Risky Decision Making 1 Gain-Loss Separability and Coalescing in

advertisement

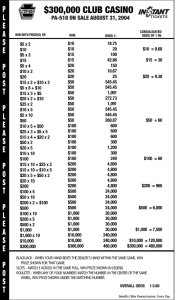

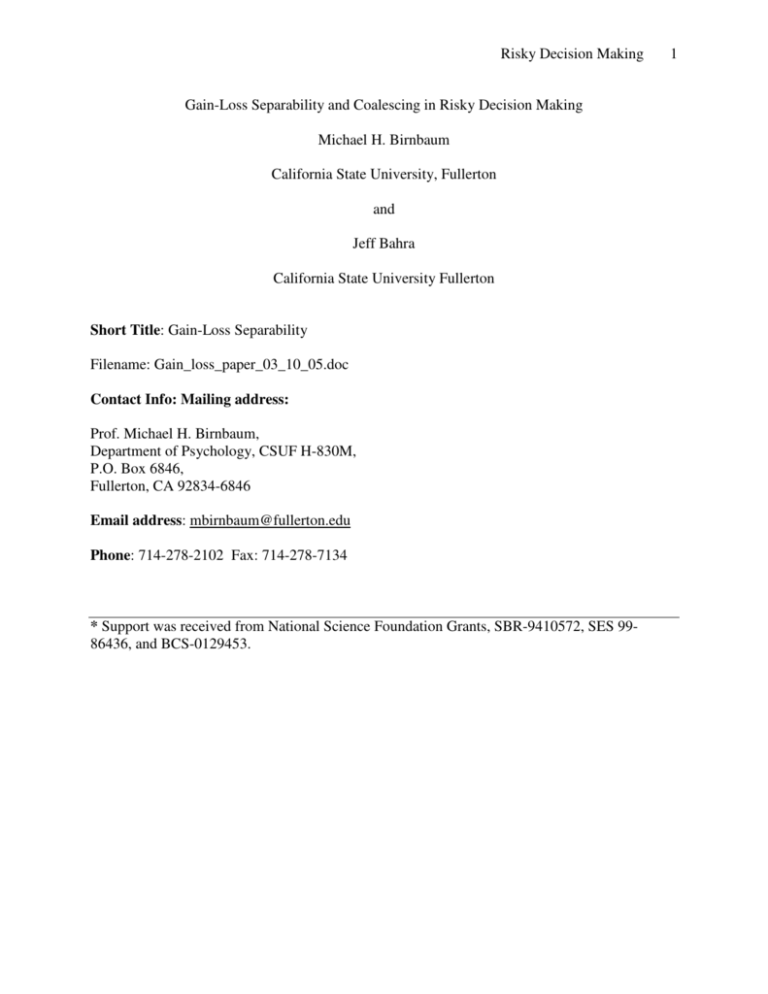

Risky Decision Making Gain-Loss Separability and Coalescing in Risky Decision Making Michael H. Birnbaum California State University, Fullerton and Jeff Bahra California State University Fullerton Short Title: Gain-Loss Separability Filename: Gain_loss_paper_03_10_05.doc Contact Info: Mailing address: Prof. Michael H. Birnbaum, Department of Psychology, CSUF H-830M, P.O. Box 6846, Fullerton, CA 92834-6846 Email address: mbirnbaum@fullerton.edu Phone: 714-278-2102 Fax: 714-278-7134 * Support was received from National Science Foundation Grants, SBR-9410572, SES 9986436, and BCS-0129453. 1 Risky Decision Making 2 Abstract This experiment tested behavioral properties of risky decision making to test between descriptive models: Gain-Loss Separability and Coalescing. Cumulative prospect theory (CPT) satisfies both properties, but transfer of attention exchange model (TAX) violates both. New tests were devised to compare predictions of CPT and TAX as fit to previous data to predict the new results. Contrary to CPT, there were systematic violations of coalescing and of gain-loss separability, consistent with predictions of the TAX model. In addition, tests of gain-loss separability depended systematically on how branches were split or coalesced. The TAX model, as fit to previous data, predicted the new data fairly well, correctly predicting when gain-loss separability would be violated and when it would be satisfied. Risky Decision Making 3 Gain-Loss Separability and Coalescing in Risky Decision Making Introduction This study is based upon an important paper by Wu and Markle (2004), and it extends their results. We provide a different theoretical interpretation of their findings, however, and a new test of that model. Their paper reported systematic violations of a property known as GainLoss Separability (GLS). GLS is implied by both original and cumulative prospect theories as well as by other rank-and sign-dependent utility theories. If GLS is violated, we must reject or revise prospect theories as descriptive models of risky decision making. As noted by Wu and Markle (2004), GLS is assumed in most treatments of loss aversion, the tendency for people to avoid 50-50 bets to win or lose equal amounts (Abdellaoui, Bleichrodt, & Paraschiv, 2004; Fennema & van Assen, 1998; Köbberling & Wakker, in press; Schmidt & Zank, 2002; Schmidt & Traub; 2002). They conclude that estimates of utility based on the assumption of GLS will be biased to the extent that GLS is not descriptive. The present study shows that violations of GLS are consistent with and predicted by the Transfer of Attention Exchange (TAX) model (Birnbaum, 1997; Birnbaum & Chavez, 1997). This paper will compare TAX and CPT. It will also test a point prediction of a simple TAX model combined with simplifying assumptions. Cumulative Prospect theory (Tversky & Kahneman, 1992) can be written as follows: CPU(G) = n i =1 [W (Pi ) W (Pi+1 )]u(xi ) + m j =1 + + [W (Qj ) W (Qj +1 )]u(x j ) , where Pi and Pi +1 are the probability of a loss being equal to or worse (lower) than xi and strictly lower than xi , respectively; Q j and Q j +1 are the probabilities of winning a (positive) prize of x j or more, and strictly more than x j , respectively. CPU (G ) is the utility (also called “value”) of the gamble in CPT. The weighting functions are further specified as follows: (1) Risky Decision Making Pr + W ( p) = ( p + (1 p) ) r r 1 r P and W ( p) = 4 (2) 1 ( p + (1 p) ) where the constants, and , have been estimated to be 0.61 and 0.69, respectively; u(x) has been approximated by u(x) = x , where = 0.88, x > 0, and u( x) = u(x); x 0. The constant, , is sometimes referred to as the “loss aversion” coefficient, and has been estimated to be 2.25. CPT accounts for the basic Allais paradoxes and other evidence cited against EU by Tversky and Kahneman (1979) and Tversky and Kahneman (1992). However, CPT also implies coalescing and properties that can be deduced from coalescing. Coalescing is the assumption that if there are two branches in a gamble leading to the same consequence, they can be combined by adding their probabilities. It should not matter whether a gamble is presented in split or coalesced form. For example, consider gamble A = ($100, 0.25;$100,0.25;$0,0.5). This (A) represents a three-branch gamble with a probability of .5 to win $0, and two branches of probability .25 to win $100. According to the property of coalescing, this three-branch gamble, A, is equivalent to the two-branch gamble, A = ($100,0.5;$0,0.5). Gamble A is called the “coalesced form” of the gamble, and A is one of many possible “split” forms. Thus, people should make the same choice between A and B as they do between A and B. A number of recent studies, however, reported systematic evidence against CPT, since people do not treat coalesced and split forms as equivalent (Starmer & Sugden, 1993; Humphrey, 1995; Birnbaum, 2004a; 2004b). Gain-Loss Separability (GLS) is implied by CPT (Wu & Markle, 2004). The property can be defined for gambles containing mixed consequences (i.e., both gains and losses). If both the positive and negative sub-gambles favor G over F, then people should not prefer F over G. Risky Decision Making 5 More precisely, let G = (y1 , p1 ; y2 , p2 ;K; yn , pn ;x m ,qm ;K; x 2 ,q2 ; x1 , q1 ) where the outcomes are ranked such that y1 < y 2 < K< y n < 0 < xm < K < x2 < x1 . Now break G into positive and + negative subgambles, as follows: G = (0, andG = (y1 , p1 ;y 2 , p2 ;K;yn , pn ; 0, m i =1 n i=1 pi ;x m , pm ;K; x2 ,q2 ; x1 ,q1 ) q i ). Let F represent another mixed gamble that can also be broken into its positive and