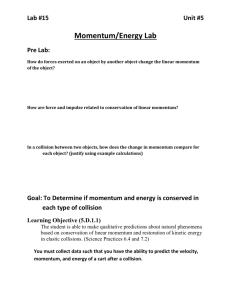

Value and Momentum Everywhere

advertisement