Intermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 1

advertisement

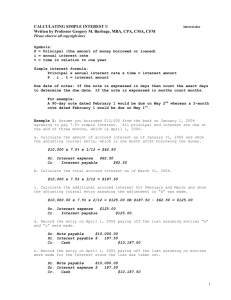

Intermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 1 Solutions The class performed unacceptably. It is the worst performance on an Intermediate Accounting 2 exam that I’ve seen in 34 years of teaching this course. And this is comparing a traditional 3 hours per week course to the La Sierra 4 hours per week course. Given that most of the students are not reading either the textbook or the professor notes, I guess it’s not surprising. Intermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 1 Solutions Question 1 Payroll accounting. Employee Maribel Mehak Employee Maribel Mehak Salary YTD August. 31 Gross Salary September Federal withholding September State withholding September 6,000 103,000 4,000 10,000 650 1,325 118 374 Salary YTD September 30 Gross Salary October Federal withholding October State withholding October 10,000 113,000 4,000 10,000 650 1,325 118 374 Required: What journal entry should Rosio accrue for employer wages expense for the month of September? What journal entry should Rosio accrue for employer payroll tax expense for the month of September? What journal entry should Rosio accrue for employer payroll tax expense for the month of October? Sep 30 Aug 31 Sep 30 Wages expense Federal income tax payable State income tax payable Social security payable Medicare payable Healthcare payable Wages payable 14,000 Payroll tax expense Social security payable Medicare payable SUT payable FUT payable 1,559 Payroll tax expense Social security payable Medicare payable SUT payable FUT payable 939 1,975 492 868 203 140 10,322 given given .062*(4,000+10,000) .0145*(4,000+10,000) 868 203 480 8 .062*(4,000+10,000) .0145*(4,000+10,000) .12*(4,000+0) .008*(1,000+0) 496 203 240 0 .062*(4,000+4,000) .0145*(4,000+10,000) .12*(2,000+0) .008*(0+0) Question 2 Current liabilities How much subscription revenue should appear on the 2013 income statement? beg SCIA + new subscriptions added to SCIA – subscriptions delivered (revenue) = end SCIA 80,000 + 760,000 – revenue = 76,000 80,000 + 760,000 – 76,000 = revenue revenue = 764,000 How much current liability related to the magazines should appear on the 2013 balance sheet? current liability = 40,000 How much in long term liability related to the magazines should appear on the 2013 balance sheet? long term liability = 46,000 Question 3 Warranties Year 2013 2014 2015 Sales $832,670 0 0 Actual Warranty expenditures $37,100 $38,300 $10,000 Required: Journal entries in 2013 and 2014 and 2015 to account for credit sales, warranty expense, and warranty repairs. Assume that Sherani accrues for warranty expense in the year of sale. 2013 journal entries Accounts receivable/cash Sales revenue Warranty expense Est. Liability for warranty repair Est. liability for warranty repair Cash/AP 832,670 832,670 83,267 83,267 37,100 37,100 2014 journal entries Est. liability for warranty repair Cash/AP 38,300 38,300 2015 journal entries Est. liability for warranty repair Cash/AP Warranty expense Est. liability for warranty repair 10,000 10,000 2,133 2,133 Question 4 Computing loan amounts. (1) The amount of an quarterly installment payment for a $41,000 loan taken out on January 30, 2014 that is to be repaid at three month intervals over 4 years, starting on April 30, 2014. The implicit interest rate for the loan is 6.4%. PV FV N I pmt type (2) The interest rate for a loan of $16,500 borrowed on January 30, 2014, when the repayment schedule calls for $3,800 annual installment payments for 6 years. The first repayment is due on January 30, 2015 PV FV N I pmt type (3) –41,000 0 16 = 4 * 4 1.6 = 6.5 / 4 ? = 2,925 end –16,500 0 6 ? = 10.1033% 3,800 end The amount of cash interest paid in 2015 for a 5% interest bearing loan of $52,600 taken out by the borrower on January 30, 2014. The loan has a maturity date of March 25, 2020. Interest is payable every January 30, starting in 2015. 2,630 = .05*52,600 (4) The amount of cash interest paid in 2014 for a 5% interest bearing loan of $52,600 taken out by the borrower on January 30, 2014. The loan has a maturity date of March 25, 2020. Interest is payable every January 30, starting in 2015. 