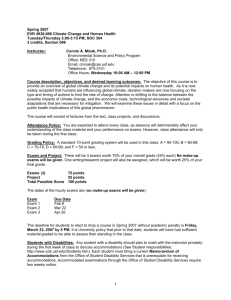

INTERMEDIATE FINANCIAL ACCOUNTING III Course Syllabus

advertisement

INTERMEDIATE FINANCIAL ACCOUNTING III Course Syllabus ACG 4123-Section 601 Summer 2013 Instructor: Debra T. Sinclair, PhD, CVA, CMA Office: PNM 106 A Office Hours: Tuesday, 12:45-1:45 PM and Thursday, 4:45-5:45 PM Class Meeting Schedule: Section 601 Class meets as follows: Class Meeting Days and Times Tuesday and Thursday 2:00 PM – 4:30 PM Final Exam Date and Time Thursday, July 18 2:00 PM – 4:30 PM Location STG 124 PREREQUISITE: The student must have completed ACG 3113 with a grade of C or better COURSE DESCRIPTION: Theory and practice underlying revenue recognition, income tax allocation, leases, post-retirement benefits, error analysis, statement of cash flows, full disclosure, and other current accounting topics. REQUIRED MATERIALS: Kieso, D.E., J.E. Weygandt and T.D. Warfield. Intermediate Accounting, 14th ed. 2012, John Wiley & Sons, Inc., New Jersey. You can access the course web site at https://my.usf.edu. You will need a USF NetID and password in order to have access. If you do not already have a USF NetID, you can obtain one by going to https://una.acomp.usf.edu, clicking on Activate your NetID, and filling out a few simple forms. A USF id card http://it.usf.edu/services/usfcard may be required for USF NetID activation. I expect you to have a thorough knowledge of the accounting principles, concepts, and standards that you have learned in prior courses. Therefore, you should rely on your prior textbooks and other materials to refresh yourselves on the accounting rules for any of the topics we cover in this class. COURSE GOALS AND OBJECTIVES: Students completing ACG 4123 will have developed knowledge and skills in the following areas: I. Revenue Recognition Apply the revenue recognition principle. Describe accounting issues for revenue recognition at point of sale. Apply the percentage-of-completion method for long-term contracts. Apply the completed-contract method for long-term contracts. Identify the proper accounting for losses on long-term contracts. Describe the installment-sales method of accounting. Explain the cost-recovery method of accounting. Explain revenue recognition for franchises and consignment sales. II. Accounting for Income Taxes Identify differences between pretax financial income and taxable income. Describe a temporary difference that results in future taxable amounts. Describe a temporary difference that results in future deductible amounts. Explain the purpose of a deferred tax asset valuation allowance. Describe the presentation of income tax expense in the income statement. Describe various temporary and permanent differences. Explain the effect of various tax rates and tax rate changes on deferred income taxes. Apply accounting procedures for a loss carryback and a loss carryforward. Describe the presentation of deferred income taxes in financial statements. Indicate the basic principles of the asset-liability method. Understand and apply the concepts and procedures of interperiod tax allocation. III. Accounting for Pensions and Post-Retirement Benefits Distinguish between accounting for the employer’s pension plan and accounting for the pension fund. Identify types of pension plans and their characteristics. Explain alternative measures for valuing the pension obligation. List the components of pension expense. Describe the amortization of prior service costs. Explain the accounting for unexpected gains and losses. Explain the corridor approach to amortizing gains and losses. Describe the requirements for reporting pension plans in financial statements. Identify the differences between pensions and postretirement healthcare benefits. Contrast accounting for pensions to accounting for other postretirement benefits. IV. Accounting for Leases Explain the nature, economic substance, and advantages of lease transactions. Describe the accounting criteria and procedures for capitalizing leases by the lessee. Contrast the operating and capitalization methods of recording leases. Identify the classifications of leases for the lessor. Describe the lessor’s accounting for direct-financing leases. Identify special features of lease arrangements that cause unique accounting problems. Describe the effect of residual values, guaranteed and unguaranteed, on lease accounting. Describe the lessor’s accounting for sales-type leases. List the disclosure requirements for leases. Understand and apply lease accounting concepts to various lease arrangements. Describe the lessee’s accounting for sale-leaseback transactions. V. Accounting Changes and Error Analysis Identify the types of accounting changes. Describe the accounting for changes in accounting principles. Understand how to account for retrospective accounting changes. Understand how to account for impracticable changes. Describe the accounting for changes in estimates. Identify changes in a reporting entity. Describe the accounting for correction of errors. Identify economic motives for changing accounting methods. Analyze the effect of errors. Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting. VI. Statement of Cash Flows Describe the purpose of the statement of cash flows. Identify the major classifications of cash flows. Differentiate between net income and net cash flows from operating activities. Contrast the direct and indirect methods of calculating net cash flows from operating activities. Determine net cash flows from investing and financing activities. Prepare a statement of cash flows. Identify sources of information for a statement of cash flows. Discuss special problems in preparing a statement of cash flows. VII. Full Disclosure in Financial Accounting Review the full disclosure principle and describe implementation problems. Explain the use of notes in financial statement preparation. Discuss the disclosure requirements for major business segments. Describe the accounting problems associated with interim reporting. Identify the major disclosures in the auditor’s report. Understand management’s responsibilities for financials. Identify issues related to financial forecasts and projections. Describe the profession’s response to fraudulent financial reporting. Understand the approach to financial statement analysis. Identify major analytic ratios and describe their calculation. Explain the limitations of ratio analysis. Describe techniques of comparative analysis. Describe techniques of percentage analysis. Describe the current international accounting environment. KEY LEADERSHIP SKILL(S) AND PERSPECTIVES ADDRESSED IN THIS COURSE: Interpersonal and Communication Skills 0 Analytical and Critical Thinking Skills Information Technology Skills 5 (a) 0 Reflective Thinking and Experiential Learning 0 Ethical and Social Consciousness Multicultural Competence 3 (b) 0 1=light treatment and 5=the highest level of integration (a) All classroom discussions, homework and exams emphasize problem solving and data analysis skills. (b) The course lecture and homework emphasize ethical decisions in today's business world. UNIVERSITY & COLLEGE POLICY Honor System: Under the USF Honor System, each student is expected to observe complete honesty in all academic matters. Violation of the Honor System will be referred to the Honor Council. Note: The following are violations of the Honor Code: Copying another student’s homework, signing another student’s name on the attendance roster, copying another group’s disk or written work, using another student’s computer disk to print out your assignment, copying another student’s file onto your disk, and misrepresenting a reason for a missed exam. Plagiarism or cheating on course work or on examinations will result in penalties that may include a grade of “F” for the specific exam or course work and a grade of “F” or “FF” for the course. Any incident of academic dishonesty will be reported to the Dean of the College. Definitions and punishment guidelines for Plagiarism, Cheating, and Student Disruption of the Academic Process may be found in the USF Policy on Academic Dishonesty & Disruption of the Academic Process at: http://www.stpt.usf.edu/ugc/documents/USFSPUNDERGRADCATALOG.pdf Students with Disabilities: Please notify your instructor by the second class meeting if you have a learning disability or require special assistance with this course. Confidential personal and learning assistance counseling are made available to students through the Division of Student Affairs. Contact R. Barry McDowell, St. Petersburg Campus: TER 200 (727) 873-4940, ( mcdowell@stpt.usf.edu) for more information. Religious Observances: Students who anticipate the necessity of being absent from class due to the observance of a major religious holiday must provide notice of the date(s) to the instructor, in writing, by the second class meeting. Copyrights: Students who wish to audiotape lectures can do so with direct permission from the professor, but tapes and lectures may not be sold. No videos or photos can be taken in the classroom! Incomplete Grades: An “I” grade may be given to an undergraduate student only when a small portion of the student’s work (normally 30% or less) is incomplete due to circumstances beyond the control of the student and only when a student is otherwise earning a passing grade. “I” grades are to be used only in emergency situations and cannot to be used as a means of avoiding a poor grade. Normally these are only for medical emergencies and require a signed letter from a medical professional that the student was prevented from attending class. The student must petition the professor before the week of final exams for a grade of “I” to be given. Grade Forgiveness: Grade forgiveness is limited to three USFSP courses with no more than one repeat per course. Accounting majors can use the forgiveness only once in upper level accounting courses. Withdrawal: No “W” grades can be obtained after the official drop or withdrawal date (indicate date for each semester). All students enrolled as of the withdrawal date (indicate date for each semester), will receive a letter grade. Emergency Preparedness: In the event of an emergency, it may be necessary for USF to suspend normal operations. During this time, USF may opt to continue delivery of instruction through methods that include but are not limited to: Blackboard, Elluminate, Skype, and email messaging and/or an alternate schedule. It is the responsibility of the student to monitor Blackboard site for each class for course specific communication, and the main USF, College, and department websites, emails, and MoBull messages for important general information. Bomb Threat or other Disruption: All scheduled classes will be held in an alternate room in the case of a bomb scare, fire alarm or other disruption. Students will gather outside of the classroom building in the STG parking lot so that an alternative room may be announced. S/U Grades: This course may not be taken on an S/U basis. Professional Behavior & Disruptions to the Academic Process: If you bring a cell phone, pager or any