ad partners - Game Informer

advertisement

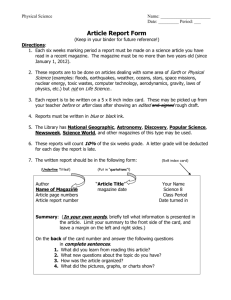

the games market ➤U .S. Video Game DOLLAR Sales Growth 2012: 14.8 Billion dollars “No other sector has experienced the same explosive growth as the computer and video game industry. Our creative publishers and talented workforce continue to accelerate advancement and pioneer new products that push boundaries and unlock entertainment experiences. These innovations in turn drive enhanced player connectivity, fuel demand for products, and encourage the progression of an expanding and diversified consumer base.” ➤U .S. Video Game UNIT Sales Growth 2012: 188 Million units The NPD Group/Retail Tracking Service; Games Market Dynamics: U.S. Michael D. Gallagher President and CEO of ESA 15 OR % 7 6 Percentage of US households that play video games Percentage Growth 2o ut of 3 Projected Annual Growth Rate 2010-2014 Video Games 10 Television Subscriptions 5 Recorded Music 0 the market demographic brand power Filmed Entertainment circulation the model ad partners Source: PricewaterhouseCoopers 2010-2014 Global Entertainment and Media Outlook sub. study rate card tech specs contacts demographic 84% MALE $ Median Age 32 T12-17 14% A18-24 17% A18-34 43% A35+ 43% $65,800 Median HH Income 69% Attended/Graduated College 70% High School Grad+ + *2013 Game Informer Subscriber Study Active Lifestyles Beyond The Games 69% Single/Never Married 22% Married 60% Employed 48% Employed Full Time The Game Informer audience is an active and involved, heavy consumer. i Game Informer readers are active, career professionals who are homeowners, car owners, and enjoy above-average incomes to support thier lifestyle. i Our readers are frequent consumers purchasing electronics, sporting goods, clothes, furnishings, insurance and more. i Our readers want to be entertained. They dine out, go to movies, and travel regularly.. i Our readers have a passion for video games. i Game Informer is their #1 source to fuel that passion. the market demographic brand power circulation the model ad partners sub. study rate card tech specs contacts brand power Over the course of 23 years, the brand power of Game Informer evolved beyond “The Final Word on Computer & Video Games” and into “The World’s #1 Computer & Video Game Magazine.” That’s an official 7,629,995 subscribers the market demographic brand power circulation the model ad partners sub. study rate card ...which is more people than the entire population of Switzerland! tech specs contacts circulation and brand reach 2013 AAM Top 20 Rank 1 AARP The Magazine 22,274,096 AARP Bulletin Game Informer 22,244,820 7,629,995 3 Better Homes And Gardens 7,615,581 5 Good Housekeeping 4,348,641 6 Reader’s Digest 4,288,529 7 Family Circle 4,092,525 8 National Geographic 4,029,881 9 People 3,527,541 10 Woman’s Day 3,311,803 11 Time 3,289,377 12 Ladies’ Home Journal 3,225,863 13 Sports Illustrated 3,023,197 14 Cosmopolitan 3,015,858 15 Taste of Home 2,975,929 16 Prevention 2,872,944 17 Southern Living 2,815,523 18 AAA Living 2,414,108 19 O, The Oprah Magazine 2,386,601 20 Glamour 2,327,793 2 the market Total Paid & Verified Circulation (Second Half 2013) Publication Name 3 demographic brand power circulation the model 365,558,082 Annual Impressions Through Syndication In addition to the already impressive circulation, newspapers throughout the U.S. publish Game Informer’s Reviews, Previews and Top 10 Lists in print and online on a weekly basis and expand GI’s impact and reputation. Chicago Tribune Star Tribune Richmond Times-Dispatch The Spokesman Review (WA) The Hartford Courant Philadelphia Daily News Wichita Eagle (KS) Ft. Worh Star-Telegram (TX) The Record (NJ) The Sun Herald (MS) South Florida Sun-Sentinel Belleville News-Democrat (MO) The Florida Times-Union Detoit Free Press Kansas City Star (MO) The Waterloo Courier (IA) The State (SC) Merced Sun-Star (CA) and more... ad partners sub. study rate card tech specs