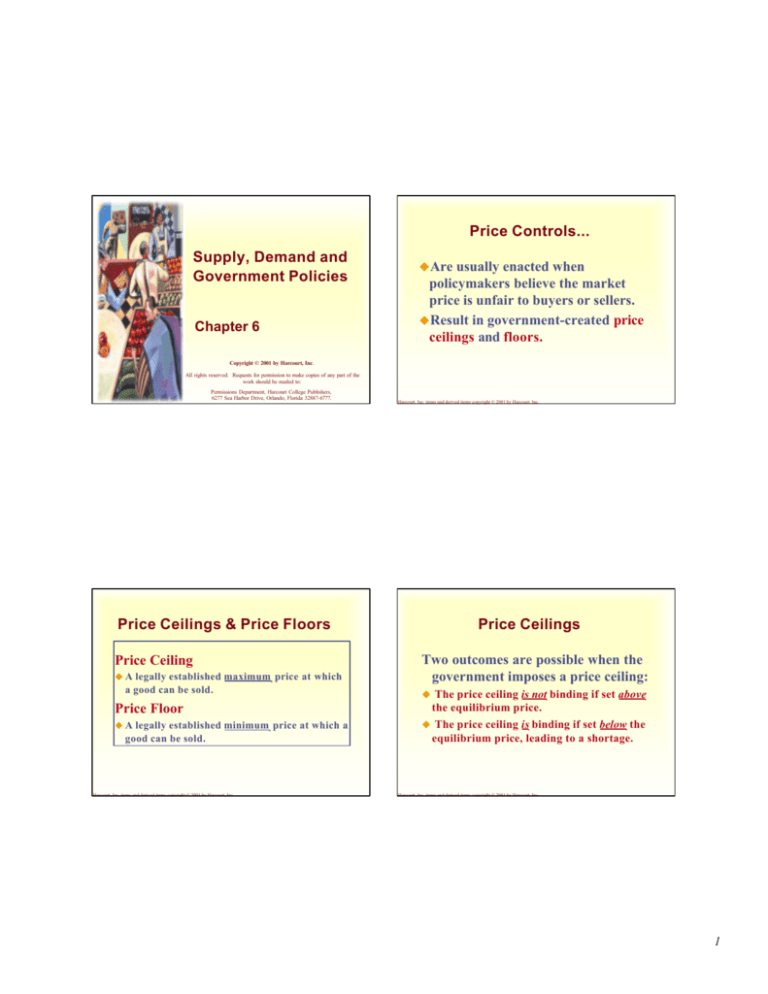

Price Controls...

Supply, Demand and

Government Policies

Chapter 6

uAre

usually enacted when

policymakers believe the market

price is unfair to buyers or sellers.

uResult in government-created price

ceilings and floors.

Copyright © 2001 by Harcourt, Inc.

All rights reserved. Requests for permission to make copies of any part of the

work should be mailed to:

Permissions Department, Harcourt College Publishers,

6277 Sea Harbor Drive, Orlando, Florida 32887-6777.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

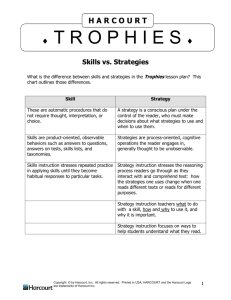

Price Ceilings & Price Floors

Price Ceiling

uA

legally established maximum price at which

a good can be sold.

Price Floor

uA

legally established minimum price at which a

good can be sold.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Price Ceilings

Two outcomes are possible when the

government imposes a price ceiling:

u

The price ceiling is not binding if set above

the equilibrium price.

u The price ceiling is binding if set below the

equilibrium price, leading to a shortage.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

1

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

A Price Ceiling That Is Not Binding...

Price of

Ice-Cream

Cone

Supply

Price

ceiling

$4

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

A Price Ceiling That Is Binding...

Price of

Ice-Cream

Cone

Supply

Equilibrium

price

$3

3

Equilibrium

price

Price

ceiling

2

Shortage

Demand

Demand

0

100

Equilibrium

quantity

Quantity of

Ice-Cream

Cones

Effects of Price Ceilings

A binding price ceiling creates ...

… shortages because QD > QS.

uExample:

Gasoline shortage of the

0

75

125

Quantity

supplied

Quantity

demanded

Quantity of

Ice-Cream

Cones

Lines at the Gas Pump

In 1973 OPEC raised the price of

crude oil in world markets. Because

crude oil is the major input used to

make gasoline, the higher oil prices

reduced the supply of gasoline.

1970s

… nonprice rationing

uExamples:

Long lines, Discrimination

by sellers

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

What was responsible for the long

gas lines?

Economists blame government

regulations that limited the price oil

companies could charge for gasoline.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

2

The Price Ceiling on Gasoline Is

Not Binding...

Price of

Gasoline

1. Initially,

the

price ceiling

is not

binding...

The Price Ceiling on Gasoline Is

Binding...

S2

Price of

Gasoline

Supply

2. …but

when supply

falls...

S1

P2

Price

ceiling

$4

Price

ceiling

P1

P1

3. …the price

ceiling becomes

binding...

4. …resulting

in a shortage.

