Canada. Textbook, MyEconLab and iClicker: Required Textbook: The Economics of Money, Banking, and Financial Markets, by Frederic S. Mishkin and Apostolos Serletis, Fifth Canadian Edition Study Guide: MyEconLab http://www.myeconlab.com MyEconLab is an electric study guide that contains practice questions, study plans, additional readings and related news. Although MyEconLab will not be used for grading, it is a useful 1 resource to facilitate learning and exam preparation. Your access kit for MyEconLab is included with your textbook purchase. Information for MyEconLab log in: Course ID: wu13313 (If you need more detailed instruction, please refer to a separate file named Student Registration Handout for wu13313.pdf) Course Name: EC 223 Note: Older editions or used book will not allow students to gain access to MyEconLab. Clicker Registration You are responsible for purchasing your clicker from the Laurier Bookstore. You are required to register your clicker online via MyLearningSpace (https://mylearningspace.wlu.ca). When you login you will see a course called “Clicker Registration for Winter 2016”. To register your clicker, follow these steps: 1. Enter the “Clicker Registration for Winter 2016” course by clicking on the title 2. From the homepage, click on the “Click here to register your clicker” link 3. Enter your clicker serial Remote ID in the box provided. 4. Click on the ‘Register’ button. Please note: Failure to register your clicker in this way may result in loss of clicker marks. You MUST complete the registration to have your clicker marks assigned to you. If you registered your clicker in Fall 2015, you may not need to register again, but please CONFIRM that your clicker is registered in the registration area in MyLearningSpace. If you registered your clicker in previous years, you MUST register it again for this term. Please direct any questions about this process or about clickers in general to clickers@wlu.ca. A clicker troubleshooting station is available at the help desk in the concourse (Waterloo). Course Evaluation: Iclicker participation: 5% In-class quizzes (January 25/26 and March 7/8): 5% Midterm examination (Friday, February 5) 35% Final examination (During Formal Examination Period) 55% Note: For students who do better in the final than the midterm, 15% of the midterm weight can be transferred to the final exam (i.e., the weight of midterm will be reduced to 20%, and the weight of the final will be increased to 70%) Clicker Grades Students are responsible for registering the clicker, bringing it to every class and ensuring that the batteries work. Clicker quiz will begin in week 3. The clicker mark is cumulative throughout the term. The formula for clicker mark calculation is as follows, Clicker mark = 5 x (number of correct answers from the beginning of the term)/(total number of questions) 2 No exception will be given for absences due to illness or forgotten clickers. However, the weight of iclicker can be transferred to the final if final mark is better than clicker mark. In-class Quizzes: Two in-class quizzes are scheduled for January and March. Each quiz counts 2.5% of the overall grade. The purpose of the quizzes is to reinforce the materials learned in class. Students will receive a mark of zero on a missed test without eligible written documentation. For students with relevant written documentation, the weight of the missed test will be shifted to the final examination. Midterm The midterm is a 90-minute test. Students will receive a mark of zero on a missed test without eligible written documentation. For students with relevant written documentation, the weight of the missed test will be shifted to the final examination. Requests for re-evaluation of midterm should be made within two weeks following the return of the test. A request for re-evaluation should be accompanied by supporting written arguments. Such arguments must be based on the student’s understanding of the relevant portion of the readings and/or lecture notes. Final The final exam is cumulative and covers material from the entire course. Course Outline (tentative): 1. Introduction: Week 1-2.5 Chapter 1: Why Study Money, Banking, and Financial Market? Chapter 2: An Overview of the Financial System Chapter 3: What is Money? 2. Financial Markets Week 2.5-6 Chapter 4: Understanding Interest Rates Chapter 5: The Behaviour of Interest Rates Chapter 6: The Risk and Term Structure of Interest Rates Week 5 Midterm (covers material to, and including, Feb1/2 class) Feb 15-19 Reading week 3 3. Financial Institutions Week 7-9 Chapter 8: An Economic Analysis of Financial Structure Chapter 9: Financial Crises Chapters 10: Economic Analysis of Financial Regulation Chapter 13: The Management of Financial Institutions 4. Central Banking and the Conduct of Monetary Policy Week 10-12 Chapter 15: Central banks and the Bank of Canada Chapter 16: The Money Supply Process Chapter 17: Tools of Monetary Policy (selected sections pp.404-408, 411417, 424-428) Academic Ethics and Other Rules: Wilfrid Laurier University uses software that can check for plagiarism. Students may be required to submit their written work in electronic form and have it checked for plagiarism. You are reminded that the University will levy sanctions on students who are found to have committed, or have attempted to commit, acts of academic or research misconduct. You are expected to know what constitutes an academic offense, to avoid committing such offenses, and to take responsibility for your academic actions. For information on categories of offenses and types of penalty, please consult the relevant section of the Undergraduate Academic Calendar. If you need clarification of aspects of University policy on Academic and Research Misconduct, please consult your instructor. Guidelines for Technology Use Image, video, and audio recording of instructors or in-class activities are strictly prohibited without the prior written consent of the instructor, students, and/or Accessible Learning. Students may be permitted to use technological devices during assessments only under the direct and written permission, in advance of the exam or test date, of the course instructor or Accessible Learning. Accessible Learning Statement: Students with disabilities or special needs are advised to contact Laurier’s Accessible Learning Centre for information regarding its services and resources. Students are encouraged to review the Calendar for information regarding all services available on campus. 4 5