contacts a winning model Game Informer’s approach is direct and has been for over 23 years: Circulation Men’s Category Sell subscriptions face-to-face in an environment where active video game players are most likely to be found...video game stores. The World’s Largest Specialty Game Retailer Over 4,400 U.S. Stores and Growing Game Informer: 7.6 Million Store Advisor Perspective Sean Allen GameStop Store Manager “At GameStop, selling a subscription to Game Informer is like selling candy in a candy store. Knowing that my customers are into games, I lead them to the best magazine on the shelf, in the same way that I lead them to the best games on the shelf. I just let my customers know what I believe...Game Informer Magazine is the most entertaining games magazine, and hands-down, the best resource you’ll ever find.” Sports Illustrated: 3.0 Million ESPN: 2.1 Million Maxim: 2.0 Million Men’s Health: 1.8 Million the market demographic brand power circulation the model ad partners sub. study rate card tech specs contacts ad partners Consumer Advertising Partners the market demographic brand power circulation the model ad partners sub. study rate card tech specs contacts independent subscriber study Reading Game Informer 91% of subscribers have made a purchase after seeing/reading about a product in GI. Time Spent Reading Each Issue 86% Read at least MEAN: 2.7 Half or More of Every Issue hrs 4 or more hrs.......21% 3 to 4hrs..........................16% 2 to 3 hrs....................................18% 1 to 2 hrs...............................................27% 45% 23% 18% 8% 6% 0% 1/2 to 1 hr........................................................14% Less than 1/2 hr.................................................4% Don’t even read it..............................................0% the market demographic brand power circulation the model ad partners read all or almost all read about three quarters read about half read about a quarter skim only don’t read sub. study rate card tech specs contacts independent subscriber study Influence Affinity 84%, which is over 6.4 Million Game Informer readers subscribe to no other video games magazine. 91%, which is 91% with GI and enjoy are very satisfied 6,942,900 of subscribers have made a purchase after seeing/reading about a product in GI. reading the magazine each month. 68%, which is 5,188,400 74%, which is 5,646,200 of subscribers agree that the ads in GI provide them with important information about products. trust Game 92% Informer’s reviews. agree that GI influences their purchases. 97% them with better, agree GI provides more reliable buying information than any other games magazine. Do you plan to renew your subscription to Game Informer? Yes......................................67% Not sure..............................31% No.........................................2% What other video game publications do you read regularly? (at least three out of four issues) agree GI is the 80% most entertaining games magazine they currently read. Official Xbox Magazine...........15% PlayStation Official Magazine.12% Why did you initially subscribe to Game Informer? save their copies 77% for reference. For magazine & discount.......65% For the discount only.............29% Gift........................................6% the market demographic brand power circulation the model ad partners sub. study rate card tech specs contacts independent subscriber study Purchasing Habits Game Informer Readers CURRENTLY OWN: Game Informer Readers PLAN TO BUY (in the next 6 months): PURCHASING SOURCES PC 41% 3,128,000 PlayStation 3 62% 4,730,000 PlayStation 4 TBD TBD PlayStation Vita 11% 839,000 Nintendo DSi 14% 1,068,000 Nintendo DS Lite 17% 1,297,000 Nintendo Wii 35% 2,670,000 Xbox 360 72% 5,493,000 Xbox One TBD TBD PC 11% 839,000 PlayStation 3 22% 1,678,000 PlayStation 4 60% 4,578,000 PlayStation Vita 3% 228,000 Nintendo DSi 5% 381,000 Nintendo DS Lite 3% 228,000 Nintendo Wii 