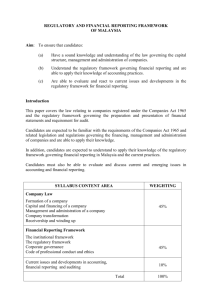

Securities Commission - capital market masterplan

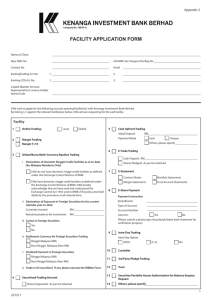

advertisement