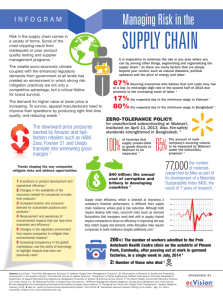

The Apparel Global Value Chain

advertisement