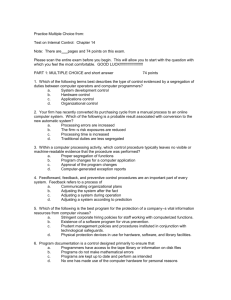

PN820 The audit of licensed corporation and associated entities of

advertisement