Solutions

advertisement

102B - Introduction to Econometrics – Winter Term 2012/13

Paolo Pin

ppin@stanford.edu

Stanford, February 21st 2013

Problem Set 5

This problem set is based on lectures 12 and 13 (February 19th and 21st).

It must be turned in to the Economics Academic Office by 4 P.M. on Tuesday March 5th.

Late homework will be assigned a grade of 0 and the lowest grade will be dropped in computing grades. It

is entirely your responsibility to ensure that you complete the assignments and remember to turn them in

on time at the designated location. There will be no extensions for the problem sets. The only exception

to this rule is for death of a family member or illness requiring immediate attention of a physician. There

will be no exception for job interviews or other non-Stanford activities or for completed work that students

forget to turn in. Athletes on the road must still turn in the problem sets by the stated deadlines, although

may do so by fax. See the course management policies (http://economics.stanford.edu/undergraduate/

economics-common-syllabus) for more details on these issues.

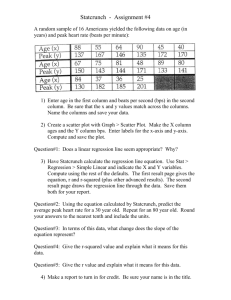

1 - Exercise with Stata

In the coursework you find the dataset ‘fertil’. includes, for women in Botswana during 1988,

information on number of children, years of education, age, and religious and economic status variables (this dataset is taken from J. M. Wooldridge (2012) “Introductory Econometrics”).

The variables that we are interested for in this exercise are:

children: number of living children

educ: years of education

age: age in years

mnthborn: month woman born

frsthalf: =1 if mnthborn ≤ 6

1

electric: =1 if has electricity

tv: =1 if has tv

bicycle: =1 if has bicycle

(a) Estimate this model by OLS

children = β0 + β1 educ + β2 age + β3 age2 + u

and interpret the estimates. In particular, holding age fixed, what is the estimated effect

of another year of education on fertility? If 100 women receive another year of education,

how many fewer children are they expected to have?

. gen age2=age*age

. reg children educ age age2, robust

Linear regression

Number of obs

F( 3, 4357)

Prob > F

R-squared

Root MSE

=

4361

= 1922.00

= 0.0000

= 0.5687

= 1.4597

-----------------------------------------------------------------------------|

Robust

children |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------educ | -.0905755

.0060483

-14.98

0.000

-.1024332

-.0787178

age |

.3324486

.0192071

17.31

0.000

.2947929

.3701043

age2 | -.0026308

.000352

-7.47

0.000

-.0033209

-.0019408

_cons | -4.138307

.2436211

-16.99

0.000

-4.615928

-3.660685

------------------------------------------------------------------------------

One year more of education reduces expected children by .09. 100 women would have 9

less children if they all had one year more of education.

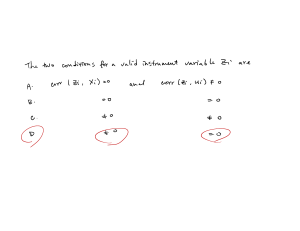

(b) F rsthalf is a dummy variable equal to one if the woman was born during the first six

months of the year. Assuming that f rsthalf is uncorrelated with the error term from

part (i), show that f rsthalf is a reasonable IV candidate for education

2

. reg educ frsthalf age age2, robust

Linear regression

Number of obs

F( 3, 4357)

Prob > F

R-squared

Root MSE

=

=

=

=

=

4361

201.72

0.0000

0.1077

3.711

-----------------------------------------------------------------------------|

Robust

educ |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------frsthalf | -.8522854

.1132665

-7.52

0.000

-1.074345

-.6302254

age | -.1079504

.0402228

-2.68

0.007

-.1868076

-.0290932

age2 | -.0005056

.0006802

-0.74

0.457

-.0018392

.000828

_cons |

9.692864

.5414317

17.90

0.000

8.631383

10.75435

------------------------------------------------------------------------------

f rsthalf is a big determinant of educ (even controlling for age), so it has a strong

correlation with it: it is relevant. The reason is probably that all women start school

in the same month of the year, after having reached a certain age (say the September

after they become 6), and most drop at a specific birthday (say the year in which they

become 10).

It is also safe to argue that it not correlated with the part of children which is not

explained by education.

(c) Estimate the model from part (i) by using f rsthalf as an IV for educ. Compare the

estimated effect of education with the OLS estimate from part (i).