negative sub-gambles. GLS is the assumption that if G + f F + and G f F then G f F . Because empirical data contain “error”, we consider three stochastic definitions of the property: Weak GLS will refer to the property that if P( G + f F + )>1/2 and P( G f F ) > 1/2, then P( G f F . ) > 1/2, where P represents choice probability. Strong GLS refers to the property that if the same premise holds, then P( G f F . ) will exceed the larger of the two choice probabilities, and moderate GLS assumes it will exceed the smaller of the two. These definitions are analogous to those given for transitivity, which has the same structure as GLS. The Appendix develops a statistical approach to fit the frequencies with which participants show each combination of choices, assuming that people sometimes make “errors” in expressing their “true” preferences. Wu and Markle (2004) reported systematic violations of Weak GLS, illustrated by the three choices of Table 1. Insert Table 1 about here. A majority of respondents preferred F to G in Choice 3, replicating a pattern found by Levy & Levy (2002), which is consistent with CPT as fit to prior data (Wakker, 2003). To test Gain-Loss Separability, Wu and Markle decomposed G and F into their gain and loss subgambles. These choices are shown with their respective choice percentages. Contrary to GLS, the majority (72%) preferred G+ over F+ in Choice 1; 60% preferred G- over F- in Choice 2; but 62% chose F over G in Choice 3(Wu & Markle, 2004). Although this violation of GLS refutes Risky Decision Making 6 CPT, it is consistent with the special TAX model (Birnbaum & Chavez, 1997), with parameters estimated from previous research (See Table 1). Consider gambles of positive consequences, G = (x1, p1; x2, p2; ... xj, pj; ...; xi, pi; ...; xn, pn), with n distinct branches, where the consequences are ordered such that x1 x2 ... xi ... xn. In the special TAX model (Birnbaum & Chavez, 1997), all weight transfers are the same proportion of probability weight as follows: n n u(xi )[t( pi ) TAX(G) = i =1 (n + 1) j = i +1 t(pi ) + i 1 (n + 1) t(p j )] j =1 (3) n t( pi ) i =1 where the configural weight parameter is . If = 0, and t(p) = p, this model reduces to EU. The effect of is to transfer weight from one branch to another, representing attention re-directed to different branches. To account for risk aversion in this model, it is assumed that weight is taken from branches with higher valued consequence and given to branches with lower valued consequences. In this paper, we use the approximated parameters of Birnbaum (1999a) for strictly nonnegative gambles, and we extrapolate them to positive, negative, and mixed gambles. In particular, it will be assumed that t ( p ) = p .7 , = 1, and u(x) = x, for $100 equation is written with branches ordered as in CPT; and so the value of x $100 . (The = 1 here corresponds to = -1 in Birnbaum (1999a) and other previous articles.) Gambles composed of strictly positive consequences and mixed consequences are calculated by Expression 3. This assumption represents both risk aversion and loss aversion by same weighting mechanism, as it assumes that both are governed by the same value of . One additional assumption is needed, however, for strictly negative gambles. These are calculated by Risky Decision Making 7 substituting absolute values for the consequences in Equation 3 (with the same value of ), and multiplying the result by –1. In summary, the simplifying assumptions are (1) the utility function is a similarity transformation of money for both positive and negative consequences near zero, (2) the configural weight transfer parameter estimated for gains also applies to mixed gambles, and (3) that reflection holds for gambles composed of non-positive consequences. This last assumption (the reflection hypothesis) holds that if a gamble with strictly nonnegative consequences is converted to a strictly non-positive one by multiplying each consequence by –1, then the order of preferences of the reflected gambles is reversed. Thus, if A = (x, p; y,1 p) f B = ( x , p ; y ,1 p ) , where all consequences are non-negative, then A = ( x, p; y,1 p) p B = ( x , p ; y ,1 p ) . Table 1 lists calculated certainty equivalents (CE) of gambles; where CE is the amount of cash that is theoretically indifferent to the gamble. These have been calculated for both CPT and TAX using the previously estimated parameters and assumptions stated above. The TAX model, with these assumptions, reproduces the violation of GLS observed by Wu and Markle shown in Table 1. The TAX model reproduces the modal choices above since + + - - TAX(G ) > TAX(F ); TAX(G ) > TAX(F ), and TAX(G) < TAX(F), respectively. It is perhaps ironic that it is not in the choice between G and F that TAX and CPT disagree (and where Levy & Levy, 2002 and Wakker, 2003 disputed CPT). Rather, it is in the two choices between the 3branch sub-gambles where TAX and CPT disagree and where CPT makes erroneous predictions (see Table 1). Note that the test of GLS in Table 1 involves three choices; two of them are between three-branch gambles and one is between four-branch gambles. This shift in the number of branches suggests that coalescing may play a role in this test. Another hint that coalescing may Risky Decision Making 8 be involved can be seen in the definitions of the sub-gambles, where all consequences below or above zero are set to zero and coalesced. To investigate possible connections with coalescing, and to test specific predictions of the TAX model, we further simplified the example of Wu and Markle. Note that choices 4, 5, and 6 in Table 2 can be compared to their Choices 1, 2, and 3 of Table 1. However, the cash consequences are equally spaced and simplified, but the new choices preserve the relative spreads of consequences