12% 915,000 Xbox 360 14% 1,068,000 Xbox One 39% 2,975,000 (computer/video games including handhelds and video game systems) GameStop.........................96% Best Buy...........................47% Wal-Mart........................46% Amazon.com..................29% Target...........................30% GameStop.com............19% eBay/Half.com............12% *2013 Game Informer Subscriber Study FREQUENCY OF SHOPPING FOR GAMES: 9% 14% 8% 24% 21% 13% 6% 3% Every Day 2-3 days per week 4-6 days per week Once a week Once every 2 weeks Once a month Once every 2 or 3 months Less than once every 2 or 3 months the market demographic brand power MOST IMPORTANT SOURCE when deciding which computer/video games/systems to purchase: 92% 72% 61% 56% 24% circulation Personal experience/preference Friends/word of mouth Magazines Websites TV ads the model ad partners NEW GAME PURCHASE HABITS: 49% 16% 17% 16% 2% sub. study Pre-order Purchase with the first week Purchase within the first month Wait more than a month to purchase Does not apply/does not purchase new games rate card tech specs contacts 2014 advertising rates Rate Card #24 3.5 Million Rate Base Guarantee 4-Color 1X 3X 6X 12X24X36X 48X 60X Full Page $205,228$199,094$193,052$187,335$179,834$174,448$169,209$164,110 1/2 Page $123,131$119,446$115,862$112,415$107,898$104,666$101,505 $98,439 1/3 Page $94,402$91,566$88,803$86,162$82,734$80,241$77,828$75,483 B &W Full Page 1/2 Page 1/3 Page $184,692$179,177$154,503$149,847$143,852$139,548$135,335$131,297 $110,817$107,500$92,702 $89,912$86,310$83,732 $81,202 $78,780 $84,951$82,421$71,077$68,923$66,162$64,185$62,245$60,398 premium positions 2nd Cover Spread 3rd Cover Spread TOC-RHP Page 1-1/2 Masthd Spread First Form Guaranteed Position Earned Earned Earned Earned Earned Earned Rate Rate Rate Rate Rate Rate + + + + + + 25% 20% 15% 15% 15% 10% Noadditionalchargeforbleeds.CirculationverifiedbyABC.Positioningofadvertisementsisatthediscretionofthepublisherunlessotherwisespecifiedandacknowledgedbythepublisherinwriting.Advertisements aresubjecttoacceptancebypublisher.Thepublisherreservestherighttorefuse,alterorcancelanyadvertisingforanyreasonatanytime.Publishershallnotbeliableforanyfailuretoprint,publishorcirculateallor any portion of any issue if such failure is due to acts of God, strikes, accidents, legal action or other circumstances beyond the publisher’s control. Commissions: 15% commissions to recognized agencies. the market demographic brand power circulation the model ad partners sub. study rate card tech specs contacts 2014 specs and closing dates 2014 Issue closing Dates Insertion Cover Date Insertion Due Date Material Due Date mechanical requirements On Sale Ad Size Bleed Trim Non-Bleed 12/13/13 2-Page Spread 18 1/4” x 11” 18” x 103/4” 171/2” x 101/4” Full Page 9 1/4” x 11” 9” x 103/4” 81/2” x 101/4” January 10/11/13 11/8/13 February 11/8/13 12/6/13 1/17/14 March 12/6/13 1/10/14 2/14/14 1/2 Page Vertical* 45/8” x 11” 41/2” x 103/4” 41/4” x 101/4” April 1/10/14 2/7/14 3/14/14 1/2 Page Horizontal (bottom) 91/4” x 51/2” 9” x 5 3/8” 81/2” x 5 1/8” May 2/7/14 3/7/14 4/18/14 June 3/14/14 4/11/14 5/16/14 1/3 Page Vertical* 3 1/8” x 11” 3” x 103/4” 21/2” x 101/4” July 4/11/14 5/9/14 6/20/14 1/3 Page Horizontal (bottom) 91/4” x 3 7/8” 9" x 33/4” 81/2” x 31/4” August 5/9/14 6/13/14 7/18/14 September 6/13/14 7/11/14 8/15/14 October 7/11/14 8/8/14 9/19/14 November 8/15/14 9/12/14 10/17/14 December 9/12/14 10/17/14 11/21/14 Digital Files Material Requirements PDF/X1-a (preferred format) **Please contact production first if you plan to submit other file formats Live Matter: Keep live matter 1/4” from trimmed sides. Text across the gutter should be avoided. Gutter Allowance: 3/8” on each side of gutter, 3/4” for two page spread. *Allow 1/8” bleed on only one side of the ad for 1/3 page vertical and 1/2 page vertical ads. Maximum Ink Density: 300% • Linescreen: 133lpi If proofs are not provided with materials, Game