. ivreg children age age2 (educ=frsthalf ) , robust

Instrumental variables (2SLS) regression

Number of obs

F( 3, 4357)

Prob > F

R-squared

Root MSE

=

4361

= 1838.43

= 0.0000

= 0.5502

= 1.4907

-----------------------------------------------------------------------------|

Robust

children |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

3

-------------+---------------------------------------------------------------educ | -.1714989

.0523859

-3.27

0.001

-.2742019

-.068796

age |

.3236052

.0202371

15.99

0.000

.2839302

.3632802

age2 | -.0026723

.0003524

-7.58

0.000

-.0033631

-.0019815

_cons | -3.387805

.5451939

-6.21

0.000

-4.456663

-2.318948

-----------------------------------------------------------------------------Instrumented: educ

Instruments:

age age2 frsthalf

------------------------------------------------------------------------------

Now, with the help of the instrument, it comes out that the effect of educ is almost

double as big.

(d) Add the binary variables electric, tv, and bicycle to the model and assume these are

exogenous. Estimate the equation by OLS and 2SLS and compare the estimated coefficients on educ.

. ivreg children age age2 electric tv bicycle

Instrumental variables (2SLS) regression

(educ=frsthalf ) , robust

Number of obs

F( 6, 4349)

Prob > F

R-squared

Root MSE

=

=

=

=

=

4356

939.15

0.0000

0.5577

1.4789

-----------------------------------------------------------------------------|

Robust

children |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------educ | -.1639814

.0643804

-2.55

0.011

-.2901999

-.037763

age |

.3281451

.0213264

15.39

0.000

.2863345

.3699556

age2 | -.0027222

.0003503

-7.77

0.000

-.0034089

-.0020354

electric | -.1065314

.1583542

-0.67

0.501

-.4169864

.2039236

tv |

-.002555

.204425

-0.01

0.990

-.4033322

.3982222

bicycle |

.3320724

.0506832

6.55

0.000

.2327074

.4314374

_cons | -3.591332

.639396

-5.62

0.000

-4.844874

-2.33779

-----------------------------------------------------------------------------Instrumented: educ

Instruments:

age age2 electric tv bicycle frsthalf

------------------------------------------------------------------------------

4

electric and tv have significative and huge effect: they have probably the causal interpretation that they reduce the time married couples spend in intimacy. bycicle is a control

variable for wealth and for the amount of time not spent at home.

2 - One theoretical exercise

Consider the simple regression model

y = β0 + β1 x + u

and let z be a binary instrumental variable for x. Show that the IV estimator β̂1 can be

written as

ȳ1 − ȳ0

β̂1 =

,

x̄1 − x̄0

where ȳ0 and ȳ0 are the sample averages of yi and xi over the part of the sample with zi = 0,

and where ȳ1 and ȳ1 are the sample averages of yi and xi over the part of the sample with

zi = 1. This estimator, known as a grouping estimator, was first suggested by Wald (1940).

We know that

β̂1T SLS

Pn

(zi − z̄)(yi − ȳ)

sZY

.

=

= Pni=1

sZX

i=1 (zi − z̄)(xi − x̄)

But then we can write

n

X

"

#

X

(zi − z̄)(yi − ȳ) =

i=1

"

#

X

(1 − z̄)(yi − ȳ) +

i:zi =1

(−z̄)(yi − ȳ)

i:zi =0

"

#

X

= ȳ1 − z̄ ȳ +

"

(−z̄)(yi − ȳ) +

i:zi =1

"

#

X

=

#

X

(−z̄)(yi − ȳ)

i:zi =0

"

(zi − z̄)yi +

i:zi =1

#

X

(zi − z̄)yi − ȳ

n

X

(zi − z̄)

i:zi =0

i=1

{z

|

"

=

#

X

"

#

X

zi yi −

i:zi =1

z̄yi +

i:zi =1

= ȳ1

1

− z̄ ȳ1

i:zi =1

X

i:zi =1

5

#

X

zi yi −

1

{z

=0

"

X

z̄yi

i:zi =0

i:zi =0

|

!

!

X

"

}

#

=0

}

!

− z̄ ȳ0 n −

X

i:zi =1

1

.

Now consider that z̄ =

1

/n, and so

i:zi =1

P

!

X

1

!

− z̄

i:zi =1

So

β̂1T SLS

X

1

i:zi =1

!

