The role of managers' behavior in corporate fraud

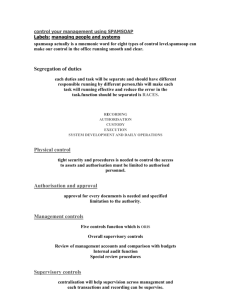

advertisement