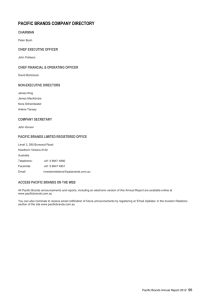

2015 Integrated Annual Report

advertisement