= z̄

n−

X

1

.

i:zi =1

P

(ȳ1 − ȳ0 )z̄ n − i:zi =1 1

sZY

ȳ − ȳ0

= 1

P

=

=

.

sZX

x̄1 − x̄0

(x̄1 − x̄0 )z̄ n − i:zi =1 1

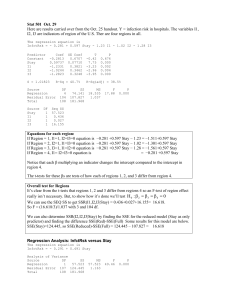

3 - Exercises from the book

Do the following exercises from: Introduction to Econometrics by James H. Stock and Mark

W. Watson (Addison-Wesley, 3rd Edition):

• empirical exercises, requiring Stata: exercises E12.1 and E12.2;

E12.1

. gen logprice=log(price)

. gen logquantity=log(quantity )

. reg logquantity logprice ice seas1 seas2 seas3 seas4 seas5 seas6 seas7 seas8 seas9 seas10 seas11

Linear regression

Number of obs

F( 14,

313)

Prob > F

R-squared

Root MSE

=

=

=

=

=

328

11.77

0.0000

0.3126

.39727

-----------------------------------------------------------------------------|

Robust

logquantity |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------logprice | -.6388847

.0732804

-8.72

0.000

-.7830692

-.4947003

ice |

.4477537

.1349288

3.32

0.001

.1822717

.7132358

seas1 | -.1328219

.0957944

-1.39

0.167

-.3213042

.0556604

seas2 |

.0668882

.0907065

0.74

0.461

-.1115834

.2453599

seas3 |

.1114365

.0970148

1.15

0.252

-.0794472

.3023201

seas4 |

.1554219

.1324978

1.17

0.242

-.1052771

.416121

seas5 |

.1096585

.1276572

0.86

0.391

-.1415162

.3608333

6

seas6 |

.0468325

.1766425

0.27

0.791

-.3007243

.3943894

seas7 |

.1225526

.1998661

0.61

0.540

-.2706984

.5158036

seas8 | -.2350078

.1749897

-1.34

0.180

-.5793126

.109297

seas9 |

.0035607

.1723754

0.02

0.984

-.3356003

.3427217

seas10 |

.1692469

.1729309

0.98

0.328

-.1710071

.5095009

seas11 |

.2151845

.1728162

1.25

0.214

-.1248439

.5552128

seas12 |

.2196331

.1700043

1.29

0.197

-.1148625

.5541287

_cons |

8.861233

.177072

50.04

0.000

8.512831

9.209635

-----------------------------------------------------------------------------. ivregress 2sls

> ce(robust)

logquantity ice seas1 seas2 seas3 seas4 seas5 seas6 seas7 seas8 seas9 seas10 sea

Instrumental variables (2SLS) regression

Number of obs

Wald chi2(14)

Prob > chi2

R-squared

Root MSE

=

=

=

=

=

328

165.29

0.0000

0.2959

.39279

-----------------------------------------------------------------------------|

Robust

logquantity |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------logprice | -.8665865

.1307362

-6.63

0.000

-1.122825

-.6103483

ice |

.422934

.1315104

3.22

0.001

.1651784

.6806896

seas1 | -.1309732

.1005382

-1.30

0.193

-.3280245

.066078

seas2 |

.0909521

.0927421

0.98

0.327

-.090819

.2727233

seas3 |

.135872

.0980894

1.39

0.166

-.0563797

.3281237

seas4 |

.1525109

.1313612

1.16

0.246

-.1049523

.4099741

seas5 |

.0735618

.1271374

0.58

0.563

-.175623

.3227465

seas6 | -.0060642

.1721703

-0.04

0.972

-.3435118

.3313834

seas7 |

.0602324

.1964209

0.31

0.759

-.3247454

.4452102

seas8 | -.2935991

.1707606

-1.72

0.086

-.6282837

.0410855

seas9 | -.0583723

.1714096

-0.34

0.733

-.3943289

.2775844

seas10 |

.0858109

.1738156

0.49

0.622

-.2548614

.4264832

seas11 |

.1517912

.1716185

0.88

0.376

-.184575

.4881573

seas12 |

.1786558

.1668587

1.07

0.284

-.1483813

.5056929

_cons |

8.573535

.2106483

40.70

0.000

8.160672

8.986398

-----------------------------------------------------------------------------Instrumented: logprice

Instruments:

ice seas1 seas2 seas3 seas4 seas5 seas6 seas7 seas8 seas9

seas10 seas11 seas12 cartel

7

(a) The estimated elasticity is -0.639 with a standard error of 0.073.

(b) A positive demand “error” will shift the demand curve to the right. This will

increase the equilibrium quantity and price in the market. Thus ln(Price) is

positively correlated with the regression error in the demand model. This means

that the OLS coefficient will be positively biased.

(c) Cartel shifts the supply curve. As the cartel strengthens, the supply curve shifts

in, reducing supply and increasing price and profits for the cartels members. Thus,

Cartel is relevant. For Cartel to be a valid instrument it must be exogenous, that

is, it must be unrelated to the factors affecting demand that are omitted from the

demand specification (i.e., those factors that make up the error in the demand

model.) This seems plausible.