Informer assumes no liability for ad reproduction quality and content accuracy. Laser Inkjet proofs or any other proofs supplied that are not SWOP certified contract proofs are accepted for file content only. CONVERT: All Spot colors need to be converted to CYMK colors before output to PDF-X1a. All advertising copy and art is subject to publisher approval. REGISTRATION: Standard registration marks and crop marks must be included and they should appear at least 1/8” outside of the trim area to avoid overlapping creative. Pages should be centered and cropped to page trim size plus bleed. MEDIA LABELING REQUIREMENTS: MEDIA: CD-R (ISO9660 and MAC), DVD-R. Mailing & Shipping Instructions: FTP: 12.25.107.16 username: advert password: myl@k3h0M3 For all mechanical materials/specification questions contact: PROOF REQUIREMENTS: Please submit two hard-copy proofs at 100% scale made from supplied PDF/X1-a file. For a guarantee in color reproduction, advertisers must submit TWO SWOP certified contract proofs at 100% scale (must include color bar & indicate proofing system used on the proofs) Issue Date, Advertiser, Agency Name, Contact Person, Phone Number, Vendor Contact, File Name/Number, Return Address, List of Contents (print of disk contents) Curtis Fung • Production Director 724 North First Street, 3rd Floor Minneapolis, MN 55401 tel: (612) 486-6058 fax: (612) 486-6101 curtis@gameinformer.com Advertiser Furnished Pieces Standard trims for inserts are as follows: Proofs must be made from supplied PDF/X1-a file. Standard full size insert: 1/8” trim on all faces – finished size of 9” x 103/4” Acceptable contract proofs are Fuji Pictro, Fuji Final Proof, Epson Contract Proof, Kodak Approval, IRIS, Digital Match Print. Less than full-size insert: 1/8” on gutter and foot, 1/2” on gutter for binding For an up-to-date list of SWOP approved color proofing systems, please visit: www.swop.org Printing Specifications: SWOP Printed Web Offset. Perfect bindery. the market demographic brand power circulation Questions Contact: Ted Katzung • Circulation Services tel: (612) 486-6107 fax: (612) 486-6101 ted@gameinformer.com the model ad partners sub. study Competing Retailer TAgs Ad creative should not include tags, logos or references to competing retailers of GameStop. These retailers include, but are not limited to Amazon, Best Buy, Target and Walmart. All advertising copy and art is subject to publisher approval. Please direct general advertising inquiries to: Game Informer Magazine 724 North First Street - 3rd Floor Minneapolis, MN 55401 tel: 612.486.6154 fax: 612.486.6101 WEST Damon Watson West Coast Advertising Director tel: 310.450.3260 fax: 310.450.3571 damon@gameinformer.com EAST Suzanne Lang Middaugh East Coast Advertising Director tel: 718.789.0162 fax: 612.486.6101 suzanne@gameinformer.com rate card tech specs contacts contacts Please direct all general advertising inquiries to: Game Informer Magazine 724 North First Street – 4th Floor Minneapolis, MN 55401 tel: 612.486.6154 fax: 612.486.6101 advertising sales WEST Damon Watson West Coast Advertising Director tel: 310.450.3260 fax: 310.450.3571 damon@gameinformer.com EAST Suzanne Lang Middaugh East Coast Advertising Director tel: 718.789.0162 fax: 612.486.6101 suzanne@gameinformer.com Janey Stringer West Coast Ad Sales Associate tel: 612.486.6104 janey@gameinformer.com Amy Arnold East Coast Ad Sales Associate tel: 541.981.4320 amy@gameinformer.com MARKETING & promotions Rachel Castle Marketing Coordinator tel: 612.486.6059 fax: 612.486.6101 rachel@gameinformer.com Mark Burger Marketing Coordinator tel: 612.486.6083 fax: 612.486.6101 mark@gameinformer.com productioN editorial Curtis Fung Production Director tel: 612.486.6058 fax: 612.486.6101 curtis@gameinformer.com the market demographic brand power circulation Andy McNamara Editor-In-Chief tel: 612.486.6123 fax: 612.486.6101 andy@gameinformer.com the model ad partners sub. study rate card tech specs contacts