in the Wu and Markle example. Insert Table 2 about here. This study will therefore test GLS in both coalesced and split forms, based on this analogy with the study of Wu and Markle. This design allows a test GLS with all gambles having three branches (as in Choices 4, 5, and 7), or with three, three, and four branches (as in Choices 4, 5, and 6). In addition, the symmetric design with equally spaced consequences permits a specific test of indifference between G and F in the split form (Choice 6), implied by TAX as fit to previous data with the simplifying assumptions stated. Summarizing the predictions, CPT implies no violations of GLS or coalescing, but TAX implies a violation of strong GLS in Choices 4, 5, and 6 and a violation of weak GLS in Choices 4, 5, and 7. A test where Weak GLS should be satisfied, according to TAX, was also constructed for this same example and included in the study as well. Method Participants completed this study as two portions of a series of 12 decision tasks, each consisting of 20-30 choices. This experiment consisted of 21 choices that were presented twice, separated by five other tasks that required a total intervening time of about 25 min. Participants viewed the materials via the WWW. Working at their own paces, most completed the series of 12 tasks (including both parts of this study) in one and one-half hours. Risky Decision Making 9 Each choice was displayed as in the following example: 1. Which do you choose? A: 50 black marbles to win $100 50 red marbles to lose $100 OR B: 50 green marbles to win $1 50 yellow marbles to lose $1 Each gamble was described in terms of a container holding exactly 100 marbles of different colors, from which one marble would be drawn at random and the color of that marble would determine the gamble’s prize. In the choice illustrated above, gamble A is a 50-50 chance to win $100 or to lose $100, and gamble B represents a 50-50 chance to win $1 or lose $1. Participants were instructed to click a button beside the gamble that they would prefer to play in each choice. They were informed that some lucky participants would receive the prize of one of their chosen gambles. They were informed that lucky participants selected from this task would receive $100 plus the consequence of one of their chosen gambles. They could thus win up to $200 or end up with as little as $0. (Prizes were awarded as promised to 5 people.) Experimental Design Tables 3 and 4 show choices used to test GLS and coalescing. Table 5 shows choices used to test risk attitude, loss attitude, and idempotence (the assumption that if all consequences are equal, the gamble is equivalent to the sure thing of that consequence; i.e., G = (x, p; x,q; x,1 p q) ~ x . Insert Tables 3 and 4 are first mentioned here. Complete instructions and materials can be viewed at the following URLs: HTTP://psych.fullerton.edu/mbirnbaum/decisions/gain_l_min_100.htm HTTP://psych.fullerton.edu/mbirnbaum/decisions/ gain_l_min_100_1.htm Risky Decision Making 10 5.2. Participants Participants were 178 undergraduates enrolled in lower division psychology at California State University, Fullerton. About half were tested on Internet-connected computers in labs, and the rest completed the studies at times and places of their own choice via the WWW. There were 137 females and 41 males; 71% were 19 years of age, and 93% were 22 years. Results Table 3 shows the percentage that chose the second (G) gamble in each choice of the main design. Choices 15, 13 and 11 form a test of GLS in which all choices use three-branch gambles. The table shows that 71% chose G+ over F+ and 65% chose G- over F-; however 76% chose F over G in Choice 11, violating Weak GLS. All three percentages are significantly different from 50%, but in opposite directions (z = 6.48, 4.60, and -7.83, respectively). Choices 15, 13, and 11 therefore violate Strong, Moderate and Weak GLS. These modal choices are consistent with the predictions of TAX, fit to previous data, but they violate CPT with any functions for W(P) and u(x). A statistical analysis of detailed response patterns is presented in the Appendix, which shows that when a “true and error” model is fit to the data, about half of participants are estimated to “truly” violate GLS in these three choices, as predicted by TAX with its previous parameters. In this model, all six patterns compatible with the hypothesis are allowed, and different “error” rates are permitted for each choice. Furthermore, the analysis shows that we can reject the null hypothesis that there are zero violations of GLS. Insert Table 3 about here. Choice 19 in Table 3 shows the same (objective) comparison as in Choice 11, except for splitting/coalescing. Here, the TAX model fit to previous data predicts indifference in Choice 19, and the empirical choice proportion is 0.517, very close to the indifference value of 0.5. The Risky Decision Making 11 small discrepancy between 0.517 and 0.5 is not significant (z = 0.56). Therefore, in Choices 15, 13, and 19, we cannot refute TAX with its previously estimated parameters and simplifying assumptions. Nor do these data warrant rejection of Weak GLS. We can, however, reject Strong GLS in Choices 15, 13, and 19. Because 71% choose G + over F + in Choice 15 and 65% chose G over F in Choice 13, we expect that at least 71% should choose G over F in Choice 19, according to Strong GLS. However, the observed proportions in Choice 19 are significantly lower than proportions in Choice 15 in both replicates. There were 47 and 51 people who switched from G + in Choice 15 to F in Choice 19 compared with 15 and 16 who made the opposite reversals in first and second replicates, respectively (z = 4.06 and 4.28). By Moderate GLS, we expect at least 65% for Choice 19. Instead, only 51.7% chose G over