(d) The first stage F-statistic is 183.0. Cartel is not a weak instrument. (e) See the

table. The estimated elasticity is -0.867 with a standard error of 0.134. Notice

that the estimate is more negative than the OLS estimate, which is consistent

with the OLS estimator having a positive bias.

(e) In the standard model of monopoly, a monopolist should increase price if the

demand elasticity is less than 1. (The increase in price will reduce quantity but

increase revenue and profits.) Here, the elasticity is less than 1.

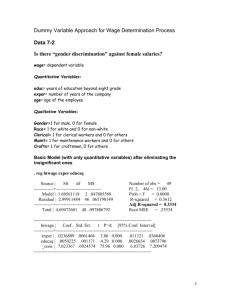

E12.2

. reg weeksm1 morekids , robust

Linear regression

Number of obs

F( 1,254652)

Prob > F

R-squared

Root MSE

= 254654

= 3820.91

= 0.0000

= 0.0143

=

21.71

-----------------------------------------------------------------------------|

Robust

weeksm1 |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------morekids | -5.386996

.0871491

-61.81

0.000

-5.557806

-5.216186

_cons |

21.06843

.0560681

375.76

0.000

20.95854

21.17832

------------------------------------------------------------------------------

8

. ivregress 2sls weeksm1 (morekids = samesex ), vce(robust)

Instrumental variables (2SLS) regression

Number of obs

Wald chi2(1)

Prob > chi2

R-squared

Root MSE

=

=

=

=

=

254654

24.53

0.0000

0.0139

21.715

-----------------------------------------------------------------------------|

Robust

weeksm1 |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------morekids | -6.313685

1.274681

-4.95

0.000

-8.812013

-3.815357

_cons |

21.42109

.4872487

43.96

0.000

20.4661

22.37608

-----------------------------------------------------------------------------Instrumented: morekids

Instruments:

samesex

. ivregress 2sls weeksm1 agem1 black hispan othrace (morekids = samesex ), vce(robust)

Instrumental variables (2SLS) regression

Number of obs

Wald chi2(5)

Prob > chi2

R-squared

Root MSE

= 254654

= 6954.98

= 0.0000

= 0.0437

= 21.384

-----------------------------------------------------------------------------|

Robust

weeksm1 |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------morekids | -5.821051

1.246386

-4.67

0.000

-8.263923

-3.378179

agem1 |

.8315975

.0226406

36.73

0.000

.7872228

.8759722

black |

11.62327

.2317953

50.14

0.000

11.16896

12.07758

hispan |

.4041802

.2607962

1.55

0.121

-.106971

.9153314

othrace |

2.130962

.2109857

10.10

0.000

1.717438

2.544486

_cons | -4.791894

.3897868

-12.29

0.000

-5.555862

-4.027925

-----------------------------------------------------------------------------Instrumented: morekids

9

Instruments:

agem1 black hispan othrace samesex

(a) The coefficient is -5.387, which indicates that women with more than 2 children

work 5.387 fewer weeks per year than women with 2 or fewer children.

(b) Both fertility and weeks worked are choice variables. A woman with a positive

labor supply regression error (a woman who works more than average) may also

be a woman who is less likely to have an additional child. This would imply

that Morekids is positively correlated with the regression error, so that the OLS

estimator of βM orekids is positively biased.

(c) The linear regression of morekids on samesex (a linear probability model) yields

morekids = 0.346(SE : 0.001) + 0.066(SE : 0.002)samesex

so that couples with samesex = 1 are 6.6% more likely to have an additional child

that couples with samesex = 0. The effect is highly significant (t-statistic = 35.2)

(d) Samesex is random and is unrelated to any of the other variables in the model

including the error term in the labor supply equation. Thus, the instrument

is exogenous. From (c), the first stage F-statistic is large (F = 1238) so the

instrument is relevant. Together, these imply that samesex is a valid instrument.

(e) No, see the answer to (d).

(f) See first IV regeression. The estimated value of βM orekids is -6.313.

(g) See second IV regeression. The results do not change in an important way. The

reason is that samesex is unrelated to agem1, black, hispan, othrace, so that there

is no omitted variable bias in the previous IV regression.

• comment on the differences and the analogies in the results between exercise “1 Exercise with Stata” above and exercise E12.2: are we measuring the same causal

effects, can we assume that there are the same causal effects

In Exercise 12.2 we check if there is a causal effect from family (more or less children)

to work (unemployment, working time and wage) – but we need an instrument to

control for the inverse causal effect; in exercise “1 - Exercise with Stata” we look a

the causal effect from education to family, that can happen also through work (but

not only: another channel could be cultural values) – and we need an instrument to

control for the inverse causal effect (and in this case it is mostly due to work).

10