HR Administration Series - Hawaii Employers Council

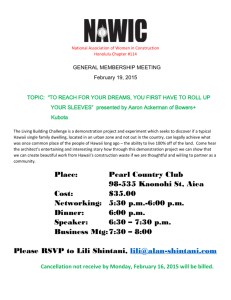

advertisement

HR Administration Series The Hawaii Employers Council is proud to present the 2013 HR Administration Series, a program specifically designed for HR practitioners and Operations Managers whose job duties involve dealing with employer-employee relations on a regular basis. As most HR practitioners are aware, today’s employment laws are more convoluted and complicated than ever before. Therefore, even simple missteps can result in a complaint being filed, or an audit being conducted, against your company. This 6-part series covers five major areas of employment law that every HR practitioner should know, and culminates with a session on how to prepare for and respond to a complaint filed with the EEOC/HCRC, or an investigation being conducted by the Department of Labor (“DOL”). The topics in this program are as follows: The Do’s and Dont's of Hiring Classifying Independent Contractors and Other Non-Employees Creating a Drug-Free Workplace Understanding FLSA Exemptions Managing Employee Leaves and Requests for Reasonable Accommodations Responding to EEOC/HCRC Charges and DOL Investigations Starting May 2nd Limited Enrollment – Register Now! http://www.hecouncil.org Hawaii Employers Council ~ 2682 Waiwai Loop ~ Honolulu HI 96819 Phone: 836-1511 2013 HR Administration Series May 2, 2013 8:30 to Noon The Employment Process: The Legal Aspects of Hiring Barbara Petrus, Partner with Goodsill Anderson Quinn & Stifel Selecting the right person, while navigating the related employment law requirements is never easy. In the long run, it seldom works out for the company when hiring someone without conducting a reference check, background review, or validating the information presented during the interview or on the application form. An effective and efficient hiring process not only helps avoid some of the legal pitfalls but it also helps ensure the hiring of a better qualified employee. In this workshop, you will learn about: Pre-Employment Inquiries Using the Internet Applicant Screening, Testing, and Selection Background Checks for Employees Form I-9 and E-Verify Compensation Decisions About Our Speaker Barbara Petrus has extensive experience in the practice of labor and employment law in Hawaii since 1982. She regularly advises and defends a wide range of employers from sole proprietorships and non-profit organizations to large Hawaii and international corporations. Ms. Petrus also represents and advises educational institutions in many issues regarding their students, including accommodations under the Americans with Disabilities Act, professional misconduct, and campus security requirements. Ms. Petrus is a graduate from Albany Law School. She is a past chair of the Section on Labor and Employment Law, Hawaii State Bar Association. Ms. Petrus joined the firm as a partner in 1989. 2013 HR Administration Series May 9, 2013 9:00 to 11:45 What Employers Need to Know about Independent Contractors and other NonEmployees Min Kirk, Assistant District Director, U.S. Department of Labor, Wage & Hour Division Herbert Lee, Community Outreach and Regional Planning Specialist, U.S. Department of Labor, Wage & Hour Division, Honolulu District Office Nicole Higa and Junior Eder, Auditors, Hawaii Department of Labor & Industrial Relations Employers who hire independent contractors, volunteers, student interns, etc. must make sure that they meet the criteria of a “non-employee” if the company is not going to be applying coverage under the various state and federal employment laws. This seminar looks at Hawaii’s “ABC test,” the auditing process under our state’s Employment Security law, and penalties and consequences of misclassifying a non-employee. The program will also cover the employment relationship under the Fair Labor Standards Act, how employers can and cannot use non-paid workers, the common employer mistakes in using temporary hires and contract workers. About our Speakers During her 10 years with the Honolulu Wage & Hour office, Min Kirk has conducted many complex investigations relating to the Government contract Statutes, Fair Labor Standards Act, H Visa Programs, Family Medical Leave Act, and the Migrant Seasonal Worker Protection Act. Ms. Kirk currently supervises the Honolulu investigative staff. She continues to promote compliance with the various labor statutes as well as meet with industry representatives to assess their needs and provide educational assistance. Herbert Lee joined the U.S. Department of Labor as a Wage & Hour investigator in 2009, conducting compliance investigations under many federal regulations, such as the Fair Labor Standards Act, Davis Bacon Act, Migrant Workers Protection Act, Break Time for Nursing Mothers, and Family Medical Leave Act. In 2012, Mr. Lee was selected as the Community Outreach and Resource Planning Specialist, offering compliance information and education to various advocacy and community groups as well as to business organizations and employers. Nicole Higa has been an auditor with the Hawaii Department of Labor Unemployment Insurance Division for 4 years. Junior Eder has been an auditor with the Hawaii Department of Labor Unemployment Insurance Division for 21 years. 