F in Choice 19. This is significantly lower than the proportion in Choice 13 in the second but not the first replicates (z = 3.49 and z = 1.81, respectively). There were 42 and 55 who switched from G in Choice 13 to F in Choice 19, compared to 27 and 24 who made the opposite reversals in replicates 1 and 2, respectively. Table 4 shows tests of coalescing and GLS, including a case where GLS should appear to be satisfied, according to TAX. Choice 9 is the same as Choice 15, except for coalescing. Similarly, Choices 5 and 13 differ only in whether branches are split or coalesced. CPT implies that there should be no differences due to splitting or coalescing. The TAX model, however (with previously estimated parameters), violates coalescing and predicts that people should prefer G over F in Choice 15, but should choose F over G in Choice 9. Table 3 shows that 71% of participants preferred G in Choice 15, and only 37% chose G in Choice 9, consistent with the TAX model. Similarly, significantly more people (66%) chose G in 13, where two branches to lose $0 were split, than did in Choice 5 (31%), where the two “good” branches were coalesced. Risky Decision Making 12 Insert Table 4 about here. Choices 9, 5, and 11 test GLS in coalesced form (but with unequal numbers of branches—two, two, and three). A very different picture emerges in this version of the test, where 63% prefers F + over G + in Choice 9, 69% chooses F over G in Choice 5, and 76% prefers F over G, in Choice 11, consistent with Strong, Moderate, and Weak GLS. In sum, both the directions of preference among the sub-gambles and the conclusions regarding GLS are affected by whether gambles are presented in split or coalesced form. Note that all of the changing modal choices in Tables 3 and 4 are consistent with the predictions of TAX model with its simplifying assumptions. Table 5 displays tests of risk and loss attitudes and idempotence. TAX and CPT agree in their predictions in all cases in Table 5. Choices 12 and 16 differ only in that the two branches to win $50 in Choice 12 have been coalesced to one branch in Choice 16, providing an indirect test of idempotence. CPT and TAX imply that there should be no change between Choices 12 and 16. The results indicate that 67% of participants preferred S in Choice 12 and 69% preferred S in Choice 16, consistent with idempotence. The finding that about two-thirds of the participants preferred the “safe” over the “risky” gamble with equal expected value indicates that these participants exhibited risk aversion, consistent with typical results. Choice 20 uses an even smaller value of sure cash and significantly more than half (60%) still prefers the “safe” alternative of $45, even though the expected value of the risky gamble is $50, consistent with both TAX and CPT. Insert Table 5 about here. Choices 6 and 10 test idempotence and risk-seeking in non-positive gambles. By idempotence, the preference should be the same in Choices 6 and 10, where the figures are 37% and 31%. Consistent with the reflection hypothesis, the majority is now risk-seeking for these Risky Decision Making 13 gambles with non-positive consequences, 63% and 69% preferring to take a chance on the gamble rather than accept the sure loss of equal expected value. Choices 8, 18 and 21 are tests of loss aversion. In Choice 8, a tiny majority of 53% shows loss aversion by preferring the certainty of neither winning nor losing to a 50-50 gamble to either win or lose $100. Recall that these participants are playing with “house” money, and perhaps that is the reason that these participants are less “loss averse” than participants who make hypothetical choices involving their own money, as for example, in Tversky and Kahneman (1992), where participants were strongly loss averse. Choice 18 was originally designed as a test of idempotence, but during the experiment, we realized that we had unintentionally introduced a type of consequence framing effect. Our initial way to coalesce a 50-50 gamble to either win $0 or lose $0, was to describe it as a “sure thing to win $0”. With this wording, 62% favored the risky gamble over a sure thing to win $0. However, with the more neutral wording of “no change for sure”, only 52% preferred the sure thing. When the sure thing was to lose $5, participants were nearly indifferent between the gamble and the sure loss. Discussion The findings indicate that TAX is more accurate than CPT in predicting new tests of GLS and coalescing. Whereas CPT satisfies both properties, TAX violates them both. An interesting feature of this study is that a test of indifference was constructed from the TAX model and the simplifying assumptions including that u(x) = x . Despite high power in the test (proportions outside the range .45 to .55 would be rejected), the observed proportion at this point prediction was .517, acceptably close to 0.5, based on the implication of indifference that followed from previous parameters. Risky Decision Making 14 It is worth repeating that this simple TAX implies risk aversion, loss aversion, and reflection, as well as violations of coalescing and GLS without using any assumption that losses “loom larger” than gains, as is done in CPT. The TAX model was fit with the assumption that u(x) = x; $100 < x < $100 . In TAX, loss aversion in mixed gambles is described by greater weight on the negative consequences rather than by amplification of negative utilities. And it is this distinction between weight and utility that accounts for violation of GLS by TAX. Put another way, TAX attributes loss aversion to greater weight rather than greater absolute utility of negative consequences. In this study, where participants risked house money, participants were not as loss averse as has been observed in studies where the