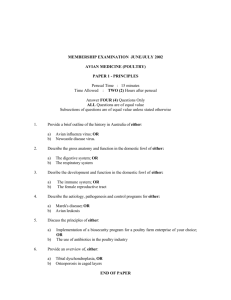

Poultry meat and egg industries summary

advertisement

Poultry meat and egg industries summary 2013 Poultry meat and egg industries summary The poultry industry is the largest individual agricultural sector in South Africa. It contributed approximately 22% of the total agriculture gross value and 47% of animal product gross value in 2013. In addition to core operations, the poultry industry supports many peripheral businesses as well as those further along the value chain. Given the agricultural dominance of the poultry industry in our country, the downstream influence on the closely-related feed industry is also considerable. LOCAL INDUSTRY OVERVIEW • Gross value The gross value of primary agricultural production from poultry meat for 2013, as recorded by the Department of Agriculture, Forestry and Fisheries (DAFF) was R32,92b, while from eggs a gross value of R8,59b was recorded. Combined, the gross poultry farm income for 2013 was R41,51b, showing a yearly increase of 10%. As broiler and egg producers, in Rand value we are the largest segment of South African agriculture at 22,1% of all agricultural production and 47,5% of all animal products. The gross value of ostrich feathers and products was R301,4m in 2013; this is 0,16% of agricultural production and 0,34% of total animal products. The total gross value of animal products was R87,4b and the total gross value of agricultural products was R187,7b in 2013. Total animal products contributed 47% to the gross value of total agricultural product, with poultry meat contributing 17,5% and eggs 4,6%. • Production growth of industries Between 2004 and 2008, the South African poultry industry went through a period of substantial growth, exceeding 6% a year. This period of growth was associated with increased demand for product and well contained input costs. From 2009 to 2012 however, growth slowed markedly to below 2% a year. During this time, production costs increased, the disposable income of consumers declined, and imports of poultry meat products at low prices eroded demand for locally produced broiler products. Approximately 78% of the birds in the South African poultry industry are used for meat production, while the remaining 22% are used in the egg industry. 1|Page Small footprint. Big impact. Poultry meat and egg industries summary 2013 The supply of eggs was maintained at a reasonably constant level over the past year. Increasing production costs and efforts to recover expenses however forced producers to increase egg prices to the market. These higher prices depressed demand, placing profit margins under severe pressure. While the broiler industry was initially able to weather adverse production and market conditions by tweaking production procedures and feed specifications, spiralling production costs and unsound market conditions continued to put pressure on profit margins over the past year. At this time, there is little indication that conditions will improve in the near future. • Consumption of meat and egg industries It is with some justification that the poultry industry can claim to feed the nation, as more poultry products are consumed every year than all other animal protein sources combined. The South African poultry industry continues to dominate the agricultural sector, providing 65% of locally produced animal protein (milk is not included) consumed in the country. The per capita consumption of poultry meat and eggs in 2013 was 36,39kg and 9,18kg a year respectively, with a combined per capita consumption of 45,57kg per annum. Compared to poultry meat, DAFF reports per capita, per annum consumption of beef, pork, mutton and goat at 17,18kg, 4,56kg; 3,16kg; 0,17kg respectively. Graph: Per capita consumption of protein sources The gap is widening between the total consumption of poultry meat and eggs and that of other types of meat. During 2013, the total consumption of poultry meat and eggs was 2,456m tons 29% more than the combined 1,341m tons of beef, pork, mutton and goat consumed over the same period. In 2013 the poultry industry supplied 1,943m tons of poultry meat (including imports) and 512 400t of chicken eggs and chicken egg product. Together, this amounts to a staggering 2,456m tons. • Price comparison of protein sources 2|Page Small footprint. Big impact. Poultry meat and egg industries summary 2013 As shown in the graph below, compared to beef and pork, poultry meat and chicken eggs remained the cheapest sources of protein. More detail is provided in the reports from the different organisations. Graph: Monthly Beef, pork, broiler and egg producer prices • Consumption of maize The total maize crop for 2012 to 2013 was 12,131,218 tons. The estimated crop for 2013 to 2014 is estimated at 11,394,800 tons. The total South African consumption of white and yellow maize for the 2012 to 2013 was approximately 8,935m tons, of which about 4,378m tons (0,904m tons white maize and 3,475m tons yellow maize) were used for animal feed. The poultry industry consumes more than 2,703m tons of maize, which represents around 30,25% of the total maize consumption in South Africa. During the current season, the maize consumed in the animal feed industry is 79,35% of yellow maize and 20,65% of white maize. FEED SALES AND USAGE Our industry continues to be the main customer of the Animal Feed Manufacturers Association (AFMA). According to their annual report, AFMA estimates that for the period April 2012 to March 2013, the entire poultry industry consumed 4,505m tons of feed, of which 4,079m tons were supplied by AFMA members and the balance of 426 000 tons by in-house/independent feed mills. Therefore, of the 6,176m tons of the total feed produced by AFMA members, 4,079m tons - or 66,05% - went out as poultry feed. AFMA members therefore supplied about 90,54% of total consumption by the poultry industry, with the balance supplied by non-AFMA members. As national feed consumption is approximately 11,146m tons, AFMA therefore represents 55,4% of the national feed consumed. Poultry feed thus accounted for approximately R17,13b of AFMA's turnover. • Feed prices During the reporting period, the industry faced a higher local and international maize price compared to the previous year. Protein prices increased significantly; subsequently poultry feed prices also increased significantly in the 2012 to 2013 season. The weakening of the Rand 3|Page Small footprint. Big impact. Poultry meat and egg industries summary 2013 against all the major currencies also did not help. Feed prices are covered in more detail in the relevant reports. TRADE • Imports Although the 390,542 tons of poultry imported in 2013 was 3% less than 2012, this quantity is still 12% more than that brought into SA in 2011. The broiler industry experienced unprecedented pressure, aggravated by the large increases in imported frozen products, especially from Brazil and the EU. This is contributing to the crisis in the industry. In 2013, 355,166 tons of broiler meat was imported, a decrease of 4% following increases of 36% and 14% in 2011 and 2012 respectively. Broiler bone-in portion imports contributed 41% and mechanically deboned meat (MDM) 40% to frozen broiler meat imports. Frozen broiler imports from the EU account for 42% of the total, with the remainder originating from other countries. Brazil remained the main contributor in 2013, with 48% of total frozen broiler imports. Mainly MDM – mechanically deboned meat - was imported, representing 72% of total frozen broiler imports that country, which remains a threat due to exchange rate dynamics, competitive advantages in terms of climate, feed costs, economies of scale, and government support. Of the total broiler imports, 42% came from the EU in 2013, with with 148,104 tons of frozen broiler meat imported - 17% more than the previous year. In terms of single EU countries, the Netherlands was the biggest contributor with 45% of frozen broiler imports, followed by the United Kingdom with 26% and Germany with 15%. Poultry imports are discussed in detail in the Broiler Organisation Chairpersons’ Report. Imports of eggs and egg products remained low, representing 0,07% of consumption. 4|Page Small footprint. Big impact.