other communication device to class, please be sure to turn it off and do not use it in the classroom. These devices are not to be used during an exam. Students are expected to conduct themselves at all times in a professional manner, including regular class attendance, alertness and interest in the class. Students are expected to attend class and make positive contributions to class discussions where appropriate and/or when called on. Unprofessional behavior includes, but is not limited to: arriving to class late, returning from breaks late, leaving class during a lecture, cell phone ringing, reading the newspaper during class, talking excessively, leaving class, sleeping in class, or engaging in any other behavior that is disruptive or disrespectful. Turn cell phone sound off during class! Cameras, laptops and other Internet enabled technologies are not allowed in the classroom without express authorization. Students who surf on the laptop during class will be denied use thereafter. Academic disruptions will be dealt with according to university policy. CLASS POLICIES: In addition to the university policies enumerated above, the following policies pertain to this class, specifically. ATTENDANCE: You are all adults. As adults, you are responsible for managing your time and setting your priorities. As adults, you must also accept responsibility for your choices. Therefore, I do not require you to attend class (with the exception of exam days). However: Learning accounting requires a substantial amount of work on your part. I have found that most students cannot keep up with the work without coming to class; I elaborate on things in the book. I also cover things in class that are not in the book. You are responsible for everything covered in class as well as everything assigned in the textbook; The Schedule of Assignments is tentative. Assignment due dates are subject to change depending upon how quickly (or slowly) we move in class. Additionally, the chapters covered on each exam are subject to change. You are responsible for knowing any revisions to the schedule, regardless of your attendance; I will not be a tutor during office hours to those who regularly miss classes. If you chose not to attend class, you are responsible for learning the materials on your own. PREPARATION FOR CLASS: Because of time constraints, all of the material cannot be covered in class. In-depth reading of the assigned chapters is essential for your understanding of the concepts. Working the assigned homework—and perhaps some extra exercises and problems—is also advised. You are responsible for your learning. To assist you, I have posted the answers to all of the exercises and problems on Blackboard. I cannot emphasis enough the importance of you really learning, rather than just memorizing, this material. I suggest you approach the class as follows: (1) Read the chapters prior to class. Make sure that you understand the concepts and take detailed notes. Your notes should be so good that you should not have to reread the chapter when studying; (2) Come to class prepared—which mean that you should bring your book as well as the notes you have taken on the chapter and a calculator; (3) Work the problems prior to class. We’ll use class time to go over some of the assigned exercises so that we can review the process of working through the problem, discuss any theoretical reasons for the treatment, and review any areas that you struggled with; and (4) Ask questions in class. It’s your class. Make the most of it! COMMUNICATION WITH YOUR PROFESSOR: If you have questions about the homework or reading, you may communicate with me in class or during office hours. I will also answer questions related to the material via email. If you have an issue that requires me to take some kind of action, you should ALWAYS communicate via email. I’d prefer if you’d email me through the Blackboard system (which “stamps” your email with your class section). If you cannot email me through Blackboard please remember to include your class section in your correspondence. If you email me, I will try to respond in a timely manner. However, as I’m sure you are, sometimes I am inundated with email. If I do not respond to you in a reasonable amount of time (approximately two business days), please feel free to email me again. Blackboard: You are required to check Blackboard on a regular basis. At a minimum, you should check Blackboard prior to coming to class. You are responsible for anything I post on Blackboard, including notes and assignments. All grades are posted on Blackboard. Once a grade is posted, you have one week to dispute it. In order to dispute a recorded grade, you must email me. If you have not emailed me to tell me that you believe your recorded grade is in error within seven days after the grade is posted, the grade stands. SCHEDULED EXAMS : Exam dates are typically NOT tentative. Rather than change an exam date, I will usually adjust the material on the exam, if necessary. Exams are typically a combination of multiple choice questions, problems, and short answers. You must bring a basic, four-function calculator to the exam if you plan to use a calculator. Calculators may not be shared on exams. Devices that have the capability to store text or communicate with others, including graphic or programmable calculators, pagers, cellular phones, Palms, other PDAs, etc., are not allowed in your possession during exams. You may not use your cell phone as a calculator. You are responsible for all of the material in the assigned