participants make hypothetical choices involving losses of their own money. It would be interesting to determine whether our results would be much impacted by use of hypothetical rather than potentially “real” losses. Also of interest would be to know if there are situations where TAX would be forced to allow the utility function to be kinked at zero. There is nothing in the TAX model that dictates against such a kink; the present data simply do not require it, once the TAX model is used. Similarly, we suspect that our use of a single value of the configural weight parameter for both positive and mixed gambles may be an oversimplification. The findings of this study are consistent with those of Wu and Markle (2004), who also concluded that GLS is violated, contradicting CPT. To account for the violations, however, they converted CPT into a type of configural weight model, where different weighting functions are used for gambles configured of non-positive, non-negative, and mixed consequences. Their model retains the use of cumulative weighting, however, which means that the configural form of CPT cannot account for the ten other “new paradoxes” that contradict CPT (Birnbaum, 2005), including violations of coalescing such as observed here. Thus, their configural version of CPT Risky Decision Making 15 may be able to account for their data, but would not be able to account for these data, in which the tests of GLS depend on how branches are split or coalesced. Both TAX and CPT satisfy idempotence and both account for risk aversion and loss aversion in these tests. Consistent with previous findings (e.g., Tversky & Kahneman, 1992), we found that the majority of participants preferred safe gambles with non-negative consequences over risky ones in 50-50 gambles. The study also shows that for 50-50 gambles with nonpositive consequences, the majority exhibits risk-seeking behavior, also consistent with previous findings. Our small tests of idempotence allow that the property can be retained, pending further tests. Such tests, of course, do not show that the property will always be satisfied. Our tests were not designed to test implications of a particular model that violates idempotence, which would be a preferable way to test such a property. Marley and Luce are currently studying such models from a theoretical perspective; but these models have not yet been fit to data to provide specific predictions of violation. In conclusion, the directions of preference and the conclusions regarding GLS are affected by whether gambles are presented in split or coalesced form. Our results show that we might have concluded that GLS was strongly violated, weakly violated, or satisfied depending on exactly how the GLS test was constructed. It is unclear to us if violations of GLS represent a distinct, new type of violation of CPT, or if they result as another consequence of violations of coalescing. Appendix: Statistical Analysis of Gain-Loss Separability The property of GLS is directly analogous to transitivity, and the same statistical techniques could be used to test either property. Whereas transitivity can be written, Af B BfC A f C , GLS can be written, G + f F + G fF G f F . In this section, we develop a technique that, to our knowledge, is more general than techniques previously used. Risky Decision Making 16 In such a three-choice study, there are eight possible choice patterns, assuming no ties. Of the eight possible response patterns, six are compatible with the property, and two are not. In addition, this study used replications, and this feature allows us to fit a general model. The statistical analysis is intended to distinguish violations that occur by “chance” or “error” (due to response unreliability) from those that are deemed “intentional” or “true” (consistent). In this analysis, it will be assumed that each person responds with his or her “true” preference with a fixed probability for each choice, and otherwise responds with an “error”. This analysis is similar to that used by Harless and Camerer (1994) and others, as modified by Birnbaum (2004b), except that in the present treatment, it is allowed that the probabilities of errors may differ for different choices. The analysis also estimates the probabilities that people “truly” fall in each of the eight of the possible choice patterns. [The analysis method of Wu and Markle (2004) can be viewed as a special case of this approach in which there is only one error rate and two patterns are treated as “real.”] Because there are two repetitions of three choices, there are 64 possible response patterns for these six choices. Each participant falls in exactly one of these 64 cells. However, the frequencies in these 64 cells are in most cases too small to be estimated reliably, so the analysis will fit the frequencies of the eight patterns that are repeated on both replicates, and the average frequencies observed in either the first or second replicate but not both. Thus, the model will fit 16 frequencies, which are mutually exclusive and the sum of which adds to the total number of participants. To be estimated from these 16 frequencies are three “error” probabilities and eight “true” probabilities that sum to 1. For example, consider the probability that a participant will show a violation of GLS of the pattern, G +G– F in both replicates of the experiment. This can happen in eight different ways, corresponding to the eight possible “true” preference patterns. The probability that a Risky Decision Making 17 person would show the observed pattern of G +G– F in both replicates given that the person’s + – “true” pattern is G G G is given by the following expression: P(G +G– F,G+G – F | G +G– G,G +G – G) = a(G+G – G,G+G – G)(1 e1 )(1 e2 )e3 (1 e1 )(1 e2 )e3 , where a(G+G – G,G+G – G) is the probability that a person’s “true” pattern is G +G– G (on both replicates); and e1 , e2 , and e3 are the probabilities of “error” in the three choices, respectively. In this case, the participant expressed her or his preference correctly on two choices in each replicate and made an “error” on the third choice of each replicate. The overall probability that a person would show this response pattern is the sum of the eight terms conditioned on the 8 possible, mutually exclusive, “true” patterns. Similar expressions can be written for each of eight “observed” response patterns given each of the eight “true” response patterns repeated on both replicates; furthermore, similar expressions were developed for observed probability of each pattern on each replicate but not on both replicates, given each of the “true” patterns. Table 6 shows observed and fitted frequencies for the test of GLS in Choices #15, 13, and 11, in which all three choices have three-branch gambles. The notation 000 in the table denotes the choices of F + f G+ , F f G , and F f G in Choices 15, 13, and 11 (Table 3), respectively, where 0 denotes preference for the F gamble and 1 denotes preference for the G gamble; in this case, 110 is the predicted pattern of violation by the TAX model, G + f F + ; G– f F – ; F f G . The model was fit to the observed frequencies, minimizing the 2 between observed and fitted frequencies. The estimated “true” probabilities of the eight patterns are listed in the rightmost column of Table 4. Insert Table 6 about here. According to the model, estimated “error” rates are .08, .27, and .17 for Choices 15, 13, and 11, respectively. The value of 2 (5)= 3.54, fitted to 16 frequencies (df = 8 + 8 – 1 – 3 – 7 = 5), indicates an acceptable fit to the data. Note that the model estimates that the most probable Risky Decision Making 18 “true” pattern was the violation predicted by the TAX model (110); this pattern, G +G F , had an estimated “true” probability of 0.51. It was indeed the most commonly repeated pattern (29 showed this pattern in both replicates) as well as the most frequent pattern in both first and second replicates (63 and 54, respectively). When this “true” probability was fixed to 0 and all other parameters were free, the overall 2 (6) increased to 25.74; therefore, 2 (1)= 25.74 – 3.54 = 22.2, a significant increase. These calculations indicate that the predicted pattern of violation of GLS is statistically significant, and that slightly more than half of participants had this as their “true” preference pattern. Models with fewer parameters also achieved reasonable approximations to the data. For example, the following special case achieved a fit of 2 (11)= 6.19. The “error” probabilities were estimated to be (0), .36, and .18, and the probabilities of the eight “true” patterns were all fixed + + + to zero except for G G F , G G G , and F G F , which had estimated “true” probabilities of .58, .12, and .30, respectively. The same approach was applied to Choices 9, 5, and 11 (with two, two, and three-branch gambles), and results are in Table 7. Here, results seem quite different, because the most frequent pattern is one that satisfies GLS. This pattern (000), always choosing the F gamble, agrees with the prediction of the TAX model in this case; it is estimated to be the “true” pattern of 66% of the participants. The error rates for the three choices are estimated to be .27, .14, and .10, respectively. The overall 2 (5) = 6.03, with all parameters free. Setting the probabilities of both patterns of violation to zero (001 and 110), however, the difference of 2 2 (7) jumped to 16.29, for a (2) = 21.22, both of which are significant. This test indicates that even though simple choice probabilities satisfied strong GLS, the detailed analysis of response sequences indicates that the small violations are significantly greater than zero. Insert Table 7 about here. Risky Decision Making 19 The same model was fit to Choices #15, 13, and #19, which form a test of GLS with three, three, and four branch gambles. Results are shown in Table 8. The modal pattern was now the 111 pattern ( G +G G ), which satisfies GLS. The 2 (5) = 2.89. As a counter weight to this pattern, the 010 and 100 patterns were now often repeated in both replicates, which contributed to the choice proportion between G and F being close to the TAX model prediction of 0.5, even though the patterns 001 and 110 were rare in this case. Insert Table 8 about here. Risky Decision Making 20 References Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2004). Measuring Loss Aversion: A ParameterFree Approach, working paper. Birnbaum, M. H. (1999a). Paradoxes of Allais, stochastic dominance, and decision weights. In J. Shanteau, B. A. Mellers, & D. A. Schum (Eds.), Decision science and technology: Reflections on the contributions of Ward Edwards (pp. 27-52). Norwell, MA: Kluwer Academic Publishers. Birnbaum, M. H. (1999b). Testing critical properties of decision making on the Internet. Psychological Science, 10, 399-407. Birnbaum, M. H. (2004a). Causes of Allais common consequence paradoxes: An experimental dissection. Journal of Mathematical Psychology, 48(2), 87-106. Birnbaum, M. H. (2004b). Tests of rank-dependent utility and cumulative prospect theory in gambles represented by natural frequencies: Effects of format, event framing, and branch splitting. Organizational Behavior and Human Decision Processes, 95, 40-65. Birnbaum, M. H., & Chavez, A. (1997). Tests of theories of decision making: Violations of branch independence and distribution independence. Organizational Behavior and Human Decision Processes, 71(2), 161-194. Fennema, H. & van Assen, M. (1998). Measuring the utility of losses by means of the tradeoff method. Journal of Risk and Uncertainty 17, 277-295. Humphrey, S. J. (1995). Regret aversion or event-splitting effects? More evidence under risk and uncertainty. Journal of risk and uncertainty, 11, 263-274. Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263-291. Köbberling, V. & Wakker, P. P. (in press), An Index of Loss Aversion, Journal of Economic Theory. Risky Decision Making 21 Levy, H. & Levy, M. (2002). Prospect theory, much ado about nothing? Management Science, 48, 1334-1349. Luce, R. D. (2000). Utility of gains and losses: Measurement-theoretical and experimental approaches. Mahwah, NJ: Lawrence Erlbaum Associates. Luce, R. D., & Fishburn, P. C. (1991). Rank and sign-dependent linear utility models for finite first order gambles. Journal of Risk and Uncertainty 4, 29-59. Luce, R. D., & Marley, A. A. (2000). On elements of chance. Theory and Decision 49, (2) 97126. Marley, A. A. J., & Luce, R. D. (2001). Rank-weighted utilities and qualitative convolution. Journal of Risk and Uncertainty, 23(2), 135-163. Marley, A. A. J., & Luce, R. D. (2004). Independence properties vis-à-vis several utility representations. Draft Manuscript, March 3, 2004. Schmidt, U. & Traub, S. (2002). An Experimental Test of Loss Aversion. Journal of Risk and Uncertainty 25, 233-249. Schmidt, U. & Zank, H. (2002). What is loss aversion? Working Paper, dated 15-Oct-2002. Starmer, C. (2000). Developments in non-expected utility theory: The hunt for a descriptive theory of choice under risk. Journal of Economic Literature, 38, 332-382. Starmer, C., & Sugden, R. (1993). Testing for juxtaposition and event-splitting effects. Journal of Risk and Uncertainty, 6, 235-254. Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297-323. Wakker, P. (2003). The Data of Levy and Levy (2002), "Prospect Theory: Much Ado about Nothing?" Support Prospect Theory. Management Science, 49, 979-981. Wu, G., & Markle, A. B. (2004). An empirical test of gain-loss separability in prospect theory. Working Manuscript, 06-25-04., Available from George Wu, University of Chicago, Risky Decision Making Graduate School of Business, 1101 E. 58 th Street, Chicago, IL 60637, http://gsbwww.uchicago.edu/fac/george.wu/research/abstracts.html. 22 Risky Decision Making 23 Table 1. A Test of Gain Loss Separability from Wu and Markle (2004). Calculations show that the violation observed by Wu and Markle is consistent with the special TAX model. No. F G % TAX CPT 497 < 601 > 552 551 -359 < -379 -276 -437 -280 > -107.2 > -300 -178.6 G 1 2 3 + F : .25 chance at $2000 .25 chance at $1600 .25 chance at $800 .25 chance at $1200 .50 chance at $0 .50 chance at $0 - F : .50 chance at $0 F: + G : - G : .50 chance at $0 .25 chance at $-800 .25 chance at $-200 .25 chance at $-1000 .25 chance at $-1600 .25 chance at $2000 G: .25 chance at $1600 .25 chance at $800 .25 chance at $1200 .25 chance at $-800 .25 chance at $-200 .25 chance at $-1000 .25 chance at $-1600 72 60 38 > Risky Decision Making Table 2. New tests, designed by TAX model to predict violations of Strong and Weak GLS. Note that Choices 6 and 7 represent the same choice, except for coalescing. No. 4 5 F + F : - F : .25 to win $100 G + G : .25 to win $50 .25 to win $0 .25 to win $50 .50 to win $0 .50 to win $0 .50 to lose $0 - G : .25 to lose $50 7 F: F’: .25 to win $100 20.6 -20.6 -13.8 -25.0 -25.0 -15.5 -34.5 .25 to lose $100 G: .25 to win $50 .25 to win $0 .25 to win $50 .25 to lose $50 .25 to lose $0 .25 to lose $50 .25 to lose $100 .25 to win $100 13.8 .25 to lose $0 .25 to lose $50 6 .50 to lose $0 TAX G’: .50 to win $50 .25 to win $0 .25 to lose $0 .50 to lose $50 .25 to lose $100 24 Risky Decision Making 25 Table 3. Tests of Gain-loss Separability and Coalescing No. Choice First Gamble, F 15 13 19 11 17 Second Gamble, G 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 50 white to win $0 50 white to win $0 50 white to lose $0 50 white to lose $0 25 pink to lose $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 25 pink to lose $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 25 black to win $100 50 blue to win $50 25 white to win $0 25 white to lose $0 50 pink to lose $50 25 red to lose $100 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 25 pink to lose $50 Prior TAX %G F G Prior CPT F G 13.8 20.6 24.6 18.7 -20.6 -13.8 -20.4 -24.8 -25.0 -25.0 -8.8 -15.3 -15.5 -34.5 -8.8 -15.3 -30.0 -20.0 -12.8 -11.2 0.71 0.65 0.52 0.24 0.57 Risky Decision Making 26 Table 4. Additional Tests of Coalescing and Gain-Loss Separability. No. Choice First Gamble, F 15 9 13 5 11 Second Gamble, G 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 50 white to win $0 50 white to win $0 25 black to win $100 50 blue to win $50 75 white to win $0 50 white to win $0 50 white to lose $0 50 white to lose $0 25 pink to lose $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 50 white to lose $0 75 white to lose $0 50 pink to lose $50 25 red to lose $100 25 black to win $100 50 blue to win $50 25 white to win $0 25 white to lose $0 50 pink to lose $50 25 red to lose $100 Prior TAX %G F G Prior CPT F G 13.8 20.6 24.6 18.7 21.1 16.7 24.6 18.7 -20.6 -13.8 -20.4 -24.8 -16.7 -21.1 -20.4 -24.8 -15.5 -34.5 -8.8 -15.3 0.71 0.37 0.65 0.31 0.24 Risky Decision Making 27 Table 5. Tests of Risk Attitude, Loss Attitude, and Idempotence. No. Choice R 12 16 20 6 10 8 18 18b %S S 50 black to win $100 50 blue to win $50 50 white to win $0 50 green to win $50 50 black to win $100 100 blue to win $50 50 white to win $0 (win $50 for sure) 50 black to win $100 100 green to win $45 50 white to win $0 (win $45 for sure) 50 white to lose $0 50 pink to lose $50 50 red to lose $100 50 orange to lose $50 50 white to lose $0 100 pink to lose $50 50 red to lose $100 (lose $50 for sure) 50 black to win $100 50 white to win $0 50 red to lose $100 50 white to lose $0 50 black to win $100 100 white marbles to win $0 50 red to lose $100 (win $0 for sure) 50 black to win $100 100 white marbles to 50 red to lose $100 win/lose $0 Prior TAX Prior CPT S R S 33.3 50 37.4 50 33.3 50 37.4 50 33.3 45 37.4 45 -33.3 -50 -40.8 -50 -33.3 -50 -40.8 -50 -33.3 0 -22.3 0 -33.3 0 -22.3 0 -33.3 0 -22.3 0 -33.3 -5 -22.3 -5 R 0.67 0.69 0.60 0.37 0.31 0.53 0.38 (no change for sure) 0.52 21 50 black to win $100 100 yellow to lose $5 50 red to lose $100 (lose $5 for sure) 0.48 Risky Decision Making 28 Table 6. Test of Gain-Loss Separability in 3-branch Gambles (#15, 13, and 11) Observed Frequencies Pattern Rep 1 Rep 2 Fitted Frequencies Both Reps U–I Both U –I Estimated “True” probs. 