2013 HR Administration Series May 23, 2013 8:00 to Noon Creating a Drug-Free Workplace Gary Shimabukuro, Laulima Hawaii Keith Kamita, Deputy Director for Law Enforcement, State of Hawaii Department of Public Safety This intense half-day Drug-Free Workplace Training & Education program features two renown experts in the field, Gary Shimabukuro of Laulima Hawaii and Keith Kamita, Deputy Director for Law Enforcement, Department of Public Safety, State of Hawaii. Both speakers will focus on training managers and supervisors to recognize drug problems and potential drug problems, and to appropriately document to safeguard the company. This will especially be helpful to those companies who currently have a “reasonable suspicion” drug testing program. During the training session, participants will have an opportunity to see first-hand illegal drugs such as marijuana, crystal meth and cocaine. About Our Speakers Gary Shimabukuro is the owner and Certified Prevention Specialist for Laulima Hawaii. Since 1978, he has been providing drug education for businesses, schools, apprenticeship programs, labor organizations, management groups, law enforcement agencies, military personnel and other organizations. Since 1988, his trainings have focused on creating a Drug-Free Workplace. Gary was a clinical supervisor for a substance abuse treatment program and a former certified trainer and “Trainer of Trainers” for the National Institute of Drug Abuse (NIDA). His trainings are hard hitting, dynamic, motivating and show the harsh reality that “Drugs Are Everyone’s Problem.” Keith Kamita is the Deputy Director for Law Enforcement, Department of Public Safety, State of Hawaii. Prior to his promotion to Deputy Director, Keith was a Narcotics Agent for over 27 years, 18 of those years as the Chief of the Narcotics Enforcement Division. The Narcotics Enforcement Division is responsible for the administration of a statewide program of enforcement, investigation, and the custodial care of Chapter 329, Hawaii Revised Statutes, Uniformed Controlled Substance Act. As a Narcotic Agent, Keith arrested and made referrals for prosecution of individuals in the State who illegally obtain, traffic in, and abuse controlled substances and regulated chemicals, including the seizure of any identifiable assets and property linked to illegal activity. 2013 HR Administration Series June 20, 2013 9:00 to 11:30 What You need to Know about FLSA Exemptions Tamara Gerrard, Director, Torkildon Katz Moore Hetherington Harris Kendra Kawai, Associate, Torkildson Katz Moore Hetherington Harris Exempt or non-exempt? That is the question! Wage and hour claims continue to plague employers, who risk financial penalties due to misclassification mistakes. Just this year, a fitness chain operating in Hawaii was required to pay nearly $17.5 million to settle a nationwide collective action brought by a group of managers misclassified as exempt and denied overtime, and nonexempt personal trainers who were required to work off the clock. Cases like this serve as a reminder that employers are wise to periodically review whether jobs are properly classified under the FLSA. Please join attorneys Tamara Gerrard and Kendra Kawai as they give expert advice on a variety of topics, including: The difference between exempt and non-exempt status The salary basis, including deductions from wages and “safe harbor” requirements Proper classification of employees under the administrative, executive, professional, outside sales, computer, and other statutory exemptions About our Speakers How to handle the potential misclassification of workers Record retention issues Tamara Gerrard has been litigating cases in Hawaii for eighteen years, twelve of which have been as a director in the employment law department at Torkildson, Katz, Moore, Hetherington & Harris. During that time, Tamara has appeared in both federal and state courts and before state agencies. Aside from litigating cases, Tamara regularly counsels employers regarding compliance with federal and state employment laws, including leave entitlement, wage and hour issues, reasonable accommodation under disability law, and harassment investigations. Kendra Kawai is an experienced trial lawyer who joined the labor and employment department of the firm in January 2007. Since then she regularly defends small and large employers in discrimination, harassment and disability cases at the administrative, state and federal levels. She also provides employers with guidance on wage and hour compliance issues and evaluates and updates employee handbooks. 2013 HR Administration Series August 15, 2013 9:00 to 12:00 Managing Employee Leaves and Requests for Reasonable Accommodations Ryan Sanada, Asst. General Counsel and Sr. HR Consultant, Hawaii Employers Council Mike Vasper, Sr. HR Consultant, Hawaii Employers Council Oftentimes, employees take leave from work due to injury, sickness, disability, need to care for a family member, or some other reason. As a result, HR professionals are routinely faced with the difficult task of managing leave for employees who cannot, should not, or simply will not go to work. For some situations, managing leave is pretty straightforward. For many situations, however, trying to navigate through the different leave laws that may be applicable to the employee gets tricky, and HR professionals are left feeling like they’re driving through a busy intersection in a foreign city, where many different streets (or laws) overlap and/or intersect, and one wrong turn can have disastrous consequences. In this program, we will be provide our attendees with a GPS system for employment leave laws, which will help you navigate your way through the tricky four-way intersection of ADA Avenue, Workers’ Comp Way, Family Leave