0 Question 5 (1) Prepare the a loan amortization table in good form. Loan Rate Years Type Payment Date 01/01/14 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 (2) 38,600 0.05 5 end 8,916 Cash Interest 8,916 8,916 8,916 8,916 8,915 1,930 1,581 1,214 829 425 6,986 7,335 7,702 8,087 8,490 Balance 38,600 31,614 24,279 16,577 8,490 0 Complete the following schedule for the amounts to appear in the financial statements for the 2015 (year 2) and 2016 (year 3) fiscal years. Xin has a fiscal year that starts on January 1 and ends on December 31. Total Liability Current Liability 2014 31,613 8,491 23,122 2015 24,279 8,491 2016 16,577 2017 2018 (3) Amort Long-term Operating Liability Income Non-op Income Operating Activities Investing Activities Financing Activities 0 –1,930 –1,930 0 +38,300–6,986 15,788 0 –1,581 –1,581 0 –7,335 8,491 8.096 0 –1,214 –1,214 0 –7,702 8,490 8,490 0 0 –829 –829 0 –8,087 0 0 0 0 –425 –425 0 –8,490 Prepare journal entries for 2014 (year 1) and 2015 (year 2). 1/1/2014 Cash Note payable 12/31/2014 Interest expense Note payable Cash 12/31/2015 Interest expense Note payable Cash 38,300 38,300 1,930 6,986 8,916 1,581 7,335 8,916 (4) Now assume that Xin took out the loan on September 1, 2014, with all future payments due on September 1 of the future years, starting September 1, 2015. Prepare journal entries for 2014, 2015 and 2016. 9/1/2014 Cash Note payable 12/31/2014 Interest expense Note payable 9/1/2015 Interest expense Note payable Cash 12/31/2015 Interest expense Note payable 9/1/2016 Interest expense Note payable Cash 12/31/2016 Interest expense Note payable 38,300 38,300 643 643 1,287 7,629 8,916 527 527 1,054 7,862 8,916 405 405 Question 6 Interest bearing loan. Olaitan Company is borrowing $47,500 from a bank on January 1, 2014. The bank is charging 6% interest for five years. Interest only is to be paid annually, starting on December 31, 2014, with all the principal to be paid on December 31, 2018 (Round all amounts to the nearest dollar. (1) Prepare an amortization table in good form to account for this loan. Round all amounts to dollars. Loan Rate Years Type Payment Date 01/01/14 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 (2) 47,500 0.06 5 end 2,850 Cash 2,850 2,850 2,850 2,850 2,850 Interest Amort 2,850 2,850 2,850 2,850 2,850 0 0 0 0 0 Balance 47,500 47,500 47,500 47,500 47,500 47,500 Complete the following schedule for the amounts to appear in the financial statements for all years from 2014 through 2018. Olaitan has a fiscal year that starts on January 1 and ends on December 31. Total Liability Current Liability Long-term Operating Liability Income Non-op Income Operating Activities Investing Activities Financing Activities 2014 47,500 2,689 44,811 0 –2,850 –2,850 0 +47,500 2015 47,500 2,689 44,811 0 –2,850 –2,850 0 0 2016 47,500 2,689 44,811 0 –2,850 –2,850 0 0 2017 47,500 47,500 0 0 –2,850 –2,850 0 0 2018 47,500 0 0 0 –2,850 –2,850 0 –47,500 Question 7 Non-interest bearing loan. The Jazmyn Company takes out a $60,000 (maturity value) loan from a bank on January 1, 2014. A rate of 7% is implicit in this loan. No interest or principal payments are to be paid annually. Maturity value is due five years hence on December 31, 2018. Round all amounts to the nearest dollar. (1) (2) Compute the loan proceeds (net amount borrowed) on January 1, 2014. Prepare an amortization table in good form to account for this loan. Round all amounts to dollars. Loan Maturity Rate Years Type Payment Date 01/01/14 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 (3) 42,779 60,000 0.07 5 end 0 Cash Interest 0 0 0 0 0 2,995 3,204 3,428 3,668 3,926 Amort (2,995) (3,204) (3,428) (3,668) (3,926) Balance 42,779 45,774 48,978 52,406 56,074 60,000 Complete the following schedule for the amounts to appear in the financial statements for the first three years of the loan (from 2014 through 2016). Jazmyn has a fiscal year that starts on January 1 and ends on December 31. Total Liability Current Liability Long-term Operating Liability Income Non-op Income Operating Activities Investing Activities Financing Activities 2014 45,774 0 45,774 0 –2,995 0 0 +42,779 2015 48,978 0 45,978 0 –3,204 0 0 0 2016 52,406 0 52,406 0 –3,428 0 0 0 2017 56,074 56,074 0 0 –3,668 0 0 0 2018 0 0 0 0 –3,926 0 0 –60,000