Demand

0

Q1

Quantity of

Gasoline

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Demand

0

Q1

Quantity of

Gasoline

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Rent Control in the Short Run...

Rent Control

uRent

controls are ceilings placed on the

rents that landlords may charge their

tenants.

uThe goal of rent control policy is to help

the poor by making housing more

affordable.

uOne economist called rent control “the

best way to destroy a city, other than

bombing.”

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Rental

Price of

Apartment

Supply

Supply and

demand for

apartments

are relatively

inelastic

Controlled rent

Shortage

Demand

0

Quantity of

Apartments

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

3

Rent Control in the Long Run...

Rental

Price of

Apartment

Price Floors

Because the

supply and

demand for

apartments are

more elastic...

Supply

When the government imposes a

price floor, two outcomes are

possible.

u The

…rent control

causes a large

shortage

Controlled rent

Shortage

Demand

0

price floor is not binding if set below

the equilibrium price.

u The price floor is binding if set above the

equilibrium price, leading to a surplus.

Quantity of

Apartments

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

A Price Floor That Is Not Binding...

Price of

Ice-Cream

Cone

Supply

A Price Floor That Is Binding...

Price of

Ice-Cream

Cone

Supply

Surplus

Equilibrium

price

$4

$3

Price floor

$3

Price

floor

2

Equilibrium

price

Demand

0

100

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Equilibrium

quantity

Quantity of

Ice-Cream

Cones

Demand

0

80

Quantity

demanded

120

Quantity

supplied

Quantity of

Ice-Cream

Cones

4

Effects of a Price Floor

Effects of a Price Floor

uA

price floor prevents supply and

demand from moving toward the

equilibrium price and quantity.

uWhen the market price hits the

floor, it can fall no further, and the

market price equals the floor price.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

A binding price floor causes . . .

… a surplus because QS >QD.

… nonprice rationing is an alternative

mechanism for rationing the good,

using discrimination criteria.

u Examples: The minimum wage, Agricultural

price supports

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

The Minimum Wage

The Minimum Wage

An important example of a

price floor is the minimum

wage. Minimum wage laws

dictate the lowest price

possible for labor that any

employer may pay.

Wage

A Free Labor Market

Labor

supply

Equilibrium

wage

Labor

demand

0

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Equilibrium

employment

Quantity of

Labor

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

5

The Minimum Wage

Wage

A Labor Market with a

Minimum Wage

Labor surplus

(unemployment)

Taxes

Labor

supply

Governments levy taxes to

raise revenue for public

projects.

Minimum

wage

Labor

demand

0

Quantity

demanded

Quantity

supplied

Quantity of

Labor

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Copyright © 2001 by Harcourt, Inc. All rights reserved

Taxes

uTax

incidence refers to who bears

the burden of a tax.

uTaxes result in a change in market

equilibrium.

uBuyers pay more and sellers receive

less, regardless of whom the tax is

levied on.

Impact of a 50¢ Tax Levied on

Buyers...

Price of

Ice-Cream

Cone

Supply, S1

3.00

A tax on buyers

shifts the demand

curve downward

by the size of

the tax ($0.50).

D1

D2

0

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

100

Quantity of

Ice-Cream Cones

6

Copyright © 2001 by Harcourt, Inc. All rights reserved

Impact of a 50¢ Tax Levied on

Buyers...

Price of

Ice-Cream

Cone

Price

buyers

pay

Price

without

tax

$3.30

3.00

2.80

Price

sellers

receive

Copyright © 2001 by Harcourt, Inc. All rights reserved

Impact of a 50¢ Tax on Sellers...

Price of

Ice-Cream

Cone

Supply, S1

Price

buyers

pay

Equilibrium without tax

Tax ($0.50)

Price

without

tax

$3.30

3.00

2.80

S2

Equilibrium

with tax

S1

Tax ($0.50)

Equilibrium without tax

Price

sellers

receive

Equilibrium

with tax

D1

Demand, D 1

D2

0

90 100

0

Quantity of

Ice-Cream Cones

A Payroll Tax

Wage

Labor

supply

Wage Tax wedge

without tax

Wage workers

receive

Labor

demand

0

90 100

Quantity of

Ice-Cream Cones

The Incidence of Tax

Wage firms

pay

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

A tax on sellers

shifts the

supply curve

upward by the

amount of the

tax ($0.50).

Quantity of

Labor

uIn

what proportions is the burden of

the tax divided?

uHow do the effects of taxes on sellers

compare to those levied on buyers?

The answers to these questions

depend on the elasticity of demand

and the elasticity of supply.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

7

Elastic Supply, Inelastic Demand...

Price

1. When supply is more

elastic than demand...

Price buyers pay

Supply

Tax

Price without tax

Price sellers receive

3. ...than on

producers.

0

2. ...the

incidence of the

tax falls more

heavily on

consumers...

Inelastic Supply, Elastic Demand...

1. When demand is more

elastic than supply...

Price

Supply

Price buyers pay

Price without tax

3. ...than on consumers.

Tax

Price sellers receive

Demand

Quantity

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

0

Demand

2. ...the

incidence of

the tax falls more

heavily on producers...

Quantity

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

So, how is the burden of the

tax divided?

The burden of a

tax falls more

heavily on the side

of the market that

is less elastic.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

8