Street, and the TDI Highway. This program will cover the following: About our Speakers The various laws that apply to employee leave; Practical guidance on how to comply with the different leave laws; Common mistakes and how to avoided them; and Dealing with difficult or challenging employee situations Ryan Sanada is responsible for helping employers with employment law compliance matters. He was previously with the law firm Imanaka Kudo & Fujimoto, where he specialized in labor and employment law. He has also served as a legal consultant to the House Labor Committee at the Hawaii legislature. He received his BA from the University of Puget Sound and his JD, cum laude, from the University of Hawaii, Richardson School of Law. Mike Vasper, SPHR, joined HEC with over 20 years of Human Resources experience in the healthcare, retail and staffing industries. He earned his BA in Economics from the University of Hawaii at Manoa and holds a SPHR (Senior Professional in Human Resources) certification. 2013 HR Administration Series September 20, 2013 Defend Yourself: Strategies for Handling EEOC/HCRC Charges and DOL 9:00 to 12:00 Investigations Christopher S. Yeh, Partner, Marr Jones & Wang In FY2012, the EEOC received 99,412 charges, and obtained $365.4M in relief for claimants. Here in Hawaii, the HCRC accepted 558 complaints. In February 2012, a DOL investigation of minimum wage, overtime, and recordkeeping violations recovered $526K in back wages for 2,000 cruise workers in Hawaii. Would you know what to do if the DOL or EEOC/HCRC came knocking on your door? Be it discrimination, reasonable accommodation, or FLSA issues, this class will cover helpful measures to protect the company when facing EEOC/HCRC charges and DOL investigations, including: About our Speaker Notifying the insurance carrier, if any Preserving evidence Gathering and presenting information to best defend against the claim Considering mediation Participating in investigation interviews and conferences Engaging in EEOC and HCRC Conciliation Christopher S. Yeh practices in all aspects of labor and employment law, advises companies on a wide range of employment matters, and has successfully represented employers in proceedings before private arbitrators as well as the state and federal courts in Hawaii, Hawaii Civil Rights Commission, Equal Employment Opportunity Commission, National Labor Relations Board, and Hawaii Department of Labor and Industrial Relations. Mr. Yeh has taught at both Hawaii Pacific University and the University of Hawaii William S. Richardson School of Law. He is a regular speaker at employment law seminars on subjects such as sexual harassment, discrimination, disability accommodation, and employee leave issues with an emphasis on the Family Medical Leave Act and American with Disabilities Act. Mr. Yeh joined MJW as an associate in December 1998 and became a partner in 2003. Prior to joining the firm, he specialized in labor and employment law at the law firm of Goodsill Anderson Quinn & Stifel in Honolulu. He is a graduate of Harvard University and Harvard Law School. 2013 HR Administration Series Hawaii Employers Council – Kahili Meeting Room Please use separate form for each person to be registered Name: _____________________________________ Email: _______________________________________ Company: __________________________________ Title: ________________________________________ Address: ___________________________________________________________________________________ Street / P.O. Box City Telephone: _________________________________ State Zip Fax: _________________________________________ Special Arrangements Requests: (e.g. front seat, etc.) _____________________________________________ Authorized by: ______________________________ Title: ________________________________________ (Registration will begin 15 minutes before start time.) The Employment Process: The Legal Aspects of Hiring Thursday, May 2, 2013 – 8:30 a.m. to 12:00 p.m. What Employers Need to Know about Independent Contractors and other Non-Employees Thursday, May 9, 2013 – 9:00 a.m. to 11:45 a.m. Creating a Drug-Free Workplace Thursday, May 23, 2013 – 8:00 a.m. to 12:00 p.m. What You need to Know about FLSA Exemptions Thursday, June 20, 2013 – 9:00 a.m. to 11:30 a.m. Managing Employee Leaves and Requests for Reasonable Accommodations Thursday, August 15, 2013 – 9:00 a.m. to 12:00 p.m. Defend Yourself: Strategies for Handling EEO / HCRC Charges and DOL Investigations Friday, September 20, 2013 – 9:00 a.m. to 12:00 p.m. Payment: $ ________ Check payable to Hawaii Employers Council $ ________ 2013-2014 Bonus Dollars – Code________________ Charge to Master Card American Express Register for individual sessions or for the entire series. Cost per participant per session: $ 75 – Members $140 – Non-Members Cancellations made 7 calendar days prior to the event will be fully refunded. A service charge of $25 will be made for cancellations made up to the day before the event. While substitutions are permitted, NO cancellations, credits or refunds will be made on the day of the event. Mail form with payment to: Vicky Tasaka-Loando Hawaii Employers Council P.O. Box 29699 Honolulu HI 96820 Fax: 833-6731 Telephone: 440-8888 Visa Discover Account Number _____________________ Exp Date ___________ 3 Digit Security Code __________________ Name on the charge card ____________________________________ Cardholder Billing Address _________________________________ City _________________________________ Zip ________________ 20130508