000 16 17 5 11.5 5.9 11.3 0.08 001 5 6 0 5.5 0.2 3.6 0 010 24 29 12 14.5 11.1 15.0 0.18 011 3 5 0 4 0.5 5.8 0 100 36 30 10 23 9.8 21.5 0.10 101 8 8 1 7 1.3 9.3 0 110 63 54 29 29.5 29.6 29.2 0.51 111 23 29 9 17 8.3 15.6 0.13 178 178 66 112 66.8 111.2 1 Total The fitted model estimated the probabilities of error to be .079, .269, and .166 for choices #15, 13, and 11, respectively; the “true” probabilities of the sequences estimated from the model are listed in the last column. The entry marked in bold is the pattern of violation of GLS predicted by the TAX model with its prior parameters. The column labeled “U – I” contains the average number for each pattern in two replicates minus the number who repeated that pattern (Union excluding the Intersection). Therefore, the sum of frequencies in “Both Reps” and this column adds to the total number of participants, (66 + 112) = 178, and no response pattern is counted twice. Risky Decision Making 29 Table 7. Test of Gain-Loss Separability in 2, 2, and 3-branch Gambles (#9, 5, and 11) Observed Frequency Fitted Frequency “True” probs. Pattern Rep 1 Rep 2 Both Reps U-I Both U-I 000 74 71 42 30.5 38.36 31.34 0.66 001 13 17 5 10 5.09 11.63 0.08 010 16 20 5 13 5.13 15.47 0.06 011 5 8 2 4.5 1.64 6.46 0.01 100 30 20 4 21 5.31 21.74 0 101 9 13 1 10 1.41 6.97 0.01 110 19 19 4 15 5.70 10.38 0.09 111 12 10 5 6 5.07 6.31 0.09 178 178 68 110 67.70 110.30 1 Total The fitted model estimates the probabilities of error to be .27, .14, and .10 for choices #9, 5, and 11, respectively, and the “true” probabilities of the sequences estimated from the model are listed in the last column. The entry marked in bold is the pattern of response predicted by the TAX model with its prior parameters. Risky Decision Making 30 Table 8. Test of Gain-Loss Separability in 3, 3, and 4-branch Gambles (#15, 13, and 19) Observed Frequency Fitted Frequency “True” probs. Pattern Rep 1 Rep 2 Both Reps U–I Both U–I 000 15 16 3 12.5 4.46 9.30 0.06 001 6 7 1 5.5 1.06 5.33 0.01 010 18 25 10 11.5 10.44 11.73 0.19 011 9 9 1 8 1.21 9.97 0 100 23 21 9 13 9.33 13.11 0.17 101 21 17 3 16 3.26 17.67 0 110 24 30 4 23 4.37 19.91 0.02 111 62 53 32 25.5 30.21 26.67 0.56 178 178 63 115 64.33 113.67 Total The fitted model estimates the probabilities of error to be .078, .221, and .231 for choices #15, 13, and 19, respectively, and the “true” probabilities of the sequences estimated from the model are listed in the last column. Risky Decision Making 31 This material is not intended for publication in the journal. It is presented here as a convenience to the reviewer, to view materials used. This material is also available via the WWW. The following instructions are from Part 1. There were 36 choices in that part. All parts used choices between gambles, described with the same mechanism for probability (marbles drawn from urns). Suppose you are required to choose one of the following gambles. Would you rather play: First Gamble: 50 red marbles to lose $50 50 black marbles to win $50 OR Second Gamble: 50 blue marbles to lose $10 50 green marbles to win $5 Think of probability as the number of marbles in one color in an urn (container) containing 100 otherwise identical marbles, divided by 100. The First Gamble has 50 black marbles and 50 red marbles; if a marble drawn at random from the First Gamble is black, you win $50. If a red marble is drawn, you lose $50. So, the probability to draw a black marble and win $50 is .50 and the probability to draw a red marble and lose $50 is .50. If someone takes the First Gamble, half the time they draw black and win $50 and half the time they draw red and lose $50. But in this study, you only get to play a gamble once, so the prize will be either lose $50 or win $50. The Second Gamble's urn has 100 marbles also, but 50 of them are green, winning $5, and 50 of them are blue and lose $10. The Second Gamble thus guarantees the most you can lose is $10, and the best you can do is win $5. The first gamble gives you a chance to win $50, but you risk losing $50. Decision-Making Experiment: Part 2 of 12 In this section, winners receive a gift of $100 plus the result of one of their chosen gambles. 1. Which do you A: 50 50 OR B: 50 50 choose? black marbles to win $100 red marbles to lose $100 green marbles to win $1 yellow marbles to lose $1 2. Which do you choose? C: 50 black marbles to win $100 50 pink marbles to lose $50 Risky Decision Making OR D: 50 blue marbles to win $3 50 green marbles to win $2 3. Which do you E: 20 30 50 OR F: 20 30 50 choose? white marbles to lose $0 orange marbles to lose $25 red marbles to lose $50 4. Which do you G: 10 50 40 OR H: 10 50 40 choose? blue marbles to win $50 pink marbles to lose $88 red marbles to lose $98 white marbles to lose $0 pink marbles to lose $48 red marbles to lose $50 blue marbles to win $50 purple marbles to win $4 red marbles to lose $98 (The other choices are described in the Tables) Winners will be notified by email. COMMENTS: (a box was provided) Please check that you have answered all of the Questions. When you are finished, push this button to send your data: I'm finished. 32