chapters, whether or not that material was covered in class. Likewise, you are responsible for any material covered in class that is not presented in the book. On exam days, you should space yourself out so as best as possible to avoid someone being able to copy from your exam. You are responsible for keeping your work covered during the exam. If your exam is visible to your neighbors, I will take it from you and you will receive a zero. PRACTICE GOOD INTERNAL CONTROLS. Take precautions to protect your work. We will generally not have time to review for exams in class prior to the exam (although we should have time to briefly discuss the topics to be covered). Therefore, it is VERY important that you keep up with the material as we go. After the exam, we will spend a short time going over the graded exams and then I will collect them. You will not have any further access to your exams. If you miss the class in which we review the exams—and the absence is excused—I will review the exam with you in my office. If your absence is unexcused, you will not get the opportunity to review your exam. Following our review, the quiz/exam will be retained in the instructor’s office for a minimum of two weeks into the next semester. After that, they will be destroyed according to USF policy. MISSED EXAMS: If you miss an exam, I will assign you a zero. If you have a legitimate excuse for missing the exam, such as illness or a death in the family, I will allow you to make up the exam in a timely manner. I will consider reasons for missing exams on a case-by-case basis. You must provide documentation of your excuse (e.g., doctor’s note). If you miss an exam and it is not convenient for me to have you make it up in a timely manner, you will be required to take a comprehensive final. GRADING: Scheduled exams (4 @ 150 points each) points 600 Your grades will be posted to Blackboard as soon as grading has been completed. RE-GRADE POLICY: If a student disagrees with the grading of any work, a written request for a re-grade must be prepared within one week of the return of the work being disputed. The request must establish the basis for questioning the grade and include appropriate documentation and/or evidence to substantiate the request. Re-grade requests presented after the one week deadline will not be considered. Any re-grade will be a re-grade of the ENTIRE exam or project, not a portion of the exam or project in question. Any or all of the exam or project is subject to change on a re-grade and the student’s grade may increase or decrease as a result of the re-grade, i.e. any other grading errors discovered during the re-grade will also be corrected whether those result in an increase or decrease of the student’s grade. Certain issues do not require a re-grade request, such as miscalculations by the instructor (or grader) or misgraded automated answer sheets. If in doubt, please see the instructor. TENTATIVE SCHEDULE Background Information Before you begin Chapter 18, you should refresh yourself on the basics. Please look over Chapter 2 again and go over the assumptions, principles, and constraints as well as the concepts. We will also quickly review these ideas on the first day of class. Date Chapter & Topic*** Tuesday, May 14 Syllabus and policy review *Review of the accounting assumptions, principles, and concepts Thursday, May 16 *Chapter 18: Revenue Recognition Tuesday, May 21 Chapter 18: Revenue Recognition (continued) *Chapter 19: Accounting for Income Taxes Thursday, May 23 Tuesday, May 28 Thursday, May 30 Tuesday, June 4 Chapter 19: Accounting for Income Taxes (continued) Thursday, June 6 *Chapter 21: Accounting for Leases (including Appendices A and B) Tuesday, June 11 Thursday, June 13 Chapter 21: Accounting for Leases (continued) Tuesday, June 18 Chapter 22: Accounting Changes and Error Analysis Thursday, June 20 *Firm incentives for earnings manipulation *Materiality Tuesday, June 25 Chapter 22: Accounting Changes and Error Analysis Thursday, June 27 Saturday, Chapter 22: Accounting Changes and Error Analysis June 29 Homework** E18-20, E18-26, E18-27 P18-3, P18-6, P18-7, P18-8 E19-6, E19-7, E19-8, E19-11, E19-20, E19-23 P19-3, P19-5 EXAM 1: Chapters 18 and 19 *Chapter 20: Accounting for Pensions and Postretirement Benefits Chapter 20: Accounting for Pensions and Postretirement Benefits (continued) E20-13, E20-16 P20-2, 20-3, 20-4, 20-5, 20-13 E21-2 P21-2, P21-6, P21-8, P21-9, P21-10, P21-11, P21-16 EXAM 2: Chapters 20 and 21 Last day to withdraw from class with a “W” E22-3, E22-5, E22-6, E22-8, E22-10, E22-14 E22-16, E22-17, E22-18, E22-21, E22-22, E22-23 P22-9, P22-10 Tuesday, July 2 Thursday, July 4 Tuesday, July 9 Thursday, July 11 Tuesday, July 16 Thursday, July 18 EXAM 3: Chapter 22 and instructor-provided materials Happy Independence Day! Chapter 23: Statement of Cash Flows 23: Statement of Cash Flows (continued) Chapter 24: Full Disclosure in Financial Reporting Chapter 24: Full Disclosure in Financial Reporting (continued) *Ratio analysis E23-1, E23-8, E23-11, E23-12, E23-15 P23-1, P23-2, P23-3, P23-8 E24-1, 24-2, 24-3 EXAM 4: Chapters 23 and 24 *Indicates additional readings, information, or notes located in the “Information” section on Blackboard **The assigned homework is the MINIMUM amount of work required for this course. I also recommend that you do similar problems in each chapter. The complete answer key for all chapter materials can be found on Blackboard under the “Chapter Solutions” section. ***Unless stated otherwise, our chapter coverage includes the appendices.